刚刚!行長易綱重磅發聲!

Recently, Governor Yi Gang of the People’s Bank of China (PBOC) was interviewed by China Global Television Network (CGTN) on issues related to mobilizing the financial system to support green transition, climate information disclosure, international cooperation in green finance and monetary policy. The transcript of the interview can be found below.

近日,中國人民銀行行長易綱就金融支持綠色轉型、綠色資訊披露、綠色金融國際合作、貨幣政策等問題接受了中國國際電視臺(CGTN)記者專訪,以下為採訪實錄。

CGTN: Green transition requires massive capital, and the financial system can play an important role in this process. In recent years, what measures has the PBOC taken to encourage financial institutions to support green transition?

記者:綠色轉型需要大量資金投入,金融體系可在其中發揮重大作用。近年來,人民銀行推出了哪些措施,鼓勵金融機構支持綠色轉型?

Yi Gang: Central banks can play a very important and positive role in green transition. The international community has reached a consensus about this.

As far as monetary policy is concerned, the first and the most important mandate for central banks is to maintain price stability. Having said that, some central banks still have room to pay attention to structural issues to facilitate green transition, where structural monetary policy could play a role.

To facilitate green transition, the People's Bank of China has done a lot. The People's Bank of China included high-quality green bonds and loans as qualified collateral to the Medium-term Lending Facility in 2018. Last year, we launched two new monetary policy instruments, namely carbon emission reduction facility and special central bank lending facility for green and efficient use of coal, both of which provide funds to qualified commercial banks at a low interest rate of 1.75%.

As of the end of May, the People's Bank of China has provided over 210 billion yuan through the two facilities to financial institutions, which reduced emission by over 60 million metric tonnes of carbon dioxide equivalents, accounting for about 0.6% of China's annual carbon emission.

Moreover, the People's Bank of China issued Green Finance Evaluation Guidance in May 2021, incorporating green loans and green bonds into financial institutions' performance rating, providing the right incentives.

These incentives have helped accelerate green financing. As of March 2022, outstanding green loans in China exceeded 18 trillion yuan, posting a rapid increase. Outstanding green bonds reached about 1.3 trillion yuan, one of the largest in the world.

In conclusion, central banks can do something to help in green transition. It is important to make the whole society aware of the benefits of green transition.

易綱:央行可以在綠色轉型中發揮重要和積極作用,對此國際社會已有共識。

就貨幣政策而言,央行首要和最重要的職責是維護價格穩定。話雖如此,一些央行仍有政策空間,通過結構性貨幣政策促進綠色轉型。

為促進綠色轉型,人民銀行做了很多工作。人民銀行於2018年將優質綠色債券和貸款納入中期借貸便利的合格抵押品範圍,並在去年推出了碳減排支持工具和支持煤炭清潔高效利用專項再貸款兩個新的貨幣政策工具,利率均為1.75%,支持符合條件的金融機構為具有顯著碳減排效應的項目提供低成本融資。

截至今年5月末,人民銀行通過兩個工具向相關金融機構累計發放資金2100多億元,帶動減少碳排放超6000萬噸二氧化碳當量,約占中國年碳排放量的0.6%。

此外,去年5月,人民銀行修訂印發《銀行業金融機構綠色金融評價方案》,將金融機構發放綠色貸款和綠色債券業務納入央行金融機構評級,以鼓勵金融機構為綠色轉型提供支持。

上述機制有助於綠色融資快速增長。截至2022年3月,中國綠色貸款餘額已超過18萬億元,增長迅速。中國境內綠色債券餘額約1.3萬億元,在全球位居前列。

總之,央行可以在綠色轉型中發揮作用,提高全社會對綠色轉型益處的認識至關重要。

CGTN: What has the PBOC done to improve climate information disclosure and prevent fake reporting? What are some achievements?

記者:人民銀行在完善綠色資訊披露、防止造假等方面做了哪些工作?取得了哪些成效?

Yi Gang: This is very important. The disclosure is important and key issue in green transition. For fair and efficient implementation of green monetary policy tools, we should guard against different kinds of moral hazards, such as green-washing, low-cost fund arbitrage, and green project fraud. Therefore, information disclosure and strict supervision are needed when we design and implement green monetary policy tools. For example, the carbon emission reduction facility requires banks to disclose information on their websites on a quarterly basis about loan amount, interest rate, number of supported projects, and especially, quantity of carbon reduction. The People's Bank of China will verify the information together with other ministries and independent third-party institutions. It is also important for the general public to know this and help to watch.

To promote better management of climate risk, the People's Bank of China conducted the first climate risk stress testing last year, where the biggest challenge was insufficient information disclosure.

To promote climate information disclosure, the PBOC released the Guideline on Environmental Information Disclosure for Financial Institutions last year, defining requirements on the form, frequency, qualitative and quantitative information of the disclosure, and has guided over 200 financial institutions to prepare environmental information disclosure reports, including procedures to identify and assess, manage and control environmental risks, issuance of green loans and reduced emissions, as verified by third-party agencies. Going forward, we plan to expand the pilot program nationwide.

易綱:資訊披露十分重要,是促進綠色轉型的關鍵。為公平高效地實施綠色貨幣政策工具,在實踐中需注意防範“洗綠”、低成本資金套利、綠色專案造假等各類道德風險問題,因此,在設計和實施支持綠色轉型的貨幣政策工具的全過程中,均要做到資訊公開透明、監管嚴格到位。例如,碳減排支持工具要求金融機構按季度公開披露其發放的碳減排貸款金額、利率、支持專案數,以及貸款帶動的碳減排數量等資訊,人民銀行將會同其他部門和獨立的協力廠商專業機構對披露資訊進行核實,公眾知悉並對此進行監督也十分重要。

為推動管理氣候風險,人民銀行去年開展了首次氣候風險壓力測試,從測試情況看,碳排放資訊披露不充分仍是面臨的最大挑戰。

為促進氣候資訊披露,人民銀行去年發佈了《金融機構環境資訊披露指南》,對金融機構環境資訊披露的形式、頻次、應披露的定性及定量資訊等方面提出要求,並已指導200余家金融機構試編制環境資訊披露報告,包括環境風險的識別、評估、管理、控制流程,經協力廠商專業機構核實驗證的發放碳減排貸款的情況及其帶動的碳減排規模等資訊,未來將適時推廣到全國。

CGTN: The PBOC has been actively advancing international cooperation in green finance through multilateral and bilateral platforms. What role has the PBOC played in developing global green finance?

記者:人民銀行一直通過多邊和雙邊平臺積極推動綠色金融國際合作。在推動國際綠色金融發展方面,人民銀行扮演了怎樣的角色?

Yi Gang: At the global level, the People's Bank of China has worked with all parties to mobilize social capital to address climate change.

First, China co-chaired the G20 Sustainable Finance Working Group. Last year, the G20 resumed the Sustainable Finance Working Group, co-chaired by the People's Bank of China and the US Treasury. The working group has completed the G20 Sustainable Finance Roadmap as an important global guidance for mobilizing social capital to address climate change. This year, our priority is to develop the framework for transition finance, to guide social capital to support low-carbon transition of high-emission sectors.

Second, we have made progress in harmonizing taxonomies with our European counterparts. The People's Bank of China and the European Commission have been comparing green finance taxonomies since 2020. In November last year, we published the Common Ground Taxonomy, proposing 55 mutually recognized economic activities that could mitigate climate change. We have just upgraded the Common Ground Taxonomy on June 3rd this year, adding another 17 economic activities. The groundbreaking work could facilitate cross border green capital flows. To date, the China Construction Bank and the Industrial Bank have issued green bonds under Common Ground Taxonomy. Some emerging market economies also refer to this taxonomy.

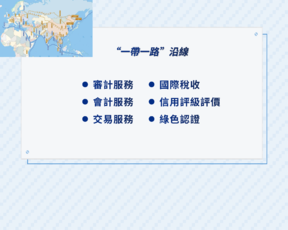

Third, we have leveraged green finance to build a green “Belt and Road”. In 2019, the People's Bank of China offered guidance in launching the Green Investment Principles (GIP) for the Belt and Road, outlining seven principles for green investment. As of May 2022, the GIP membership have expanded to 41 signatories and 14 supporters.

The People's Bank of China is also working with the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), the FSB and the BCBS on various fronts, including regulatory standards for green finance.

Going forward, the PBOC will continue to strengthen international cooperation on green finance through multilateral and bilateral platforms to create an enabling environment for China to achieve the target of carbon peaking and neutrality.

易綱:在國際領域,人民銀行與各方一道,積極引導市場資金支持氣候變化應對。

一是聯席牽頭G20可持續金融工作組。2021年初,G20恢復設立可持續金融研究小組,人民銀行和美國財政部任聯合主席,牽頭制定完成了《G20可持續金融路線圖》,成為國際層面引導市場資金支持應對氣候變化的重要指引。今年,我們的重點是推動制定轉型金融框架,引導市場資金支援高排放行業穩妥有序地實現低碳轉型。

二是與歐方推進綠色金融分類標準趨同取得階段性成果。2020年起,人民銀行與歐委會開展中歐綠色分類標準比對,並於2021年11月發佈《共同分類目錄》,提出了中歐各自綠色金融分類標準共同認可、對減緩氣候變化有顯著貢獻的55項經濟活動清單。今年6月3日,人民銀行和歐委會發佈了《共同分類目錄》的更新版,增補了17項經濟活動。中歐率先推動雙方綠色分類標準可比、互通,有利於引導跨境綠色資金流動。目前中國建設銀行、興業銀行已發行了《共同分類目錄》貼標綠色債券,部分新興市場國家發佈的綠色金融分類目錄也參考了《共同分類目錄》。

三是以綠色金融打造綠色“一帶一路”。2019年人民銀行指導發起了《“一帶一路”綠色投資原則》(GIP),GIP對綠色投資提出七條原則。截至2022年5月,GIP成員規模擴大到41家簽署機構以及14家支持機構。

此外,人民銀行還同央行與監管機構綠色金融網路(NGFS)、金融穩定理事會(FSB)、巴塞爾銀行監管委員會(BCBS)等開展多領域交流合作,推動完善綠色金融監管標準。

下一步,人民銀行將繼續通過多雙邊平臺推動綠色金融國際合作,更好地服務我自身實現碳達峰、碳中和目標。

CGTN: The Chinese economy has been facing some downward pressures, and the RMB exchange rate has depreciated recently. What is the current stance of China’s monetary policy and how would it support economic recovery?

記者:近期中國經濟面臨一定下行壓力,人民幣出現一定貶值。當前貨幣政策的取向如何?將在支持全國經濟復蘇中發揮怎樣的作用?

Yi Gang: China’s monetary policy is accommodative in supporting the real economy. Growth of broad money M2 and total social finance is in line with the nominal GDP growth rate, and provide ample liquidity and support to small- and medium-sized enterprises with the purpose of maximizing employment.

The market interest rate has been stable and trending downward in the past 10 years. The natural interest rate is mainly determined by the marginal productivity of capital and long-term demographic trend.

In China, interest rates are determined by market supply and demand, and the central bank guides market interest rates with monetary policy instruments. Currently, the time deposit rate is 1-2%, and bank loan rate is about 4-5%, and the bond market and the equity market function well. After taking into account of inflation, you can see the real interest rate is pretty low. The financial market makes an efficient allocation of resources.

We have a flexible and market-determined exchange rate system using a basket of currencies as reference. Compared to 20 years ago, RMB has appreciated against the USD by 25%, and appreciated against a basket of currencies by about 30% in nominal terms. The appreciation in real terms is even more.

Inflation outlook is stable in China. Right now, consumer price index is 2.1% and producer price index is about 6.4% on the year-on-year basis. Maintaining price stability and maximizing employment are our high priorities.

This year, we face some downward pressures of growth due to COVID-19 and external shocks, and the monetary policy will continue to be accommodative to support economic recovery in aggregate sense. At the same time, we also emphasize structural policies such as supporting small- and medium-sized enterprises and green transition.

易綱:中國的貨幣政策一直是與支援實體經濟發展相適應的。廣義貨幣M2和社會融資增速與名義GDP增速基本匹配,保持流動性合理充裕,支援中小企業發展以實現就業最大化目標。

過去十年來,中國的市場利率水平穩中有降。自然利率水準主要由資本邊際產出率和人口長期發展趨勢所決定。

中國利率形成機制是由市場供求決定的,中央銀行通過運用貨幣政策工具引導市場利率。目前定期存款利率約1-2%,銀行貸款利率約4-5%,同時債券和股票市場較為有效地運行。考慮到通脹水準,可以看出實際利率水準是相當低的,金融市場得以有效配置資源。

我國實行的是靈活的、以市場供求為基礎,參考一籃子貨幣進行調節的匯率制度。與20年前相比,人民幣對美元匯率升值約25%,對一籃子貨幣的名義匯率升值約30%,實際匯率升值幅度更高。

中國的通脹前景較為穩定,CPI同比增長2.1%,PPI同比增長6.4%。保持物價穩定和就業最大化是我們的工作重點。

今年以來,受疫情和外部衝擊等影響,中國經濟面臨一定下行壓力。貨幣政策將繼續從總量上發力以支持經濟復蘇。同時,我們也會強調用好支援中小企業和綠色轉型等結構性貨幣政策工具。

請先 登錄後發表評論 ~