The most complete analysis of the basic model of establishing industrial funds by Chinese listed companies

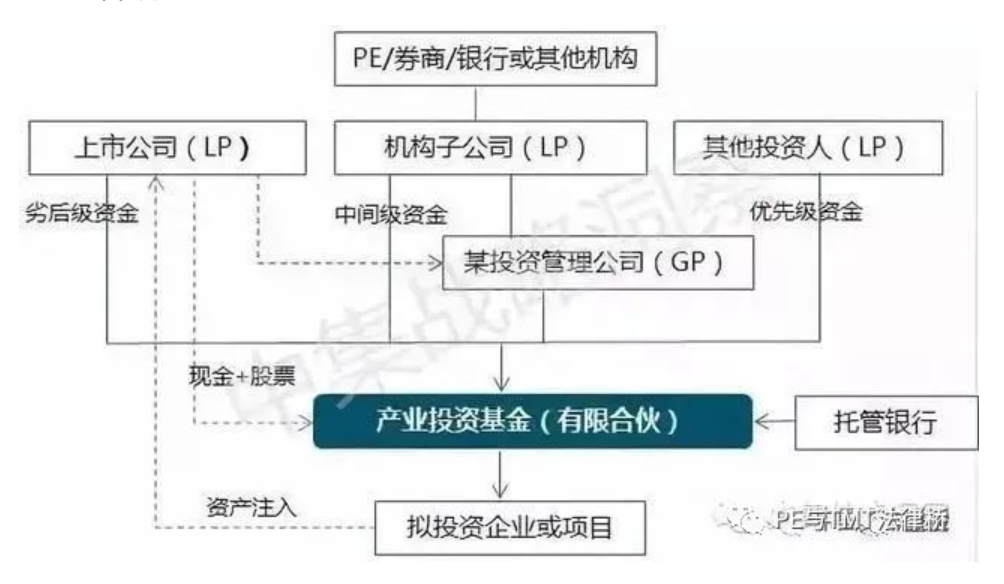

Structured Funds

Basic elements:

Fund structure: the listed company's contribution is the inferior level of the fund, and the investment institution's contribution is the mezzanine (or intermediate level), and the investment institution is responsible for raising priority funds.

Listed companies substantially participate in or lead fund investment decisions in the following ways (see the red dotted line above):

1) Set up a holding subsidiary as the GP,

2) The holding subsidiary and the investment institution shall be operated by the dual GP or the investment company established by both parties as the GP,

3) The investment institution is the GP, but the listed company has veto power.

The sequence of income distribution is generally:

1) Principal and income of priority funds,

2) Mezzanine principal,

3) Inferior principal,

4) Principal of the Fund Manager,

5) The remaining investment income shall be distributed by the inferior, mezzanine and fund managers in a certain proportion.

Credit enhancement measures:

1) Listed companies or their major shareholders provide capital guarantee and income commitment for priority funds,

2) The listed company promises to acquire the invested project,

3) Pledge the income right of the investment project

Duration: generally 2-10 years, mainstream 5-6 years.

Exit methods: IPO, M&A, management buyback, acquisition and reorganization of listed companies, etc. It is generally agreed that listed companies have the right of first refusal. The invested project enters the listed company system by means of asset injection, and the fund exits by cash, cash+stock, or stock (see the dotted line above).

Management fee: the mainstream management fee is 2%.

Investment forms: there are two mainstream operation modes:

1) To make capital contributions by installments, and pay corresponding proportions of capital contributions within a certain period of time;

2) Commit to contribute to the project according to the investment progress of the fund.

Investment field: "tailored" for listed companies, which is generally the upstream and downstream of the industrial chain of listed companies or the emerging strategic business that listed companies intend to enter.

Investment decision-making: generally, listed companies dominate.

Case 1:

Donghu Hi Tech (600133) and Everbright Capital jointly launched the establishment of an industrial investment fund.

Structured Funds

Donghu Hi Tech invested 300 million yuan as the inferior fund,

Everbright Capital contributed 300 million yuan as intermediate (mezzanine) funds,

Everbright Baptist Investment is responsible for raising 1.8 billion priority funds.

Everbright Baptist Investment, 100% controlled by Everbright Capital, serves as the fund GP.

Fund size: 2.4 billion yuan.

Duration: 3 years (2 years investment period, 1 year exit period).

Exit methods: IPO, M&A, management buyback, acquisition and reorganization of listed companies, etc.

Income distribution: The distribution order is as follows according to the principle of first returning the principal and then sharing the profits:

1) The investment principal will be recovered once the priority fund matures,

2) Fixed income of priority funds: the annualized income is calculated based on the investment principal of no more than 7.8%,

3) The mezzanine fund recovers the investment principal,

4) The investment principal is recovered by inferior funds,

5) The fund manager recovers the investment principal,

6) The remaining investment income is distributed between inferior funds and mezzanine funds at a ratio of 80% to 20%. The fund manager does not share the excess return.

Management fee: no more than the market average.

Form of contribution: committed contribution system. The amount of contribution subscribed by investors will be paid in installments according to the investment progress of the fund.

Case 2:

Storm Technology (300431) and CITIC Capital launched the establishment of overseas M&A fund

The priority is the products of Ping An Trust, accounting for 75% of the total fund size. It is the main fund provider, and the expected annual yield is 11%. The inferior ones are Storm Technology and Chunxin Endeavour, accounting for 10% and 15% of the total fund size respectively. In the income distribution, 90% of the priority excess income belongs to the inferior level;

Feng Xin, a major shareholder of Stormwind Technology, guaranteed the minimum return of the fund as a whole;

Chunxin Endeavour and CITIC Capital (Shenzhen) are subsidiaries of CITIC Group

Fund size: 684 million

Duration: 2 years

Exit channel:

First, one year after the fund held the equity of a specific enterprise, it exchanged shares with Stormwind Technology and sold shares in the secondary market or withdrew in cash;

Second, certain enterprises will exit after being listed in the US capital market, and are expected to be listed independently in the next two years;

The third is to sell equity through agreement transfer.

Distribution order of fund income:

1) Principal and income of priority funds;

2) Among the excess returns, 90% of the priority excess returns belong to the inferior, and Stormwind Technology and Chunxin Endeavour obtain floating returns according to the proportion of their contributions.

Transaction arrangement: First, set up a buyout fund in the form of a limited partnership. Then, the funds left the country to set up a special purpose vehicle (SPV) in the Cayman Islands, a tax haven, to obtain the equity of the target company. Then Storm Technology will issue shares or pay cash to the fund to purchase the equity of the underlying company held by the fund. Finally, stock exchange exit or specific enterprises exit from the US stock market.

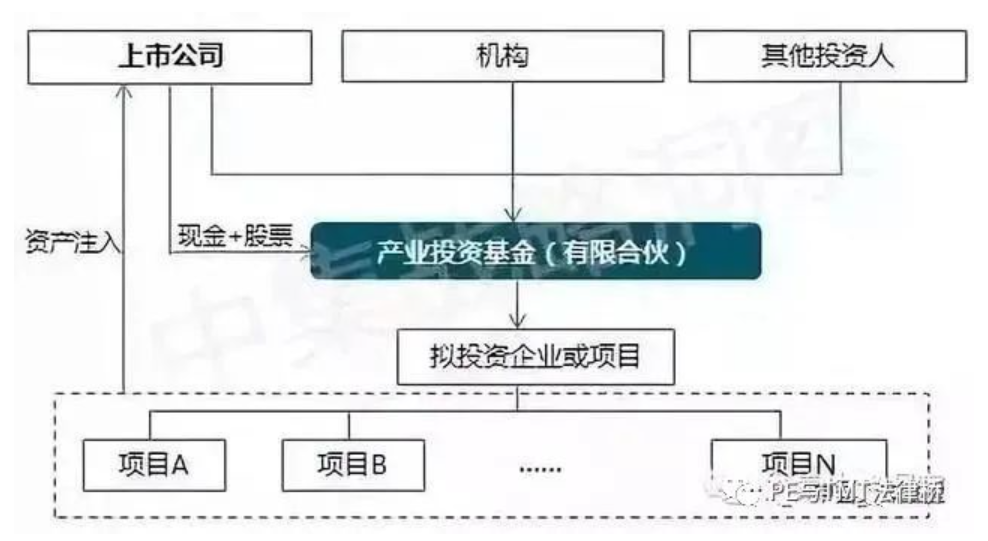

Unstructured fund (or horizontal fund)

Basic elements:

Fund structure: The listed company shall jointly invest with other institutions, and there is no difference between priority and inferiority. Generally, the foundation has an open period, and GP will raise investment or listed companies or institutions will increase capital depending on the development of the fund and the investment progress of potential projects.

The sequence of income distribution is generally:

1) Return the accumulated paid in capital contribution of the partners in proportion to their capital contribution until each partner has recovered all their paid in capital contribution,

2) To pay the preferred return of partners' investment, a threshold rate of return is usually set. Before reaching the threshold rate of return, GP will distribute the total income of the fund to each partner's account according to the proportion of partners' investment,

3) Management remuneration paid to the general partner: after the internal rate of return of the accumulated paid in capital contribution of the partner exceeds the threshold rate of return, 20% of the total income of the fund will be distributed to the general partner, and the remaining part will be distributed to each partner according to the actual proportion of capital contribution.

Duration: generally 2-10 years, mainstream 5-6 years.

Exit methods: IPO, M&A, management buyback, acquisition and reorganization of listed companies, etc. It is generally agreed that listed companies have the right of first refusal. The invested project enters the listed company system by means of asset injection, and the fund exits by cash, cash+stock, or stock (see the dotted line in the left figure)

Management fee: the mainstream management fee is 2%

Form of contribution:

There are two mainstream operation modes:

Investment decision-making: generally dominated by listed companies

Case 1:

Suning Yunshang (002,024) initiated the establishment of an industry M&A fund

The fund is planned to raise 5 billion yuan, with the first phase of 2 billion yuan. Suning Electric and Suning Cloud Merchants will each subscribe 1.48 billion yuan and 500 million yuan, and GP Suning Ding will invest 20 million yuan. In the future, the general partner of the Fund will raise funds from external investors according to the Fund's development and potential project investment progress, and the Company may also increase the capital of the Fund or participate in the subsequent raising of sub funds after performing the corresponding approval procedures. External investors can participate either by directly increasing the capital of the fund or by establishing a sub fund.

Fund size: 5 billion, initial 2 billion

Duration: 6+1 years

Management fee: 2%

Fund income distribution mechanism: the distribution order is as follows

1) Distribute to each partner until each partner has obtained all the accumulated paid in capital contribution;

2) Distribute to the limited partners, so that each limited partner can achieve an annual rate of return of 8% on all the accumulated paid in capital contributions;

3) The portion of the annual rate of return of the fund investment above 8% and below 10% shall be distributed to the general partner;

4) After the above distribution, 80% of the remaining part will be distributed among the limited partners according to their actual contribution ratio, and 20% will be distributed to the general partner.

Risk bearing: Each partner shall bear the losses and expenses incurred by the Fund in accordance with the proportion of its subscribed capital contribution. Limited partners shall be liable for the risk of the Fund to the extent of their subscribed capital contribution, and general partners shall bear unlimited joint and several liability for the risk of the Fund.

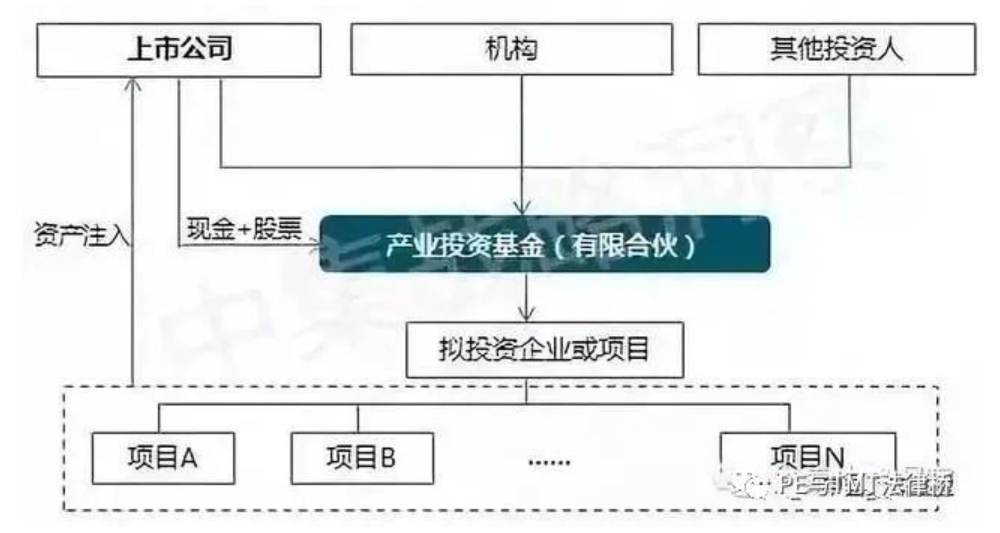

Between listed companies and industrial M&A funds Capital operation channel

Basic elements:

Operation logic: The industry fund is responsible for searching, screening, investing or merging projects that conform to the industrial development strategy of listed companies. After investment, the industry fund will coordinate with the listed companies to conduct business integration and management, and incorporate them into the system of listed companies through asset injection when appropriate.

Exit method: Generally speaking, the listed company has the priority to acquire the invested project, and the acquisition by the listed company is the main exit method (see the left table). When exiting, the listed company will pay cash, or cash+stock, or stock, so that the industrial fund can realize the investment income in the primary market, and the listed company can obtain high-quality asset injection to enhance the company's value.

Typical cases:

Heaven Yuanjin Acquires Yihetang

In January 2013, Jingxin Pharmaceutical released an announcement that it planned to cooperate with Zhejiang Silicon Paradise Valley Equity Investment Company and Zhejiang Yuanjin Investment Company to launch an industrial M&A fund of no more than 1 billion yuan, of which Zhejiang Yuanjin Investment subscribed 10% - 20%, Silicon Paradise Valley contributed 5 million yuan, and Silicon Paradise Valley was responsible for raising the rest from external investors.

In October 2013, Jingxin Pharmaceutical released an announcement that Zhejiang Paradise Silicon Valley Yuanjin Venture Capital Partnership and Guangdong Yihetang Pharmaceutical Co., Ltd.'s original shareholders, Le Yao and Liu Jianxiong, signed the Agreement on the Acquisition of All Equity of Guangdong Yihetang Pharmaceutical Co., Ltd., and Tiantang Yuanjin acquired 100% equity of Yihetang for 120 million yuan.

In January 2015, Jingxin Pharmaceutical said in the Minutes of Investor Relations that "Yihetang passed the new version of GMP certification last year, and its sales increased significantly. It is expected to achieve faster growth this year."

In March 2016, Jingxin Pharmaceutical said at its 2015 annual performance briefing that Yihetang is still in the process of further cultivation at this stage, and the company will carry out mergers and acquisitions at an appropriate time.

How Buyout Funds Get Loans from Commercial Banks

In overseas developed capital markets, commercial bank M&A loans, as one of the important financing tools in M&A transactions, are widely used by private equity investment funds ("PE funds"). Compared with the overseas capital market, domestic M&A loans are subject to strict issuance conditions, high loan interest rates, and limited leverage ratio. PE funds rarely obtain domestic M&A loans. However, with the rapid development of the M&A market and the further liberalization of relevant policies, as well as the marketization of interest rates, changes in the foreign exchange market and the transformation of banking business, domestic M&A loans have gradually become one of the financing channels for PE funds. Here, we have preliminarily sorted out and summarized the relevant Chinese laws and practice issues of PE funds obtaining domestic M&A loans at this stage, for the reference and exchange of interested relevant persons.

PE fund acquisition

Background of the loan

In the international capital market, with the assets and future earnings of the target enterprise as the source of guarantee and repayment, leveraged buyouts of the target enterprise using M&A loans (that is, loans issued by commercial banks to the acquirer enterprise or its controlling subsidiaries to pay the consideration for the acquisition of equity), a debt financing tool, have become one of the financing channels widely used by PE funds, especially large PE funds, in M&A transactions. Through M&A loans for acquisition transactions, PE funds can not only acquire larger target enterprises with less own funds (the amount of M&A loans generally accounts for 50% - 70% of the total amount of acquisition funds), but also improve the profitability of target enterprises by relying on the tax saving effect of interest generated by a large number of debts and the efficiency improvement brought about by the change of capital structure, thus further improving the return on investment.

Restricted by the market and regulatory environment, the domestic M&A loan business started relatively late, and went through the process from the principle prohibition of the General Principles of Loans in 1996, to the "batch by batch" of the CBRC in 2005, to the conditional release of relevant regulations in 2008, and to the further support of the CBRC in 2015. At present, the most important provisions on domestic M&A loans are the Guidelines on Risk Management of Commercial Banks' M&A Loans ("Guidelines") issued by the CBRC in December 2008. For the first time, the Guidelines explicitly allow domestic enterprises to use bank loans to pay for M&A transactions in M&A, breaking the provisions of the General Rules on Loans that prohibit the use of bank loans for equity investment. In February 2015, the CBRC revised the Guidelines, extending the loan term from five years to seven years, increasing the proportion of the loan amount to the purchase price from 50% to 60%, and further reducing the requirements for guarantees, making the conditions for acquiring M&A loans more relaxed. As far as PE funds are concerned, the Guidelines do not specify whether they can obtain M&A loans. In the first half of 2014, the CBRC directed several banks to pilot the merger and acquisition loan business for PE funds in the Shanghai Free Trade Zone. Relevant banks, including Shanghai Pudong Development Bank, began to formulate and implement relevant pilot policies ("pilot policies"), which are mainly applicable to PE funds registered in the Shanghai Free Trade Zone.

Compared with the overseas market, the distribution objects and conditions of domestic M&A loans are strictly restricted, and there are problems such as high loan interest rates and limited leverage ratio. In practice, they are mainly used for industrial M&A of state-owned enterprises, large enterprise groups and leading enterprises. Due to the lack of industrial background and insufficient credit guarantee ability, it is difficult for relevant PE funds to obtain M&A loans, so the use of domestic M&A loans has been very rare for some time. However, with the further liberalization of relevant policies, as well as the marketization of interest rates, changes in the foreign exchange market and the transformation of banking business, domestic M&A loans have gradually become one of the domestic financing channels for PE funds. At present, banks have officially launched M&A loans for PE funds according to pilot policies, and some successful cases of PE funds obtaining M&A loans have also appeared in the market.

PE fund acquisition

1. Main conditions of the loan

Main conditions for the acquirer

Industry relevance or strategic relevance According to the Guidelines, the acquirer needs to have a high industry relevance or strategic relevance with the target enterprise. Through mergers and acquisitions, it can obtain the target enterprise's R&D capabilities, key technologies and processes, trademarks, concessions, supply or distribution networks and other strategic resources to improve its core competitiveness. According to the pilot policy, the industries that PE funds mainly invest in or operate should be related to M&A transactions, with clear strategic objectives and strategic guidance; M&A transaction must be a strategy aimed at long-term holding and improving the value of the target enterprise. We note that, in practice, a few PE funds that have obtained M&A loans basically have strong industrial background (such as industrial investment funds launched by CITIC, Lenovo and other large industrial groups).

The M&A transaction shall aim at obtaining control. According to the Guidelines, the M&A transaction to obtain M&A loans must aim at obtaining or maintaining control over the target enterprise. Under the pilot policy, M&A transactions can be either controlled M&A by PE fund as the controlling party, or follow on M&A by PE fund through strategic cooperation with the acquirer. Based on the above, PE funds that do not seek direct or indirect control are basically unable to obtain M&A loans, and can only indirectly obtain financial support from banks through other arrangements such as investment and loan linkage.

The matching requirements of self owned funds In order to prevent the risks brought by highly leveraged M&A financing, the Guidelines require that the proportion of M&A loans in the price of M&A transactions should not be higher than 60%, and the withdrawal conditions should at least include that the self raised funds of the acquirer have been fully paid. In addition, before granting M&A loans, commercial banks should carefully determine the financial leverage ratio of M&A projects by taking into account the relevant risks, the situation of both M&A parties, the financing method and amount of M&A, and ensure that a reasonable proportion of equity capital is included in the source of funds for M&A.

Although the above provisions do not explicitly require that 40% of the transaction price other than the M&A loan shall not include debt financing, in practice, banks tend to require that all of the price come from the acquirer's own funds and be fully paid before the issuance of the M&A loan. Therefore, the leverage ratio (the ratio of debt to self owned capital) of leveraged buyouts by PE funds that obtain M&A loans will be strictly limited, which is far lower than the 9-10 times leverage ratio that can be achieved by overseas leveraged buyouts.

Legal Compliance of Mergers and Acquisitions The acquirer shall be legal and compliant when conducting merger and acquisition transactions. If it involves national industrial policies, industry access, anti-monopoly, transfer of state-owned assets and other matters, it shall obtain approval from relevant parties and perform relevant procedures in accordance with relevant laws, regulations and policies.

2. Main requirements for loan banks

According to the provisions of the Guidelines, commercial banks (policy banks, foreign bank branches and enterprise group finance companies refer to commercial banks for application) that operate M&A loans should have corresponding risk management and internal control mechanisms and professional due diligence and risk assessment teams, and the capital adequacy ratio should not be less than 10%. At present, the four major state-owned commercial banks, major joint-stock commercial banks (such as Shanghai Pudong Development Bank, China Merchants Bank, Minsheng Bank and Industrial Bank) and large urban commercial banks (such as Bank of Beijing and Bank of Shanghai) have all carried out conventional M&A loans, and the balance of M&A loans of ICBC alone has exceeded 100 billion yuan. It is reported that SPDB is the most active bank in the industry to expand PE fund M&A loan business. It has not only participated in the issuance of the first PE fund M&A loan under the pilot policy, but also carried out conventional PE fund M&A loan pilot business and specialized PE fund financing innovative financial services.

In addition, the Guidelines require that the balance of all M&A loans should not exceed 50% of the bank's net tier one capital in the same period, and the balance of M&A loans to a single borrower should not exceed 5%. Therefore, the amount of M&A loans that PE funds can obtain depends on the size and financial strength of the bank. If a single bank can provide limited loans, it may need to obtain all the required loans through the syndicated loan model.

PE fund acquisition

Loan model

According to the current case, after the issuance of the Guidelines and before and after the implementation of the pilot policy, PE funds have the following modes to obtain M&A loans in practice:

Acquire M&A loans through wholly-owned or holding subsidiaries ("SPV") established by PE funds without other business operations. It is reported that in 2013, CITIC M&A Investment Fund (Shenzhen) Partnership (Limited Partnership), through its SPV Shenzhen Reliance Investment Co., Ltd., acquired control of Shenzhen CSG Display Technology Co., Ltd. This M&A obtained the M&A loan of 50% of the transaction price from China Merchants Bank Shenzhen Qianhai Branch, which is the first PE fund SPV M&A loan in China. The interest rate of this loan is 9%, and the equity of the target company obtained by the exchange is also pledged to the bank. At present, CITIC Investment Buyout Fund has partially exited through repurchase by major shareholders.

As the direct application for M&A loans may affect the conclusion of M&A transactions due to the long internal approval time and great uncertainty of approval, in practice, PE funds also use other transitional financing arrangements to purchase domestic target companies first, and then obtain domestic M&A loans from banks to replace this arrangement. Such arrangements include: PE Fund seeks investment institutions recognized by banks to jointly acquire target enterprises and reach repurchase agreements with them, and then PE Fund obtains bank's M&A loans to repurchase the shares of such institutions and complete the acquisition of target enterprises; The other way is that PE funds first obtain M&A loans from overseas banks in the international capital market to complete the acquisition of target enterprises, and then obtain M&A loans from domestic banks to pay off overseas loans and complete debt sinking.

Apply for M&A loans directly according to the pilot policy. As mentioned above, in the first half of 2014, the CBRC allowed several banks to pilot PE fund M&A loan business, among which SPDB has officially launched this business. It is reported that at the beginning of 2015, Shanghai Pudong Development Bank, Bank of China and Bank of Shanghai provided the first PE fund M&A loan for Hongyi Investment to invest 1.508 billion yuan in Shanghai Jinjiang International Hotel Development Co., Ltd. ("Jinjiang Shares") with the help of pilot free trade zone and non resident financial policies. In this transaction, the subject who obtained the credit is Hony (Shanghai) Equity Investment Fund Center (Limited Partnership), which, after obtaining the merger and acquisition loan, invested in Jinjiang Shares in the way of private placement, becoming its second largest shareholder.

PE Fund M&A

Main legal documents of loan

Similar to providing M&A loans to industrial enterprises, the main legal documents involved in commercial banks' granting M&A loans to PE funds include: M&A loan agreements, guarantee documents (including guarantee agreements, equity pledge agreements, real estate mortgage agreements, etc.) and other relevant agreements (such as inter creditor agreements involved in syndicated loans). Among the above documents, the M&A Loan Agreement is the most core legal document, which specifies the rights and obligations of both lenders and borrowers in detail. Its main contents usually include:

Conditions Precedent for Withdrawal The conditions for withdrawal of M&A loans shall at least include that the self raised funds of the acquirer have been fully funded and the compliance conditions for M&A have been met.

Loan purpose clause The loan fund shall only be used to pay the transaction price and other related expenses. If the borrower misappropriates it for other purposes, penalty interest shall be paid and the bank has the right to require it to prepay.

Guarantee terms The borrower shall provide sufficient guarantees that can cover the risk of M&A loans, including but not limited to asset mortgage, equity pledge and third-party guarantee. In addition, the bank may also require to be the insurance beneficiary of the target enterprise for the main assets to strengthen protection.

Other protective clauses

Set requirements for important financial indicators of borrowers or post merger enterprises (such as leverage ratio, interest coverage ratio, capital expenditure);

The additional cash flow obtained by the borrower under specific circumstances (such as listing, disposal of major assets, obtaining insurance income, etc.) shall be used for prepayment;

Monitor the main or special accounts of the borrower or the post merger enterprise; And to ensure the lender's right to consent to major matters (such as change of control, sale of major assets, etc.) and the right to know (such as regularly submitting financial statements of itself and related parties providing security during the duration of the loan).

Epilogue

Although it has been widely used in the international capital market, PE fund M&A loan business is still in its infancy in China. However, with the exploration of practice and the opening of policies, PE funds have been able to obtain M&A loans directly or indirectly through various modes such as the pilot PE fund M&A loans in the Shanghai Free Trade Zone and the SPV M&A loans of PE funds outside the zone, and some banks have begun to actively expand the relevant business of PE fund financing. It is believed that with the opening of the domestic capital market and the increase of M&A business in the future, PE fund M&A loan business will achieve further development.

First, please LoginComment After ~