Smart Contract-based Carbon Credits attached to Green Bonds

Download the report ↓

Smart Contract-based Carbon Credits attached to Green Bonds

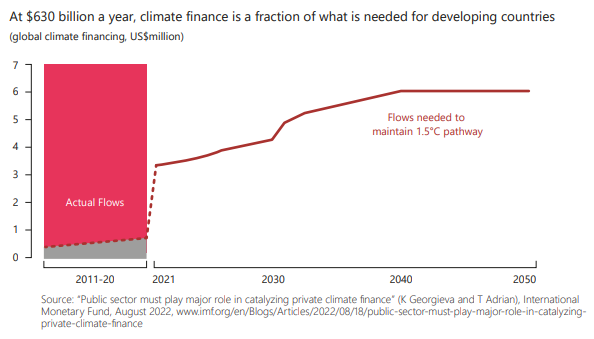

With the record-breaking summer this year, and the number of lives lost and families displaced in climate disasters in recent years, climate risks can no longer be ignored. More effort and partnerships from all sides are clearly needed to achieve the ambitious goal of limiting temperature rise to 1.5°C above pre-industrial levels, as set out in the Paris Agreement.

Finance has historically been a vehicle that facilitates changes, however, to achieve the magnitude and depth of the green transition required, the current green finance market needs to be transformed.

As the clock of nature ticks, the Genesis projects, consisting of Genesis 1.0 and Genesis 2.0, aim to demonstrate the green art of the possible, by making the green finance market more efficient and effective, through the use of innovative technology and public-private partnerships.

Project Genesis 1.0, BIS Innovation Hub’s first green finance project, demonstrated the possibilities arising from a tokenised retail government green bond. The two prototypes, using both a public blockchain and a permissioned blockchain, achieved in conjunction with six private parties, make investing in a retail government green bond more efficient, cheaper, more transparent, and allows investors to track the environmental impact linked to the investment in real time as well as to sell the bonds in a transparent secondary market.

In this Genesis extension project, the BIS Innovation Hub has collaborated with the Hong Kong Monetary Authority and the UN Climate Change Global Innovation Hub. Project Genesis 2.0 explored the use of blockchain, smart contracts, and internet-of-things (IoT), and achieved two prototypes that aim to tackle the greenwashing concern of the green bond market, and transform the carbon market from an ex post reward to an ex ante enabler for green projects.

To ensure that finance is being efficiently channelled towards effective climate solutions, Project Genesis 2.0 combines the green bond market and the carbon market by proposing a new green bond structure appended with mitigation outcome interests (MOIs), which are future contracts with a commitment to deliver, at maturity, verified carbon credits compliant with the Paris Agreement. The technology solutions digitally track, in real time, mitigation outcome data linked to the green bond’s lifecycle, providing investors transparency on the climate impact of the investment. The prototypes also achieved digital delivery and transfer of MOIs enabled by smart contracts.

Project Genesis 2.0 demonstrated the benefits of integrating the green bond and carbon markets, as well as the possibility brought about by technology to enhance the transparency and environmental integrity of the green bond market. We hope that the possibility and learnings demonstrated in Project Genesis 2.0 will catalyse innovations in the green finance market, leading to developments that shift mainstream finance towards meaningful and impactful climate solutions.

First, please LoginComment After ~