Triennial Survey shows global foreign exchange trading averaged $7.5 trillion

- The 2022 Triennial Central Bank Survey shows foreign exchange (FX) trading rose to $7.5 trillion per day in April 2022 and trading of over-the-counter (OTC) interest rate derivatives dropped to $5.2 trillion per day, compared with 2019.

- The US dollar maintained its place as the dominant currency, being on one side of 88% of all FX trades in April 2022 and 44% of global turnover of interest rate derivatives.

- Sales desks in the United Kingdom remained the most important for both FX exchange and interest rate derivatives, although other locations' shares are growing.

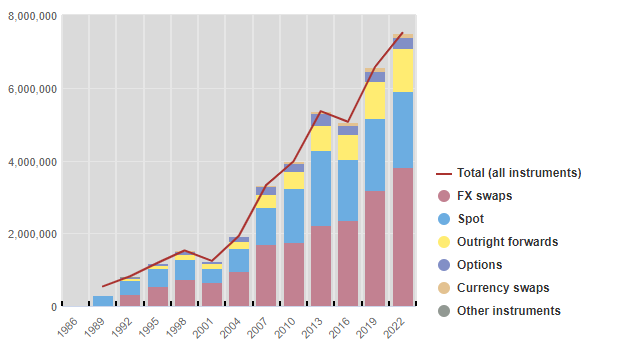

The 2022 Triennial Central Bank Survey of foreign exchange (FX) and over-the-counter (OTC) interest rate derivatives markets activity shows trading in FX markets reached $7.5 trillion per day in April 2022, up 14% from 2019. Trading of OTC derivatives was $5.2 trillion per day, down 19% from 2019.

The Triennial Survey, the most comprehensive source of information on the size and structure of global FX and OTC interest rate derivatives markets, provides a snapshot of market activity in April 2022. Central banks and other authorities in 52 jurisdictions participated, collecting data from more than 1,200 banks and other dealers in their jurisdictions.

The survey showed trading in spot and FX swaps continued to account for the bulk of FX turnover. Turnover of FX swaps accounted for 51% of global turnover, up from 49% in 2019. The share of spot trades fell to 28% from 30% in 2019, and that of outright forwards remained unchanged at 15%.

The US dollar held its place as the dominant currency – it was on one side of 88% of all FX trades in April 2022, unchanged over the past decade. The euro remained the second most actively traded currency but decreased its share marginally from 2019 to 31%. The Japanese yen and the pound sterling remained unchanged since the last survey, while the renminbi's share rose to 7%, making it the fifth most traded currency in 2022 (up from eighth place in 2019).

Average daily turnover of US dollar-denominated interest rate derivatives contracts was $2.3 trillion, or 44% of global turnover. However, this was down from 2019. US dollar turnover was hit by a drop in forward rate agreements (FRAs) following the transition away from the use of Libor as a reference rate in 2021. FRA turnover overall fell by 74% since 2019 to just $0.5 trillion, driving down total turnover in all OTC interest rate derivatives products. Turnover of FRAs denominated in US dollars, which typically reference Libor rates, fell to $26 billion from $1.3 trillion in 2019. Turnover of euro contracts rose to $1.8 trillion, or 34% of global turnover (from 25% in 2019). Among emerging market economy currencies, Korean won-denominated contracts were the most actively traded.

The Triennial Survey shows that FX and derivatives trading continues to be concentrated in the largest financial centres. In April 2022, FX sales desks in five markets – the United Kingdom, the United States, Singapore, Hong Kong SAR and Japan – accounted for 78% of foreign exchange trading. The United Kingdom remained the most important FX trading location globally, with 38% of global turnover, although this was down from 43% in 2019.

Sales desks in the United Kingdom recorded the highest turnover of interest rate derivatives, at $2.6 trillion, or 46% of global "net-gross" turnover (down from 51% in 2019). Turnover in USD swaps has partially shifted from sales desks in the United Kingdom to the United States and Asian financial centres. Similarly, turnover in EUR swaps has shifted from the United Kingdom to the euro area.

First, please LoginComment After ~