GBA – Survey Shows Delayed Boost from Policy Pivot

Please click to read the full report.

Accelerated reopening has to matter, right?

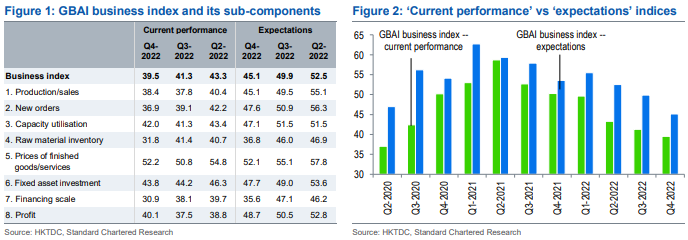

Our GBA Business Confidence Index (GBAI), based on quarterly surveys of over 1,000 companies operating in the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) and conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that the current performance of ‘business confidence’ weakened for a sixth straight quarter in Q4, dipping below 40 for the first time in 10 quarters to 39.5 from 41.3 in Q3 (Figures 1 and 2). Destocking and reduced financing appetite were the main drags, matching the broad-based softness in recent macro data. Furthermore, the expectations indices have yet to fully capture China’s recent COVID relaxation efforts, which only started halfway through the survey period; any boost from rising reopening hopes were also quickly overshadowed by the onset of the first COVID exit wave. However, this also means plenty of room for GBA sentiment to play catch-up in H1-2023, assuming the impact of future COVID waves will diminish over time. Meanwhile, we take comfort from the fact that monetary conditions remain accommodative; borrowing costs are expected to fall further in the coming quarter, while respondents' cash flow positions are also set to improve.

‘Manufacturing and trading’ saw the worst expectations reading among industries; retailers and tech respondents, in contrast, improved q/q – a sign of policy support quietly seeping through. By city, Hong Kong outperformed again by having the highest expectations print, benefitting from improved hopes of border reopening with the mainland; Guangzhou, on the other hand, saw extensive COVID disruptions hurting respondents’ sentiment. Our thematic questions dug deeper into how policy and market expectations have changed following the 20th Party Congress and the COVID policy pivot.

First, please LoginComment After ~