Asset Purchase Facility Quarterly Report - 2022 Q3

Overview

This report contains information on the Bank of England’s Asset Purchase Facility (APF) for 2022 Q3, describing operations from 1 July 2022 to 30 September 2022. This report also contains information about how cash flows between the APF and HM Treasury (HMT) might evolve over time. More information on what the APF is and what it does is available in our Market Operations Guide. A short timeline describing the history of the APF is provided as background at the end of the report.

APF operations in the past quarter

This section contains details of gilt and corporate bond transactions, and gilts lent to the Debt Management Office (DMO), during the quarter.

On 4 August, the Bank published a Market Notice describing its provisional approach to the sale of gilts held in the APF for monetary policy purposes, which was to be operationalised following a confirmatory vote by the Monetary Policy Committee (MPC). Additional operational details were provided in a further Market Notice on 1 September.

On 18 August, the Bank published a Market Notice outlining the operational details of the Bank’s programme of sales of corporate bonds held in the APF, to be implemented through a combination of sales auctions and buybacks by bond issuers. Sales of corporate bonds began on 27 September, in line with a previous decision by the MPC.footnote[1]

At its meeting ending on 21 September, the MPC voted to reduce the stock of purchased gilts held in the APF by £80 billion over the following 12 months. Given the profile of maturing gilts, this implied a sales programme sufficient to unwind the APF by around £45 billion over the period. Alongside the MPC decision, the Governor and the Chancellor of the Exchequer exchanged letters which confirmed the Bank’s approach to gilt sales and additional operational arrangements.

On 28 September, as a result of a significant repricing of UK and global financial assets, particularly affecting long-dated UK government debt, the Bank announced that it would carry out temporary purchases of long-dated conventional gilts, in order to restore orderly market conditions in line with the Bank’s financial stability objective. In line with this announcement, the Chancellor of the Exchequer approvedOpens in a new window an extension of the maximum size of the APF by £100 billion to £966 billion.

These temporary operations were subsequently expanded to include index-linked gilts, and were concluded as planned on 14 October 2022.

On 28 September the Bank’s Executive also postponed the beginning of gilt sale operations that were due to commence from 3 October 2022. These operations subsequently commenced on 1 November 2022.

As of 28 September 2022 the total stock of assets held in the APF was £856.8 billion, comprising £838.0 billion of gilt purchases and £18.9 billion of sterling non-financial investment-grade corporate bond purchases.

Table A summarises the stock of APF gilt and corporate bond purchases in 2022 Q3. Note that purchases made during the recent financial stability interventions are not included in this table as they settled after the end of the reporting quarter. The gilts purchased in these operations are held in a segregated portfolio within the APF, and more information will be included within the 2022 Q4 APF Quarterly Report. Details are also available on the Bank’s website.

Table A: Summary of stocks in Asset Purchase Facility Schemes (a) (£ millions)

- Source: Bank of England.

- (a) The outstanding amount in each facility is reported on a settlement date basis.

- (b) The overall stock of APF gilt purchases for monetary policy purposes, net of sales and redemptions, valued at initial purchase price.

- (c) The overall stock of APF Corporate Bond Purchase Scheme purchases for monetary policy purposes, net of sales and redemptions, valued at initial purchase price.

- (d) 2022 Q2 measured as the amount outstanding as at 30 June 2022.

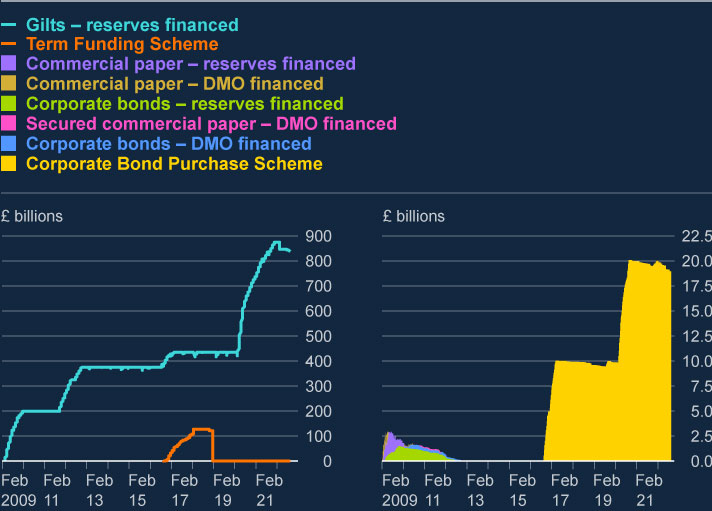

Chart 1 shows the cumulative net value of APF transactions between the establishment of the APF and 28 September 2022. As at 28 September, the Bank had reported cumulative asset purchases net of sales, redemptions and repayments totalling £856.8 billion.

Chart 1 is separated into two panels with different scales. Gilt purchases and the Term Funding Scheme (TFS - which from 2016 to 2019 was on the APF balance sheet before its transfer to the Bank’s balance sheet) are on the left panel.footnote[2] The corporate bond schemes and legacy commercial paper schemes that have been operated via the APF balance sheet are on the right panel.

Chart 1: Cumulative APF purchases by type: amounts outstanding (a) (b)

Footnotes

- Source: Bank of England.

- (a) Data based on settled transactions.

- (b) On 21 January 2019 the TFS drawings were moved to the Bank’s balance sheet and therefore are not reported after this date.

Gilts purchased for monetary policy purposes via the APF continue to be made available for on-lending to the market through a gilt lending arrangementOpens in a new window with the DMO. The average daily aggregate value of gilts lent by the APF to the DMO during the three months to 30 September 2022 was £8.4 billion.

Cash-flow arrangements between the APF and HM Treasury

In line with the indemnification of the APF by HMT, the assets held in the APF generate a range of cash flows which – alongside interest costs and the gains or losses made at maturity or sale – drive consequent cash transfers between HMT and the APF.

Since 2009, the APF’s activities have generated positive net cash flows from the APF to HMT, totalling £123 billion at end-September 2022.

When this arrangement was put in place it was recognised that reverse payments from HMT to the APF were likely to be needed in the future as Bank Rate increased and as the APF's gilt holdings were eventually unwound by the MPC.footnote[3]

This was explained in a May 2022 Quarterly Bulletin articlefootnote[4] and was reconfirmed in an exchange of letters between the Governor and the Chancellor of the Exchequer in September 2022.

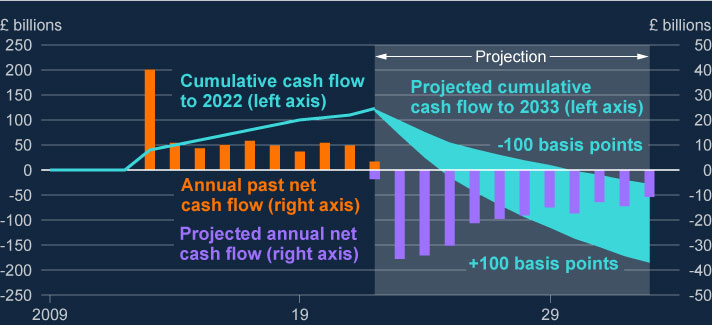

The Quarterly Bulletin in May 2022 explained the mechanics of cash flows. It also provided a summary of cash flows to date, and a projection into the future based on prevailing market conditions and the MPC’s policy at the time. Chart 2 below provides an update on that: it shows how cash flows have evolved since May 2022, and provides an updated projection of future cash flows.

A development since May is that the first quarterly transfer from HMT to the APF has now occurred, involving the transfer of £828 million in October 2022. This was confirmed at the time in a Written Ministerial StatementOpens in a new window made to the House of Commons on 19 October 2022 in relation to the Contingencies Fund Advance.

Looking ahead, future cash flows are uncertain and highly sensitive to the assumptions used for market interest rates and how quickly the portfolio is unwound.

The projection in Chart 2 is based on the following updated assumptions:

- Annual net cash flows are projected using the market path for Bank Rate as of 31 October 2022.footnote[5] In order to illustrate how sharply the broad profile could change under different conditions, the cumulative position shows a range of outcomes based on paths for rates 100 basis points above and 100 basis points below the prevailing level on 31 October 2022.

- Reflecting the MPC’s current policy, the stock of gilts is assumed to reduce by a total of £80 billion in the year to September 2023, including £45 billion from sales. For following years the MPC has stated it will set an amount for the reduction in the stock of purchased gilts over the subsequent 12-month period as part of an annual review. For illustrative purposes only, the projection in Chart 2 assumes sales of gilts continue at the current rate in future years until the combination of sales and maturities means the portfolio is fully unwound. In addition, the stock of corporate bonds in the APF is assumed to fall to zero by end-September 2024.

Chart 2: APF cash flows (actual and projected) (a) (b)

Footnotes

- Sources: Bloomberg LLP for market rates as at 31 October 2022. Bank of England calculations for data in relation to APF cash flows.

- (a) The stock of assets used for the projection of cumulative cash flows is based on holdings as at 28 September 2022, consistent with the holdings reported in Table A.

- (b) The OBR recently published its own forecast of net transfers from HMT to the APF. See Table 3.6 ‘Flows relating to the APF’, November 2022 Economic and fiscal outlook – supplementary fiscal tablesOpens in a new window. The OBR’s forecast is broadly consistent with the Bank’s approach as set out in Chart 2. Nevertheless, the OBR produces its forecast independently and there may be some differences in underlying assumptions. Accordingly, the two projections are not directly comparable.

In line with the Bank’s commitment to provide updated projections on a regular basis, a further update will be provided in April 2023 as part of the APF Quarterly Report 2023 Q1.

First, please LoginComment After ~