The HKMA's Response to the US Fed's Rate Hike

Mr Eddie Yue, Chief Executive of the HKMA, said, “Since March, the Fed has raised the federal funds target range six times consecutively by a total of 375 basis points. The 75-basis-point rate hike this time is generally in line with market expectation. The Fed has also indicated that they would continue to take into account economic data when considering the pace of future rate hikes, and the terminal interest rate level might be higher than previously expected.

As I stressed many times before, rate hikes in the US will not affect the financial and monetary stability of Hong Kong. In fact, our monetary and financial markets continue to operate in a smooth and orderly manner. The Linked Exchange Rate System (LERS) also continues to work well.

As the US continues to raise interest rates, there will be carry trades incentivised by the widened Hong Kong – US interest rate differentials, which will in turn drive funds to gradually flow from the Hong Kong dollar to the US dollar. It is therefore normal for the Hong Kong dollar exchange rate to remain weak. When the weak-side Convertibility Undertaking is triggered, the HKMA will buy Hong Kong dollars and sell US dollars according to the mechanism. The Aggregate Balance will decline correspondingly. The Hong Kong dollar interbank rates will rise gradually, offsetting the incentives for carry trades. This will stabilise the Hong Kong dollar within the 7.75-7.85 range. This adjustment process is entirely within the design and expectations of the LERS. The market has sufficient understanding and operational experience of the LERS, and continues to have strong confidence in the system.

If the US continues to raise interest rates, it is expected that the Hong Kong dollar interbank rates will continue to rise. Although the speed and magnitude for the Hong Kong dollar interbank rates to catch up with their US dollar counterparts will ultimately be subject to the supply and demand of the Hong Kong dollar funding in the local market, the public should be prepared for the Hong Kong dollar interbank rates to rise further.

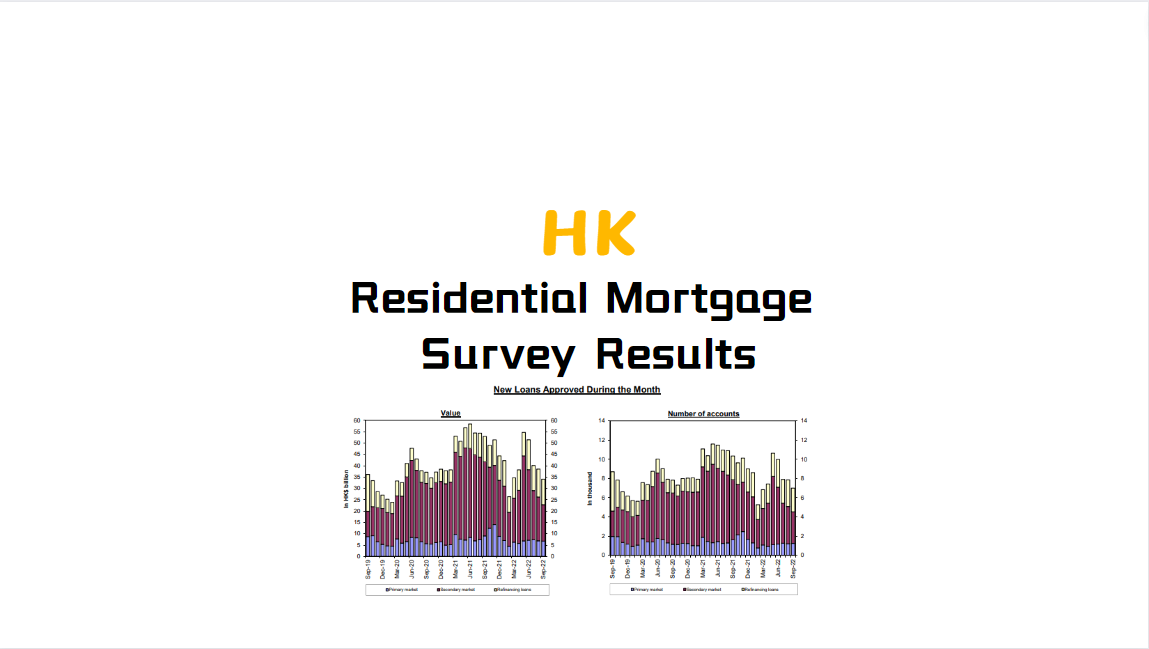

On the commercial interest rates of banks, many banks have already raised their saving and lending rates, including the prime rates and the interest rate cap for newly approved mortgage loans. The public should be prepared for the commercial interest rates to rise further, and carefully assess and manage the relevant risks when making property purchase, mortgage or other borrowing decisions.”

First, please LoginComment After ~