HKTDC Export Index 4Q22: Local Exporter Confidence Falters in Face of Global Economic Slowdown

- In terms of sectors, the most upbeat was machinery at 38.3 (a 3.4-point increase over the previous quarter), followed by timepieces at 36.8 (+3.0). The largest drop, meanwhile, related to the jewellery sector, which fell to 30.8 from its previous reading of 44.2.

- Overall, Asia continued to be seen as home to the most promising markets, with Japan topping the table at 47.2, followed by mainland China (44.4) and the ASEAN bloc (43.5). Exporters, however, remained notably less optimistic in the case of both the EU (40.4) and the US (40.2).

- Looking to the sub-indices, the Trade Value Index stayed in contractionary territory at 39.2, a 1-point decrease. This suggests exporters see continued downward pressure on prices as highly likely.

- By contrast, the Procurement Index rose 4.6 points to 28.9. This can be taken as signalling a likely increase in procurement activities, especially in the timepiece, machinery, electronics and clothing sectors where the readings rallied.

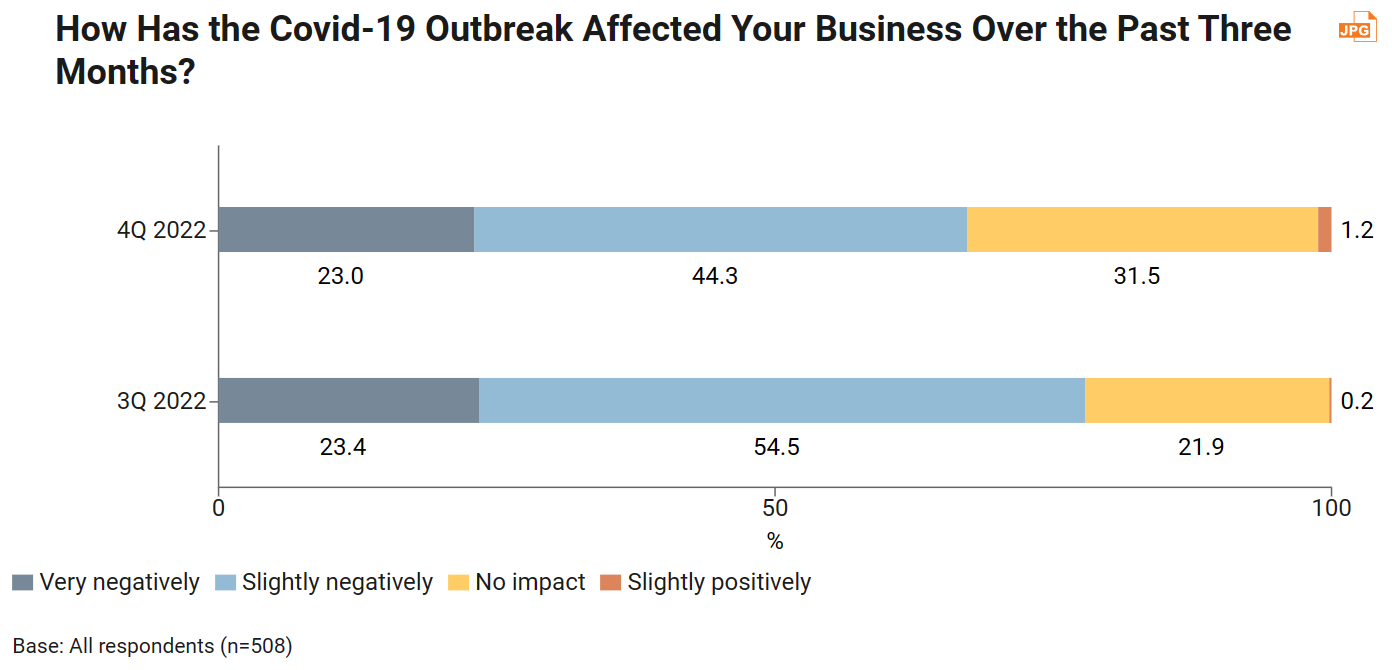

- In another positive development, significantly more exporters indicated their pandemic-related problems were receding (up 10.6 percentage points from the previous quarter), with progress made towards resolving the challenge of high transportation costs and logistics bottlenecks. Overall, only 67.3% of respondents cited continuing problems, down from 77.9%.

- Looking ahead to 2023, the risks of an economic slowdown and / or recession in many of the major markets has become the primary concern of the largest proportion of exporters (36.2%).

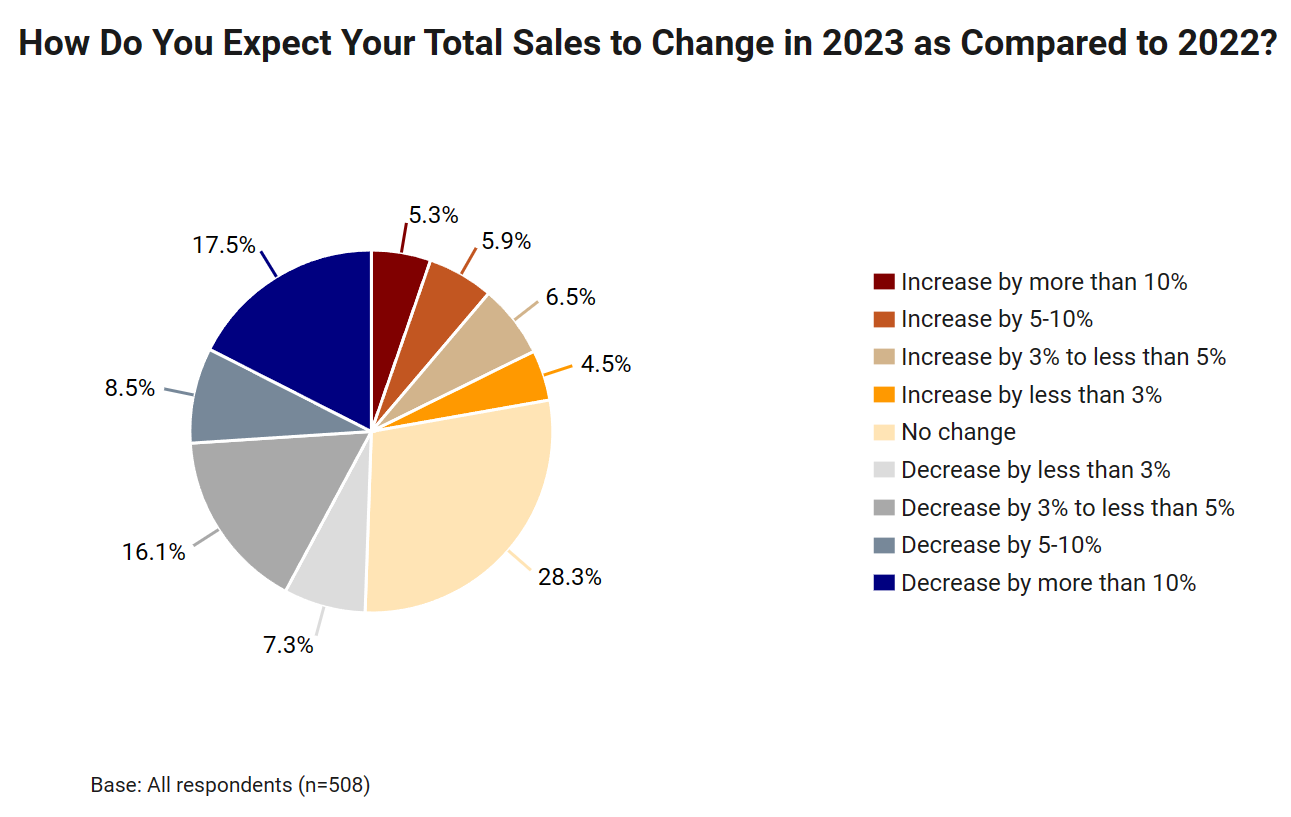

- In general, exporters are remaining cautious and close to half of them (49.4%) anticipating that their total sales will decrease in 2023 compared to 2022, while the remainder believes there will either be no change (28.3%) or an increase (22.2%).

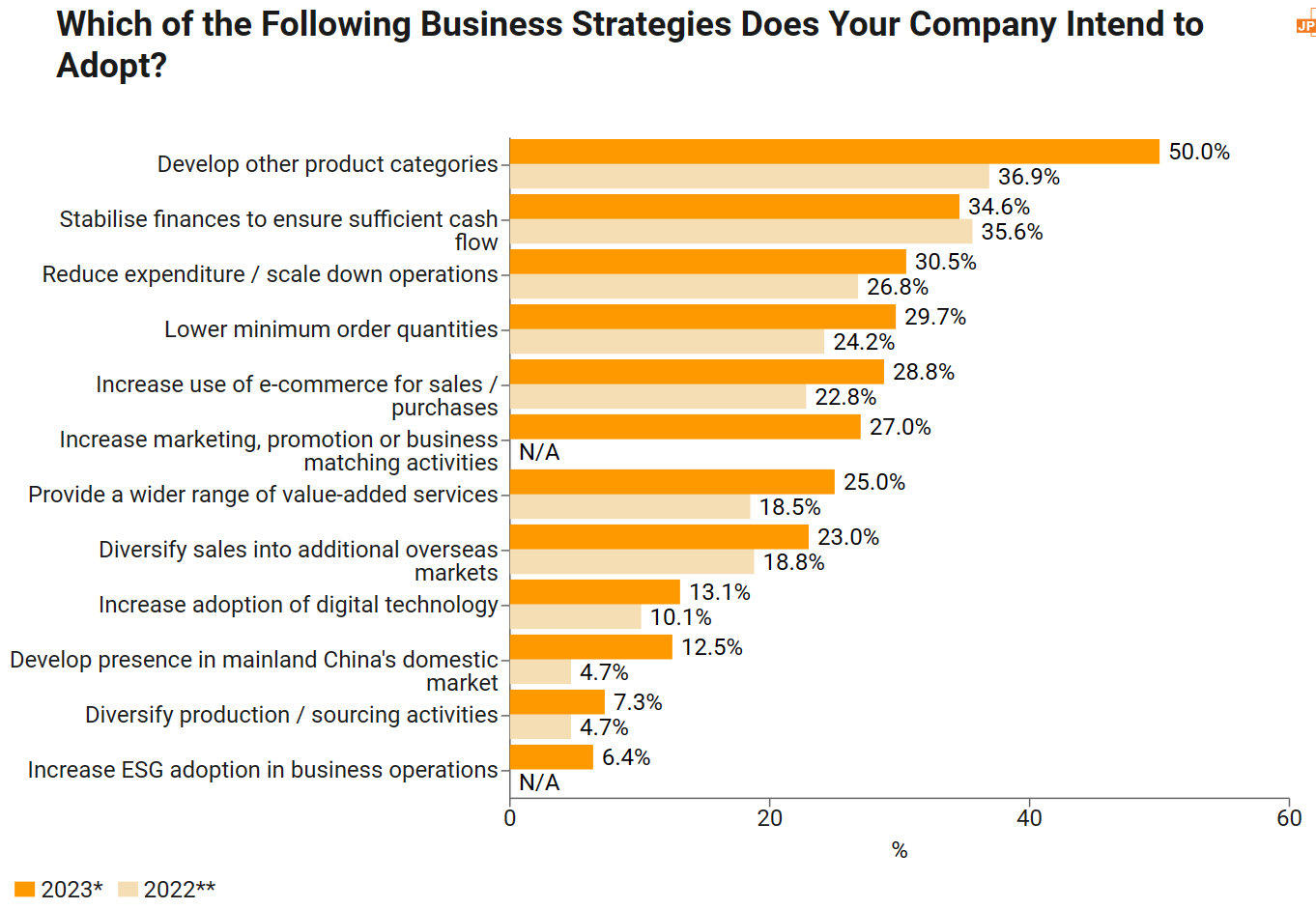

- In response, the three strategies most likely to be favoured by exporters in 2023 are: developing new products (50.0%), improving cash-flow management (34.6%) and cutting costs (30.5%).

For 4Q22, the HKTDC Export Index stood at 29.7, a 3.1‑point decrease from the 32.8 reported for 3Q22. As global demand has been perceived as falling, this heightened uncertainty has undermined confidence in Hong Kong’s near‑term export outlook.

Across the major industrial sectors, sentiment is decidedly mixed. While machinery at 38.3 (+3.4) and timepieces at 36.8 (+3.0) were relatively upbeat, sentiment with regard to jewellery (‑13.4), toys (‑8.1) and clothing (‑7.4) was notably less positive. At 29.5 (‑3.2), meanwhile, the electronics sector was relatively stable.

Period | HKTDC | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

4Q22 | 29.7 | 29.5 | 23.8 | 28.9 | 30.8 | 36.8 | 38.3 |

3Q22 | 32.8 | 32.7 | 31.2 | 37.0 | 44.2 | 33.8 | 34.9 |

2Q22 | 30.9 | 30.4 | 33.4 | 38.7 | 34.3 | 34.6 | 37.7 |

1Q22 | 24.7 | 24.5 | 28.0 | 33.5 | 23.5 | 19.7 | 25.0 |

Overall, Hong Kong exporters continued to see Asia as home to the most promising markets. This saw Japan (47.2) top the list, followed by mainland China (44.4) and the ASEAN bloc (43.5). Exporters, however, had lower expectations of both the EU (40.4) and the US (40.2), with persistent inflationary pressure and the likelihood of recession seen as set to hamper demand.

HKTDC Export Index | US | EU | Japan | Mainland China | ASEAN |

4Q22 | 40.2 | 40.4 | 47.2 | 44.4 | 43.5 |

3Q22 | 41.1 | 40.5 | 48.4 | 45.8 | 46.9 |

2Q22 | 41.2 | 42.3 | 47.6 | 43.1 | 43.3 |

1Q22 | 39.1 | 39.5 | 45.6 | 42.1 | 41.2 |

The Offshore Trade Index, which tracks sentiment relating to shipments not passing through Hong Kong but managed by businesses within the city, declined by 2.2 points in 4Q22, falling from 21.9 to 19.7.

The Trade Value Index also fell, dropping by one point to 39.2, indicating the likelihood of sustained downward pressure on unit export prices, with jewellery (down 9.2 points to 39.4) and toys (down 8.8 points to 37.3) facing the biggest declines. Machinery (up 5.6 points to 44.8) and timepieces (up 7.8 points to 44.6), meanwhile, were perceived as the sectors most likely to enjoy a degree of price stability.

Period | Trade Value Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

4Q22 | 39.2 | 39.1 | 34.9 | 37.3 | 39.4 | 44.6 | 44.8 |

3Q22 | 40.2 | 40.2 | 37.4 | 46.1 | 48.6 | 36.8 | 39.2 |

2Q22 | 51.7 | 51.8 | 49.0 | 53.2 | 54.4 | 51.0 | 50.3 |

1Q22 | 52.8 | 53.5 | 46.0 | 56.7 | 37.3 | 41.8 | 48.8 |

The Procurement Index, however, rose by 4.6 points to 28.9, with the lead here taken by timepieces (up 11.8 points to 37.3) and machinery (up 7.4 points to 35.2). Electronics (+4.6) and clothing (+3.5) rallied, although both jewellery (‑3.9) and toys (‑2.8) are now expected to scale down procurement‑related activity.

Period | Procurement Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

4Q22 | 28.9 | 28.6 | 29.2 | 26.8 | 28.8 | 37.3 | 35.2 |

3Q22 | 24.3 | 24.0 | 25.7 | 29.6 | 32.7 | 25.5 | 27.8 |

2Q22 | 25.0 | 24.6 | 27.7 | 33.8 | 23.5 | 28.8 | 30.2 |

1Q22 | 20.3 | 20.0 | 24.3 | 26.1 | 20.6 | 19.2 | 22.8 |

For its part, the Employment Index decreased slightly, falling to 40.3 from its previous level of 41.8. Employment prospects in the machinery (44.4) and timepieces (43.1) sectors were seen as likely to improve, while recruitment in the electronics, clothing, jewellery and toys sectors was expected to face something of a downturn.

Period | Employment Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

4Q22 | 40.3 | 40.3 | 38.6 | 37.3 | 38.5 | 43.1 | 44.4 |

3Q22 | 41.8 | 41.7 | 42.1 | 46.5 | 47.1 | 37.3 | 42.0 |

2Q22 | 45.3 | 45.4 | 46.5 | 43.0 | 45.1 | 42.3 | 43.2 |

1Q22 | 40.4 | 40.4 | 39.6 | 41.5 | 40.2 | 38.5 | 40.1 |

In another positive development, 32.7% of respondents reported that their business had not suffered on account of the pandemic in 4Q22, a 10.6 percentage‑point rise over the previous quarter. Tempering this, however, 67.3% of respondents indicated ongoing Covid concerns were still adversely affecting their businesses.

Among respondents reporting a continued negative impact from the pandemic, increased transportation costs (53.2%) and logistics disruptions (49.1%) remained the primary challenges, although the number adversely affected was notably down. In addition, following the lifting of quarantine requirements for arrivals in Hong Kong as of September 2022, the problem of communicating with overseas buyers / suppliers became less of a concern in 4Q22, falling 9.3 percentage points to 38.9%.

Looking ahead, the risk of an economic slowdown / recession in the major markets has overtaken pandemic‑related concerns to become the primary issue for the largest percentage of exporters (36.2%).

In terms of their sales expectations for the year ahead, Hong Kong exporters remain largely cautious. While many (49.4%) expect sales to decline, 28.3% anticipate they will remain unchanged and a further 22.2% believe they will actually increase.

Product development clearly stands out as the most favoured strategy for business growth in 2023 (50.0% of respondents), followed by cash‑flow management (34.6%) and reducing expenditure / scaling down operations (30.5%).

Looking from an individual industry perspective, it is clear that different approaches are favoured. In addition to new product development, for example, businesses in the electronics, toys and machinery sectors are also keen to adopt a more flexible approach to minimum order quantities. Those in the jewellery, toys and machinery sectors, meanwhile, are prioritising enhanced marketing / promotional activity as a means of sales growth, while jewellery and timepiece businesses also plan on refining their e‑commerce offerings.

First, please LoginComment After ~