New China D-SIB Framework Positive for Bank Credit Profiles

Fitch, Mon 07 Dec, 2020 - 下午11:29 ET

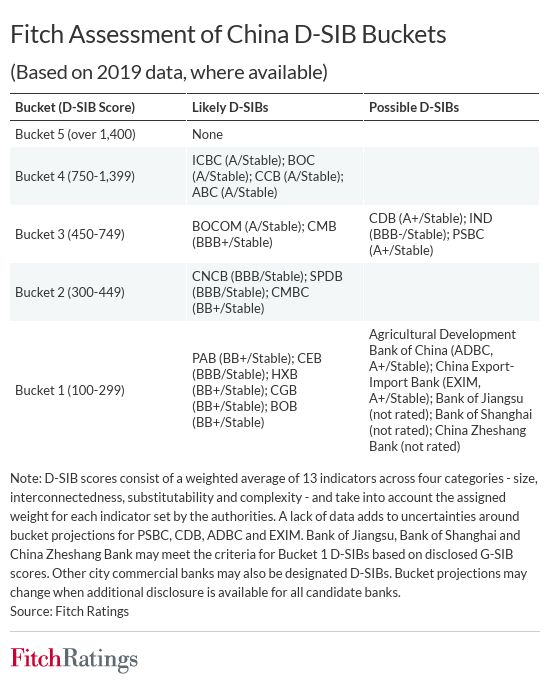

Fitch Ratings-Shanghai/Hong Kong-07 December 2020: The Chinese government’s final assessment framework for domestic systemically important banks (D-SIB) has adopted a broader approach than we had anticipated based on earlier draft consultations, and we now believe at least 20 of the 30 large banks under consideration will fall into the D-SIB category, says Fitch Ratings. We believe the framework should help strengthen the resilience of China’s largest banks, notably by raising minimum capital requirements for some institutions.

Regulatory D-SIB designations will be one factor in forming our view on a bank's systemic importance and likelihood of receiving timely sovereign support. Typical Support Rating Floors (SRFs) for D-SIBs would be 1-2 notches below the sovereign rating for sovereign ratings that are in the 'A' category, such as China (A+/Stable). However, the government's ability to provide support to a large number of D-SIBs may be constrained by the size of the banking system in the event of systemic stress, so additional notching may be imposed in China’s case.

Our Support Ratings also consider other factors such as banks’ ownership structures, past history of state support, and policy or quasi policy roles, apart from systemic importance. Consequently, a broader assessment will be required to determine whether the D-SIB designations will have an impact on banks’ Issuer Default Ratings (IDRs). The designated D-SIBs may need to submit recovery and resolution plans, though the impact of these on the government's propensity to support D-SIBs is not clear to us yet. Nevertheless, we believe the government will remain supportive of its most systemically important banks.

The new D-SIB framework forms part of the Chinese authorities’ ongoing efforts to strengthen regulatory supervision across the financial sector, reducing associated risks to systemic stability. It will come into effect on 1 January 2021, based on 2020 data, and we expect official announcements on D-SIB regulatory assessments to be made in 2H21. It incorporates five buckets, ranging from Bucket 5 (the most systemically important) to Bucket 1 (the least).

Besides support ratings, D-SIB designations may also influence banks’ standalone Viability Ratings (VRs), particularly if they increase minimum capital requirements. Under the existing framework, D-SIBs in China face a 1pp capital surcharge. It is unclear at this stage what capital surcharges D-SIB status will entail under the new framework, whether these will vary between buckets, and how any additional requirements will be phased in.

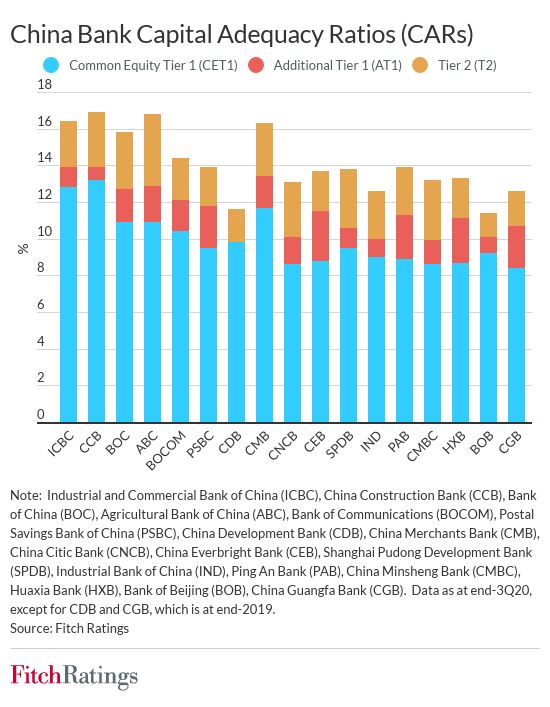

Fitch believes that the big four state banks that we estimate will fall into Bucket 4 – Industrial and Commercial Bank of China, Bank of China, China Construction Bank and the Agricultural Bank of China - can meet their D-SIBs capital surcharges as they are already required to meet the global systemically important banks (GSIB) buffer of 1.0% to 1.5%. We do not expect the capital surcharge for these institutions at this stage to differ materially from that already needed to meet the G-SIB requirements.

We believe meeting the additional capital levels required of D-SIBs could be challenging for some banks in lower-tier buckets, given our expectations around their growth and generally weak profitability. The sector as a whole already faces a difficult task in raising core capital levels and meeting total loss-absorbing capital requirements. Several Fitch-rated mid-tier banks had common equity Tier 1 ratios close to the current minimum 8.5% requirement for D-SIBs as of end-3Q20. As such, we believe that any D-SIB capital surcharges are only likely to be phased in over time. This may partly blunt the otherwise positive impact of the new D-SIB designations in reducing systemic risk in the near term.

First, please LoginComment After ~