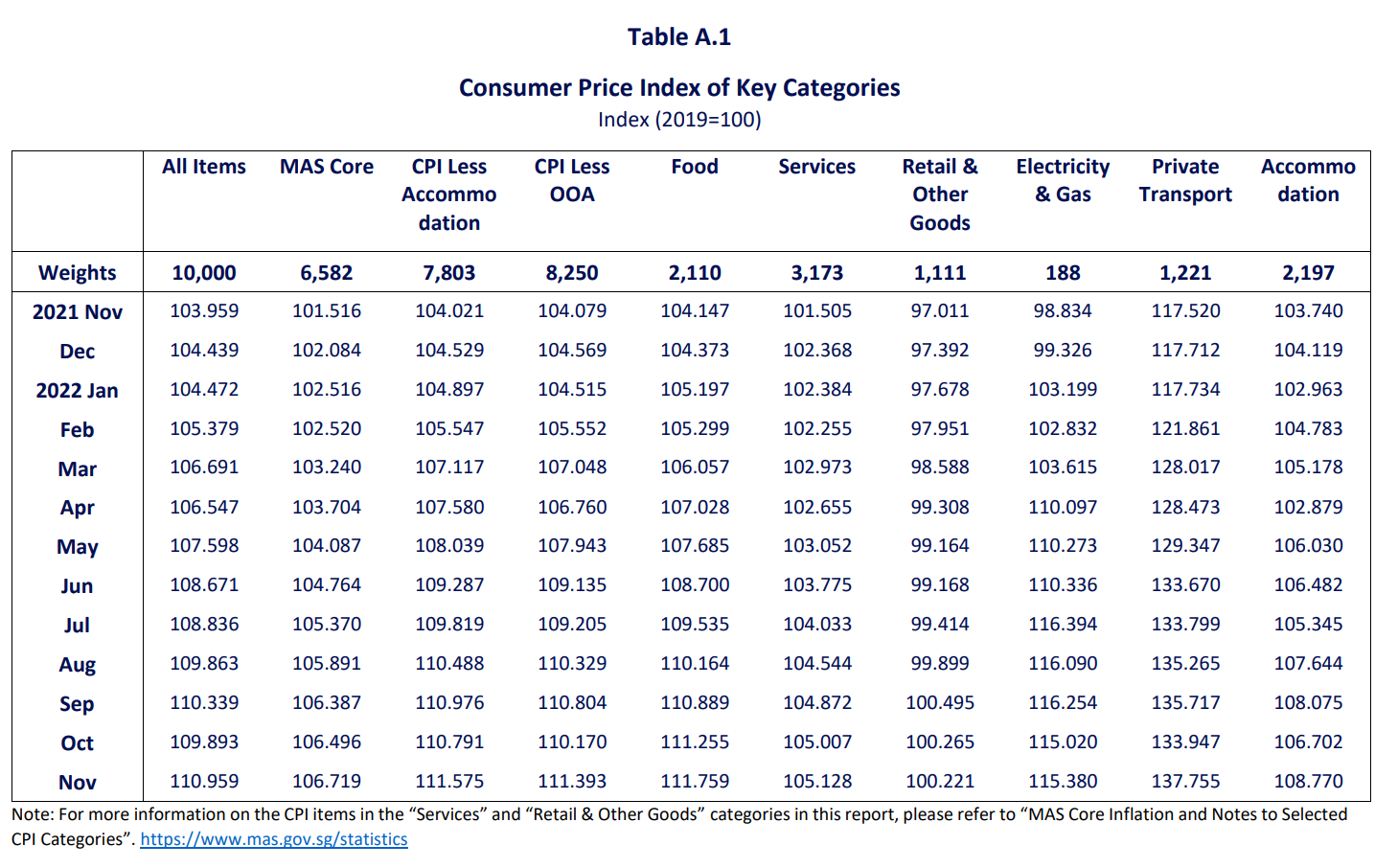

Consumer Price Developments in November 2022

Summary

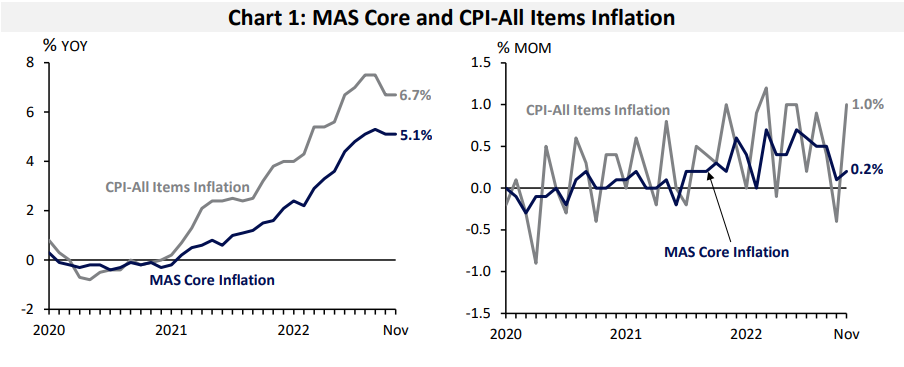

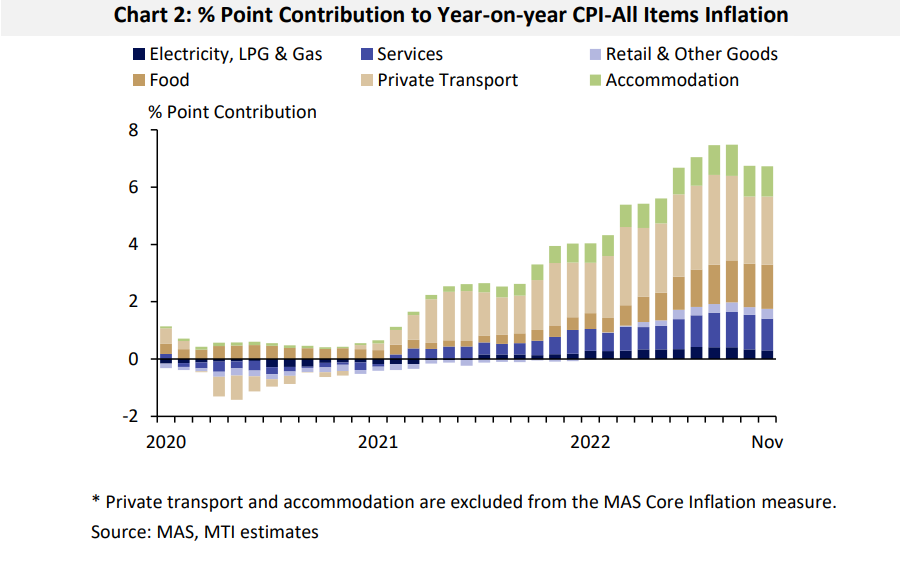

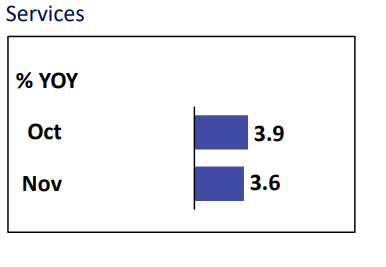

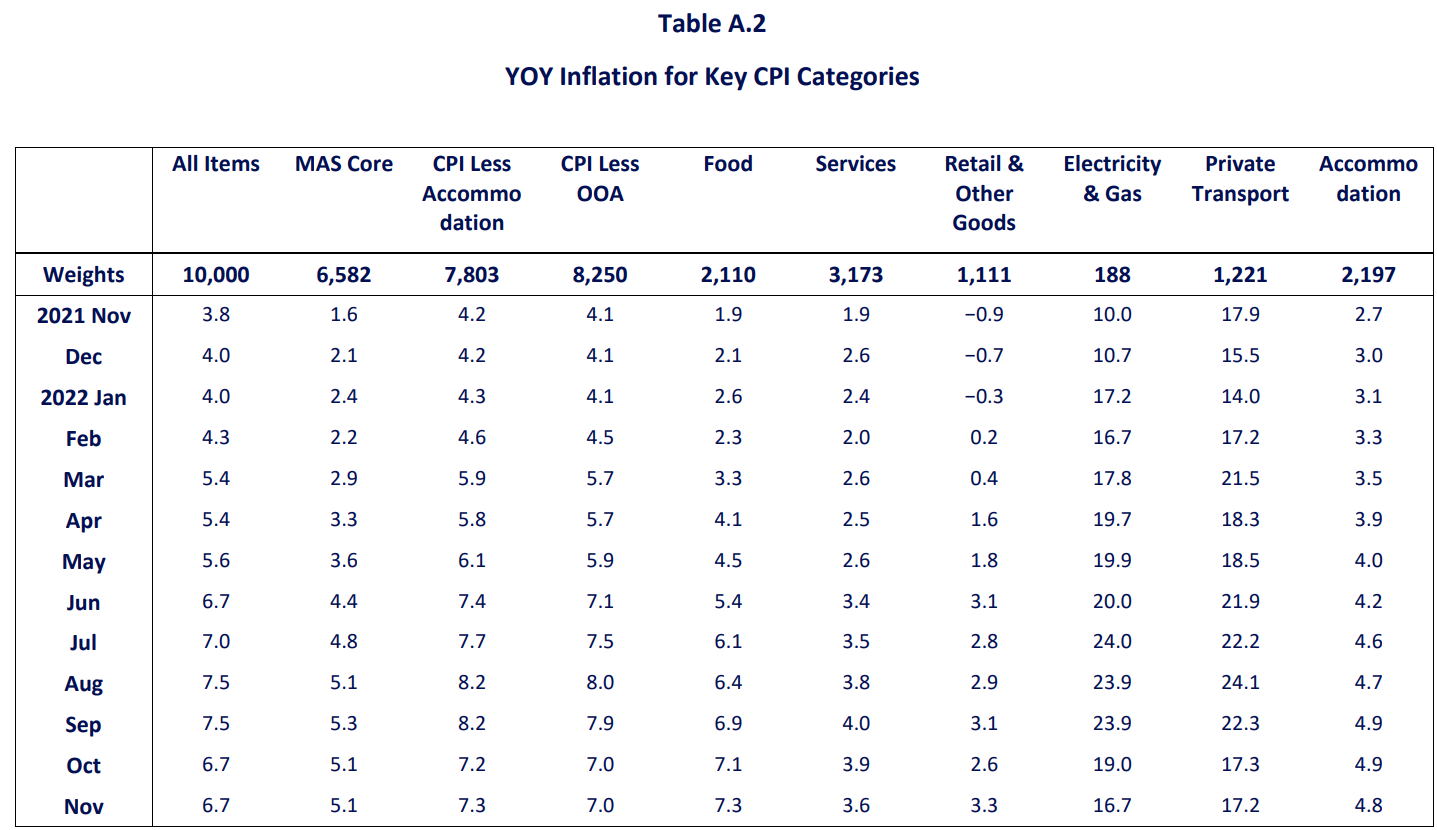

• MAS Core Inflation came in at 5.1% on a year-on-year (y-o-y) basis in November, unchanged from October. o This was because smaller increases in the costs of services and electricity & gas were broadly offset by a steeper pickup in the costs of retail & other goods and food.

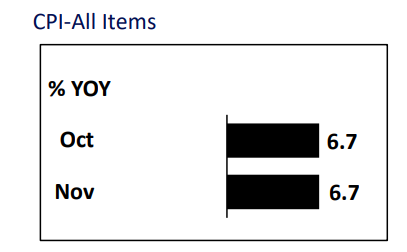

• CPI-All Items inflation also remained unchanged in November relative to October, at 6.7% y-o-y. o Headline inflation held steady as core inflation was unchanged while private transport and accommodation inflation moderated marginally.

• On a month-on-month (m-o-m) basis, core CPI increased by 0.2% and CPI-All Items rose by 1.0%.

CPI-All Items inflation was unchanged at 6.7% in November.

CPI-All Items inflation remained unchanged as lower inflation for services and electricity & gas was broadly offset by higher inflation for retail & other goods and food. At the same time, the decline in private transport and accommodation inflation was marginal.

Services inflation eased, mainly on account of a smaller increase in airfares.

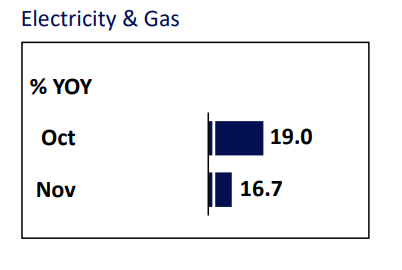

Electricity & Gas Electricity & gas inflation fell, partly due to the higher base a year ago. 1

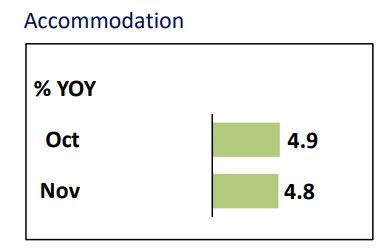

Accommodation inflation edged down as housing rents rose at a more gradual pace.

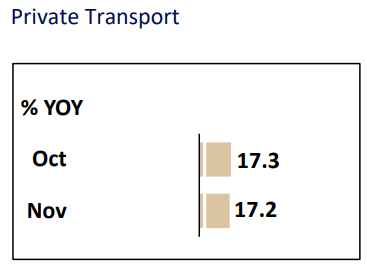

Private transport inflation slowed marginally in line with smaller increases in car and petrol prices.

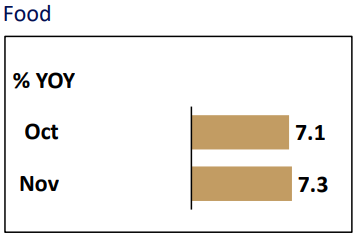

Food inflation rose on account of higher food services inflation.

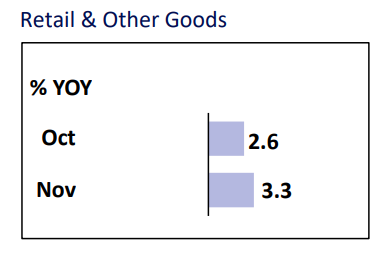

The cost of retail & other goods picked up more strongly due to steeper increases in the prices of clothing & footwear, personal care products, as well as medicines & health products.

1. In November 2021, some households whose Open Electricity Market (OEM) retailers had exited the market were transferred to SP Group. This contributed to a rise in electricity costs in November 2021 as

the regulated tariff charged by SP Group was generally higher than the prices offered by OEM retailers.

Outlook

Demand conditions in major economies have softened while supply chain frictions have continued to ease. Prices of energy and food commodities have come off the peaks reached earlier in the year, but remain firm given ongoing supply constraints. In addition, labour markets in major advanced economies are still tight, keeping wage pressures strong.

Accordingly, Singapore’s imported inflation across a range of goods and services is expected to remain significant for some time. On the domestic front, unit labour costs are expected to increase further in the near term alongside robust wage growth. At the same time, the cost of utilities is likely to remain elevated. Firms are expected to continue to pass through accumulated import, labour and other business costs to consumer prices amid resilient demand.

Meanwhile, car and accommodation cost increases are anticipated to stay firm in the quarters ahead amid tight COE quotas for cars and strong demand for rental housing, respectively. Against this backdrop, MAS Core Inflation is projected to stay elevated in the next few quarters before slowing more discernibly in H2 2023 as the current tightness in the domestic labour market eases and global inflation moderates.

For 2022 as a whole, CPI-All Items inflation is expected to average around 6.0%, and MAS Core Inflation around 4.0%. In 2023, taking into account all factors including the GST increase, headline and core inflation are projected to average 5.5–6.5% and 3.5–4.5%, respectively. Excluding the transitory effects of the GST hike, headline and core inflation are expected to come in at 4.5–5.5% and 2.5– 3.5%, respectively. There are upside risks to the inflation outlook, including from fresh shocks to global commodity prices and more persistent-than-expected external inflation.

Annex:

Price Indicators

CPI – All Items

The CPI is commonly used as a measure of consumer price changes in the economy. It tracks the change in prices of a fixed basket of consumption goods and services commonly purchased by the general resident households over time.

The CPI covers only consumption expenditure incurred by resident households. It excludes non-consumption expenditures such as purchases of houses, shares and other financial assets and income taxes etc.

The CPI – All Items provides a comprehensive overview of the prices of consumer goods and services. Nevertheless, useful information can also be revealed by complementary CPI series derived by excluding specific items in the All Items basket. For example, two other CPI series reported on a monthly basis are the CPI less imputed rentals on owner-occupied accommodation and the MAS Core Inflation.

MAS Core Inflation

The Monetary Authority of Singapore (MAS) monitors a core inflation measure that excludes the components of “Accommodation” and “Private Transport”. These items are excluded as they tend to be significantly influenced by supply-side administrative policies and are volatile. Core inflation is meant to capture the generalised and persistent price changes that are driven by underlying demand conditions. It thus provides useful information for monetary policy which has the objective of ensuring price stability in the medium term.

CPI less imputed rentals on owner-occupied accommodation

Accommodation, one of the groups in the Housing & Utilities category of the CPI, comprises “rented and owner-occupied accommodation”, as well as “housing maintenance & repairs”. A significant share of the Accommodation group is “owner-occupied accommodation (OOA)” cost, which is meant to reflect the costs to homeowners of utilising the flow of services provided by their homes over an extended period of time. As the cost of using housing services is not directly observed for homeowners, it is proxied by market rentals.

Changes in the CPI imputed rentals on OOA, however, have no direct impact on the monthly cash expenditure of most households in Singapore as they already own their homes. Hence, the CPI less imputed rentals on OOA is compiled as an additional indicator to track households’ actual expenditures. Actual rentals paid on rented homes are still included in this measure.

First, please LoginComment After ~