Chinese Companies See Rising Profits Despite Fallout of COVID-19 Outbreak in 2020

By GT staff reporters Source: Global Times

More than 40% of A-share stocks see sizzling business for 2020

A total of 641 firms listed on China's A-share market, as of Friday, released performance forecasts for 2020. More than 40 percent are predicting positive growth, despite the fallout of the COVID-19 pandemic, according to information released by Wind, a financial information database.

Among the 273 firms forecasting a good year for business, 118 forecast growth and 73 said they will reverse losses seen in the first half of the year and turn profitable, China Securities Journal reported.

According to the report, 111 firms forecast a net profit growth rate of over 50 percent and 78 predicted a growth rate in profits of over 100 percent. Over the entire year of 2020, the Chinese stock market has grown by nearly $5 trillion, despite the global headwinds in the financial market.

Support to the outstanding performances of the Chinese companies amid the coronavirus comes from a fast recovery of production and resumption of work in China, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Sunday.

"COVID-19 brings both challenges and opportunities. Instead of being hit down, many medical care, pharmaceutical and internet companies sped up production and grasped opportunities, reaping benefits and reporting better-than-expected performances," Dong noted, adding that compared with other major countries, China's overall economic recovery, consumption and the employment situation are significantly better.

The predictions come alongside China's effective containment of the coronavirus and rapid recovery of economic activities. The IMF estimates China is expected to be the only major economy to record positive growth in 2020, compared to the global economy's predicted 4.4 percent contraction.

China's foreign trade is also quickly picking up despite the challenges seen in the first few months of this year. According to the latest data from the Ministry of Commerce (MOFCOM), China's total import and export volume is expected to reach around 32 trillion yuan ($4.89 trillion) this year, up 30 percent from 2015, according to media reports.

As the tough year winds down, with the coronavirus still taking its toll on many countries, China's next Five-Year Plan is designed to make its economy even bigger and stronger by 2025, offering a favorable environment for businesses operating in China to grow and thrive.

Growth despite US crackdown

In addition, a large number of Chinese companies are seeking market listing, with most eyeing stock markets in Shanghai and Hong Kong, according to Dong.

"Amid the US crackdown on some Chinese companies, the New York stock market and NASDAQ exchange are being gradually replaced by the exchanges in Shanghai and Hong Kong, which have a high level of openness and inclusiveness and can also satisfy the needs for IPOs of emerging Chinese companies," he noted.

Earlier this month, US president Donald Trump signed into law a new bill that could kick Chinese companies off US stock exchanges if they don't comply with American auditing standards within three years.

The bill, titled "The Holding Foreign Companies Accountable Act," bars foreign companies from listings on any US exchange if they fail to comply with the US Public Accounting Oversight Board (PCAOB)'s audits for three years.

Although the law applies to all foreign companies listed in the US, it is widely seen as being directed at Chinese firms. The Trump administration is also attempting to prevent the US pension fund from holding Chinese stocks.

"The more containment the US puts on Chinese firms, the more open China will be," Dong said, warning that without the contributions of Chinese listed companies on the US stock market, the market will lose its global recognition and attraction to global investors.

Chinese stocks listed globally have generally demonstrated good performance throughout this year. According to a report by the Wall Street Journal, citing S&P Global Market Intelligence, a financial information firm, Chinese stocks listed in global exchanges, including in New York and Shanghai, have gained 41 percent in total valuation to $16.7 trillion. In contrast, US companies gained only 21 percent this year.

Several internet companies' stocks have also reaped benefits from the lockdown during the COVID-19 pandemic, which forced higher levels of online activity than previously seen, Tian Yun, vice director of the Beijing Economic Operation Association, told the Global Times on Sunday.

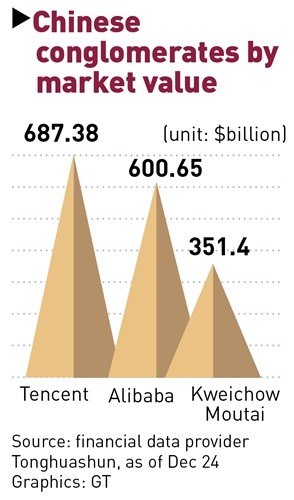

The Chinese internet giant Tencent's share price is up more than 60 percent compared to March, and Meituan, another e-commerce platform, saw its share price rise more than threefold since March.

But the main reason for the strong performance in Chinese stocks is the rising optimism in the Chinese economy, according to Tian.

"China's fast recovery from COVID-19 has drastically driven up investors' enthusiasm this year. Coupled with several high-profile IPOs of Chinese companies, the high expectation of Chinese businesses has pushed up the valuation of the capital market," Tian said.

In comparison, the sluggish economic performance in the US, pressured by the ineffective containment of the pandemic, will weigh on the forecasted stock performances of US companies, Tian said.

According to Vanguard, an investment advisor company, the annual returns of US stocks will be around 8 percentage points lower than in the past decade, down to only about 5 percent.

First, please LoginComment After ~