Bank of England may launch biggest rate hike since 1989 if energy bill support fuels inflation

“Providing stimulus mainly via transfers to households would leave in place a very high inflation peak” of 15 per cent, Bank of America said.

Governor Andrew Bailey and the rest of the monetary policy committee have already lifted rates six times in a row, including a 50 basis point hike, the biggest rise in over 25 years, earlier this month.

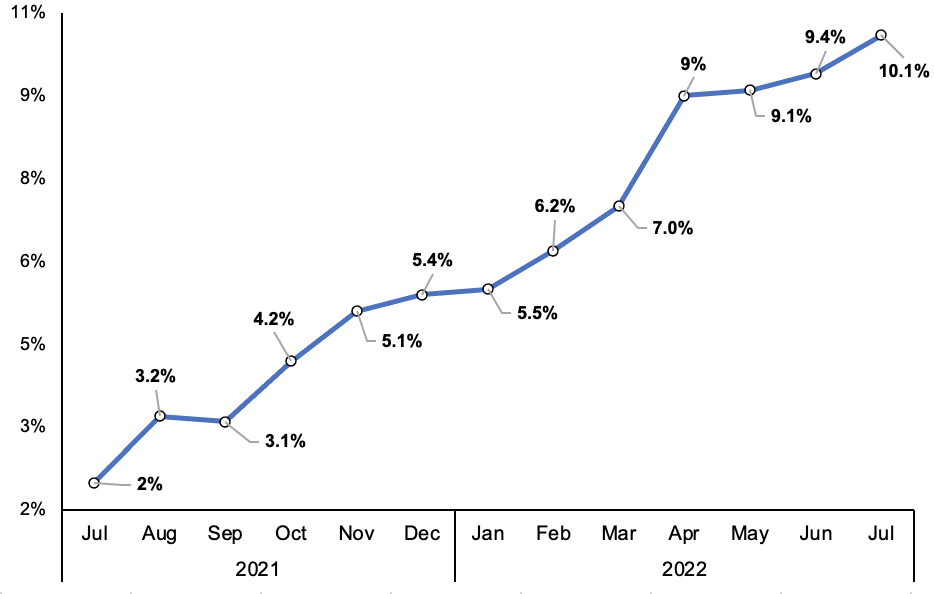

Inflation is running at 40-year high of 10.1 per cent.

Annual UK CPI inflation

Households are bracing for the energy watchdog to announce a potential 80 per cent upgrade to the bill cap tomorrow, sending the average annual bill to over £3,500.

Rising bills will tip millions of Brits into fuel poverty, prompting a string of economists today to warn the government is running out of time to save households and businesses from the cost of living crunch.

Britain is set to tip into a 15-month long recession at the end of this year, according to Threadneedle Street.

Rich households would bag greater cash benefits compared to poorer households if the government kept prices artificially low.

Richer households spend a higher cash value on energy bills. However, poorer households spend a larger share of their income on energy bills, meaning they would receive greater relative advantages.

“A price cap has the advantages of clarity and preventing anyone from falling between the cracks of various support mechanism,” Bank of America added.

Rates are set to rise 50 basis points again in September and 25 basis points in December and February, Bank of England said. Including a 75 basis point rise, borrowing costs would climb to 3.5 per cent. Money markets think they will peak at four per cent next May.

First, please LoginComment After ~