US Stocks are Forecast to Have Less Pain but No Gain in 2023

The S&P 500 Index is forecast to turn out flat returns and no growth in earnings in 2023 after declining about 17% this year, according to Goldman Sachs Research. Our strategists expect the benchmark to fall about 9% in the next three months before rebounding after the Federal Reserve’s tightening cycle ends in May. Revenue of S&P 500 firms is predicted to rise 4%, in line with nominal GDP growth, but margins will likely shrink, eliminating growth in earnings per share.

A lot has changed in the past year. The Federal Reserve is hiking interest rates to curb inflation, sharply driving up the cost of capital for U.S. firms from practically nothing to the highest level in a decade. That has translated into a drop in valuations, especially in growth stocks whose earnings are expected to materialize further in the future. Goldman Sachs Research expects the weighted average cost of capital for U.S. companies to remain high in 2023.

Our strategists favor stocks that aren’t as sensitive to changes in interest rates, like companies in healthcare, consumer staples and energy. They also think industries with a history of outperforming when inflation is high and falling — such as medical equipment, semiconductors, and consumer services — could be an opportunity in 2023, as could companies with resilient margins. They expect unprofitable enterprises and firms with vulnerable margins to have lower returns.

The prospects for big tech companies have changed, too. The revenue from tech companies has grown much faster than the overall index for the last decade — 18% for tech versus just 5% for the index. But that extra revenue growth (or premium sales growth) has narrowed dramatically: In the coming years through 2024, our strategists expect revenue from big tech to increase at an annualized pace of 9% versus 7% for the overall index. The valuation premium for big tech has compressed as well.

The U.S. economy is forecast to narrowly avoid recession next year as inflation declines and unemployment rises only slightly, according to economists at Goldman Sachs. As concerns about an economic downturn and inflation fade, our strategists expect investors to demand less compensation for owning stocks instead of risk-free Treasuries (or a decline in the equity risk premium). However, Fed policy is likely to keep gains in the stock market contained. The labor market is tight, which means policymakers will be reluctant to allow financial conditions to ease.

“The Fed will likely seek to keep financial conditions sufficiently tight to maintain below-trend economic growth and contain inflation,” our strategists wrote. “This policy means limited valuation expansion and limited upside to equities, a key component of financial conditions.”

While not our economists’ base case, a U.S. recession is forecast to spark around a 20% decline in the S&P 500. (During the 12 post-war recessions, the S&P 500 fell to a trough that was on average 30% below its peak.)

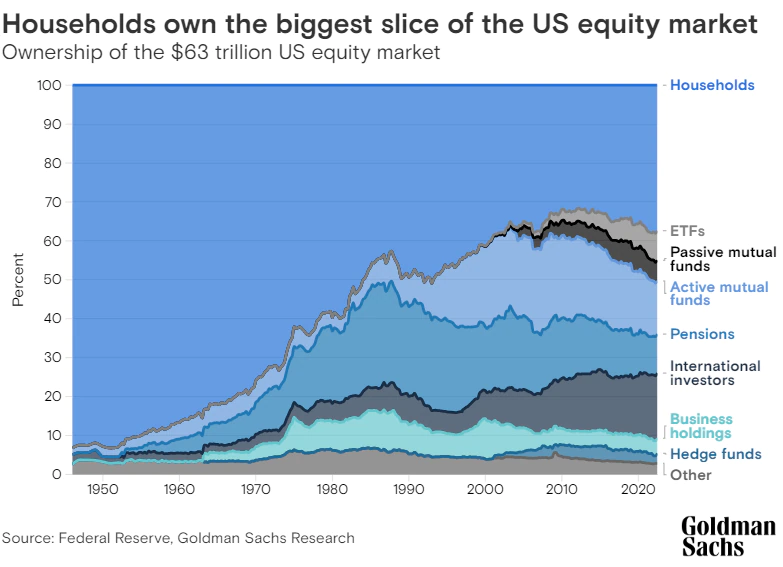

There are several reasons stock prices are vulnerable. Investors appear to be positioned for a soft landing (as suggested by the performance of cyclical stocks versus defensive stocks), according to Goldman Sachs Research. Households, the largest holder of U.S. stocks, still have a lot of money allocated to equities by historical standards, which is another risk for valuations. Our strategists expect individual investors to reduce their equity holdings next year for the first time since 2018. As households shift some investment to (now higher yielding) bonds, they are expected to reallocate $100 billion out of equity funds. Corporate stock buybacks are also predicted to shrink as earnings-per-share stall.

That said, a peak in interest rates could be a sign that U.S. stocks have reached their bottom. Since 1980, the S&P 500 has rallied by an average of 7% during the three months following a peak in two-year Treasury yields. Over a 12-month investment period, however, returns have varied dramatically depending on whether the economy subsequently entered recession or continued to grow.

“The combination of limited upside in our base case and large downside in the case of a recession means investors should remain cautious in the near term,” our analysts wrote.

First, please LoginComment After ~