FSB reports on global trends and risks in non-bank financial intermediation

Download the report → Global Monitoring Report on Non-Bank Financial Intermediation 2022

The report mainly covers developments in 2021, when most economies experienced a better than expected recovery from the COVID-19 shock, in many ways because of the extraordinary steps taken by official sector authorities to support key financial markets and the real economy. It describes broad trends in financial intermediation across 29 jurisdictions that account for approximately 80% of global GDP, before narrowing its focus to the subset of NBFI activities that may be more likely to give rise to vulnerabilities. The main findings from this year’s monitoring exercise include:

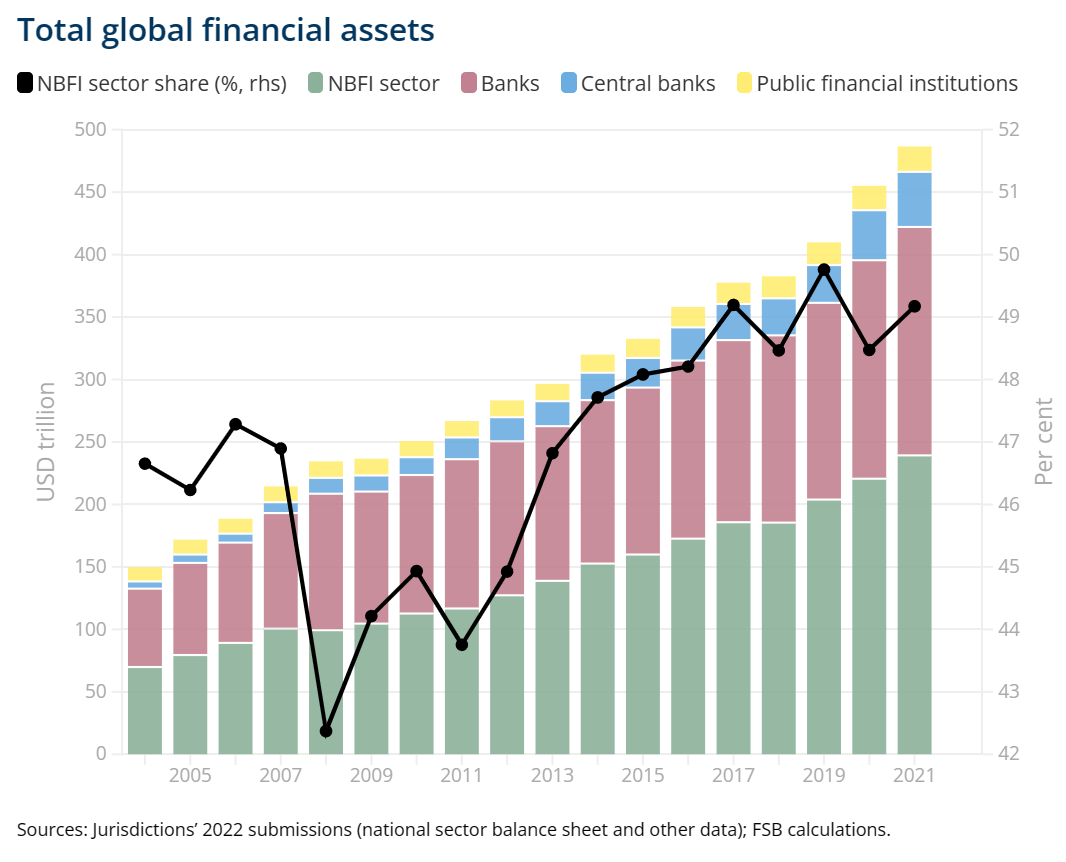

The NBFI sector exhibited strong growth in 2021, driven in particular by investment funds. These benefited from the economic recovery and experienced both inflows and higher valuations of a wide range of their investments. The NBFI sector grew by 8.9%, and its share of total financial assets remained stable at 49%.

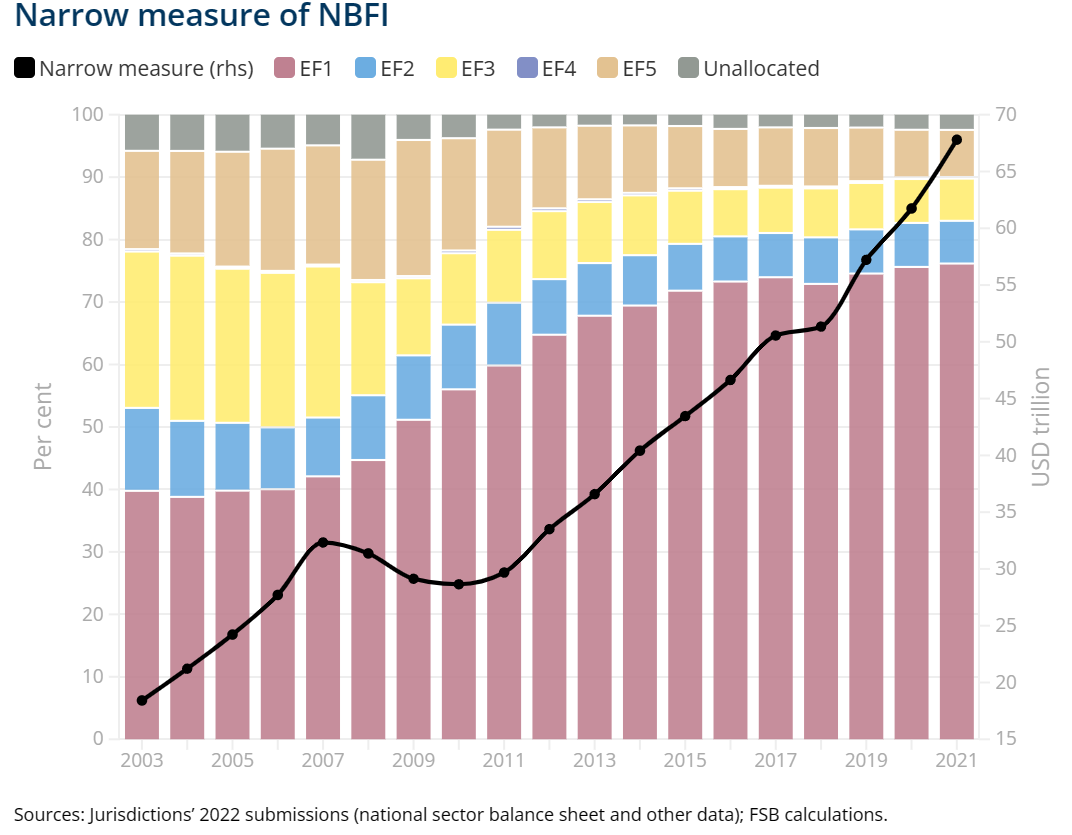

The narrow measure of the NBFI sector – comprising entities that authorities have assessed as being involved in credit intermediation activities that may pose bank-like financial stability risks – reached $67.8 trillion in 2021, representing 28.3% of total NBFI assets and 14.1% of total global financial assets. Collective investment vehicles with features making them susceptible to runs remained by far the largest component of the narrow measure, and their aggregate measures of credit intermediation, liquidity and maturity transformation remained at elevated levels.

Since 2013, NBFI sector linkages with the banking sector through funding and exposures have continued to decrease. However, the sector continued to be a net provider of cash in the repo market and its net level of repo assets rebounded strongly in 2021.

Global economic and financial conditions have deteriorated significantly since the beginning of 2022, with knock-on effects on the NBFI sector, and Box 1-1 of the report provides some detail on the NBFI entities most sensitive to these developments. As part of its work programme to enhance the resilience of the NBFI sector, the FSB has identified key amplifiers of liquidity stress and will continue to develop metrics and tools to monitor associated vulnerabilities.

First, please LoginComment After ~