Navigating the Global Transition

Good afternoon, GIC Board Directors, honoured guests, ladies and gentlemen. A very warm welcome to GIC Insights. Thank you for joining us.

We organise this forum to share insights and show our appreciation. Most of you already collaborate very closely with GIC. For that, we thank you.

With that, let’s review the theme of the forum, “Navigating the Global Transition”. This afternoon, we look at three fundamental transitions: macro, digital, and sustainability.

For all these developments, GIC has more questions than answers. Geopolitics, for example, presents a complex set of issues. We think about it as comprising two parts: chronic and acute challenges.

- Chronic issues, such as gradual tit-for-tats, are quite difficult to deal with but manageable.

- Acute problems, including sudden military incidents like the war in Ukraine, are impossible to predict with confidence. For investors, this is made more challenging as we need to find the right investment instruments and transact at the right prices.

We may not even have the right questions. So, to help us, we have assembled a whole host of expert panellists and speakers. I thank them for their help.

We also want to get to solutions and actions. That’s why we partnered FCLTGlobal, a long-standing champion of long-term investing, which GIC has long been associated with, to bring their C-suite roundtable discussions here. You will have the opportunity – and task – to tackle the issue of “balancing resilience with agility”. After the discussions, we will develop a toolkit to help turn your insights into actions and improve our organisations for the future.

Let me now share my thoughts on the three transitions – macro, digital, and sustainability – and the key questions I hope we can tackle today.

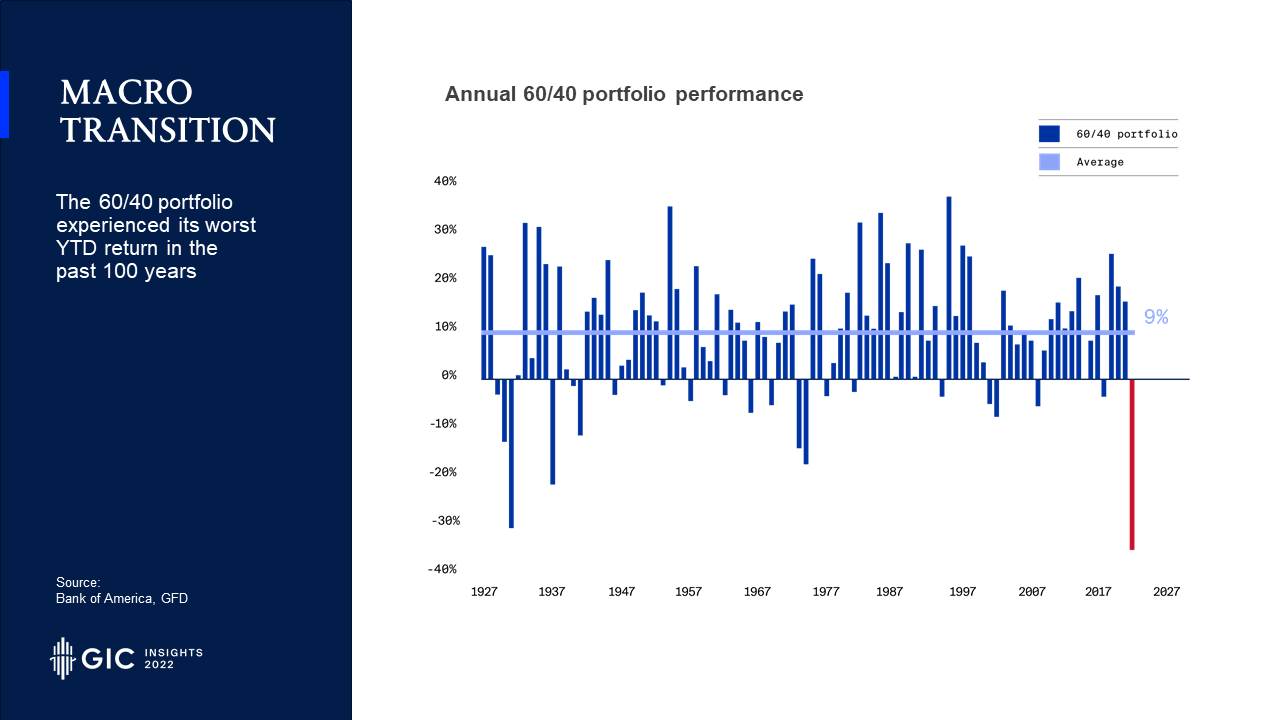

Firstly, the macro transition.

Let’s use the 60/40 portfolio to illustrate the issue. The 60/40 portfolio has become a popular, standard asset mix over the past four decades. No one seems to remember its origin. It is popular primarily because it has delivered good returns over long periods of time. That changed this year.

- Our Bridgewater friends would say the correlation jump was incidental, which we agree with. The more fundamental drivers are the higher discount rates and the expectation of a poorer growth/inflation mix – the much dreaded “stagflation”.

- A key macro variable is interest rates. Will we go back to a zero-interest world, which seemed to have sustained a lot of businesses? Beyond the current overheating in the economy, deglobalisation and decarbonisation trends are pointing to a more inflationary world ahead of us. Yet a return to the ‘70s seems too pessimistic, or at least we are hopeful that central banks will remain determined to anchor long-term inflation psychology.

- This leaves us with several questions:

- What’s the growth-inflation mix we are likely to see in the coming years?

- Have we truly left the world of “lower for longer”?

- Should we be concerned about financial stability?

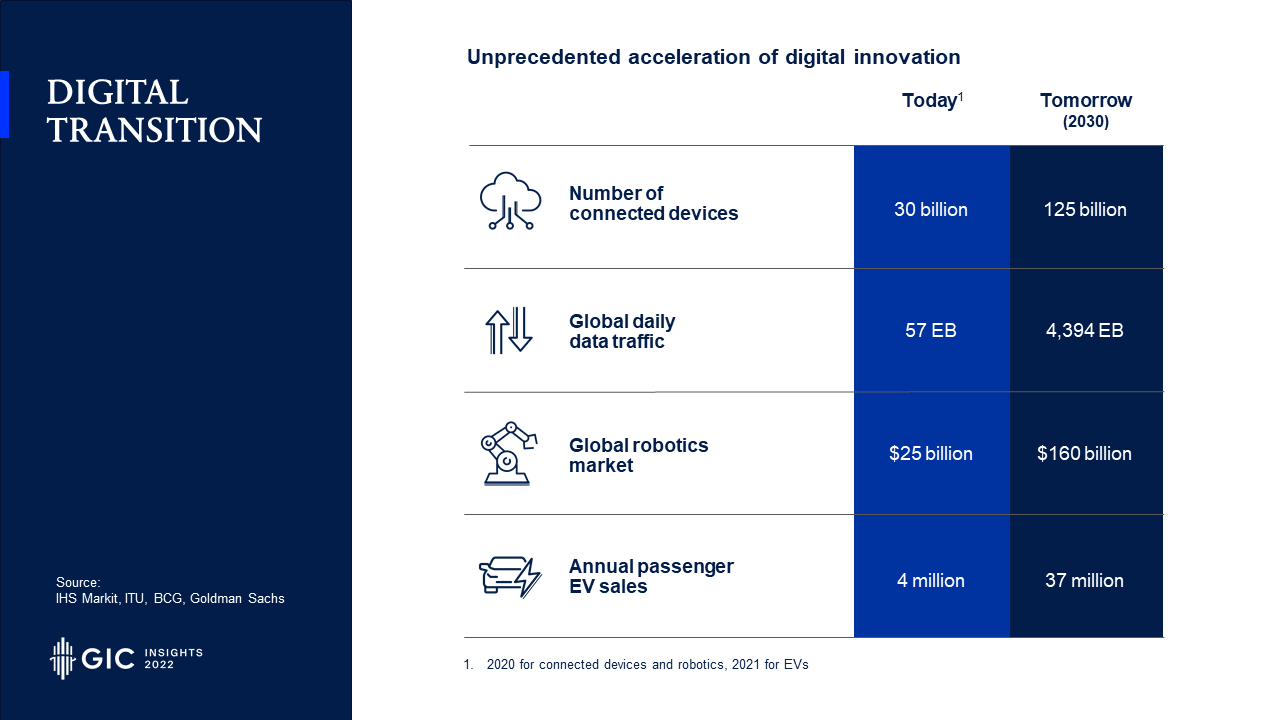

The second transition is digital.

- The end of cheap capital has decimated the fringes of the tech industry. The loss-making tech complex is down an astonishing 70-80% year to date .

- If you assume that the complex has an interest rate duration of approximately 30 years, that magnitude is about right. A 2.5% change in interest rate multiplied by 30 years is about 75%.

- Scarcity of capital is a huge challenge, particularly, for early-stage companies. As top-line difficulties are likely to play out, cost discipline and balance sheet strength are critical for survival now. Investors are hopeful of more rational competition and less wasteful spending. Having the financial strength and playing the long game will likely offer a huge competitive advantage as the weaker ones falter. That's the lesson from history.

- History also teaches us that we should not throw the baby out with the bath water. Digital innovation continues to scale and impact the real economy.

- For investors, the tech sector offers a unique value proposition in the form of platform companies with vast total addressable market and networks. Their scale and scope are a great advantage, because revenues can scale without additional new dollars being invested, resulting in tremendous capital efficiency.

- But such a tech advantage has also produced more negative externalities. Issues related to data privacy, increasing digital divide, the risk of monopoly power, cyber risk, supply chain dependency, and ethics are becoming more and more critical.

- Against this backdrop, we must ask:

- How should tech companies deal with scarcity of capital?

- Which tech trends deserve the most investor attention?

- What should our expectations of regulation be given the list of negative externalities?

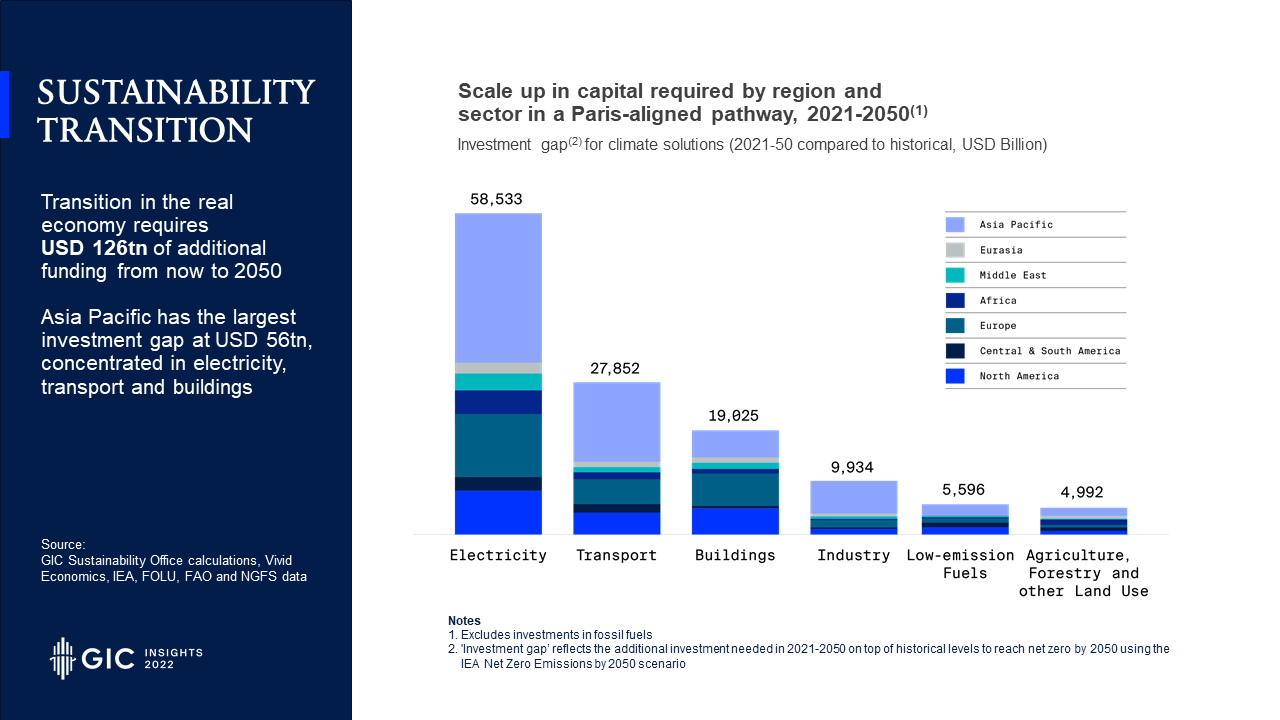

Thirdly, the sustainability transition.

- The role of climate finance was front and centre at COP27. Based on the IEA’s “Net Zero Emissions by 2050” scenario, transition in the real economy will require an additional US$126 trillion from now until 2050, and almost half of this money is needed in Asia-Pacific.

- These significant financing requirements also offer potentially big opportunities for investors. Importantly, they are also a must-do, given the severe negative return consequences of a transition failure.

- GIC looks at the task by first dividing the investment universe into three categories.

- Using the MSCI ACWI Index as a reference point, high-emitting assets in sectors such as electricity, transport, and buildings make up about 10% of market cap, but account for 40% of Scope 1 and 2 emissions, so their transition will make a huge difference. Equally, companies in this space that are not able or willing to make this transition will become stranded.

- At the other end of the spectrum are green assets deriving a high percentage of their revenues from green activities such as renewable energy and other decarbonisation solutions. GIC has been quite active in investing in this area, but as you can see from the Index proxy, these assets only make up a small part of the investment universe. We need to help to grow this. GIC would like to play a role in developing the ecosystem, including the off-take market and creating customer demand for climate solutions such as green hydrogen.

- The in-between segment is the largest, making up almost 85% of the index. They have a lower emission intensity compared to high-emitting assets, but they also need to transition urgently.

- GIC has engaged with a number of these companies. For example, through an industry engagement programme (AIGCC’s Asia Utilities Engagement Program), we worked with a Hong Kong utility to set targets to phase out coal by 2040 and reach net zero by 2050. I had previously reported that we had provided US$2bn in transition finance to Duke Energy Indiana in the US. We also invested in a Korea-based chemical company to help it replace oil-based plastics with renewable raw materials, switch to renewable energy for its operations and introduce CCU (carbon capture and usage) by 2050. We have since expanded our investments to its battery subsidiary.

- Making these investments bankable is not easy. In an ideal situation, cost-competitive new technologies or innovative business models allow for cost-effective and scalable solutions. More likely, there would be additional costs to be borne among governments, customers, existing shareholders and perhaps, if possible, multilateral organisations or philanthropic funds. Not all can afford it. We were looking closely at the US Inflation Reduction Act and that is a good example of government support with a comprehensive set of incentives. But not all governments can afford to implement those kinds of programmes.

- Most sustainability goals can be captured under the “iron triangle” of sustainability, security and affordability. Achieving each goal is difficult on its own; achieving all three is much more challenging. The current energy crisis is a case in point.

- Some questions for this transition include:

- How can we scale transition finance, especially in emerging markets where it is most needed?

- How can investors help develop the off-take market?

- Which new technologies are most promising?

Conclusion

Years of easy money need to be repaid. Years of digital splurge need to be rationalised. Years – in fact decades and centuries – of emissions need to be accounted for.

We need to navigate these transitions well. Let’s hear from the panels on how we can do so.

I wish you a good Insights.

First, please LoginComment After ~