Investment funds: liquidity management tools in practice

By using such new liquidity tools, German asset managers have more flexibility for responding to liquidity problems faced by open-ended funds. The tools can be used to prevent a potentially imminent suspension of the redemption of fund units (see info box).

At a glanceLMTs in the German Investment Code (Kapitalanlagegesetzbuch – KAGB)

Since the spring of 2020, German asset managers have had the option to implement LMTs such as notice periods. This means that investors are required to make their redemption request some time before the units are actually to be redeemed.

Another option involves redemption gates, which set limits in respect of redemption requests per redemption date once a certain threshold has been reached. If investors’ redemption requests exceed a specified threshold, the asset manager can decide not to fulfil the requests in full.

The third tool, swing pricing, involves passing on the transaction costs associated with the redemption or subscription of units to those who have caused the costs. These costs can be taken into account in the calculation of the net asset value of a fund.

BaFin conducted a survey on the German market in the early summer of 2022, seeking to obtain an initial overview of the current status of LMT implementation (see info box).

At a glanceScope of the survey

BaFin’s survey addressed all 53 authorised German asset managers and EU management companies that had set up open-ended German funds as of 31 May 2022. The survey thus covered about 5,600 funds with a total volume of 2.3 trillion euros. Real estate funds were not taken into account at that time.

The key aim of the survey was to find out which LMTs had been implemented by the asset managers and for which funds, and to ascertain the reasons why certain LMTs had not (yet) been implemented.

BaFin also collected data on certain features of the funds – e.g. whether a particular fund was a retail fund, i.e. available for purchase by retail investors, or a special fund intended for professional and semi-professional investors only, or how the respective fund was to be categorised (equity fund, bond fund, mixed securities fund, etc.).

Results

The overall findings show that the majority of German asset managers had not implemented any new LMTs by the survey reference date 31 May 2022. Some of the participating asset managers attributed this to the fact that the related processes were still in the implementation phase. According to the information provided by other participants, certain funds did not require any additional LMTs for the purposes of liquidity management.

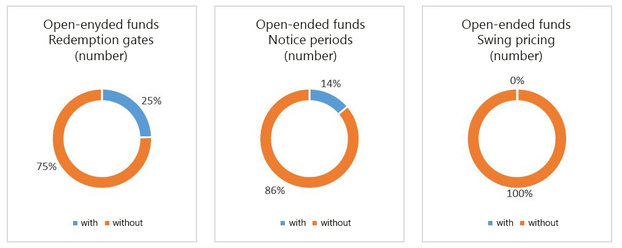

Overall, it was found that the participating asset managers had most often implemented redemption gates. Almost 25 percent of the funds surveyed had already set up this instrument. In terms of fund volume, such funds still accounted for 15.2 percent. In addition, as of the reference date of the survey, some firms were still in the phase of implementing this instrument.

At present, notice periods are in place in about 14 percent of all the funds. In terms of volume, this corresponds to 17.5 percent, which is chiefly explained by the high proportion of large-volume special funds.

Swing pricing is currently only implemented to a very limited extent (under 1 percent of the funds and the fund volume). At the time of the survey, however, some of the participating firms were still considering whether to implement this tool.

It should also be noted that the implementation status often depends less on individual funds or categories of funds than on the asset manager itself. Once processes have been set up for LMTs, the use of these tools within the asset manager increases significantly. This means that once the technical implementation is complete, asset managers are more willing to provide for LMTs in the fund rules.

Figure 1: Use of liquidity management tools in open-ended funds

The survey results show that the observations regarding the use of LMTs based on the analysis of the number of funds are similar to the observations based on the analysis of the volumes of funds. For this reason, the following analysis only addresses the number of funds.

However, the picture becomes very different if, instead of open-ended funds as a whole, retail funds and special funds are analysed as separate categories. This is due to the differences in investor structure. Retail funds typically involve investment on the part of many private investors; in contrast, usually only a few institutional investors invest in special funds – and there is often only one.

Retail funds

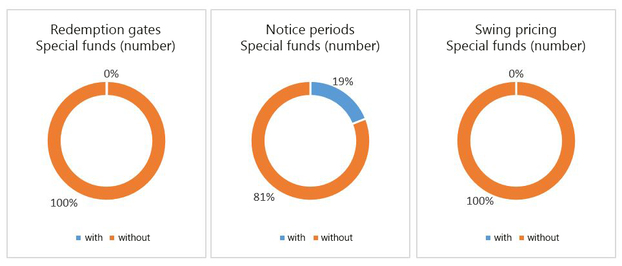

Retail funds primarily make use of the instrument of redemption gates. Since German asset managers have the option to spread out larger redemption amounts over a longer period of time, they consider the buffer available to be sufficient for creating the necessary liquidity in case of need. Many asset managers consider redemption gates in the area of retail funds to be sufficient for the time being; they are not planning to make use of any other new tools. Notice periods are thus being set up in significantly fewer cases, and swing pricing is also rarely implemented (also under 1 percent).

Figure 2: Use of liquidity management tools in retail funds

On examination, the different types of funds categorised as retail funds do not show any special, discernible pattern. Fund categories involving less liquid securities do not provide for redemption gates more often than very liquid types such as equity funds.

A special case of retail funds is that of exchange-traded funds (ETFs). The implementation of LMTs is currently not intended for ETFs, since fund units are generally sold via the stock exchange. Consequently, reallocations within the portfolio and thus liquidity measures are unnecessary.

Special funds

Special funds within the open-ended category hardly make any use of redemption gates or swing pricing. For these funds, the asset managers surveyed consider a sudden large-scale withdrawal to be highly unlikely, particularly because there is often only one investor involved, and this one investor would have to bear the associated losses in value alone. There are thus no first-mover advantage problems occurring in this context. Instead, asset managers in the special fund segment prefer to use notice periods that take into account the liquidity of the assets in the fund. A separate analysis of single-investor special funds did not yield any findings that were fundamentally different to those regarding the use of LMTs for special funds overall.

Figure 3: Use of liquidity management tools for special funds

Outlook

At present, German asset managers have implemented LMTs for retail funds predominantly in the form of redemption gates; in the case of special funds, the LMTs primarily implemented are notice periods. Asset managers are continuing to examine which tools are most appropriate for which funds. BaFin will be actively monitoring the ongoing developments – also in dialogue with the asset managers – and conducting additional surveys.

Author

Dr Ines Seibel, Cajus Beyer, André Wetzel

Division WA 51 Policy Issues and Open-Ended Funds and WA 54 Securities Supervision/Asset Management Open-Ended Funds

First, please LoginComment After ~