Venture Funds

What are Venture Funds?

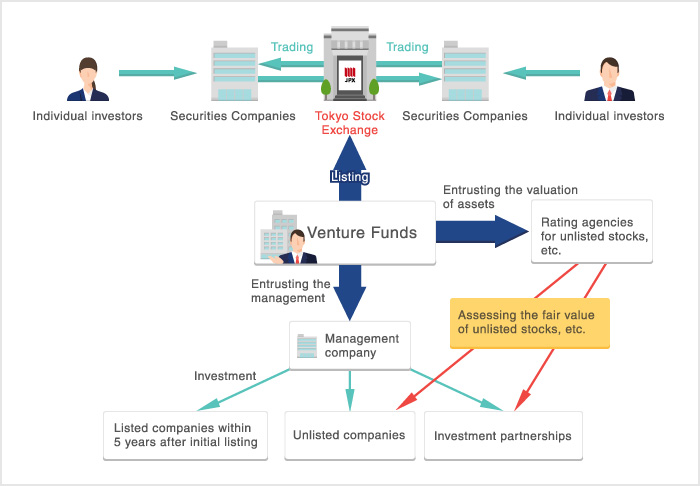

Venture Funds market was established on December 3, 2001 as a new market for investment corporations to invest in venture companies especially in unlisted companies.

Establish new financial scheme for venture companies

Venture funds are new financial scheme for venture companies utilizing investment corporations system (company-type investment trust).It gathers funds from general investors widely and invest in venture companies such as unlisted companies.

Provide individual investors with the opportunity of investment in unlisted companies.

Generally, venture companies are invested by investment partnership such as the institutional investors. Development of Venture Funds allows low-cost investment and the market where funds are easily-exchangeable enables individual investors to invest in venture companies.

Listing (Criteria for Listing Examination)

Criteria for Listing Examination are as follows.

Criteria of liquidity

| The number of listed investment units (the number as a regular stock) |

At least 2,000 units |

| The number of investors (the number of shareholders as a regular stock) |

At least 300 |

| The ratio of investment units held by major investors | Less than 80% |

| Total net asset value | At least JPY 3 billion |

Ratio of assets under management

The ratio of the amount out of the sum of investment in domestic unlisted stocks, etc., unlisted stocks, etc.-related assets, and stocks, etc. within five 5 years of listing to the total amount of assets under management, etc. is expected to reach more than 70%, and the ratio of the amount of investment in unlisted stocks, etc. to unlisted stocks, etc. investment amount is expected to reach more than 50%.

Assets other than unlisted stocks, etc., unlisted stocks, etc.-related assets, and stocks, etc. within 5 years of listing shall be for the purpose of reducing risks, such as losses due to price fluctuations pertaining to current assets, etc. and assets under management, etc., and those assets are limited to rights and other assets pertaining to transactions for which such reduction in such losses and other risks is objectively recognized.

Appropriateness of rating of unlisted stocks, etc.

Rating of unlisted stocks, etc. must be entrusted to an independent rating agency for unlisted stocks, etc.

The rating agency for unlisted stocks, etc. has an internal structure to conduct appropriate valuation.

Others

Appointment of administrator of shareholder, etc.

Trading

The Same Trading Method as Regular Stocks

Trading method of Venture Funds is the same as that of Regular Stocks. Both Limit and Market Orders are available.

Margin Trading is also available

Venture Funds are eligible for margin trading as with stocks. Criteria for selecting of Standardized Margin Trading Issues and loan trading issue is the same as stocks.

TEL: +81-3-3666-1361

Official Website:jpx.co.jp

First, please LoginComment After ~