U.S. Fund Managers Have Decided to Follow the Rush of Money Into Etfs With A Vengeance.

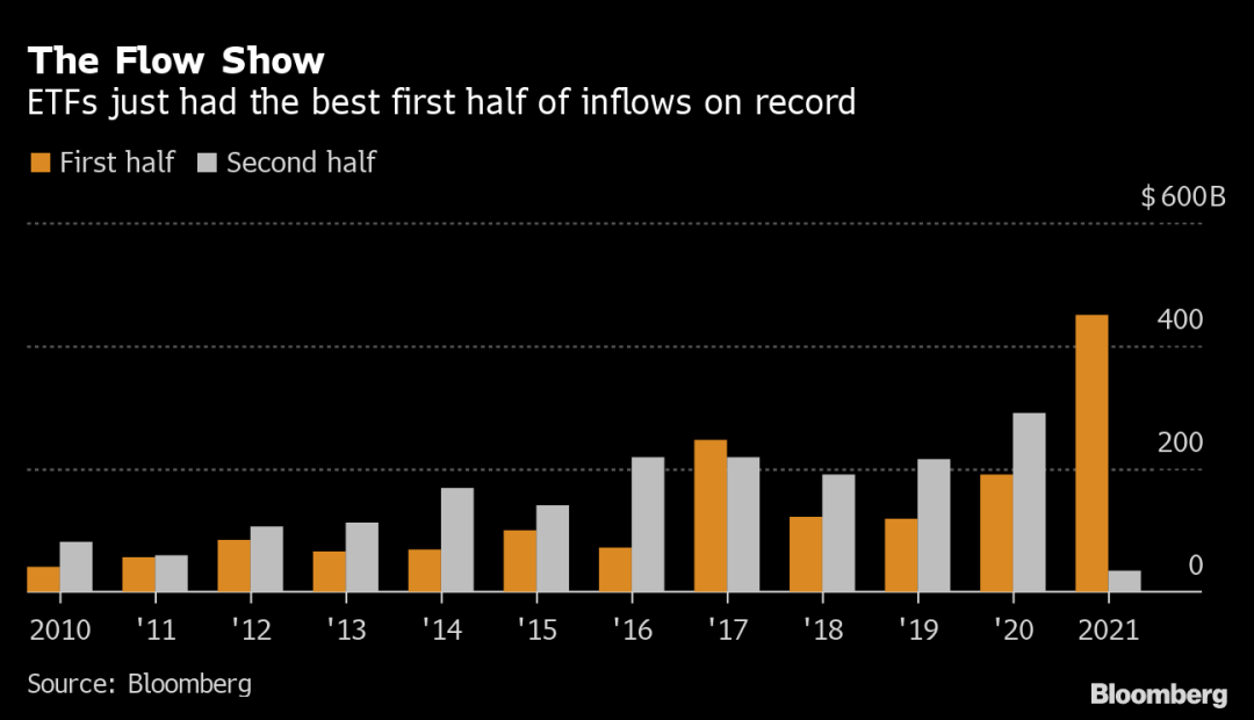

ETFs have attracted more money in seven months than in almost any single year on record. Currently at $488.5 billion and continuing to grow, they could break the annual record of $497 million set in 2020 in a matter of weeks or even days.

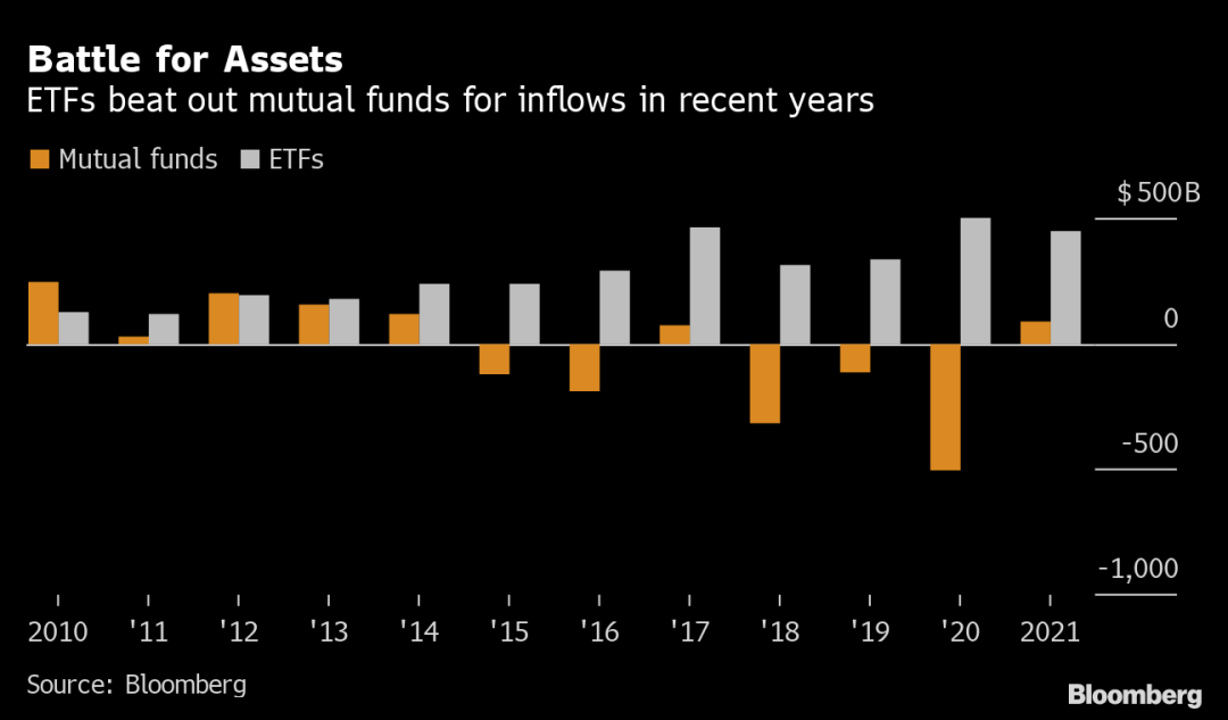

The influx of money reflects a historic surrender in the mutual fund industry.

Investors have long been turning to cheaper, easier-to-trade and more tax-efficient vehicles. Almost all of the 25 largest U.S. asset managers offer or plan to offer ETFs, according to Bloomberg Information. The biggest is Capital Group, bar none, and it doesn't take long for it to plan to join the club.

Fund assets in the U.S. have jumped to a record $6.6 trillion, up from $3.7 trillion at the peak of last year's sell-off pressure. ETFs added $497 billion in new money in 2020, and mutual funds saw net outflows of $506 billion. (Source: Bloomberg)

First, please LoginComment After ~