Economic Research: The Missing Factor In China's Remarkable Recovery

Source: S&P Global Ratings, Shaun Roache

Key Takeaways

- Consumers in China are still cautious and financial conditions remained tight at the end of 2020. This may not derail the recovery, but it will restrain its momentum.

- The government recently said that the recovery is "not yet solid" and is "unstable and unbalanced." This has been our view for some time.

- Our 7% growth forecast for 2021 is at the low end of the consensus range. Upside risks stem mainly from the possibility of an official growth target closer to 8%, implying more stimulus.

China's economic recovery is remarkable but not complete. Consumption is lagging both investment, including property, and exports. The rebalancing towards consumption, needed for safer and greener growth, has reversed for now. S&P Global Ratings sees robust growth of 7% in 2021 yet our forecast is low compared with consensus views. The main upside risk to our forecast is that the government targets growth closer to 8% and sets its macro policies to get there.

For now, most observers are focusing on China's performance relative to that of its global peers. China announced yesterday its GDP grew by 2.3% in 2020, ahead of our forecast of 2.1%, meaning it could outpace global growth in 2020 by over 6 percentage points, a remarkable achievement.

However, the recovery from COVID-19 has exposed China's economic strengths as well as some of its weaknesses. Both are important for assessing what comes next. First, it has underlined the resilience and scale of the industrial and export sectors. The trade war appears to have done little to degrade supply chains, especially in the technology industries, which have driven the rebound. Second, it shows that policy stimulus still uses the old playbook of juicing infrastructure investment rather than helping households directly. Finally, it suggests that the rebalancing of the economy towards consumption is fragile and still a work in progress.

Still An Unbalanced Recovery…

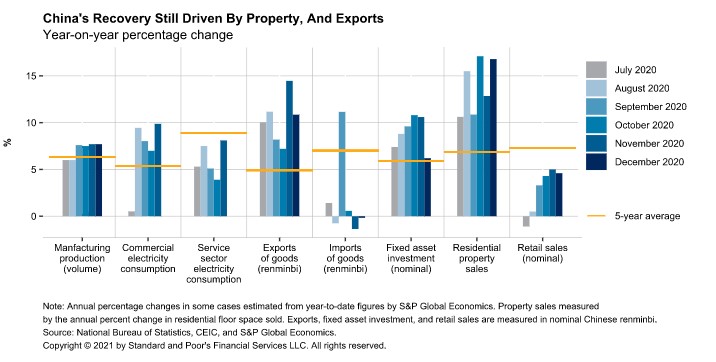

Monthly data for December tell a familiar story--this is an unbalanced recovery led by property, and exports. Infrastructure investment, buoyant earlier in 2020 helped by easing borrowing constraints for local governments, cooled at the end of the year. Residential property sales, measured by floor space, were more than 15% higher compared with the end of 2019. Exports, in local currency, are still growing in double-digits, driven by electronics. In turn, these sources of demand are driving manufacturing production, which is still expanding at well over 7%, in real terms, for the fourth consecutive month--see chart 1.

…As The Consumer Remains Cautious

What is striking about chart 1, though, is retail sales whose growth dipped back below 5% in December. Let's recall that sales were growing reliably at about 8% before COVID. Since the income shock of early 2020 has not yet fully abated, sales growth has never pushed back to, let alone above, pre-pandemic levels.

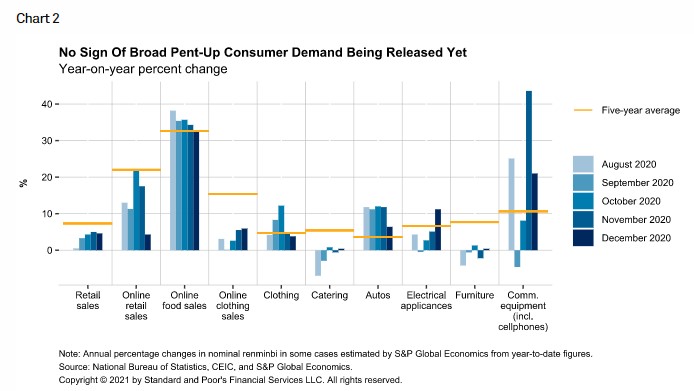

There's little evidence of pent-up demand, except perhaps for autos and luxury goods (which tells us something about the unequal impact of COVID on household finances). Sales of jewelry were up by about 20% in the final three months of 2020. Purchases of electronics also picked up late last year, helped by the annual November 11 "Singles Day" online sales event. However, purchases of clothes, furniture, and meals outside the home remained soft. Ahead of the lunar new year holidays, Chinese consumers have also cut back on traveling--passenger turnover on the railways was about 20% lower at end-2020 than the previous year.

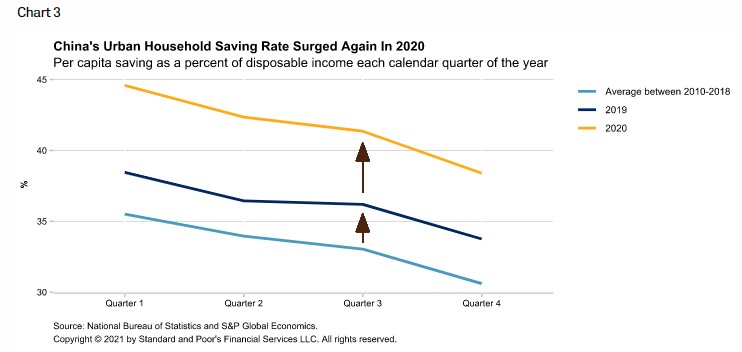

Chinese households are saving more, not going on buying sprees. The household survey suggests that urban residents saved almost 40% of their disposable income in the final quarter of 2020. This is exceptionally high by international standards and has been rising in recent years. Rural households are also saving more than normal although these households have much less surplus income to stash away for a rainy day. COVID-19 may have set back the rebalancing towards private consumption needed for safer and greener growth.

Inflation Still Low, Suggesting Soft Demand

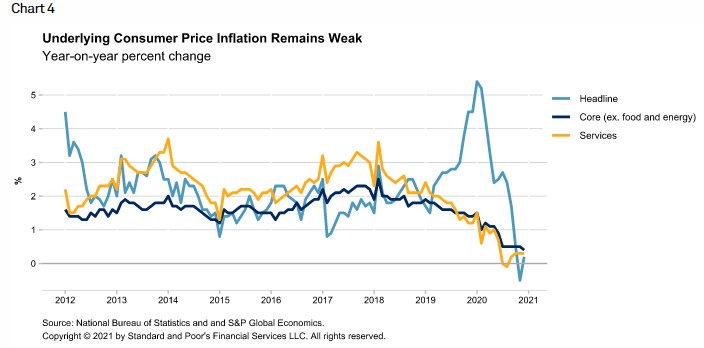

Soft demand is also evident from inflation. Inflation is a lagging indicator because it takes time for firms to change their prices--it is a bit like looking in the rear-view mirror. We should not overreact to inflation, especially if leading indicators are pointing in a different direction.

Still, the persistent decline in consumer price inflation is indicative of a demand problem. Let's ignore commodity prices for now, including iron ore, fuel, and pork. These prices can be helpful to help us understand overall demand, but they are often noisy and affected by idiosyncrasies such as sudden changes in supply.

Given the rising importance of the service sector in China's economy (and its key role in driving a post-COVID recovery) let's instead focus on consumer prices excluding food and energy and consumer service prices. Chart 4 shows that their inflation has steadily declined and is now well below the 3.5% expected in last year's government work report. This suggests many consumer-facing firms are not being overrun with customers to the point that they are able to raise prices. In turn, these firms may protect their margins by keeping labor costs, including wages, low.

Financial Conditions Tight For This Point In The Cycle

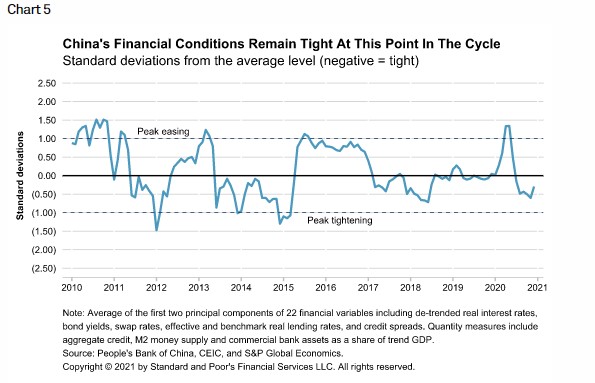

Domestic demand is not getting much help from financial conditions, which matter in China. When conditions tighten, growth momentum often wanes. Our index of key financial variables show that conditions remain tight for this point in the cycle (see chart 5). This is not signaling acute stress, but it is suggesting that the supply of credit is less abundant than normal, even as consumer demand is only just recovering.

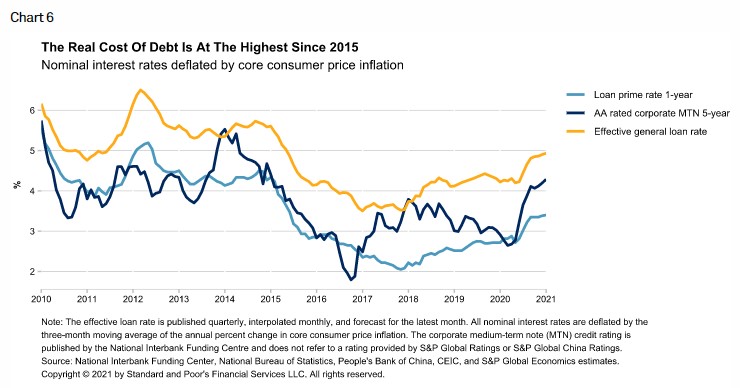

Conditions are tight, in part, because real interest rates remain high. The People's Bank of China (PBOC) has kept a steady hand on the policy tiller in recent quarters but real rates have still risen. Corporate bond yields had edged higher as both government bond yields and credit spreads rose, the latter reflecting increased aversion to risk. Interest rates charged by banks on new corporate loans have remained sticky above 5%, as chart 6 shows. At the same time, core inflation, excluding volatile commodity prices, has fallen and remains low. When inflation falls, the real cost of servicing debt rises.

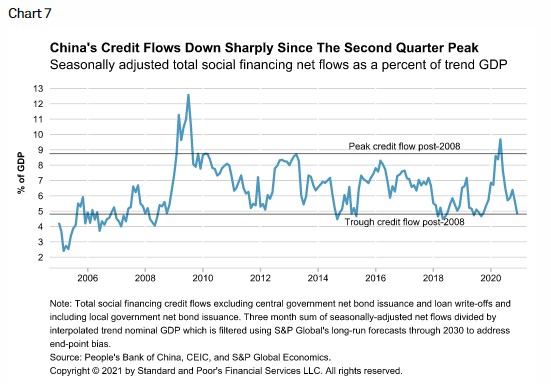

Credit flows to the real economy are weakening. When we measure net new credit to the economy over rolling three-month periods as a percent of trend GDP, we find a clear cycle which peaks at about 10% and troughs at about 5%. This roughly corresponds with the policy cycle. Since May 2020, the measure of credit has moved swiftly from peak to trough (see chart 7). There is a benign interpretation of this--that a large productivity boom is helping China grow without credit. This seems unlikely--more likely, credit is being kept tight by policymakers worried about too much financial risk.

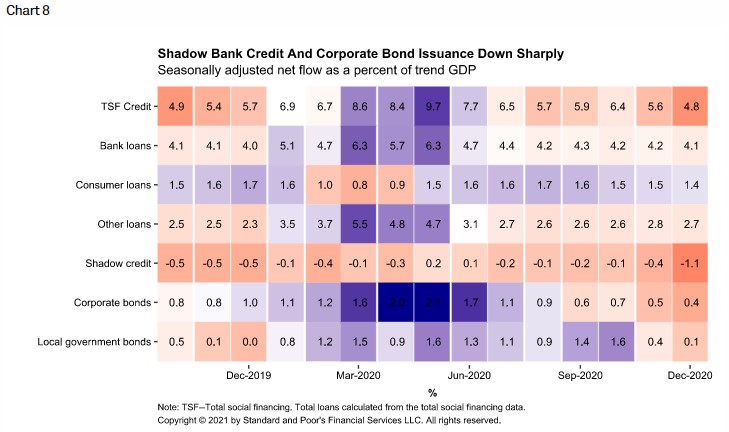

Shadow banking and corporate bond issuance explain much of the waning credit flow. Chart 8 below shows that these two have fallen quickly in recent months. The amount of shadow bank credit, during the final quarter of 2020, fell by over 1% of GDP, due largely to a sharp decline in trust lending. This is not a good sign for private firms, especially small and midsized enterprises (SMEs) which tend to rely on less formal lending. [1]

The PBOC has established programs to boost lending to SMEs [2]. Our Ratings colleagues note that this had some success with estimated 30% growth in SME loans and the big five megabanks achieving their 40% SME mandates for 2020 (this is boosting some parts of consumer lending (see chart 8). S&P Global Ratings expects the program to be renewed in some form in 2021.

However, the SME loan program is not a market-based solution--it will crowd out other borrowing and is not economical for banks From a macro perspective, administrative targets are unlikely to improve the allocation of capital and raise economy-wide productivity growth rates.

What Are Policymakers Doing?

For economists following China, the Central Economic Work Conference is a highlight of the year. This conclave is made up of senior officials from all the key economic and financial agencies and gathers every December to firm up the specifics of economic policy for the year ahead. The Politburo takes the lead, of course, and meets earlier in the month to set the tone. In the past, the conference also fixed the GDP growth target. While not officially confirmed until the big government meetings in March, the target often leaks into the public domain soon after the conference concludes.

Unlike other major economies, where much time is spent crunching data and running models, economists covering China often base their GDP forecasts on the official growth target. This is a reasonable strategy since the outcome is often very close to the target. Last year, for the first time in decades, the government refrained from setting a target due to the uncertainties of the pandemic. It is no surprise, then, that the range of economists' forecasts were uncharacteristically wide.

Growth Target Of 8% Would Pose Upside Risk To Our Forecast Of 7%

Early indications, including local media reports and forecasts from respected onshore think tanks suggest a growth target of about 8%. This is not confirmed and could change. It might be the mid-point of a range, a "soft" target, or (less likely) there may be no target at all. We should not rush to judgement.

Still, if the target is close to 8%, then our current forecast of 7% is too low. For economists in the U.S. and Europe, this may seem an odd statement. The U.S. Office of Management and Budget, the European Commission, or central banks are just forecasters like everyone else and while their forecasts influence opinion, most economists use their own reasoning. This is not how it works in China.

Ignore China's Growth Target At One's Peril

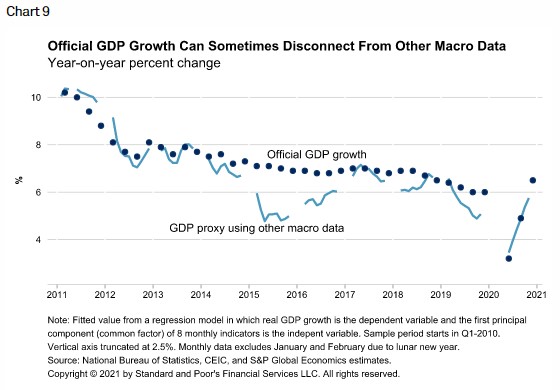

China's growth target is not a forecast but an organizing principle and meeting it is a measure of political success. This means three things. First, policies are set to achieve the target--a higher growth target, all else equal, means looser policies. This includes national-level macro policies but also local-level policies that affect growth, such as real estate measures. Second, the official GDP print may become somewhat detached from other measures of economic activity. More so than in many other economies, never simply rely on a GDP forecast to understand the view of a China economist. Third, the growth target is rarely wrong--since 2004, actual growth has undershot the target (or target range) only once, by 0.1 percentage point in 2014.

If the target is close to 8%, our forecast of 7% would be too low mainly because our assumptions about policy are wrong. We have assumed a substantial fiscal consolidation in 2021, tighter real estate policies, greater tolerance of defaults, but steady monetary policy. To get to 8% growth would mean less fiscal tightening, perhaps fewer restrictions on real estate. Suggestions from the conference that policies would be "stable," rather than signaling a big inflexion point, do add weight to the view that this may indeed be the case.

The other way to be wrong is simply that the official GDP outcome prints at the target, even if other data suggest lower growth. The last time this happened was during the 2014-15 downturn when key macro indicators suggested real growth had fallen below 5% even though the official print never fell below 6%. Remember, most China economists' GDP growth forecasts (ours included) are predicting where the official number will land, not what underlying conditions will be. These might be the same, but they are not always the same, as recently noted by Federal Reserve researchers. [3]

Looser Policy Mix Needed For 8% Growth

If the government announces a target close to 8%, this would mean that stimulus would have to be withdrawn very slowly, especially fiscal stimulus. This view seems to underlie the latest International Monetary Fund (IMF) forecasts. [4]

The IMF forecasts China will grow by almost 8% in 2021 and makes a key assumption--that the official fiscal deficit will fall by just 0.5 percentage point of GDP. This will keep the official deficit above the 3% of GDP level seen as an implicit government target. The IMF also expects only a small reduction in their expansive view of the total fiscal deficit, including some off-balance sheet borrowing by local governments by about 1 percentage point to 17.2% of GDP.

We should expect deficits to fall even if many of the stimulus measures remain in place--an improving economy will lift tax revenues and cut some spending whether or not policies change. After accounting for these effects, it appears that the IMF is not expecting much fiscal tightening at all.

Juicing growth up to 8% leaves almost no space for monetary tightening either. Already real interest rates are high, credit flows are waning, and the exchange rate is appreciating. Hiking short-term interest rates (or withdrawing liquidity which amounts to the same thing), could make it much harder to reach the 8% level.

We Keep Our 7% Forecast For 2021 For Now

We retain our 7% growth forecast for now but recognize the upside risk. There is little in the data that convinces us to upgrade now, except from some carryover from robust manufacturing in late 2020. The main upside risk comes not from underlying economic forces but policy and the possibility that the government goes all in for growth of 8% or above.

We will know the growth target, if there is one, in March. But we will get clues about the target from some indicators beforehand. Many activity indicators will not be reported for January--increasingly, the statistics agency rolls up the January and February figures together as they straddle the lunar new year holiday. However, the monthly credit will provide a key signal.

Credit data are highly seasonal. Banks' loan quotas reset in January, so lending is often quite strong at the start of the year. We will have to adjust for these seasonal effects and note that borrowing by local governments will have to wait for the budget in March. However, if we start to see a marked rise in the credit flow-to-GDP ratio and steady interest rates, this will signal renewed policy easing. That will be the trigger for us to start thinking about an upgrade for 2021 growth.

Endnotes

[1] Tsai, Kellee, 2016, "When Shadow Banking Can Be Productive: Financing Small and Medium Enterprises in China," Journal of Development Studies, Vol. 53, Issue 1.

[2] "China to Boost SME Lending with 400 billion Yuan Special Loan Buybacks," S&P Global Market Intelligence, June 2, 2020.

[3] Clark, Hunter L., Jeffrey B. Dawson, and Maxim L. Pinkovskiy, 2020, "How Stable Is China's Growth? Shedding Light on Sparse Data," Economic Policy Review, Volume 26, Number 4, Federal Reserve Bank of New York.

[4] International Monetary Fund, People's Republic of China: 2020 Article IV Consultation Staff Report, Jan. 8, 2021.

This report does not constitute a rating action.

First, please LoginComment After ~