Korean Economic Outlook Update for 2022 - 2023

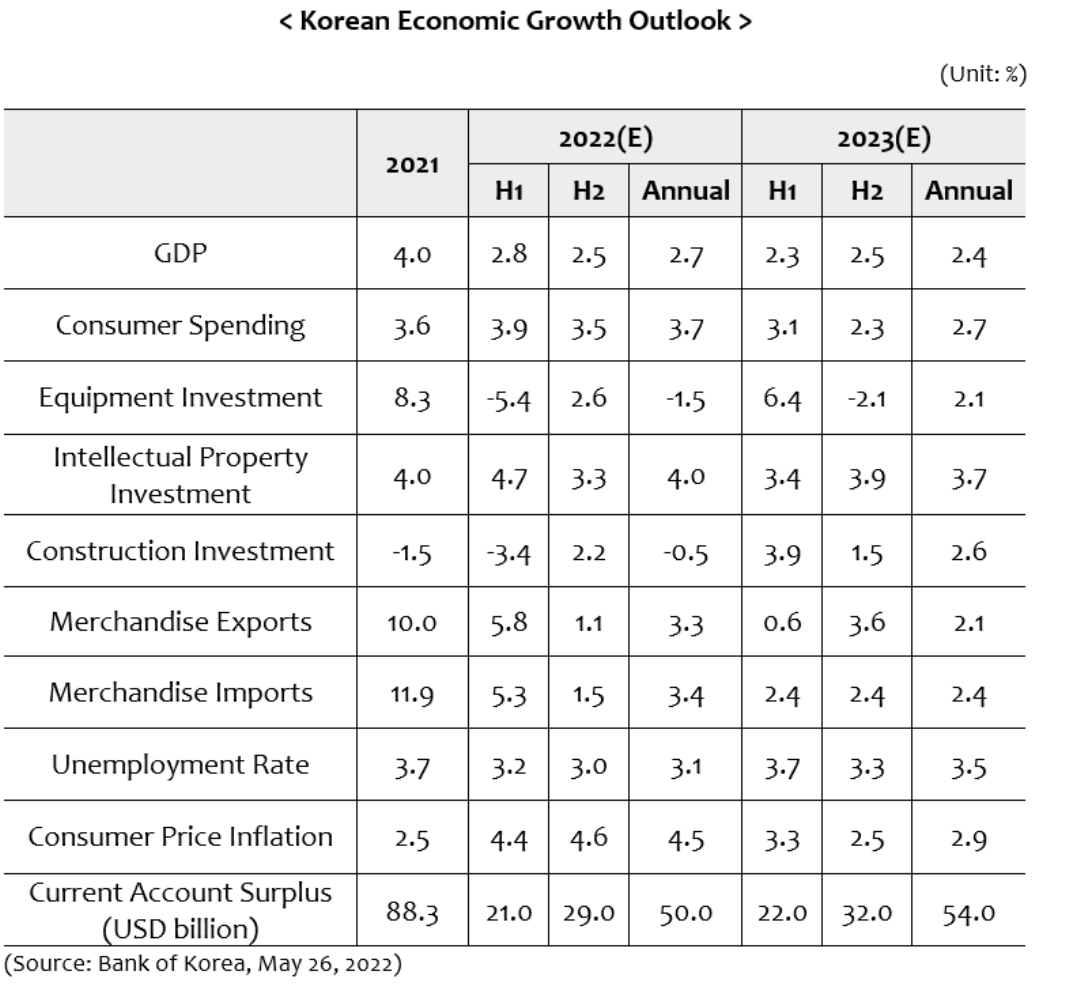

The growth projection for 2022 is 0.3%p below the central bank’s previous forecast. As the economy is faced with a set of downside risks such as the war in Ukraine, global supply chain disruptions, and rising interest rates, its economic output is expected to grow at a slower pace in the coming years.

Despite the moderation of overall economic growth, consumer spending is likely to maintain recovery momentum and remain resilient thanks to the lifting of social distancing restrictions and improving income conditions. Private consumption is projected to grow by 3.7% in 2022 and 2.7% in 2023. Inflation can be a major threat to consumer spending growth as soaring prices are eroding the real purchasing power of households and curb consumer confidence.

Equipment investment is expected to decline by 1.5% in 2022 and then start to regain strength in 2023 on the back of solid investment spending in the IT and semiconductor sectors. Companies are struggling with ongoing supply chain issues and increasing interest rates, with high inflation remaining one of their biggest concerns.

Construction investment will contract by 0.5% in 2022 but will rebound to a 2.6% growth in 2023. Rising commodity prices continue to dampen construction investment, but investment spending will bottom out soon and start to improve in 2023, with the recovery being led by building construction. Investment in the civil engineering construction sector will remain weak due to a cut in the government’s investment in infrastructure.

A steady upward trend will continue for intellectual property investment, which is forecast to grow by 4.0% in 2022 and 3.7% in 2023. R&D investment is expected to be on the rise thanks to improving corporate revenues in the private sector and an increase in government budget for R&D. Growing demand for software applications for online platforms and services will also help boost investment activities in other intellectual property sectors.

Korea’s merchandise export growth is anticipated to moderate to 3.3% in 2022 and 2.1% in 2023, with volatility in commodity prices and the war in Ukraine making global trade conditions uncertain. In particular, the trend of slowing economic growth in major economies like the U.S. and China is hurting Korea’s export prospects. Moreover, a potential shortage of commodities sourced from Russia and Ukraine could weaken the country’s semiconductor exports. In spite of the gloomy outlook, the IT sector is likely to remain robust in terms of export performance.

Korea’s current account surplus is projected to drop sharply to USD 50 billion in 2022 and USD 54 billion in 2023 because of soaring energy and commodity prices and the resulting increase in imports. Following eased travel restrictions and quarantine measures, international travel is expected to recover, which will widen the country’s service account deficit.

Consumer price inflation will accelerate from 2.5% in 2021 to 4.5% in 2022 and then cool down to 2.9% in 2023. Upward pressures are gathering strength amid supply-side disturbances, which are pushing up prices of natural gas and other commodities, and agricultural produce. Core inflation, which excludes food and energy prices, is projected to increase to 3.2% in 2022 and 2.6% in 2023.

Labor market conditions are improving in 2022, mostly in the service sector such as dining and accommodation. In the manufacturing sector, employment growth is expected to slow due to sluggish exports. The number of the employed people is expected to increase by 580,000 in 2022 compared to a rise of 370,000 in 2021. The unemployment rate is projected to decline to 3.1% in 2022 and 3.5% in 2023.

Going forward, economic policymakers will keep a close watch on risks that may tip the economy into an inflationary recession. While they will continue to focus on effective control of COVID-19 to help the economy emerge from the pandemic, they will be challenged to walk the narrow path between tamping down inflation and making sure that economic recovery does not lose steam.

First, please LoginComment After ~