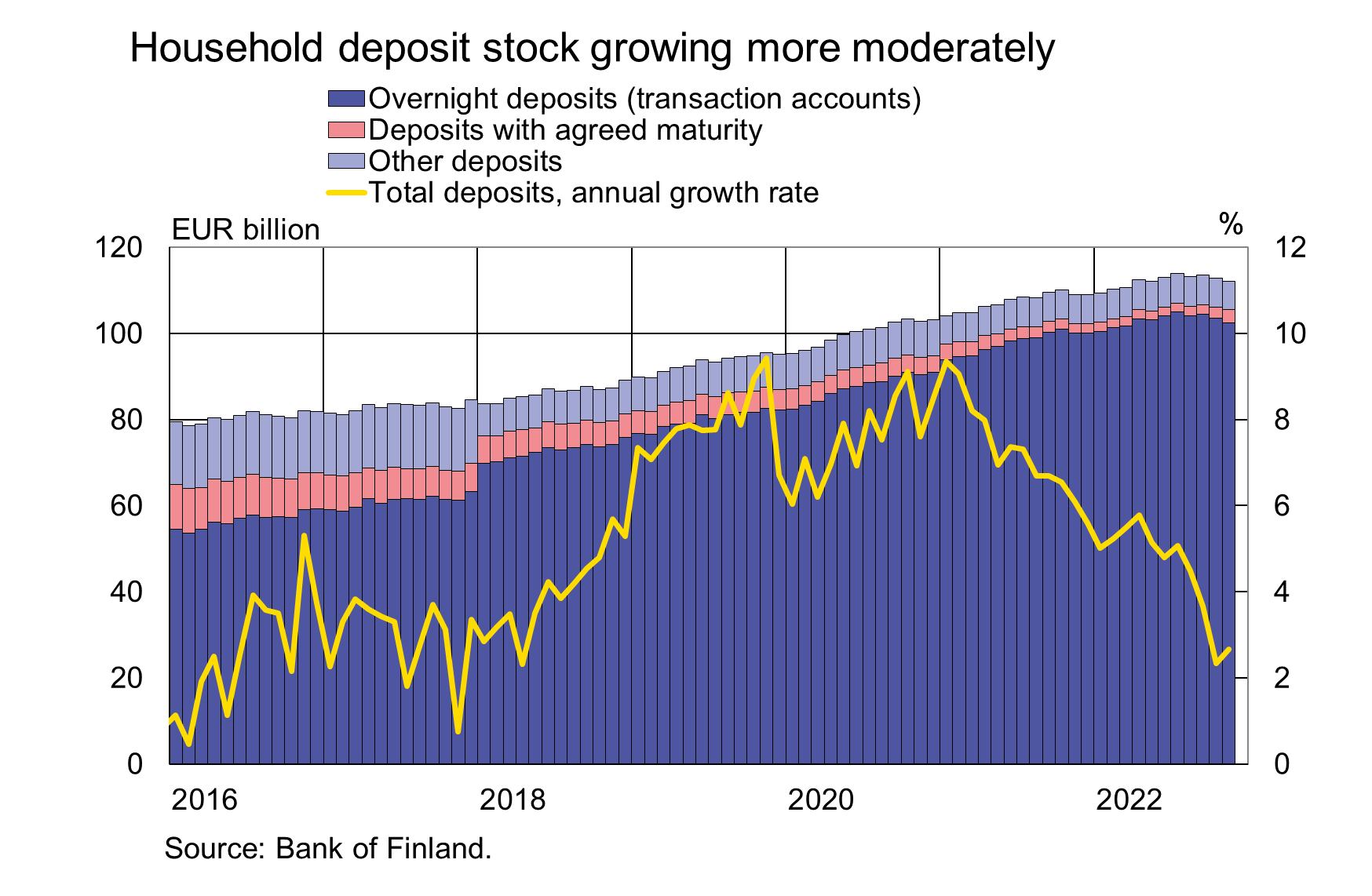

Funds held in transaction accounts decreasing – popularity of deposits with agreed maturity increasing

At the end of November 2022, the stock of household deposits totalled EUR 112.0 billion, the lowest level since March 2022. Most of the funds held in deposit accounts were in transaction accounts (EUR 102.5 billion). Funds held in transaction accounts decreased in November by EUR 1.0 billion. The popularity of deposits with agreed maturity has increased in response to rising interest rates. The November inflow[1] into deposits with agreed maturity totalled EUR 500 million. At the end of November, the stock of household deposits with agreed maturity stood at EUR 3.1 billion and the stock of other deposits, EUR 6.4 billion.

The annual growth rate of the household deposit stock was 2.7% in November 2022. Year-on-year, the growth rate moderated notably. Month-on-month, however, the growth rate picked up slightly, reflecting the growth of deposits with agreed maturity. In November households made new agreements on deposits with agreed maturity to a total of EUR 647 million, an increase of EUR 596 million on November 2021.

The interest rate on transaction accounts rose to 0.13%, while the interest on deposits with agreed maturity reached 1.23%. The share of deposits with an agreed maturity of up to 1 year in the stock of agreed maturity deposits has increased. The interest rate paid on deposits of up to 1 year was higher in November (1.44%) than the interest on longer deposits (1.10%). The lower interest on the latter reflects deposits for first home purchase (ASP deposits), as these are included in deposits with an agreed maturity of over 1 year. The interest paid by banks on ASP deposits is 1%.

Loans

Finnish households drew down new housing loans in November 2022 to a total of EUR 1.2 billion, a decline of EUR 750 million year-on-year. Of the total, investment property loans accounted for EUR 80 million. The average interest rate on new housing loans rose from October, to 3.18%. At the end of November 2022, the stock of housing loans stood at EUR 107.7 billion, and the annual growth rate of the loan stock was 1.3%. Investment property loans accounted for EUR 8.8 billion of the housing loan stock. At end-November 2022, the stock of loans to Finnish households comprised EUR 17.0 billion in consumer credit and EUR 18.0 billion in other loans.

Finnish non-financial corporations drew down new loans in November in the amount of EUR 2.4 billion, of which loans to housing corporations accounted for EUR 570 million. The average interest rate on the new loans rose from October, to 3.61%. At the end of November 2022, the stock of loans to Finnish non-financial corporations stood at EUR 106.5 billion. Of this, loans to housing corporations amounted to EUR 42.3 billion.

Deposits

The aggregate stock of Finnish households’ deposits at end-November 2022 totalled EUR 112.0 billion. The average interest rate on the deposits was 0.15%. Overnight deposits accounted for EUR 102.5 billion and deposits with agreed maturity for EUR 3.1 billion of the deposit stock. In November, households made EUR 650 million of new agreements on deposits with agreed maturity, at an average interest rate of 1.65%.

| Loans and deposits to Finland, preliminary data | |||||

| September, EUR million | October, EUR million | November, EUR million | November, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 142,969 | 142,875 | 142,778 | 1,2 | 2,33 |

| - of which housing loans | 107,671 | 107,663 | 107,717 | 1,0 | 1,77 |

| - of which buy-to-let mortgages | 8,810 | 8,791 | 8,776 | 1,87 | |

| Loans to non-financial corporations2, stock | 106,001 | 106,653 | 106,539 | 10,0 | 2,24 |

| Deposits by households, stock | 113,558 | 112,789 | 112,031 | 2,7 | 0,15 |

| Households' new drawdowns of housing loans | 1,582 | 1,265 | 1,180 | 3,18 | |

| - of which buy-to-let mortgages | 127 | 91 | 84 | 3,43 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

First, please LoginComment After ~