Hong Kong’s Under-rated Bond Market

Source: Eddie Yue, Chief Executive, Hong Kong Monetary Authority

It is widely acknowledged that Hong Kong has one of the world’s most vibrant equity markets. We are all so familiar with these laurels:

- In 7 of the past 12 years, Hong Kong topped the league of initial public offering (IPO) activities.

- Within a matter of about 3 years, we have become the world’s second largest fundraising hub for biotechnology companies.

- The Stock Connect with Shanghai and Shenzhen has injected strong impetus to secondary trading in the Hong Kong stock market, thanks also to the increasing presence of new economy companies listed here.

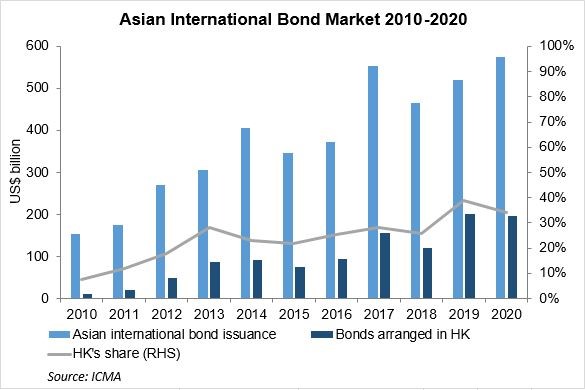

By comparison, there is a perception that the Hong Kong bond market is less developed, lagging behind other financial markets and our regional peers. Is that true? Again, we believe facts and figures are the best way to present the true picture. In this connection, it is most timely that the International Capital Market Association (ICMA), an independent global industry body that promotes best market practices for international capital market functioning, has just released a report on Asian international bond markets. Let me cite some findings from this report:

- ICMA pointed out that there could be different ways to determine the location of bond issuance (e.g. arranging, listing, etc). Bond arrangement and execution is a more important and relevant factor in this respect as these activities encapsulate the entire process of structuring, book building and allocation, which capture up to 80% of the value-adding of a bond issuance. On this count, Hong Kong is the largest centre for arranging Asian international bond issuance, capturing 34% (or US$196 billion) of Asian international bonds in 2020, followed by the US (18%), the UK (17%) and Singapore (5%). (Please see chart below.)

- Hong Kong is also well ahead of other major international financial centres in terms of arranging first-time bond issuance, capturing 75% (US$18 billion) of the Asian market versus Singapore (9%) and the UK (5%). First-time issuance has been a key growth driver in Asian bond market. Given that issuers tend to use the same location for subsequent issuances, it should be a good indicator for future growth.

- In terms of listing of Asian international bonds, Hong Kong comes second (28%), which is well ahead of Luxembourg (17%) and the UK (4%), and only slightly behind Singapore (31%).

The ICMA findings are encouraging because international bond issuance is more important than local bond issuance as a reference in assessing the strength of an international financial centre, as it caters for bond issuance in any currency by issuers of any nationality and to investors from anywhere. So the latest findings reaffirm Hong Kong’s leading status as an international bond centre in Asia.

The Game Changers

We will continue with our strenuous efforts to develop the overall bond market in Hong Kong, riding on some positive and important developments in recent years.

First, Bond Connect. The scheme has proved to be a major success in less than four years since it was launched in 2017, initially only with the Northbound flow in a cautious incremental manner to gauge global investors’ interest in the China Interbank Bond Market (CIBM) and address the capital outflow concern at the time. It now attracts over 2,400 institutional investors worldwide, and has facilitated Chinese sovereign bonds to be included into various major global bond indices such as Bloomberg-Barclays Global Aggregate Index and J.P. Morgan Government Bond Index – Emerging Markets. In 2020 the scheme recorded an average daily turnover of nearly RMB30 billion, accounting for 52% of foreign investors’ total turnover in the CIBM market. The popularity of the scheme shows that Hong Kong continues to be the preferred channel for investing in the Mainland market. The next exciting thing will be the launch of the Southbound Bond Connect, which will open up a ground-breaking conduit for Mainland investors to access the international bond market via Hong Kong. We are already working with the People’s Bank of China on the design parameters for the Southbound Bond Connect with a view to an early launch of the scheme. With Chinese bonds making up an increasing proportion of global investors’ portfolio and the prospect of two-way traffic, this should attract more financial institutions to step up their bond arranging and trading operations in Hong Kong, further consolidating our leading position in the Asian bond market.

The HKMA has all along been playing a pivotal role in the Bond Connect development as all the existing Northbound trades are conducted through the Central Moneymarkets Unit (CMU) as the central custodian for global investors’ investments in the CIBM bonds. We have plans to further upgrade the system and service of CMU to cater for the growing demand of Northbound trades and to prepare for the opening of Southbound trades. We believe the Bond Connect would help attract both foreign and Mainland investors as well as issuers to Hong Kong, which could help CMU grow into an international central securities depository (ICSD) in Asia.

Second, green and sustainable bond market. The global green bond market has grown from practically non-existent ten years ago to US$270 billion in 2020. In Hong Kong, we recognised the significance of this market quite early on with the launch of the Green Bond Grant Scheme in 2018. A new Green and Sustainable Finance Grant Scheme was unveiled in the latest Government Budget, which will focus on green and sustainable bond issuers and borrowers and extend the scope of eligible products, external reviewers and expenses. To create the demonstrative effect and establish a benchmark yield curve, the Government itself has issued two rounds of green bonds since 2019 that are aligned to international standards such as ICMA’s Green Bond Principles. The latest issuance of 30-year green bond by the HKSAR Government is indeed the longest tenor green bond issued by a government in Asia and the Global Medium Term Note Programme is the first such programme dedicated to green bond issuances set up by a government in the world. Encouraged by overwhelming market response, we plan to double the overall borrowing ceiling to HK$200 billion which will provide more room for exploring future issuance in other currencies, project types and channels.

By the end of 2019, US$26 billion of green bonds has been arranged and issued in Hong Kong with a significant number of them by Mainland and overseas entities. While we do not have the 2020 figure yet, our estimates show that the issuance pipeline remained strong during the year despite the disruptive effect of Covid. We are seeing increased issuer and product diversity and expect the strong momentum to continue. Mainland China has just announced the ambitious 2060 carbon neutrality target. We believe Hong Kong, which adopts international standards in green bond issuance, is the ideal platform to raise green capital from international investors to support this transition and are looking at ways to facilitate this, in particular within the Greater Bay Area.

Meanwhile, the evolution, and our work, continues…

Notwithstanding the above, more work is still needed. As pointed out in the ICMA report, the overall bond market in Asia remains relatively small and less diverse when compared with the more mature US and European markets; the liquidity in the secondary market appears fragmented along the lines of issuer nationality; the uptake of e-trading has also lagged the US and Europe. Globally, the emergence of new breeds of fixed income investors, such as bond exchange traded funds and private credit funds, are forcing us to revisit our understanding of the boundary of the market, with potentially far-reaching policy implications.

The Financial Secretary has announced in his latest Budget that he would lead a steering group to formulate a roadmap for promoting the development of Hong Kong’s bond market, which will surely take into account the new developments and opportunities mentioned above in formulating the policy and strategy.

First, please LoginComment After ~