在降低通胀之前,我们都会坚持——美联储副主席布雷纳德最新演讲

JH会议之后,美联储理事加强了与市场的沟通,传达鹰派抗通胀的政策立场和决心。如同可以改变利率曲线一样——QE+前瞻指引可更大幅度的压低期限溢价,前瞻指引也可以改变通胀预期曲线。美联储的政策意图是将长期通胀预期牢牢地钉在2%政策目标上,防止“工资-物价螺旋”或“利润-物价螺旋”的形成。

本文为美联储副主席9月7日的演讲,解释了高通胀的原因,传递了边际趋缓的乐观信号,最后表达了美联储抗击通胀的决心,“不能过早地打退堂鼓”,“直到通胀降下来之前(as long as it takes),都会保持紧缩的政策”等,以德拉吉式的沟通(“whatever it takes”)安抚市场。

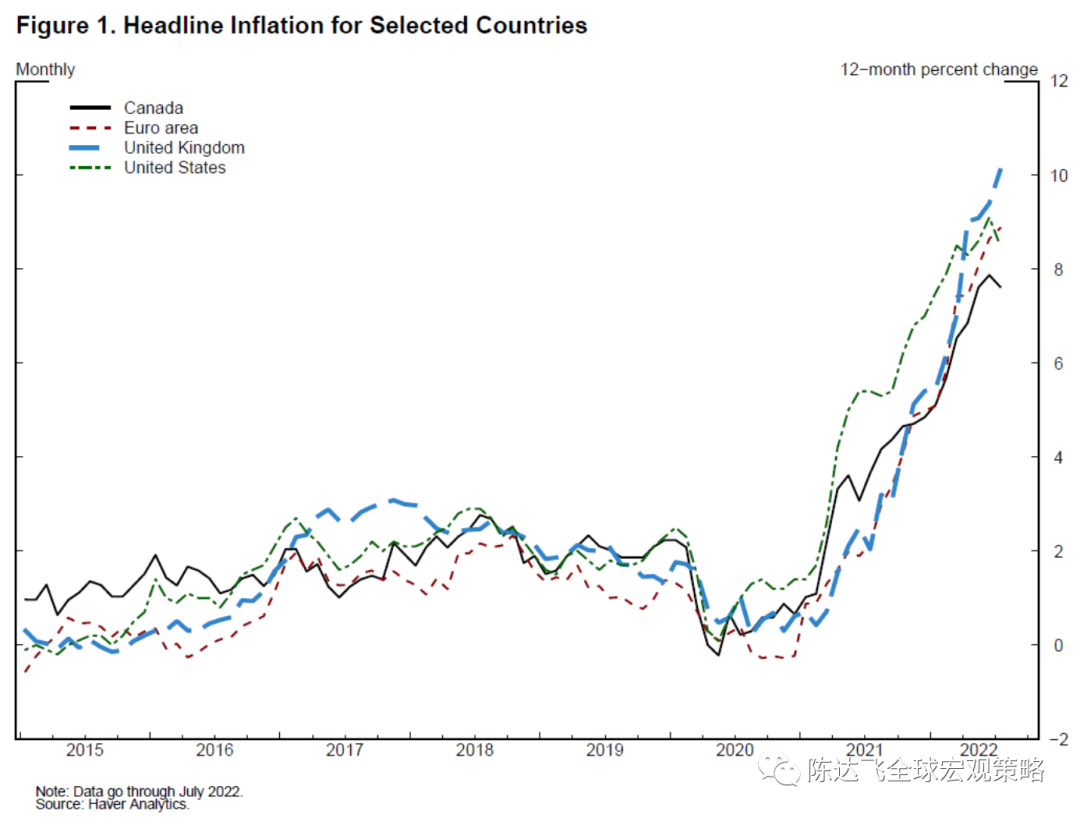

Over the past year, inflation has been very high in the United States and around the world (figure 1). High inflation imposes costs on all households, and especially low-income households. The multiple waves of the pandemic, combined with Russia's war against Ukraine, unleashed a series of supply shocks hitting goods, labor, and commodities that, in combination with strong demand, have contributed to ongoing high inflation. With a series of inflationary supply shocks, it is especially important to guard against the risk that households and businesses could start to expect inflation to remain above 2 percent in the longer run, which would make it much more challenging to bring inflation back down to our target. The Federal Reserve is taking action to keepinflation expectations anchored and bring inflation back to 2 percent over time.1

在过去的一年里,美国和世界各地的通货膨胀都非常高(图1)。高通货膨胀冲击了所有家庭,尤其是低收入家庭。多波疫情,加上俄罗斯对乌克兰的战争,引发了一系列供给冲击,如商品、劳动力和大宗商品,再加上强劲的需求,导致了持续的高通胀。在一系列供给冲击的情况下,防范家庭和企业可能开始预期通胀长期保持在2%以上的风险尤为重要,这将使通胀回落到我们的目标水平变得更具挑战性。美联储正在采取行动,以保持通胀预期稳定,并使通胀在一段时间内回到2%。

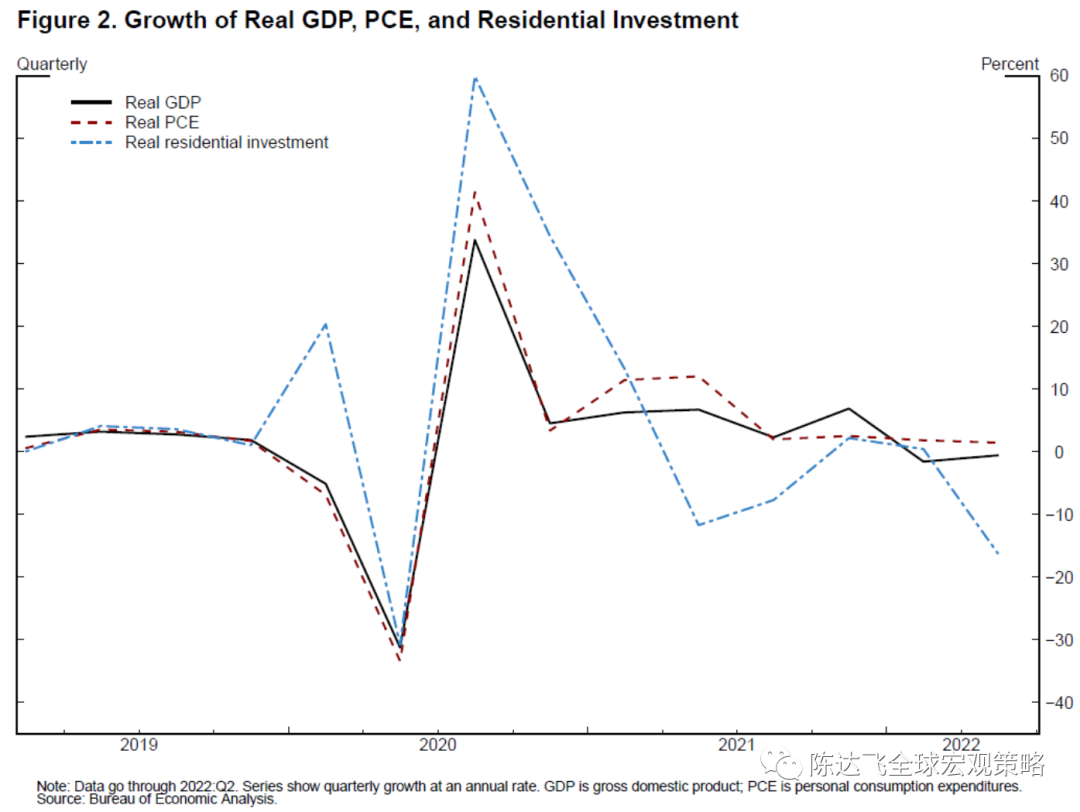

While last year's rapid pace of economic growth was boosted by accommodative fiscal and monetary policy as well as reopening, demand has moderated this year as those tailwinds have abated. A sizable fiscal drag on output growth alongside a sharp tightening in financial conditions has contributed to a slowing in activity. In the first half of 2022, real gross domestic product (GDP) declined outright, overall real consumer spending grew at just one-fourth of its 2021 pace, and residential investment, a particularly interest-sensitive sector, declined by 8 percent (figure 2).

尽管去年经济的快速增长得益于宽松的财政和货币政策以及重新开放,但随着这些有利因素的减弱,今年的需求有所放缓。财政对产出增长的严重拖累,加上金融条件的急剧收紧,导致经济活动放缓。2022年上半年,实际国内生产总值(GDP)开始收缩,整体实际消费支出仅增长了2021年的四分之一,作为对利率尤其敏感的领域的住宅投资下降了8%(图2)

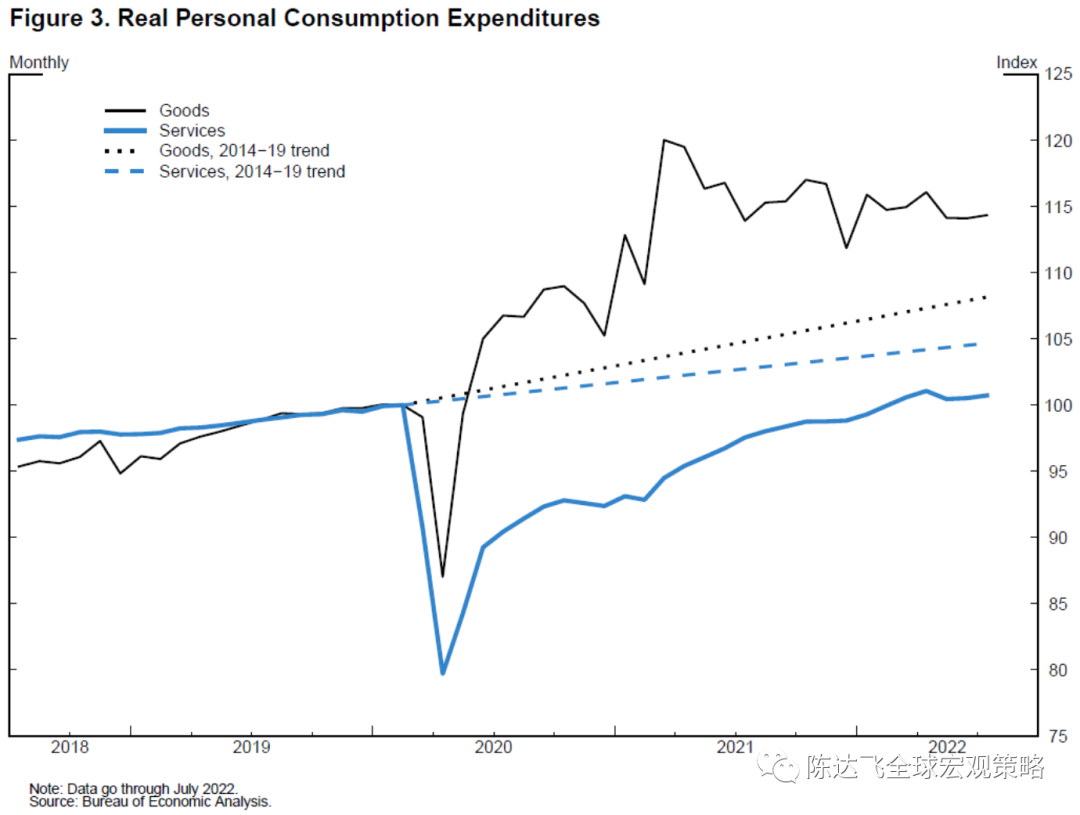

The concentration of strong consumer spending in supply-constrained sectors has contributed to high inflation. Consumer spending is in the midst of an ongoing but still incomplete rotation back toward pre-pandemic patterns. Real spending on goods has declined modestly in each of the past two quarters, while real spending on services has expanded at about half its 2021 growth rate. Even so, the level of goods spending remains 5 percent above the level implied by its pre-pandemic trend, while services spending remains 4 percent below its trend (figure 3).

强劲的消费支出集中在供应受限的行业,导致了高通胀。消费者支出正处于向大流行前模式的回归但仍不完全的逆转过程中。过去两个季度,商品实际支出均出现小幅下降,而服务实际支出的增幅约为2021年增幅的一半。即便如此,商品支出水平仍然比大流行前的趋势水平高出5%,而服务支出仍然比趋势水平低4%(图3)。

In addition to the fiscal drag and tighter financial conditions, high inflation—particularly in food and gas prices—has restrained consumer spending by reducing real purchasing power. While price increases in food and energy are weighing on discretionary spending by all Americans, they are especially hard on low-income families, who spend three-fourths of their income on necessities such as food, gas, and shelter—more than double the 31 percent for high-income households.

除了财政拖累和金融状况收紧,高通胀(尤其是食品和天然气价格)通过降低实际购买力抑制了消费者支出。虽然食品和能源价格的上涨对所有美国人的可自由支配支出造成了压力,但对低收入家庭来说尤其困难,他们将收入的四分之三用于购买食品、汽油和住房等必需品,这一比例是高收入家庭31%的两倍多。

Since the very elevated prices at the pump in June, the nationwide average price of a gallon of regular unleaded gasoline has declined every day throughout July and August, most recently falling below $4 a gallon, according to the American Automobile Association.4 The rise and fall of gasoline prices played a major role in the dynamics of inflation over the summer, contributing 0.4 percentage point to month-over-month personal consumption expenditures (PCE) inflation in June and subtracting 0.2 percentage point in July. This 0.6 percentage point swing in the contribution of gasoline prices was an important driver of the decline in month-over-month PCE inflation from 1 percent in June to negative 0.1 percent in July.

根据美国汽车协会的数据,自从6月份汽油价格达峰以来,全国每加仑普通无铅汽油的平均价格在7月和8月期间每天都在下降,最近已经跌到了每加仑4美元以下。汽油价格的涨跌对整个夏天的通货膨胀起了主要作用。对6月份的个人消费支出月度通胀贡献了0.4个百分点,对7月份的个人消费支出减少了0.2个百分点。汽油价格贡献的0.6个百分点变化,是7月PCE环比涨幅从6月的1%降至- 0.1%的重要推动因素。

In contrast, food price pressures continue to worsen, reflecting Russia's continuing war against Ukraine, as well as extreme weather events in the United States, Europe, and China.5 The PCE index for food and beverages has increased each month this year by an average of 1.2 percent, resulting in an 8-1/2 percent cumulative increase in the index year-to-date through July. For context, the net change in the food and beverages price index over the entire four-year period before the pandemic was only 0.5 percent.

相比之下,食品价格的压力继续升级,这反映了俄罗斯发动的对乌克兰的持续战争,以及美国、欧洲和中国的极端天气事件。食品和饮料的PCE指数今年每月平均增长1.2%,导致今年到7月为止该指数累计增长8.5%。在大流行之前的整个四年期间,食品和饮料价格指数的净变化仅为0.5%。

Core inflation—inflation excluding volatile food and energy prices—also moderated in July. Core goods PCE inflation decelerated to 0.1 percent month-over-month in July after averaging 0.5 percent in May and June.6 While the moderation in monthly inflation is welcome, it will be necessary to see several months of low monthly inflation readings to be confident that inflation is moving back down to 2 percent.

核心通胀(不包括波动较大的食品和能源价格)在7月份也有所缓和。核心商品PCE通胀在5月和6月平均为0.5%后,7月下降至0.1%。虽然通胀的缓和是受欢迎的,但有必要看到数个月度的低通胀数据,才能相信通胀正在回落至2%。

How long it takes to move inflation back down to 2 percent will depend on a combination of continued easing in supply constraints, slower demand growth, and lower markups, against the backdrop of anchored expectations. With regard to supply constraints, a variety of indicators are showing signs of improvement on delivery times and supplies of some goods. In addition, labor force participation showed a welcome increase in the August employment data, particularly in the boost in participation among women in the core working years of 25 to 54 years of age. Even with this improvement, the participation rate is still 1 percentage point below its pre-pandemic level, well in excess of the decline in the participation rate that would have been expected due to retirements in the absence of the pandemic.

在预期被锚定的背景下,需要多长时间才能将通胀降至2%,这将取决于供应限制的持续放松、需求增长放缓和利润率下降的综合作用。关于供应方面的限制,各种指标显示出一些货物的交货时间和供应情况有所改善的迹象。此外,劳动力参与率在8月份的就业数据中出现了可喜的增长,尤其是25至54岁的核心工作年龄女性的参与率有所提高。即使有了这一改善,参与率仍然比大流行前的水平低1个百分点,远远超过在没有大流行的情况下由于退休而预期的参与率的下降。

Reductions in markups could also make an important contribution to reduced pricing pressures. Last year's rapid demand growth in the face of supply constraints led to product shortages in some areas of the economy and high margins for many firms. Although we are hearing some reports of large retailers planning markdowns due to excess inventories, we do not have hard data at an aggregate level suggesting that businesses are reducing margins in response to more price sensitivity among customers. At an aggregate level, in the second quarter, measures of profits in the nonfinancial sector relative to GDP remained near the postwar peak reached last year.7

降低成本加成率也可能对降低物价压力作出重要贡献。去年,在供应受限的情况下,需求的快速增长导致了一些经济领域的产品短缺和许多公司的高利润率。尽管我们听到一些报告称,大型零售商因库存过剩而计划降价,但我们没有确凿的总体数据表明,企业正在降低利润率,以应对消费者对价格的更敏感。总体而言,在第二季度,非金融部门利润相对于GDP的指标仍接近去年达到的战后峰值。

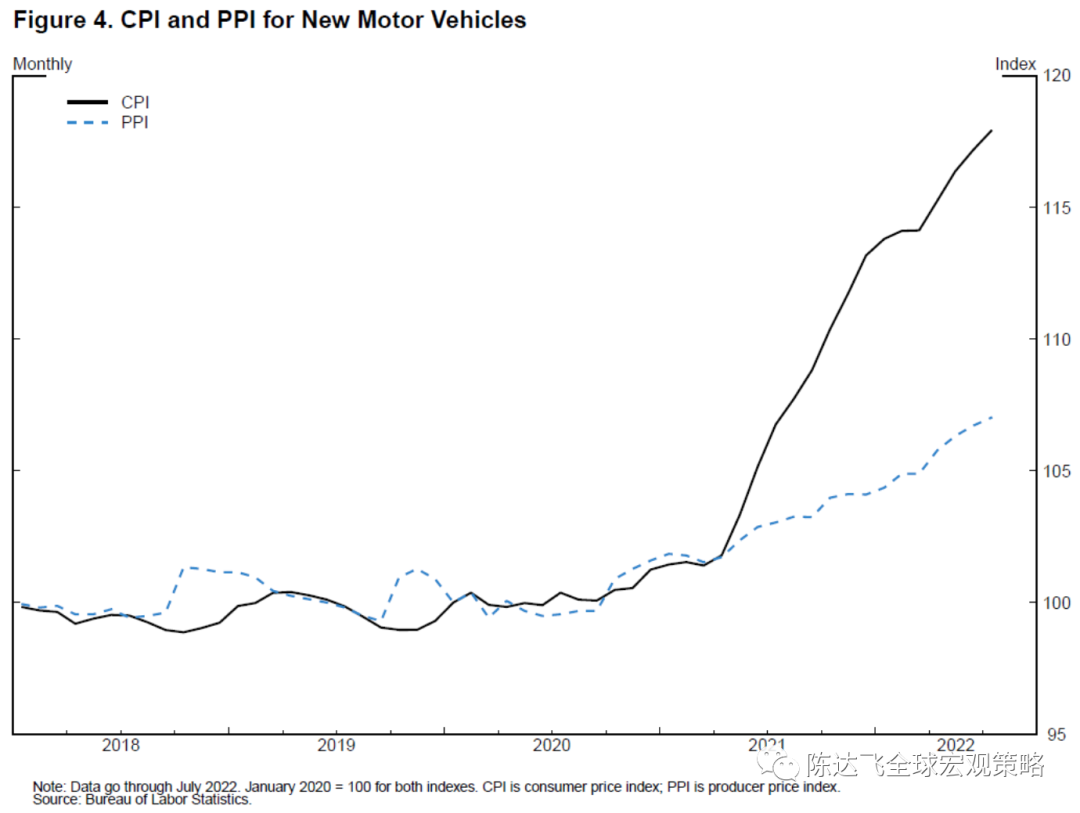

Using the available macroeconomic data, it is challenging to measure directly how much firms mark up their prices relative to their costs. That said, there is evidence at the sectoral level that margins remain high in areas such as motor vehicles and retail. After moving together closely for several years, starting early last year, the new motor vehicle consumer price index (CPI), which measures the price dealers charge to customers, diverged from the equivalent producer price index (PPI), which measures the price dealers paid to manufacturers. Since then, the CPI has increased three times faster than the PPI (figure 4). This divergence between retail and wholesale prices suggests an unusually large retail auto margin. With production now increasing, and interest-sensitive demand cooling, there may soon be pressures to reduce vehicle margins and prices in order to move the higher volume of cars being produced off dealer lots.

利用现有的宏观经济数据,很难直接衡量企业相对于成本提高了多少价格。尽管如此,有证据表明,在行业层面,汽车和零售等领域的利润率仍然很高。从去年年初开始,衡量经销商向消费者收取的价格的新汽车消费价格指数(CPI)与衡量经销商向制造商支付的价格的同等生产者价格指数(PPI)紧密结合了数年之后出现了背离。从那以后,CPI的增长速度是PPI的三倍(图4)。零售和批发价格之间的差异表明,汽车零售利润率异常高。随着产量的增加和对利率敏感的需求的降温,可能很快就会有降低汽车利润和价格的压力,以把更多的汽车从经销商处转移出去。

Similarly, overall retail margins—the difference between the price retailers charge for a good and the price retailers paid for that good—have risen significantly more than the average hourly wage that retailers pay workers to stock shelves and serve customers over the past year, suggesting that there may also be scope for reductions in retail margins. With gross retail margins amounting to about 30 percent of sales, a reduction in currently elevated margins could make an important contribution to reduced inflation pressures in consumer goods.

同样,在过去的一年中,总体零售利润率——零售商对一种商品收取的价格和支付的价格之间的差异——的增长明显高于零售商支付给工人的平均小时工资,这表明零售利润率可能还存在下降的空间。由于零售毛利率约占销售额的30%,降低目前较高的利润率可能会对降低消费品的通胀压力做出重要贡献。

Labor demand continues to exhibit considerable strength, which is hard to reconcile with the more downbeat tone of activity. Year-to-date through August, payroll employment has increased by about 3-1/2 million jobs, a surprisingly strong increase given the decelerating spending and declining GDP over the first half of the year. The unemployment rate has fallen, on net, from 4 percent in January to 3.7 percent in August. Possibly the strongest indications that the labor market is tight were the first- and second-quarter readings of the employment cost index (ECI), which point to strong and broad-based growth in total hourly compensation. The 6.3 percent reading for the ECI in the second quarter was the largest annualized quarterly growth in compensation under this metric since 1982. The most recent reading of average hourly earnings suggested some possible cooling, decelerating from a gain of 0.5 percent in July to 0.3 percent in August, although it will be important to see additional data.

劳动力需求继续表现出相当强劲的势头,这与经济活动较为悲观的基调很难调和。今年截至8月份,美国就业人数增加了约350万,考虑到上半年支出减速和GDP下滑,这一增幅令人意外地强劲。净失业率已经从1月份的4%下降到8月份的3.7%。一季度和二季度的就业成本指数(ECI)可能是劳动力市场吃紧的最有力证据,该指数显示总时薪强劲且广泛地增长。二季度的ECI增速为6.3%,为1982年以来的最大单季增速。最新数据显示,平均时薪可能有所降温,增幅从7月的0.5%降至8月的0.3%,不过重要的是要看到更多数据。

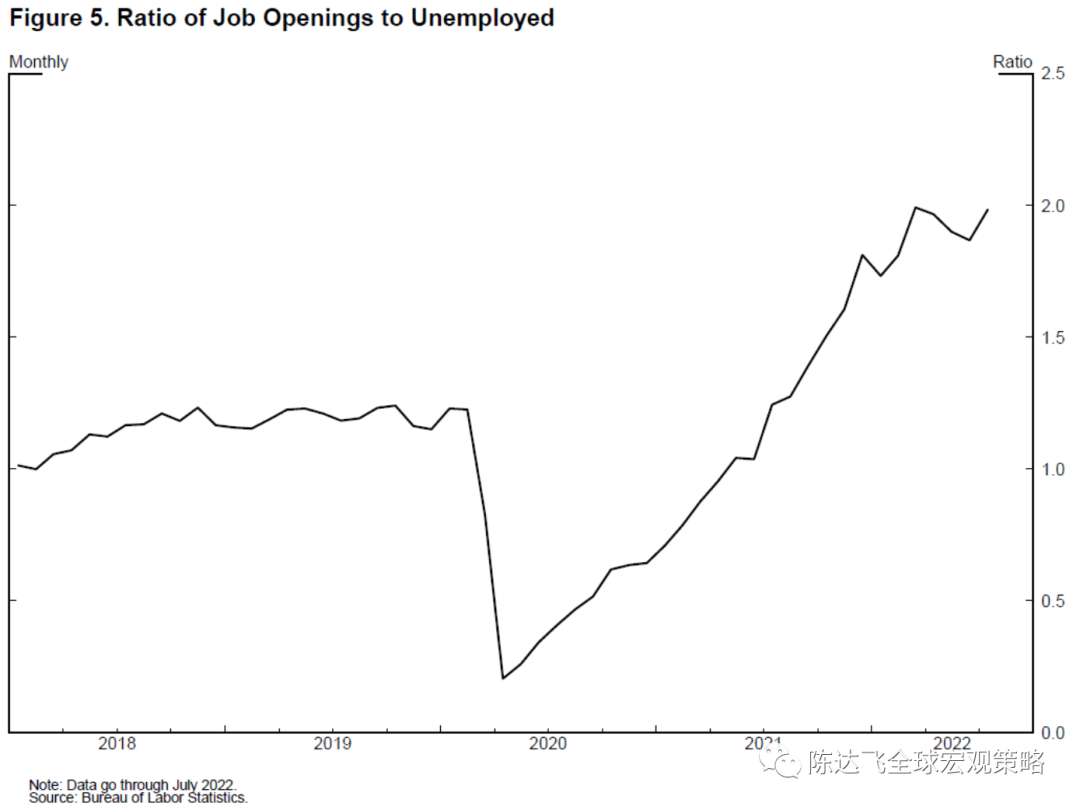

The deceleration in economic activity thus far this year has coincided with only a slight easing in job openings, on net, since their peak in March. The current high level of job openings relative to job seekers remains close to the largest in postwar history, consistent with a tight labor market (figure 5). Businesses that experienced unprecedented challenges restoring or expanding their workforces following the pandemic may be more inclined to make greater efforts to retain their employees than they normally would when facing a slowdown in economic activity. This may mean that slowing aggregate demand will lead to a smaller increase in unemployment than we have seen in previous recessions, but it is too early to draw any definitive conclusions, and I will be monitoring a variety of labor market indicators closely.

今年迄今经济活动的减速与净职位空缺自3月份达到峰值以来仅略有减少相对应。目前相对于求职者的职位空缺水平仍然接近战后历史上的最高水平,这与紧张的劳动力市场相一致(图5)。在大流行之后,经历了恢复或扩大劳动力的前所未有的挑战的企业可能更倾向于在经济活动放缓时比通常情况下更努力地留住员工。这可能意味着,总需求放缓将导致失业率比我们在以往的衰退中看到的增幅更小,但现在得出任何明确的结论还为时过早,我将密切关注各种劳动力市场指标。

As we follow through on our plan to move monetary policy to an appropriately restrictive stance, the effect of the increased policy rate and pace of balance sheet shrinkage should put downward pressure on aggregate demand, particularly in interest-sensitive sectors like housing. Continued improvements in supply conditions and a further rotation of consumption away from goods and into services should also help by reducing price pressures in goods. With regard to non-housing services, the magnitude of price pressure over the next several quarters will depend on an overall slowing in spending as well as the extent to which labor supply improves in these sectors.

随着我们贯彻将货币政策转向适当的限制性立场的计划,政策利率上调和资产负债表收缩应该会对总需求造成下行压力,尤其是在住房等利率敏感领域。供应状况的持续改善以及消费从商品转向服务的进一步循环也应有助于减轻商品价格压力。至于非住房服务业,未来几个季度价格压力的大小将取决于支出的整体放缓,以及这些部门的劳动力供应改善的程度。

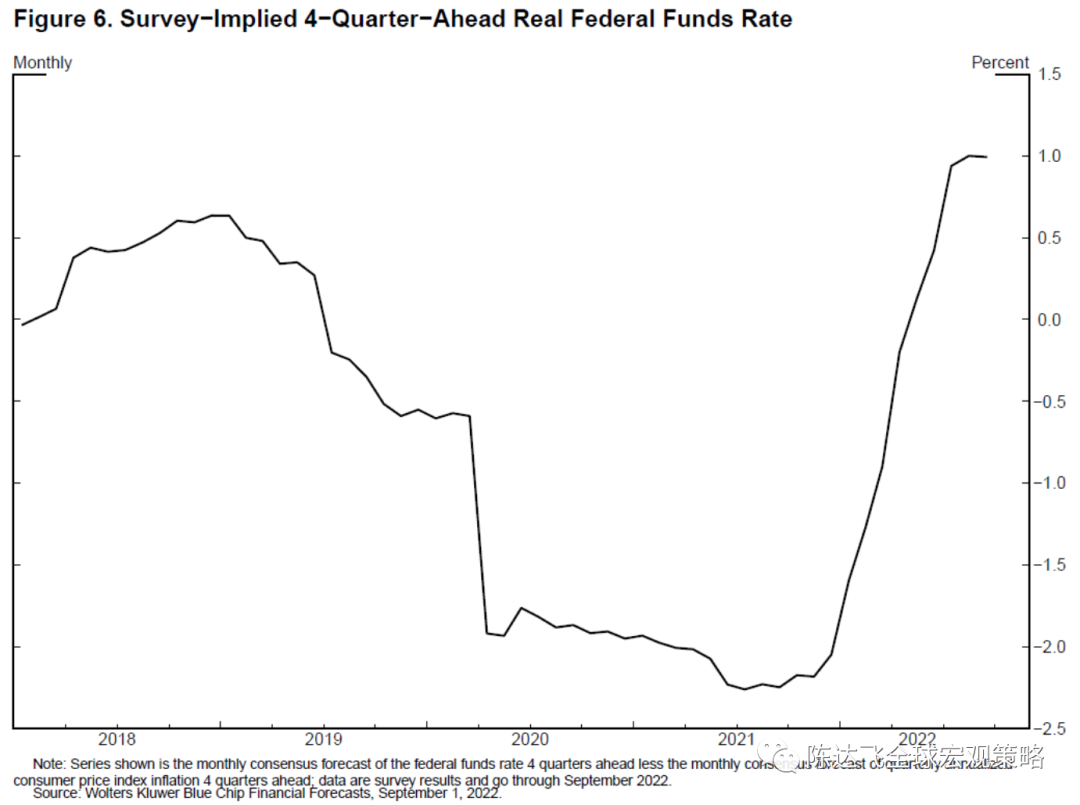

Since pivoting last year, our actions and communications have tightened financial conditions significantly and at a much more rapid speed than earlier cycles. So far during 2022, real 2-year yields have risen more than 350 basis points to about 1.2 percent, and 10-year real yields have risen almost 200 basis points and now stand at 0.85 percent—in the range of values for 10-year real yields from 2014 to 2018. The rapid tightening in monetary policy is also reflected in a significant increase in the projected real short rate: The Blue Chip Financial Forecasts has the expected short rate moving above 0.5 percent in real terms to a significantly higher level than pre-pandemic within the next 12 months (figure 6).

自去年转向以来,我们的行动和沟通已经显著收紧了金融状况,而且速度比之前的周期快得多。到目前为止,2022年期间,2年期实际收益率已上升逾350个基点,至约1.2%,10年期实际收益率上升近200个基点,目前为0.85%——这是2014年至2018年10年期实际收益率的波动区间。货币政策的迅速收紧还反映在预期的实际短期利率大幅上升上:蓝皮书(The Blue Chip Financial Forecasts)预测的实际短期利率在未来12个月内升至0.5%以上,大大高于大流行前的水平(图6)。

It may take some time for the full effect of these tighter financial conditions to work their way through the economy. The disinflationary process here at home should be reinforced by weaker demand and tightening in many other countries. This is particularly the case as Europe contends with downside risks to activity and a severe energy shortage caused by Russia's war against Ukraine, and as China maintains its zero-COVID approach against a backdrop of weaker consumption.

这些收紧的金融环境的全部影响可能需要一段时间才能在经济中发挥作用。国内的反通胀进程应该会因其他许多国家的需求疲软和紧缩政策而得到加强。在欧洲应对俄罗斯对乌克兰战争造成的经济活动下行风险和严重能源短缺,以及中国在消费疲软的背景下还保持“QL”策略之际,情况尤其如此。

At some point in the tightening cycle, the risks will become more two-sided. The rapidity of the tightening cycle and its global nature, as well as the uncertainty around the pace at which the effects of tighter financial conditions are working their way through aggregate demand, create risks associated with overtightening. And if history is any guide, it is important to avoid the risk of pulling back too soon. Following a lengthy sequence of adverse supply shocks to goods, labor, and commodities that, in combination with strong demand, drove inflation to multidecade highs, we must maintain a risk-management posture to defend the inflation expectations anchor.9 While we have no control over the supply shocks to food, energy, labor, or semiconductors, we have both the capacity and the responsibility to maintain anchored inflation expectations and price stability.

在紧缩周期的某个时刻,风险将变得更加双向(译者注:紧缩不足和紧缩过度)。紧缩周期的速度及其全球的同步性,以及金融条件收紧影响总需求的不确定性,制造了与过度紧缩相关的风险。从历史经验来看,避免过早地“打退堂鼓”是很重要的。在一系列对商品、劳动力和大宗商品的不利供应冲击之后,再加上强劲的需求,将通胀推至几十年来的高点,我们必须保持风险管理姿态。虽然我们无法控制食品、能源、劳动力或半导体的供应冲击,但我们有能力也有责任保持稳定的通胀预期和价格稳定。

We are in this for as long as it takes to get inflation down. So far, we have expeditiously raised the policy rate to the peak of the previous cycle, and the policy rate will need to rise further. As of this month, the maximum monthly reduction in the balance sheet will be nearly double the level of the previous cycle.10 Together, the increase in the policy rate and the reduction in the balance sheet should help bring demand into alignment with supply. Monetary policy will need to be restrictive for some time to provide confidence that inflation is moving down to target. The economic environment is highly uncertain, and the path of policy will be data dependent. While the precise course of action will depend on the evolution of the outlook, I am confident we will achieve a return to 2 percent inflation. Our resolve is firm, our goals are clear, and our tools are up to the task.

在通货膨胀降下来之前,我们会一直坚持适度的紧缩政策立场。到目前为止,我们已经迅速将政策利率上调到上一个周期的峰值,政策利率还需要进一步上调。截止到这个月,资产负债表的最大月度削减将是上一个周期水平的近两倍总之,上调政策利率和缩减资产负债表应有助于使需求与供给保持一致。货币政策需要在一段时间内保持紧缩,以让人们相信通胀正在降至目标水平。经济环境具有高度的不确定性,政策路径将取决于数据。虽然具体的行动将取决于前景的演变,但我相信我们将实现2%的通货膨胀目标。我们的决心是坚定的,我们的目标是明确的,我们的工具可以胜任这项任务。

主要内容:1. 专题直播(预告+PPT+数据);2. 深度报告(原版+PPT+数据);3.学术文献(电子版+笔记);4. 每周书单(电子书+笔记);5. 经济时评(原版);6. 研究小记

請先 登錄後發表評論 ~