Norwegian and Finnish Covered Bond Market Insights 2021 (part 1)

Source: S&P Global Ratings, Casper R Andersen

Key Takeaways

We expect the COVID-19 pandemic to have a modest impact on Finnish and Norwegian mortgage loan performance as house prices increase.

Both Norwegian and Finnish cover pools present unique loan features and government support initiatives continue to support credit performance.

EU harmonization will bring changes to the legal frameworks, but we believe these changes are manageable without disrupting these markets.

In its Covered Bond Market Insights reports, S&P Global Ratings presents the Norwegian and Finnish covered bond markets, explains how the relevant legal framework works, provides an overview on the mortgage markets, and compares key characteristics of the existing programs.

In our view, solid economies, stable ratings and outlooks on most issuers, and strong sovereigns will continue to support ratings stability for both Norwegian and Finnish covered bonds despite the COVID-19 pandemic.

As vaccine rollouts in several countries continue, S&P Global Ratings believes there remains a high degree of uncertainty about the evolution of the coronavirus pandemic and its economic effects. Widespread immunization, which certain countries might achieve by midyear, will help pave the way for a return to more normal levels of social and economic activity. We use this assumption about vaccine timing in assessing the economic and credit implications associated with the pandemic (see our research here: www.spglobal.com/ratings). As the situation evolves, we will update our assumptions and estimates accordingly.

Overview: Growing Covered Bond Markets

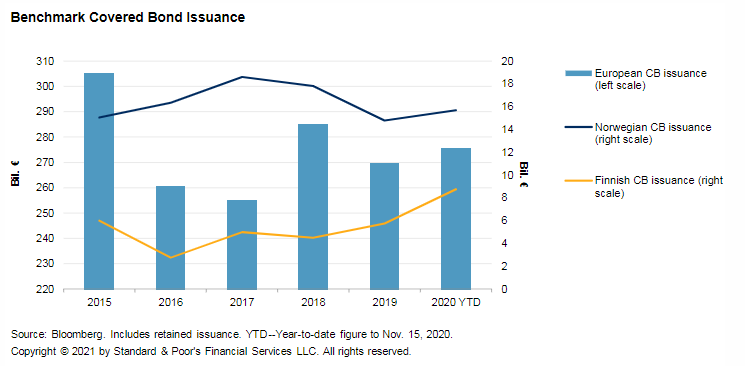

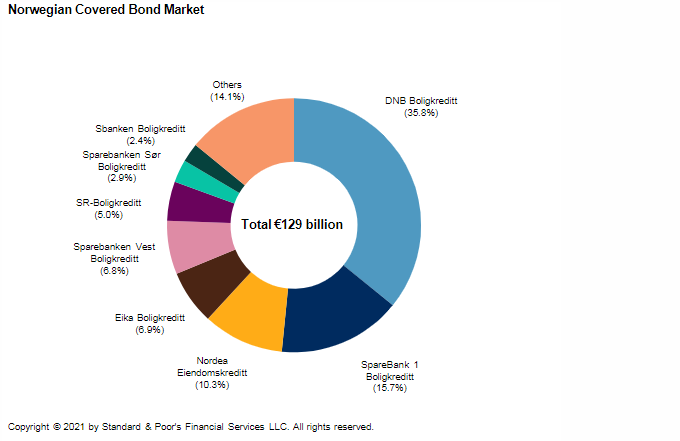

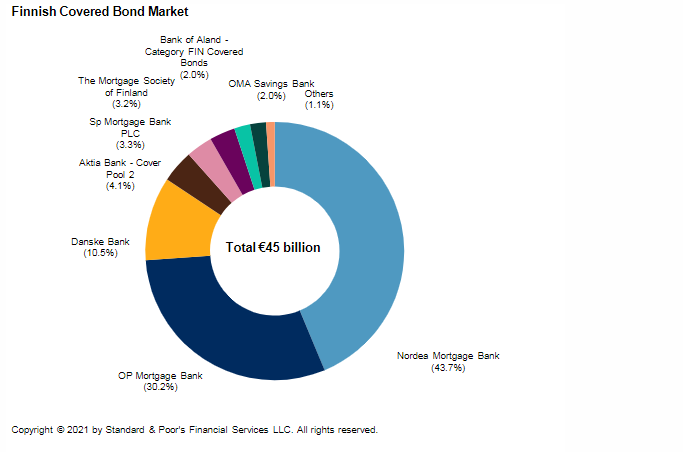

Both Norway and Finland have well-established covered bond markets. In the past decade, both jurisdictions have experienced stable growth in issuance volumes. The Norwegian market is the seventh largest European market while the Finnish market is the 14th largest. Together, the two countries account for just below 10% of the European benchmark market, with Norwegian banks issuing more than three times the volume of their Finnish peers.

The Norwegian covered bonds legislation was adopted in June 2007. Cover pools are primarily secured by Norwegian residential mortgages and mortgages backed by tenant-owner rights. Most loans are floating rate and all are Norwegian krone (NOK) denominated.

The first legal framework for covered bonds in Finland was adopted in 1999. Several amendments have followed since then, most recently in 2010 when the special banking principle was abolished, allowing universal banks to issue covered bonds. Cover pools are generally secured by Finnish residential mortgages and, to a lesser extent, loans to housing cooperatives. All loans are euro-denominated and mainly floating rate.

Chart 1

Chart 2

Chart 3

Government stimulus following COVID-19

Following the outbreak of the COVID-19 pandemic, the European Central Bank (ECB) announced a significant bond purchase facility, the Pandemic Emergency Purchase Programme (PEPP), on March 18, 2020. The program was announced as a €750 billion asset purchase program until at least June 2021. At the beginning of June and again in December 2020, the program was increased to €1,850 billion. The program is designed to keep capital markets functioning, liquidity flowing, and encouraging banks to extend capital to keep the economy going. We expect the ECB's monetary policy to remain loose at least until 2023. The PEPP comes on top of the existing Asset Purchase Programme (APP) and we expect that covered bond yields will remain at historically low levels.

In mid-March, Norges Bank launched a number of market operations to improve market liquidity. It eased collateral requirements for loans to banks and allowed banks to fully finance covered bond issuances from their own mortgage companies using loans from Norges Bank. After hiking rates three times in 2019, in the spring of 2020, Norges Bank lowered its policy rate to 0% from 1.5%, to dampen the negative effects of the coronavirus outbreak. Recent indication from Norges Bank point toward an earlier than expected post-COVID-19 interest rate hike, but other tools remain available should it be required to ease conditions further.

The Norwegian government introduced large financial packages to support the economy, including reforms to support businesses and individuals affected by the coronavirus outbreak and falling oil prices. Fiscal spending includes various measures to help ease the economic impact of lockdown measures and to help employment rates to recover swiftly. Support packages in Norway have been large and consist of guarantees to business of Norwegian krone (NOK) 130 billion, deferral of taxes--including the value-added tax--of NOK230 billion, and additional fiscal spending amounting to almost NOK200 billion. This support totals about 15% of GDP.

European covered bond framework under implementation

In September 2019, the European Parliament approved the final version of the directive and regulation on the harmonization of covered bonds. Following the publication of the directive and regulation in the Official Journal of the European Union, expected before year-end, national authorities have 18 months to transpose it into their national legislation and an additional 12 months to apply the new rules.

The alignment of the Finnish legislative framework with the European Banking Authority's best practices is high.

Norway is not a member of the EU and the harmonization directive is not currently a part of the EEA agreement. Regardless, Norway was the first country to publish a consultation note followed by a public hearing, which ended in August 2020. Generally, the Norwegian legislation requires few changes to live up to the harmonization directive. The proposal maintains the specialist banking principles while introducing two designations for covered bonds: premium (plus) and standard. It proposes to increase maximum loan-to-value (LTV) ration for residential properties to 80% from 75% and an increase in minimum overcollateralization to 5% from 2%. The proposal also includes a 180-day liquidity buffer, calculated without considering potential extensions, but considering existing liquidity coverage ratio (LCR) requirements. Based on the proposal, and despite a lack of clarity on extension triggers, we expect the Norwegian covered bond framework to comply with the EU directive. The revised legislation will be implemented in accordance with the timeline defined in the directive.

Recent market developments

The Finnish and Norwegian financial authorities (Finanssivalvonta and Finanstilsynet) follow the COVID-19-specific recommendations from the European Banking authority (EBA). Additionally, Norway cut the key policy rate to 0%, the mortgage loan regulation was in part temporarily suspended (until Sept. 30, 2020) to allow increased use of deferred amortization, and the countercyclical capital buffer requirement was lowered. Finanstilsynet has since proposed to tighten the current mortgage regulation, which currently includes an LTV ratio cap at 85%, a maximum debt-to-income ratio of five times the gross annual income (4.5 times proposed), a minimum payment requirement of 2.5% if the LTV ratio exceeds 60%, and a flexibility ratio of 10% (8% in Oslo) with a proposed rate of 5% nationally.

Finnish regulators lowered solvency requirements and reversed an earlier LTV ratio cap to 90% from 85% in June 2020 to further support the housing market. In both housing markets, significant price differences exist between the larger cities (mainly the capitals) and rural areas, and the lending limitations are more relevant in the capitals. In both countries, banks have offered short-term amortization relief (grace periods), and customer take-up of interest-only loans has been notable, reflecting relatively easy accessibility, but levels are now normalizing again.

The extraordinary support by the central banks and labor market support have bolstered house prices, and even led to house price rises.

Covered Bond Frameworks: Seasoned Legislations Protect Credit Quality

Legal framework in Norway

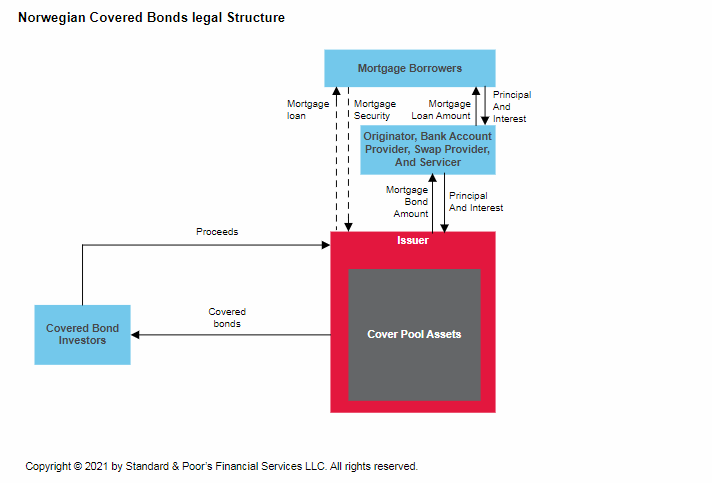

The Norwegian covered bond law defines the eligibility criteria for the type of assets that may and may not be included in the cover pool. Finanstilsynet appoints an independent inspector to regularly review compliance, oversee the register for the cover pool, and ensure that the value of the cover pool always exceeds the issued covered bonds. The law also stipulates that the issuer must be a specialized credit institution and obtain a license from Finanstilsynet.

A mortgage credit institution can include mortgage credit assets secured on residential and commercial properties within the European Economic Area (EEA) or the Organisation for Economic Co-operation and Development (OECD), and public sector credit assets granted to or guaranteed by a public body within the EEA and the OECD. It may also include supplementary assets, i.e., securities issued by eligible financial institutions within the EEA or the OECD.

According to the Norwegian covered bond law, in the event of issuer insolvency, bondholders have an exclusive preferential claim on the cover pool. Should an event occur, an administrator will be appointed to administer the cover pool and to ensure timely payments.

On Jan. 1st 2019, a resolution regime similar to the EU's Bank Recovery and Resolution Directive (BRRD) came into effect in Norway.

Chart 4

Legal framework in Finland

The Finnish Mortgage Bank Act (MBA), passed in 1999 and amended in 2003 and 2010, provides the legal framework for issuing Finnish covered bonds.

The MBA provides the eligibility criteria. Issuers can include mortgage assets secured on residential property located in any eurozone country, and substitute assets. Only collateral that is in the same currency as the covered bonds may be entered in the bond register.

This legislation provides covered bond investors with the right to receive payments before any other claim, according to the original terms and conditions of the covered bonds. This means that the holder of a covered bond has a preferential claim on the cover pool in the event of default.

The cover pool assets must be registered and kept separate from the issuer's other assets. The information in the register must be reported monthly to Finanssivalvonta. The counterparties to derivatives contracts are also included in the register and must survive the issuer's insolvency. The derivative contracts rank pari passu with the covered bonds.

After a mortgage bank has been placed in liquidation, Finanssivalvonta will appoint an attorney to supervise the interest of the covered bondholders. While the bankruptcy trustee manages both the insolvency estate and the covered bonds, the attorney ensures that there is no conflict of interest between the secured and unsecured bondholders. If necessary, the attorney can ask the bankruptcy trustee to conclude necessary derivative contracts and sell collateral or transfer liabilities to another approved bank or, subject to the Finnish FSA's approval, accelerate the covered bond repayments.

Chart 5

Table 1

|

Legal Framework Comparison |

||||

|

Norway |

Finland |

Sweden |

Denmark |

|

|

Product |

Norwegian Covered Bonds |

Finnish Covered Bonds |

Swedish Covered Bonds |

Realkreditobligationer (ROs) or Særligt Dækkede Obligationer (SDOs) or Særligt Dækkede Realkreditobligationer (SDROs) |

|

Legislation |

The Norwegian Act on Financial Institutions, entered into force in January 2016. |

The Act on Mortgage Credit Bank Operations, entered into force in August 2010. |

The Swedish Covered Bonds Issuance Act, entered into force in July 2004. |

The Danish Mortgage-Credit Loans and Mortgage-Credit Bonds et. Act |

|

Issuer |

Specialized credit institution |

Universal credit institution with a special license or Specialized credit institution |

Universal credit institution with a special license |

Specialized credit institution or Universal credit institution with a special license |

|

Owner of the cover assets |

Issuer |

Issuer |

Issuer |

Issuer |

|

Cover asset type |

Residential mortgage loans, Commercial mortgage loans, Public sector loans, Loans secured on other registered assets, Substitute assets and Assets in form of derivative agreements |

Residential mortgage loans, Commercial mortgage loans, Public sector loans and Substitute assets |

Mortgage loans, Exposures to public sector entities and Exposures to credit institutions |

ROs/SDOs/SDROs Loans secured by real property and Exposures to public authorities SDOs Exposures to credit institutions and Collateral in ships |

|

Mortgage cover asset location |

EEA or OECD |

EEA |

EEA |

Denmark, Faroe Islands, Greenland Or Outside of the above, if pre-approved by regulator |

|

Mortgage cover assets LTV ratio limit |

Residential: 75% Commercial: 60% |

Residential: 70% Commercial: 60% |

Residential: 75% Agricultural: 70% Commercial: 60% |

ROs Residential: 80% Agricultural: 70% Commercial: 60% Holiday: 60% SDOs/SDROs Residential: 75%/80% Agricultural: 60% Commercial: 60% Holiday: 60% |

|

Primary method for mitigating market risk |

Derivatives |

Derivatives |

Natural matching and Stress testing |

Balancing principle |

|

Mandatory overcollateralization |

2% nominal |

2% NPV |

2% (nominal + NPV) |

8% risk weighted assets |

|

Sources: ECBC, S&P Global Ratings. SPE--Special purpose entity. LTV--Loan to value. NPV--Net preset value. |

||||

Overcollateralization and liquidity tests

The covered bond laws in both countries require the value of the assets to be higher than the value of the liabilities at all times. Additionally, issuers must include 2% overcollateralization. There is currently no requirement for the issuer to cover the maximum liquidity need within the next 180 days. As most covered bonds are issued with a soft-bullet format, we do not adjust the potential rating uplift for lack of liquidity coverage.

Currency of issuance

Large Norwegian issuers do not rely solely on NOK-denominated issuance for their funding needs and more than half of the issuance of covered bond are denominated in foreign currencies, mainly euro. Currency mismatches between assets and liabilities do not affect our view of risk, given that they are mitigated via cross-currency swaps.

A number of smaller Norwegian issuers rely mainly on the growing NOK market for issuance as the costs of cross-currency swaps and the difficulty in achieving benchmark size make foreign currency issuance uneconomical.

Due to their economic and monetary union membership and the large euro investor base, Finnish issuances are typically not in foreign currency.

Table 2

|

Norwegian And Finnish Covered Bond Programs--Overview |

|||||

|

Program |

Long-term issuer credit rating |

Covered bond rating |

Outstanding covered bonds at September 2020 (mil. €)* |

Program type |

Collateral type |

|

Norway |

|||||

|

DNB Boligkreditt AS |

AA-/Stable/A-1+ |

AAA/Stable |

46,355 |

Hard & Soft bullet |

Residential assets and Commercial assets |

|

Eiendomskreditt AS |

BBB-/Stable/A-3 |

AAA/Stable |

389 |

Soft bullet |

Commercial assets and Substitute assets |

|

Nordea Direct AS |

A+/Positive/A-1 |

AAA/Stable |

1,422 |

Soft bullet |

${item.keyword}`) }) articleContainer.innerHTML = content; Comment 0

First, please LoginComment After ~ Comment

View All

0Comments

|

First, please LoginComment After ~