China-Japan ETF Connectivity-SSE

Along with QDII investment quotas specially allocated for the scheme, ETFs listed based on China-Japan ETF Connectivity will create a link between the ETF markets of both exchanges.

Through this scheme, investors in Japan will be able to indirectly invest in Chinese assets through feeder ETFs of SSE-listed ETFs listed on Tokyo Stock Exchange (TSE). Similarly, feeder ETFs of TSE-listed ETFs in Shanghai will allow Chinese investors to indirectly invest in Japan.

On June 25, 2019, the SSE and JPX held the launch ceremonies for the China-Japan ETF Connectivity respectively, with four SSE-JPX ETF Connectivity products successfully listed on the SSE.

On January 25, 2021, the SSE and JPX signed the revised China-Japan ETF Connectivity Agreement, which laid the foundation for the China-Japan ETF Connectivity mechanism to further expand the scale of products, increase the product types and broaden the scope of interconnection.

On April 8, 2021, the second batch of ETFs under China-Japan ETF Connectivity were launched on the JPX, including an ETF tracking an index of 50 stocks on the SSE STAR Market (STAR50).

Framework

An ETF feeder scheme for creating an ETF (feeder) that invests in a target ETF whose trust assets are Chinese or Japanese asset classes* based on additional QDII quota specially created for this scheme.

The scheme aims to increase opportunities for Chinese and Japanese investors to invest in Japanese and Chinese asset classes by linking ETFs listed on the two exchange markets.

* An ETF of which at least 90% of AUM is invested in a target ETF listed on the other exchange market based on agreement between the ETF providers. The target ETF should have been listed for more than 1 year and has enough liquidity.

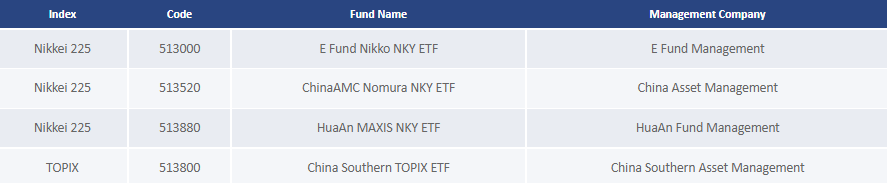

ETFs Listed

Under this scheme, Chinese and Japanese ETF providers can create feeder ETFs to invest in Japanese or Chinese asset classes. Such feeder ETFs invest mainly in the counterpart ETF provider's fund based on a special investment quota for the scheme* obtained from China's State Administration of Foreign Exchange (SAFE).

ETFs listed at SSE under this scheme are listed below.

*An investment quota for a Qualified Domestic Institutional Investor (QDII). In September 2020, the CSRC abolished the investment quota requirement of Qualified Foreign Institutional Investor (QFII).

To view ETFs listed at TSE under this scheme, please visit:

https://www.jpx.co.jp/english/equities/products/etfs/etf-connectivity/01.html

First, please LoginComment After ~