Focusing on China's Domestic Demand and Tapping Greater Bay Area Market Opportunities

This article forms part of a joint study conducted by Hong Kong Export Credit Insurance Corporation and HKTDC:

Focusing on the Mainland’s Domestic Demand

Hong Kong is a powerful trading hub connecting the mainland and international markets and an important platform for mainland consumers to get overseas products. It is also a distribution centre for industrial materials imported into China. As it is close to Guangdong, many mainland enterprises, especially those in the GBA, have set up offices in Hong Kong to handle foreign trade and import consumer goods and industrial materials into Guangdong and beyond.

The 14th Five‑Year Plan (2021–2025) proposes that China will boost domestic demand, expedite the establishment of a complete demand system, strengthen demand‑side management, and build a robust domestic market. The intention is to organically combine expanding domestic demand with deeper supply‑side structural reform to implement a new development paradigm with domestic circulation as the mainstay and domestic and international circulation complementing each other. The mainland plans to use its huge market to create a new growth model. The central government has been offering tax concessions and refunds along with tax and fee payment deferrals in recent months. It is also encouraging consumption and trying to minimise the burdens on businesses while further expanding domestic demand.

In Guangdong, the provincial government has moved to reduce fees and taxes and introduced support schemes to expedite economic recovery. A raft of relief measures was introduced in early 2022 to help struggling industries quickly recover and resume development. These include 47 specific policies and measures to lower operating costs for companies, improve the business environment and support the services sector. [1] Subsequently, in the Circular on the Issuance of Guangdong’s Implementation Plan for Implementing the Package of Policies and Measures of the State Council to Firmly Stabilise the Economy (Yue Fu No. 51 [2022]) issued on 31 May, it introduced 131 implementation measures. These included a number of fiscal and monetary policies as well as 25 policies to stabilise investment and promote consumption, in the hope of boosting domestic demand and expediting economic recovery in the post‑Covid era.

Under the Outline Development Plan, Guangdong, Hong Kong and Macao have made a joint effort to improve the business environment in the GBA, including the implementation of facilitation measures for cross‑border trade. Against this backdrop, more and more Hong Kong businesses have turned their eyes to the GBA. For example, Hong Kong companies may now directly apply to establish Hong Kong‑invested enterprises in Guangdong through representative offices of mainland departments “without setting foot outside of Hong Kong”. [2] The authorities have also streamlined procedures and reduced the time taken for approvals. On the other hand, Hong Kong people working in GBA cities enjoy a preferential individual income tax policy.

Under this policy, the individual income tax payable by overseas high‑end and urgently‑needed talent in excess of 15% of their taxable income may be subsidised by the people’s government of the nine mainland GBA cities. [3] Many Hong Kong firms are therefore closely following the latest post‑Covid developments in the GBA and taking advantage of the facilitation measures offered to set up business in the region.

Hong Kong Companies Develop Domestic Sales in the GBA

The mainland government has done much in recent years to encourage imports to satisfy the huge demand from consumers as well as industrial and commercial sectors for imported goods. In 2021, the mainland’s total imports exceeded US$2.6 trillion, of which US$497.7 billion was imported into Guangdong. [4] Indeed, Guangdong is an important window for the mainland’s foreign trade and economic co‑operation. The government has established the Guangdong Pilot Free Trade Zone, including free trade areas in Qianhai‑Shekou and Hengqin which have close ties with Hong Kong and Macao. It has also made efforts to streamline trade and customs clearance measures in order to improve the business environment. There are comprehensive bonded zones in places like Guangzhou, Dongguan and Shenzhen, and pilot zones to facilitate cross‑border e‑commerce have been set up in many places, including mainland GBA cities like Zhongshan, Jiangmen and Zhaoqing. [5] These measures will help Hong Kong and other overseas foreign trade enterprises to open up the GBA domestic sales market through these Guangdong channels.

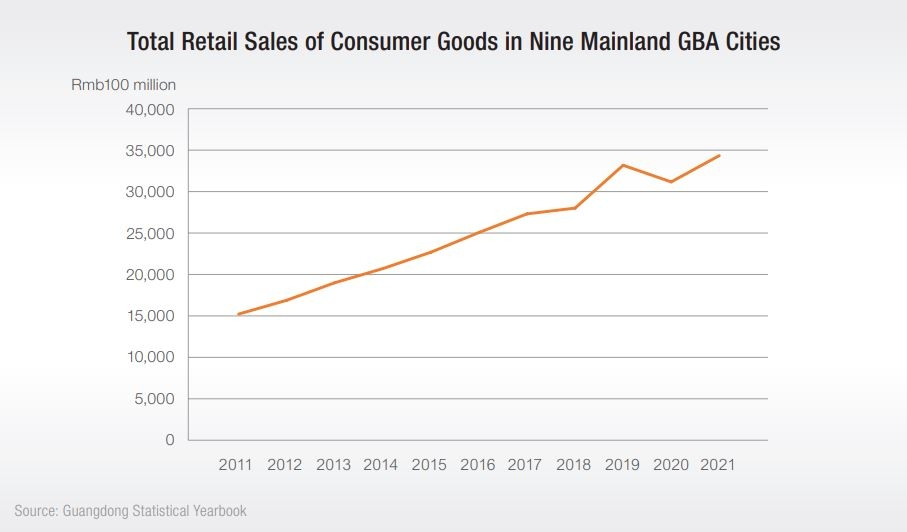

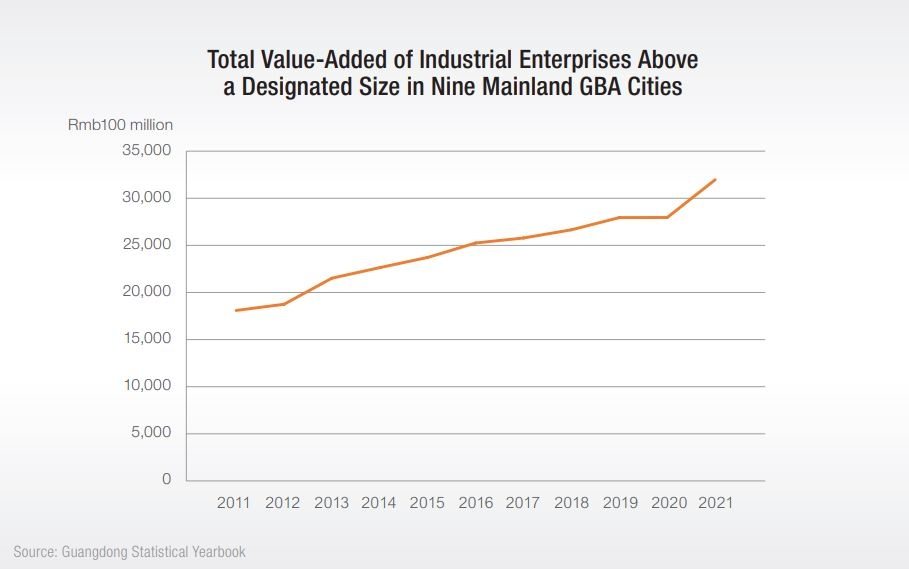

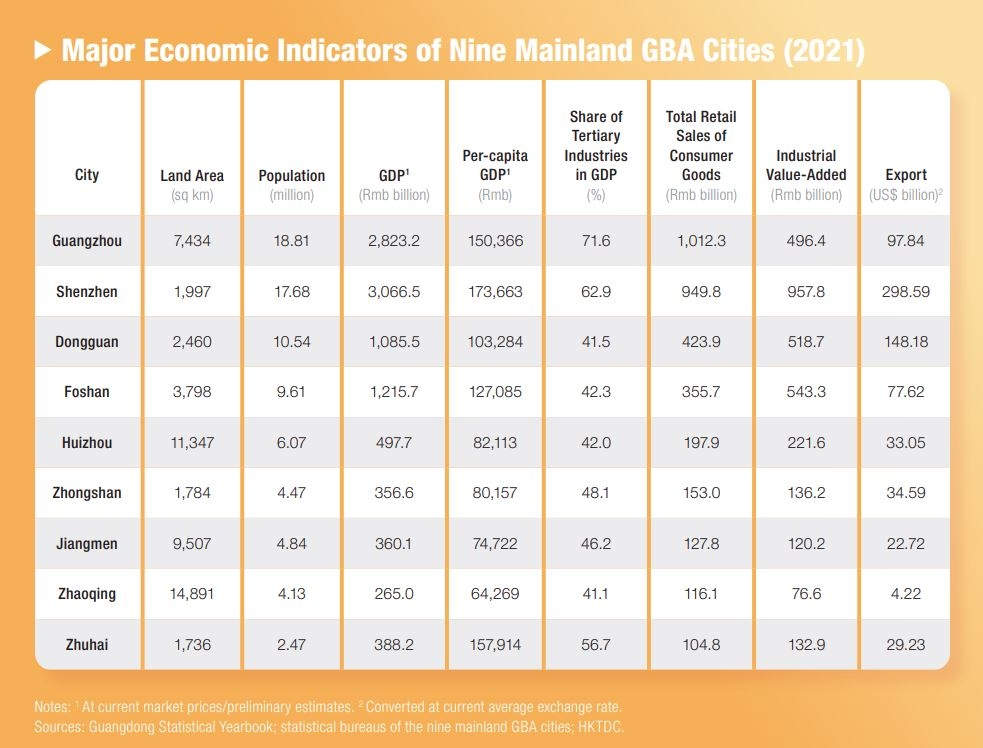

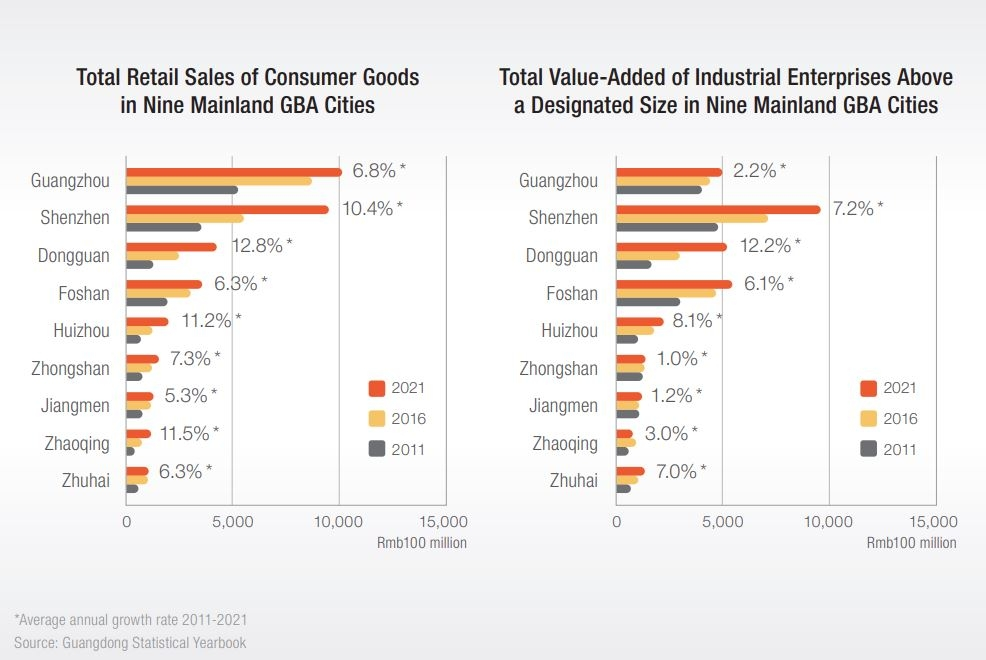

Consumer and manufacturing activities are rapidly expanding throughout Guangdong, including the nine mainland GBA cities. Between 2011 and 2021, total retail sales of consumer goods in these nine cities increased at an average annual rate of 8.6% from Rmb1.5 trillion to Rmb3.4 trillion. The total value‑added of industrial enterprises above a designated size also grew by an average of 5.9% annually from Rmb1.8 trillion to Rmb3.2 trillion.6 The steady growth of consumption and industrial production provides ample market opportunities for Hong Kong businesses. Given that Hong Kong is geographically close to Guangdong and understands the consumer culture and business environment of the province, Hong Kong companies can use Guangdong’s marketing channels to expand their business first to the GBA and then to other regions to exploit business opportunities throughout the mainland.

Results of a survey conducted by HKTDC Research before the pandemic [7] show that as the economies of the nine mainland GBA cities have continued to expand, consumer confidence has remained at a high level. Over 80% of respondents in the survey indicated that their daily expenditure had increased when compared with three years ago while most of them expected their expenditure to rise in the next three years. Although consumer demand has been impacted by the fluctuating pandemic conditions, the consumer market in the GBA should continue to expand after the situation stabilises thanks to government measures to stimulate the economy.

Furthermore, Hong Kong companies enjoy considerable advantages in the GBA. The abovementioned HKTDC Research survey indicated that over 50% of mainland consumers regard Hong Kong as the most international city in the GBA, far more than those who opted for Shenzhen and Guangzhou. The respondents also generally regarded Hong Kong as a shopping haven in the GBA. [8] Obviously, Hong Kong companies are more readily accepted by consumers in the GBA because they have a good reputation not just in promoting own‑brand products but also in introducing foreign brands.

Industrial production and exports in the nine mainland GBA cities have also been expanding, with the total value‑added of industrial enterprises above a designated size reaching Rmb3.2 trillion. Exports soared to US$746 billion in 2021. Bustling industrial activities in the nine cities have created a keen demand for all kinds of industrial materials to support the massive production and export business. Hong Kong has always been a trading hub for the shipment of industrial materials to the mainland and other Asian destinations. Closeness to the major industrial production centres in the Pearl River Delta also makes the GBA a convenient access point for Hong Kong companies to enter the mainland market.

Assessing Regional Market Differences

All the nine mainland cities of the GBA, including the more central cities of Guangzhou, Shenzhen and Dongguan, as well as other second‑tier cities, have seen their consumer market and industrial production activities expand in recent years. Despite this, Hong Kong companies exploring opportunities in the GBA still need to take into consideration the disparities in the development of different cities. For example, Guangzhou as the provincial capital of Guangdong has the biggest consumer market while Shenzhen has big industrial clusters which have registered rapid growth in the past decade. Dongguan and Foshan are not far behind. The consumer and industrial markets are relatively small in cities like Huizhou and Zhongshan, but these markets are also less competitive. Although Zhuhai is relatively small in size and has a small population, its Hengqin new area of the Guangdong Free Trade Zone is eligible for the facilitation measures of the free trade zone. Hong Kong companies should familiarise themselves with the territory and select suitable cities as an access point into the domestic sales market of the GBA based on their market development strategy.

Hong Kong manufacturers and traders have mostly focused on overseas markets in the past decades. Although many Hong Kong companies have experience in mainland trade, they often simply import foreign raw materials and industrial items to the mainland for processing production and then export them to international markets such as Europe and the US. Hong Kong companies lack mainland marketing channels for the development of domestic sales. Small and medium‑sized enterprises, in particular, rarely have their own sales offices or sales networks on the mainland though they may produce or procure goods in Guangdong and other places.

Unlike Hong Kong and elsewhere, new marketing channels such as online shopping and social media are popular on the mainland. The mainland business system is also quite different. Hong Kong companies therefore face different business environments and need to take additional measures to manage risk when developing sales in the GBA and on the mainland. Many Hong Kong companies are trying to adjust their commercial development model to better address markets in the GBA. These companies need appropriate services support to exploit GBA market opportunities and respond to the challenges of a fluctuating epidemic situation and an unpredictable environment for business.

[1] Source: Circular of the General Office of the Guangdong Provincial People’s Government on the Issuance of Several Measures of Guangdong Province to Promote the Development of Hard‑Hit Service Industries (Yue Ban Han No. 40 [2022])

[2] The former Guangdong Provincial Administration for Industry and Commerce jointly launched with the Bank of China (Hong Kong) (BOCHK) and the BOC Guangdong Branch the “Guangdong‑Hong Kong Business Registration and Banking Services Connect”. Individuals or business investors in Hong Kong may apply for the establishment of foreign‑invested enterprises in Guangdong by submitting application forms and supporting documents to BOCHK. Eligible regions include Dongguan, Huizhou, Jiangmen, Zhongshan, Foshan and Shantou. Hong Kong investors may also make use of the “Easy Connect, Easy Registration” service launched by the Shenzhen Municipal Administration for Market Regulation in collaboration with BOCHK, Chong Hing Bank, China Merchants Bank and Industrial and Commercial Bank of China to apply for the establishment of Hong Kong‑invested enterprises in the Qianhai and Shekou free trade areas in Shenzhen through branches of the participating banks. These banking branches can assist them in applying for business licences, opening basic accounts, capital verification, engraving official seals and other services. The Qianhai Authority has also joined with the Shenzhen Municipal Administration for Market Regulation and Qianhai Tax Service in launching the Qianhai e‑Services Hong Kong‑Macao Station to provide free one‑stop services online to people in Hong Kong and Macao in matters such as business registration and taxes.

[3] Source: Circular of the Guangdong Provincial Department of Finance, Department of Science and Technology, Department of Human Resources and Social Security, State Administration of Taxation and Guangdong Provincial Tax Service on Continuing to Implement the Preferential Individual Income Tax Policy for the Greater Bay Area (Yue Cai Shui No. 29 [2020])

[4] Source: General Administration of Customs of the People’s Republic of China

[5] For further information, see Guangdong Announces Implementation Plans for Seven Cross-Border E-Commerce Comprehensive Pilot Zones.

[6] Source: Guangdong Statistical Yearbook

[7] The survey was released in March 2020. For details, see The Mainland Cities of the Greater Bay Area (1): Consumer Confidence and Wealth Management Arrangements.

[8] In that survey, 51% of respondents regarded Hong Kong as the most international city in the GBA, far higher than the 22% who opted for Shenzhen or the 19% who chose Guangzhou. 56% of respondents labelled Hong Kong the GBA’s shopping haven, again surpassing the numbers for Guangzhou (18%), Shenzhen (12%) and Macao (12%). For further information, see The Mainland Cities of the Greater Bay Area (5): The Advantages of Hong Kong’s Retail Sector.

First, please LoginComment After ~