MAS Monetary Policy Statement

INTRODUCTION

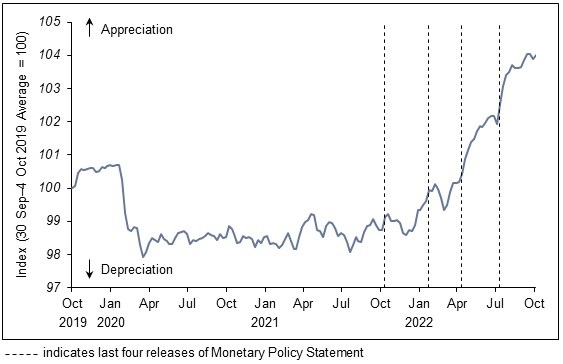

1. In its July 2022 Monetary Policy Statement, MAS re-centred the mid-point of the Singapore dollar nominal effective exchange rate (S$NEER) policy band up to the then-prevailing level of the S$NEER. There was no change to the slope and width of the band. While Singapore’s growth momentum was expected to slow, MAS had assessed that it was prudent to tighten monetary policy further and lean against price pressures becoming more persistent. This was its fourth tightening move since October 2021.

Chart 1

S$ Nominal Effective Exchange Rate (S$NEER)

2. Over the last three months, the S$NEER has broadly appreciated and is now close to the top of the policy band. The three-month S$ Singapore Interbank Offered Rate (SIBOR) rose to 3.4% from 2.5% in July, while the Singapore Overnight Rate Average (SORA) increased to 3.4% from 2.1%.

OUTLOOK

3. Inflation is expected to remain high in most of Singapore’s key trading partners in the near term, while global growth moderates. The Singapore economy will grow at a slower pace in tandem with weakening global demand. However, core inflation will stay elevated over the next few quarters, as imported inflation remains significant and a tight labour market supports strong wage increases. Inflation is projected to ease more discernibly in the latter half of 2023, although there is considerable uncertainty around the outlook for both inflation and growth.

Growth Backdrop and Outlook

4. The Advance Estimates released by the Ministry of Trade and Industry today indicate that the Singapore economy grew by 1.5% on a quarter-on-quarter seasonally-adjusted basis in Q3 2022, reversing the 0.2% contraction in Q2. The expansion was underpinned in part by a stronger-than-expected recovery in the domestic-oriented and travel-related sectors as more COVID-19 restrictions abroad and locally were relaxed. In contrast, manufacturing output and financial services weakened in Q3 amid a softening in external demand. On a year-ago basis, GDP grew by 4.4%.

5. Global economic activity slowed in Q3 2022. Persistently high inflation and tighter financial conditions have begun to dampen private consumption and investment. The downturn in the global electronics industry has also weighed on a number of external-oriented Asian economies. Meanwhile, the pace of recovery has been muted in regional economies that have not fully re-opened.

6. In the quarters ahead, the drag on economic activity from the globally synchronised tightening in monetary policy will intensify. While inflation should moderate, it will remain high for some time. At the same time, growth in Singapore’s major trading partners will slow to below trend but stay positive in 2023. However, further shocks, including from geopolitical tensions, could drive inflation higher and cause full-year recessions in some key economies.

7. Against this backdrop, prospects for Singapore’s manufacturing sector and some trade-related services have dimmed. The growing weakness in electronics production and its supporting industries is likely to persist. Nevertheless, growth in the Singapore economy should be sustained by continuing expansions in the domestic-oriented and travel-related sectors, underpinned by strong household balance sheets and wage incomes. However, the pace of discretionary spending could moderate over the course of 2023, with sentiment softening alongside mounting global growth risks.

8. Singapore’s GDP growth is projected to come in at 3–4% in 2022. In 2023, the economy is forecast to grow at a pace that is below trend, which could cause the current mildly positive output gap to reverse.

Inflation Trends and Outlook

9. MAS Core Inflation, which excludes the costs of accommodation and private transport, rose by more than expected in July–August, to 4.9% year-on-year, from 3.8% in Q2. Inflation for discretionary goods and services was the major contributor, amid robust demand conditions that supported the pass-through of higher imported and domestic costs. Electricity & gas and non-cooked food inflation also rose, reflecting the effects of the step-up in global energy and agricultural input costs compared to a year ago. At the same time, private transport and accommodation inflation accelerated, causing CPI-All Items inflation to pick up to 7.3% July–August, from 5.9% in Q2.

10. For the rest of 2022, the confluence of demand and supply factors that drove the price increases in July–August is expected to persist. A tight domestic labour market will support robust wage increases, while imported inflation will remain significant across a range of intermediate and final goods.

11. In the coming year, costs pressures which have been accumulating along domestic and global supply chains will continue to pass through to consumer prices. Even as prices of energy and food commodities have moderated from their peaks, businesses will face higher utility and raw material costs as contracts are renewed. The pace of domestic unit labour cost increases should ease over the course of 2023, as labour demand and supply rebalance, but remain above its historical average.

12. MAS Core Inflation is likely to stay around 5% for the rest of 2022, and into early 2023. Although the one percentage point increase in the GST will result in a one-off step-up in the price level, its effect on inflation should be transitory. Overall, core inflation is expected to remain high in H1 2023 before slowing more discernibly in the second half as cost pressures gradually ease.

13. For 2022 as a whole, MAS Core Inflation will average around 4% and CPI-All Items inflation around 6%. In 2023, taking into account all factors including the GST increase, MAS Core Inflation should come in at 3.5–4.5% on average over the year, and CPI-All Items inflation at 5.5–6.5%. However, even excluding the one-off effects of the GST increase, core inflation would remain above trend at 2.5–3.5% and headline inflation at 4.5–5.5%. Furthermore, there are upside risks to these forecasts, including from fresh shocks to global commodity prices and second-round effects associated with a prolonged period of high inflation.

MONETARY POLICY

14. The global economy faces high inflation and lower growth next year. Singapore’s GDP growth will come in below trend in 2023, and downside risks have intensified. At the same time, MAS Core Inflation is expected to remain elevated over the next few quarters, with risks still tilted to the upside.

15. MAS has assessed that, on balance, a further tightening of monetary policy is needed to help ensure that price pressures are dampened over the next few quarters.

16. MAS will therefore re-centre the mid-point of the S$NEER policy band up to its prevailing level. There will be no change to the slope and width of the band.

17. This policy shift, building on past tightening moves, will further reduce imported inflation and help curb domestic cost pressures. The policy stance will help dampen inflation in the near term and ensure medium-term price stability, providing the basis for sustainable economic growth.

18. MAS will continue to closely monitor global and domestic economic developments, amid heightened uncertainty on both the inflation and growth fronts.

First, please LoginComment After ~