Digital Transformation & Innovation in Auditing: Insights from a Review of Academic Research

In January 2022, a paper titled “The Effects of Person-Specific, Task, and Environmental Factors on Digital Transformation and Innovation in Auditing: A Review of the Literature,” prepared by Dereck Barr-Pulliam, Helen Brown-Liburd and Ivy Munoko, was published detailing the findings from this study. This article sets out some of the insights the IAASB gained from reviewing this research and discussing it with the paper’s authors.

Using technology in an audit continues to evolve and, by examining relevant literature published over the last 20 years, insights can be learned about evolving trends and the trajectory of digital transformation in audit.

The paper’s authors were among the first to conduct an extensive review of the growing academic literature on digital transformation in the external audit arena. The study identified an increasing interest in publishing digital transformation-related research, as demonstrated by the increase in volume of research over recent years, but indicated that research on external auditors’ use of emerging technologies is still at an early stage. This latter point could reflect the fact that many emerging technologies are yet to achieve widespread adoption due to their complexity of implementation and use.

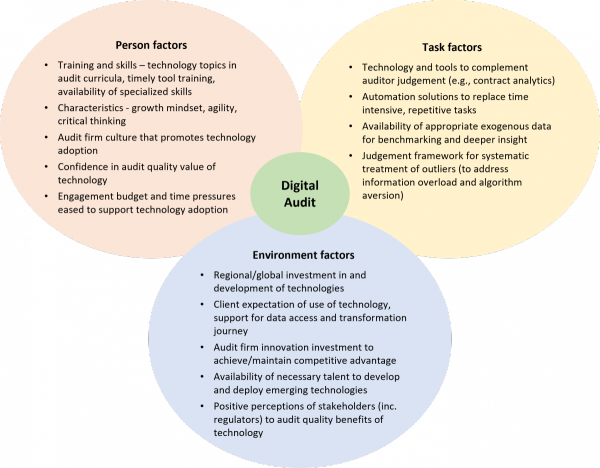

The research identified person, task and environmental factors which affected digital transformation in audit engagements and distinguished between the types of analytics used by auditors—descriptive, diagnostic, predictive and prescriptive—and the research findings relevant to each. The findings suggest very few studies have examined the more complex predictive and prescriptive analytics.

The diagram below identifies factors that positively influence adoption of the digital audit; these themes are explored in more detail throughout this article.

Person related factors impact enthusiasm and willingness to adopt technology in the audit

The research identified some key person-specific factors influencing the adoption of technology. When discussed with the original paper’s authors, this was highlighted as the most significant reason for a lag in technology adoption.

1) Training and skills

The study noted that accounting curricula lags accounting practice due to the complexities in augmenting university course content and that missing components include an understanding of the information lifecycle and the technologies of the information system. The study also notes a need for greater emphasis on helping students become more agile and use more critical thinking when interacting with disruptive technology, and some studies identified possible approaches to address including use of case studies. Tool-specific training was noted as a critical driver for using technology with the timeliness of this training (i.e., before busy season) being a way to encourage greater use.

2) Auditor Characteristics and Behavior

The review of research identified certain auditor behaviors that foster greater commitment to technology adoption with growth mindset, agility and critical thinking recognized as behaviors that positively influence the reliance on and support for technology in the audit. Research into whether mindset (fixed or growth) moderates the effect of inspection risk on auditors’ reliance on data analytics tools found that when inspection risk is high, those with a fixed mindset rely less on data analytic tools than those with growth mindset. This finding in conjunction with others related to concerns about regulators’ response to and acceptance of emerging technologies provides valuable insight into key barriers to technology adoption.

Some research noted the impact of algorithm aversion, which suggests individuals will be more likely to discount computer-generated advice or evidence more heavily than human advice or evidence. One example of this is a study that found that auditors who received contradictory evidence from an artificial intelligence system (for example, where used to evaluate a complex estimate) proposed smaller adjustments to management’s initial estimate, mainly when the underlying inputs and assumptions are objective.

3) Stakeholder/external attitudes

The review identified several publications that presented research performed to understand perceptions of and behavioral responses to using analytics in the audit. Findings suggest that stakeholder views (including peer reviewers and regulators) influence auditors’ willingness to adopt technology.

Whilst a primary benefit of data analytics is increased audit quality, some research indicated that peer reviewers, external reviewers and key stakeholders viewed quality as largely unaffected by using data analytic techniques as an alternative to traditional audit procedures.

It is clear from the research that confidence in using automated tools and techniques by auditors and various stakeholders in audit outcomes is key to enabling increased adoption of technology on engagements.

Task related factors such as structure and complexity impact technology adoption

The research identified variations in audit task complexity and noted the importance of understanding how using emerging technology in the audit interacts with task complexity to impact judgement quality.

1) Task complexity

Descriptive analytics were noted as most widely used of all the advanced analytics types, particularly data visualization—which is used to better understand an entity’s financial performance and for population testing, as well as for business insights. Research indicates that when data visualization is appropriately integrated into audit tasks it can improve decision making. However, as the data becomes more voluminous and the analytic more complex, there are challenges for the auditor in understanding and interpreting this data and making appropriate judgements regarding treatment of anomalies.

Studies of auditors’ use of diagnostic analytics indicates task complexity moderates the effectiveness of technology used in the audit, particularly when it gives rise to a high number of anomalies—potentially significantly more than would require investigation in a traditional sample test.

Unstructured tasks such as the use of advanced data analytic techniques, like clustering to identify patterns in data that could signal higher risk areas, may increase complexity because the auditor must process a higher number of information cues (i.e., larger data sets), combine the information in an unspecified way (e.g., identify patterns) or adapt to changes in required actions or information cues (i.e., identify higher risk areas).

As the technology being deployed becomes more complex, there is a risk that auditors experience information processing and cognitive limitations (e.g., information overload) when analyzing and interpreting output from data analytic tools. A decision aid, framework, or an accepted systematic approach can help with practical challenges faced when potentially large numbers of outliers result from full population testing. Research identified that higher levels of false positives associated with data analytics can also negatively influence the extent to which auditors exhibit professional skepticism. However, it was noted that this can be mitigated by consistently rewarding auditors for exhibiting appropriate skepticism.

2) Examples of technology driving audit quality improvements and audit efficiency

Despite challenges around task complexity, several publications reviewed as part of the study identified examples of automated tools and techniques that could positively impact audit quality, as well as potentially improving the audit experience.

- Exogenous Data – some research looked at the use of exogenous data combined with company data to gain deeper insights. Findings indicated benefits of using this data but stressed the importance of carefully evaluating how the exogenous data linked to financial accounts.

- Benchmarking – research noted the use of appropriate benchmarking and incorporation of relevant information can improve auditors’ performance of analytical procedures.

- Machine learning – research identified benefits in using machine learning to develop independent estimates to compare to management’s estimates with studies showing that these are generally more accurate and benefit from the model being retrained each year using the actual figures.

- Contract analysis – research identified various AI-enabled techniques used in the audit, such as natural language processing to analyze contracts for unusual terms or clauses enabling a more efficient and effective approach to examining full populations of contracts and related audit tasks.

- Automation – the use of robotic process automation (RPA) technologies to automate routine, repetitive tasks to improve audit efficiency with some research proposing frameworks to use for development of RPA in an audit practice including determining which activities to automate.

- Drones – one study identified the use of drones to support inventory counts and noted that this had driven significant reductions in inspection time as well as reductions in errors.

- Process mining – research indicated that use of this technology is emerging and found that it improved the evaluation of the effectiveness of internal controls over financial reporting.

Environmental factors influence technology adoption in audit

The study highlighted some environmental factors that influenced the adoption of technology in the audit. These factors include client preferences, competitor activity, regulatory response to technology in the audit as well as regional and global shifts towards digitization. The adoption rate, enthusiasm and expectations of these environmental parties directly impact the audit firm’s use of technologies.

The following environmental factors were noted.

1) A regional and global shift towards digitization, automation and business intelligence – Regional factors such as government influence, competition of audit firms, regulation, advancement of technology and availability of necessary talent play a significant role in the adoption of technology.

2) Influence of the audit client on adoption of emerging technologies – Factors such as the client’s expectation of auditor use of emerging technology and client support for data access influences how the auditor can deploy emerging technology and the regularity of use. Client expectations regarding additional insights gleaned from using emerging technology coupled with tensions around anticipated audit fee reduction because of using technology impact adoption. Additionally, an expectation gap may exist regarding the level of assurance attained from testing full populations of transactions or related to the evaluation of non-financial information through technology.

3) Business drive to achieve/maintain competitive advantage – Emerging technologies provide opportunities to increase audit efficiency and effectiveness, for example, through use of Robotic Process Automation (RPA) to automate routine, repetitive audit tasks. A disparity was noted in emerging technologies and the phase of digital transformation across accounting firms with larger firms having innovation leaders or organizations that help identify, develop, and otherwise facilitate the digital transformation journey whilst smaller firms are more likely to use off-the-shelf tools, placing them at a disadvantage in competing for clients and human capital.

4) Regulator response to adoption of emerging technologies – Uncertainty about regulators’ response and acceptance of emerging technologies can hinder its adoption. Insights provided through using data analytics may be perceived by regulators as a breach of independence impacting audit quality, with a lack of clarity on regulator response to using technology causing “confusion and frustration.” Findings noting a need for regulators to be more proactive in identifying appropriate use of emerging technology in the audit rather than being reactive through identified findings from inspecting completed engagements.

Environmental factors that support the adoption of technology create the right conditions for successful use. Where these factors work against the adoption of technology in the audit, they give the auditor a greater hill to climb to achieve successful technology adoption.

Of the factors noted, the influence of the audit client on an auditor’s adoption of emerging technology seems to be most significant. This factor is particularly important when it comes to supporting the acquisition of data needed to run the technology and in setting an expectation with the auditor of technology use, whilst the auditor needs to appropriately manage expectations around fees and the level of assurance to be provided (reasonable not absolute) where technology is deployed.

Conclusion and takeaways

The research has provided some valuable insights into digital transformation within audit engagements and delineates person-specific, task, and environmental factors that influence adoption of technology. The research recommends that audit firms and practitioners avoid the temptation to run before they can walk. That is, instead, they take a methodical approach to technology adoption by involving all necessary parties and ensuring there are sufficient resources (human capital and technology) to enable the adoption of specific types of data analytic tools.

The research also advises consideration by standard setters and regulators about whether specific guidance on emerging technologies in the audit may help to allay concerns about adoption of these technologies. For example, in regard to artificial intelligence, to potentially mitigate auditor perception of technological innovation as an addition to traditional audit procedures rather than an enhancement.

Finally, the research concludes that a confluence of positive factors is required to achieve more widespread adoption of the digital transformation. The factors require actions by all stakeholders within the audit and assurance ecosystem. Continued collaboration between academia, audit firms, standard setters and regulators can yield significant insight into adoption of emerging technologies in audit.

First, please LoginComment After ~