German general government debt up in 2021 to €2.48 trillion

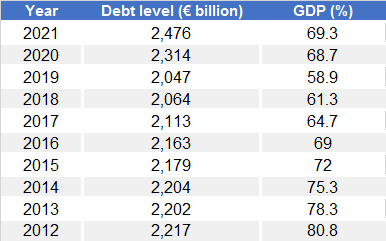

In the second year of the coronavirus pandemic, general government debt in Germany as defined in the Maastricht Treaty increased by €162 billion to €2.476 trillion. Growth was therefore weaker than in the first year of the coronavirus pandemic.

The debt ratio, meaning the ratio of debt to nominal gross domestic product (GDP), rose by 0.6 percentage point to 69.3% and is therefore in excess of the Maastricht Treaty’s reference value of 60%, as was the case in 2020. The increase in the debt ratio was relatively small because nominal GDP grew considerably (+6%), partly on account of rising prices. Strong GDP growth lowered the debt ratio by 4 percentage points in arithmetical terms.

The lion's share of the increase in debt was attributable to the general government deficit of €132 billion. The government used the remaining new debt to fund a build-up of financial assets. First, general government deposits at banks increased by €19 billion.

Second, central government, in particular, used funds for coronavirus assistance loans and government stakes in individual firms. On the other hand, the first large loan repayments were made on previously granted assistance loans.

The government-owned “bad banks” continued to reduce their debt. Support measures in favour of domestic financial institutions added €169 billion to the debt level and 4.7 percentage points to the debt ratio at the end of 2021. Assistance measures for euro area countries once again accounted for €87 billion (2.4 percentage points).

The EU Member States report data on the general government fiscal balance and on debt to the European Commission each year at the end of March and end of September – known as the Maastricht notification. To this end, the Federal Statistical Office calculates the balance and the Bundesbank the debt level.

First, please LoginComment After ~