Nation's 2020 FDI Rises 6.2%, Nearing Trillion Yuan

By LIU ZHIHUA and ZHONG NAN | China Daily

China's record-setting use of foreign direct investment last year reflects foreign investors' strengthened confidence in doing business in the country, analysts and business executives said.

Their confidence has been inspired by reduced barriers to investment, improvement of the business environment and, most important, optimism over China's economic outlook featuring the new "dual circulation" development paradigm, they said.

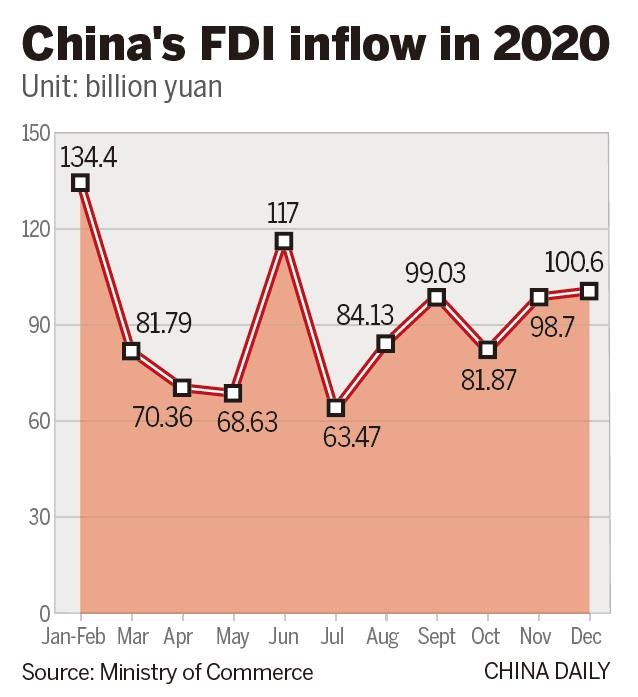

Their comments came on the heels of the latest official data showing China's actual use of FDI surged 6.2 percent year-on-year to 999.98 billion yuan ($154.6 billion) in 2020, a historic high.

In US dollar terms, the foreign capital inflow went up by 4.5 percent year-on-year to $144.37 billion last year, the Ministry of Commerce announced on Wednesday.

The structure of FDI also was improved. The country's service sector attracted 776.77 billion yuan of FDI in 2020, jumping 13.9 percent on a yearly basis, accounting for 77.7 percent of the country's total use of foreign investment.

In the meantime, annual FDI from the Netherlands grew by 47.6 percent, from the United Kingdom by 30.7 percent, and from the Association of Southeast Asian Nations by 0.7 percent.

"China showed strong economic resilience during the pandemic, becoming the only major economy projected to have positive growth," said Cui Fan, an international trade and economics professor at the University of International Business and Economics in Beijing.

"Its future growth potential also remains stronger than that of most other major economies, as it is shifting to dual circulation development, featuring further opening-up and the synergy of domestic and foreign markets, with constant rollouts of policy measures facilitating investment and enhancing the business environment."

The FDI inflow will continue to boom as the Chinese economy expands and the business environment improves, and foreign investors can play a key role in the improved interplay of domestic and foreign markets required by dual circulation development, Cui said.

Asgar Rangoonwala, chairman of the executive committee of the research and development-based Pharmaceutical Association Committee, which is part of the China Association of Enterprises with Foreign Investment, said the committee's 42 multinational members are very optimistic about the potential and future development of the healthcare market in China and will step up investments.

"China has led the world in combating the pandemic, resuming work and production, ensuring people's livelihoods and promoting economic growth. This has greatly enhanced the confidence of foreign companies in their long-term development in China," he said.

Italian tire maker Pirelli plans to invest more in tires with technical features such as noise-cancellation, run-flat and seal-inside functions that are suitable for new energy vehicles, during the country's 14th Five-Year Plan (2021-25) period, as China is set to produce more of the vehicles.

Giuliano Menassi, CEO of Pirelli for the Asia-Pacific region, said the company will add more investment and digital technologies in its two manufacturing bases and other innovation facilities across China in the next five years, as well as further expand its online sales.

Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing, also said China's pursuit of dual circulation development-in which the domestic market is the mainstay and the domestic and international markets support each other-will bolster the prospects for the Chinese economy while creating more development space for foreign investors.

Zhou Hong, CEO of Roche Pharma China, said China is advancing higher-standard opening-up and stabilizing foreign investment and higher-quality development, and the company will invest more in China as it feels fully confident in its future.

Rogier Janssens, managing director and general manager of the healthcare arm of Merck China, said that with China's further opening-up, foreign enterprises gain more benefits in terms of market access and intellectual property protection. The ever-improving business environment will enable foreign companies to better operate their businesses, Janssens said.

First, please LoginComment After ~