Securities & Commodities Authority

Overview

Since its inception, the Securities and Commodities Authority has been keen on putting the objectives stated in the Federal Law No. (4) of 2000 into effect by sparing no effort to strengthen the legislative structure through issuing such regulations and instructions that ensure the development of the organizational and supervisory framework of the listjoint-stock companiesand other companies operating in the securities field. Besides, the Authority has introduced some controls and criteria that would contribute positively to enhancing the investors' trust in the Authority.

Based on the above, markets for trading in securities and commodities have been set up in the UAE where each market shall take the shape of a local public establishment licensed by the Securities and Commodities Authority, provided that the markets across the UAE are electronically connected on a reciprocal basis.

The market is managed by a board, which is formed by a decision by the competent local authority, provided that none of the board members shall be a board member of a listed public joint-stock company or a financial broker.

Establishment

On January 29, 2000 HH UAE President issued a federal decree to set up a public authority in the UAE's capital, which was called "Securities and Commodities Authority." The Authority enjoyed a legal entity, financial and administrative independence with the control and executive powers necessary for it to discharge its tasks in line with the provisions of this law and the regulations issued in implementation thereof, noting that the authority reported to the minister.

The Authority may set up subsidiary branches or offices to discharge the tasks of supervising and monitoring the markets but may neither practice trade activities nor seek benefit in any project nor own or issue any securities.

Visio, Mission and Philosophy

OUR VISION

To build a sustainable investment environment within an advanced financial market.

OUR MISSION

To safeguard the rights of investors, promote sound practices, and create an environment attractive to capital, using innovative systems.

OUR PHILOSOPHY

The Regulatory Philosophy of the Securities and Commodities Authority

OUR VALUES

Fairness and Integrity

To maintain the rights of all participants in securities and commodities markets and strengthenm the soundness and accuracy of the transactions executed.

Transparency

To provide all capital market participants with sufficient information and data simultaneously.

Creativity

To adopt and implement innovation and excellence standards in designing and executing tasks.

OUR STRATEGIC GOALS

1st Strategic Goal

To enhance the legislative framework necessary for the development of UAE-based capital markets.

2rd Strategic Goal

To safeguard the rights of financial market investors.

3rd Strategic Goal

To promote transparency and corporate governance practices.

4rd Strategic Goal

To ensure the provision of all administrative services in line with the transparency, efficiency and quality standards.

5rd Strategic Goal

To foster a culture of innovation in an institutional workplace.

Our Strategic Priorities

Pioneer islamic capital market

Sustainable financial market

Advanced financial market ecosystem

Fully fledge financial intermediary institutions

Provide public finance to SME’s

Regulating the financial market technologies

Regulating the issuance and trading of ICO’s through block chain technology

Introduce innovation and advanced solutions in regulations and supervision

Advanced corporate governance standards based on best international practices

Sustain UAE ranking amongst top 10 countries in the world in the field of competitiveness (KPI of protection of minority shareholders rights)

Launch joint initiatives with financial markets to increase the financial markets depth and enhance the liquidity

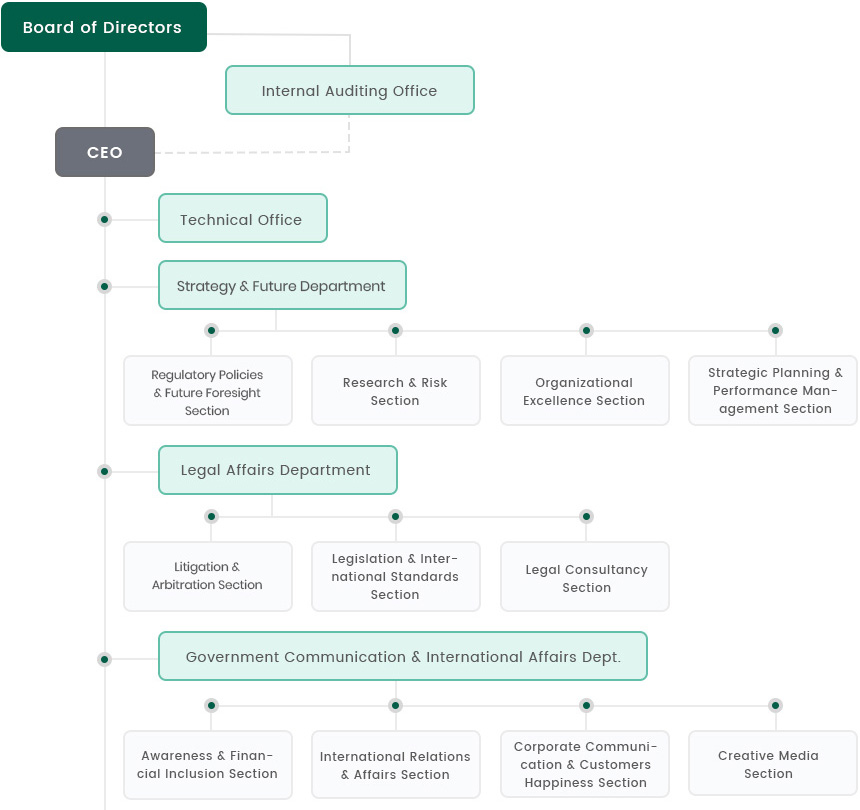

Organisational Chart

Board Member

H.E. Engineer Sultan Bin Saeed Al-Mansoori

Minister of Economy, Chairman of SCA Board

H.E. Saeed Mohammed Al Shared Al-Falasi

Deputy Chairman of SCA Board

H.E. Abdulla Khalifa Ahmed Al-Sowaidi

Board Member

H.E. AlYazia Ali Al Kywaiti

Board Member

H.E. Humaid Ali Bin Butti Al-Mheir

Board Member

H.E. Ahmed Saeed Ghanem Al Qamzi

According to the Cabinet decree, the Authority is to be managed by a Board of Directors chaired by His Excellency the Minister and five well experienced members who will be nominated by the Chairman and the Chief Executive.

The membership term of the Board is four years renewable for one time only except for the Chief Executive.

The Board should meet four times a year at least or as required by the Chairman's invitation. The Cabinet has approved the reconstitution of UAE Securities & Commodities Authority Board of Directors, where the members have been selected to boost the Board in its mission and to enhance targets based on the success achieved through the last three years of the previous board.

Consultants Council

As part of the efforts of the Securities and Commodities Authority (SCA) to sustainably improve the performance of UAE financial markets and to be abreast with latest international financial market developments and legislations, the SCA set up in 2007 an advisory board to provide technical advice to SCA board of directors and prepare the necessary studies on any subject

matter requested by the Board. The Advisory Board follow-up developments related to international laws, legislations and regulations, as well as all technical regulations on international financial markets in order to provide suggestions on the most appropriate practices for the SCA and UAE securities markets.

Since its establishment, the board has held several meeting which mainly dealt with issues related to the issuance of regulations according to priority and significance, specifying the objectives of those regulations which take into consideration the special nature of the UAE local markets and the potential effect of global crisis on the UAE markets.

he board also makes suggestions on avenues of developing the UAE financial services industry. It also evaluates the impact of regulations and decisions issued by the SCA on the UAE securities sector and those doing business in that sector, conduct studies to identify areas that need development in the working environment of the SCA and the UAE securities markets, in particular and in the UAE financial sector, in general, in addition to other matters that would be referred to the Advisory Board by the SCA Board of Directors, Chairman or the SCA Chief Executive Officer.

Our Partners

Central Bank of the UAE | Ministry of Finance Ministry of Economy | Ministry of Justice| Federal Public Prosecution|

Abu Dhabi Global Market | Abu Dhabi Securities Exchange | Dubai Financial Market |Department of Economic Development, Abu Dhabi | Department of Economic Development, Dubai ...

Reach US

Head Office - Abu Dhabi

First, please LoginComment After ~