Global situation of undertakings for collective investment at the end of November 2022

I. Overall situation

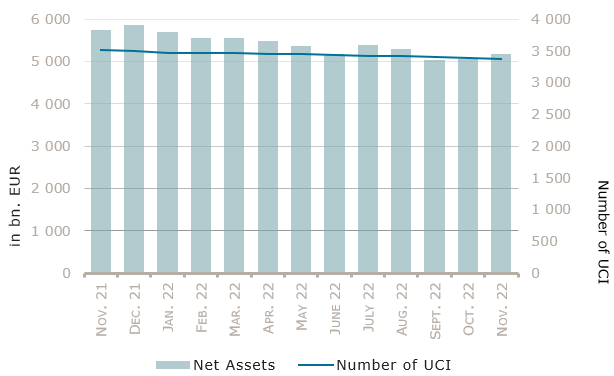

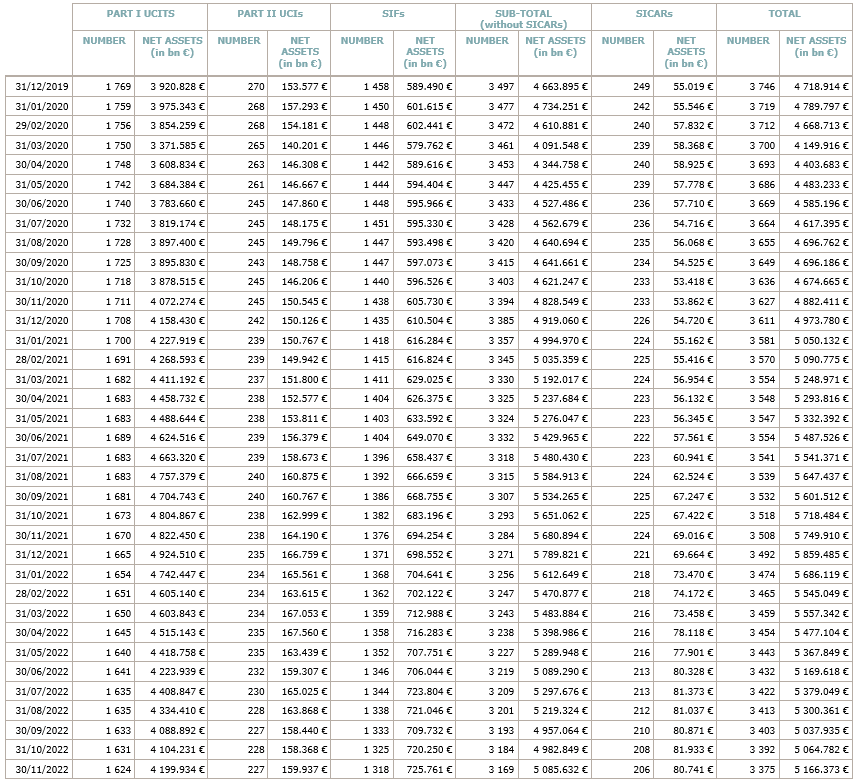

As at 30 November 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,166.373 billion compared to EUR 5,064.782 billion as at 31 October 2022, i.e. an increase of 2.01% over one month. Over the last twelve months, the volume of net assets decreased by 10.15%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 101.591 billion in November. This increase represents the sum of positive net capital investments of EUR 8.074 billion (+0.16%) and of the positive development of financial markets amounting to EUR 93.517 billion (+1.85%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,375, against 3,392 the previous month. A total of 2,204 entities adopted an umbrella structure representing 13,133 sub-funds. Adding the 1,171 entities with a traditional UCI structure to that figure, a total of 14,304 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of November.

Despite a general context marked by the Ukraine crisis, persistent high inflation, recession fears and rising interest rates, most UCI categories delivered positive returns in November. This performance was mainly driven by 1) decreasing inflation in the US and the expectation of decelerating interest rate hikes, 2) softening of the zero-COVID policy in China and 3) global easing of the supply chain bottlenecks.

Concerning developed markets, the European equity UCI category registered a positive performance due to the market perception that inflation was at, or close to, its peak and by slightly improving indicators of economic activity (though still in the recessionary zone). Concerning the US equity UCI category, while the slowdown of the industrial activity was confirmed by new indicators, the US economy remained relatively resilient in terms of retail sales and employment. This relative resilience, together with decelerating inflation, contributed to the positive performance of the US equity UCI category in November (although this performance was partially neutralised by the USD depreciation). The Japanese equity UCI category also finished the month in positive territory, supported by a good season of quarterly earnings fed by the relative weakness of the yen.

Emerging countries outperformed developed markets in November. The rally in Asian equity category was driven by the potential warming of the China-US relationship ahead of the G20 meeting, by the softening of the zero-COVID policy in China and by policy support for the property sector, despite macroeconomic data still being on the downside. The Eastern European equity UCI category realised a negative performance. The Latin American equity UCI category was the worst performing UCI category in November due to declining commodity prices and EUR appreciation mainly.

In November, the equity UCI categories registered overall a negative net capital investment. The Global market equities UCI category recorded the highest outflows (in euros).

Development of equity UCIs during the month of November 2022*

|

Market variation in % |

Net issues in % | |

| Global market equities |

2.39% |

-0.38% |

| European equities |

5.84% |

-0.54% |

| US equities |

0.09% |

-0.48% |

| Japanese equities |

4.78% |

1.82% |

| Eastern European equities |

-3.04% |

-0.66% |

| Asian equities |

11.85% |

-0.75% |

| Latin American equities |

-6.68% |

-0.79% |

| Other equities |

6.52% |

-0.14% |

* Variation in % of Net Assets in EUR as compared to the previous month

In fixed income markets, government bond yields were declining on both sides of the Atlantic and the investor demand for investment grade and High Yield was relatively strong.

The European Central Bank (ECB) interest rates remained at 2% in November (no meeting was planned in November). While some advanced indicators signalled the potential peaking of inflation in the EU, and given the decreasing inflation in the US, markets started to price a potential deceleration of interest rate hikes by the ECB. As a result, yields decreased, i.e. prices rose, in November and the credit spreads narrowed. Overall the EUR denominated bond UCI category realised a positive performance in November.

Given the figures of decreasing inflation published in November and a consecutively softer communication of the Fed paving the way for a slowdown of interest rate rises, the 10-year US government yields decreased by around 40 basis points. The USD denominated bond UCI category recorded a positive performance in November, though moderate due to the depreciation of the USD against the EUR.

The Emerging Market bond UCI category delivered positive returns in November, from both investment grade and high yield bonds, partly due to potential deceleration of interest rate hikes in the US and EU and to the easing of the zero-COVID policy in China.

In November, fixed income UCI categories registered an overall positive net capital investment. The USD money market UCI category recorded the highest inflows (in euros).

Development of fixed income UCIs during the month of November 2022*

|

Market variation in % |

Net issues in % | |

| EUR money market |

0.15% |

5.44% |

| USD money market |

-4.38% |

6.38% |

| Global money market |

-0.37% |

1.39% |

| EUR-denominated bonds |

2.47% |

0.61% |

| USD-denominated bonds |

0.11% |

-1.76% |

| Global market bonds |

1.68% |

0.03% |

| Emerging market bonds |

3.58% |

0.26% |

| High Yield bonds |

0.95% |

-0.92% |

| Others |

1.24% |

-1.80% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2022*

|

Market variation in % |

Net issues in % | |

| Diversified UCIs |

1.59% |

-0.12% |

| Funds of funds |

0.88% |

-0.13% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following four undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- MYINVESTOR FCP, 4, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- DAMAN ENHANCED INCOME FUND S.A. SICAV-SIF, 18, boulevard Royal, L-2449 Luxembourg

- EUROPEAN PROPERTY INVESTORS SPECIAL OPPORTUNITIES 6 SCSP-SICAV-SIF, 4, rue du Fort Wallis, L-2714 Luxembourg

- HENDERSON PARK REAL ESTATE MASTER FUND S.A R.L., SICAF-SIF, 48, rue de Bragance, L-1255 Luxembourg

The following twenty-one undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AIP SICAV, 3, rue Gabriel Lippmann, L-5365 Munsbach

- BPM, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- EUROTAX ALL INVEST, 17, rue de Flaxweiler, L-6776 Grevenmacher

- ISPB LUX SICAV, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SEB TRYGG PENSION, 4, rue Peternelchen, L-2370 Howald

- SP – LUX SICAV II, 49, avenue J-F Kennedy, L-1855 Luxembourg

- UNIINSTITUTIONAL EM CORPORATE BONDS 2022, 3, Heienhaff, L-1736 Senningerberg

- UNIINSTITUTIONAL GLOBAL CORPORATE BONDS 2022, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- TARGET SELECTION, 5, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- AQUANTUM COMMODITY SPREAD FCP-SIF, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ARNICA SICAV-FIS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- FIVE ARROWS CREDIT SOLUTIONS SCA SICAV-SIF, 33, rue Sainte Zithe, L-2763 Luxembourg

- KOBALT MUSIC ROYALTIES SCA SICAV-SIF, 9, rue de Bitbourg, L-1273 Luxembourg

- MUGC/WA U.S. INVESTMENT GRADE CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- OPPENHEIMER RESOURCES SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- PORTUGAL REAL ESTATE OPPORTUNITIES FUND (S.C.A.) SICAV-SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- REM FCP-SIF, 13A, Fausermillen, L-6689 Mertert

- VALIANCE FARMLAND SICAV-FIS, 6, rue Dicks, L-1417 Luxembourg

- ZOBEL SCA SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

SICARs:

- ARCANO SPANISH OPPORTUNITY REAL ESTATE II S.C.A., SICAR, 11-13, boulevard de la Foire, L-1528 Luxembourg

- ARCANO SPANISH OPPORTUNITY REAL ESTATE S.C.A., SICAR, 11-13, boulevard de la Foire, L-1528 Luxembourg

First, please LoginComment After ~