Survey on Greater Bay Area Market Development of Hong Kong Companies: Advantages, Challenges and Service Needs

- Hong Kong's advantages and challenges

Most respondents believe that Hong Kong has certain advantages that will help them develop domestic markets in the GBA. A large proportion believe that Hong Kong brands, Hong Kong products, and those sold through Hong Kong agents enjoy a good reputation on the mainland (48.4%). Hong Kong is also good at bringing in quality and trendy products from overseas to meet the demands of the mainland market (43.3%). Hong Kong has a good knowledge of the market development of the GBA/Guangdong Province and can cater to their market demands (34.4%) and goods produced by or sold through Hong Kong companies as agents are more competitive on design (33.4%). Other advantages include Hong Kong’s status as a convenient service platform for the mainland to purchase overseas products (30.3%) and the price competitiveness of goods produced by or sold through Hong Kong companies as agents (26.6%).

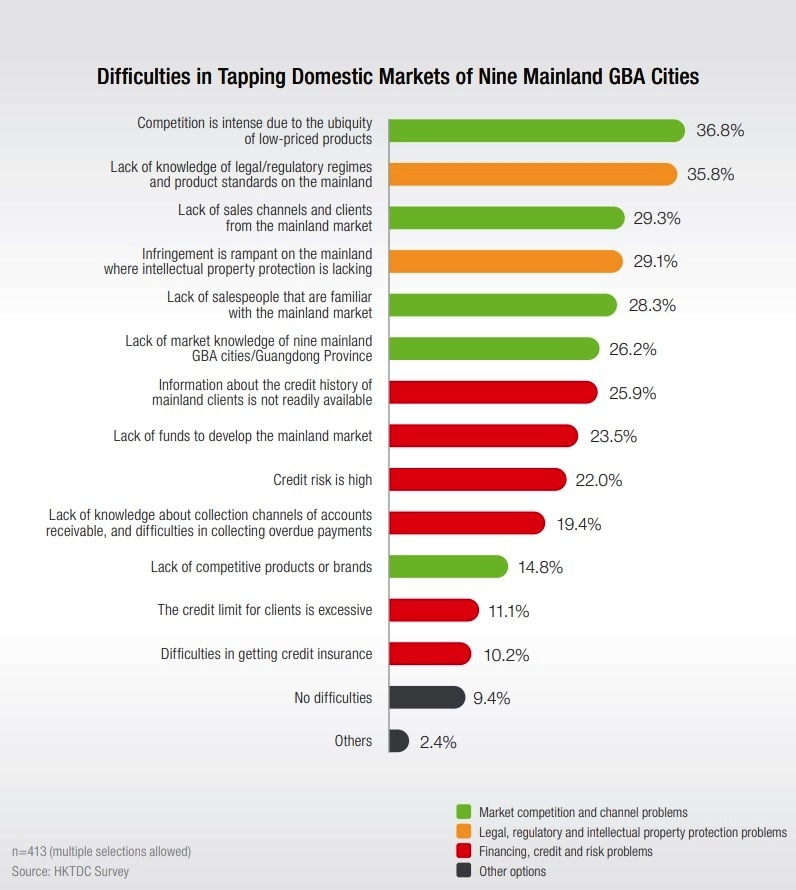

However, many respondents also said they have encountered difficulties and challenges in developing domestic markets in the GBA. Competition is intense on the mainland because it is full of low-priced products according to 36.8% of respondents, and 35.8% said that they have a lack of knowledge of the legal/regulatory regimes and product standards on the mainland. Furthermore, 29.3% believe there are insufficient sales channels and clients in the mainland market and 29.1% said infringement is rampant on the mainland because intellectual property protection is weak. A further 26.2% said they do not know much about the markets of the nine mainland GBA cities and Guangdong Province.

In addition, 25.9% of the respondents said that information about the credit history of mainland clients is not readily available, while 23.5% said they don’t have sufficient funds to develop mainland markets. Some 22.0% mentioned the high credit risk involved while 19.4% said they are uncertain about the collection channels for accounts receivables and there are difficulties in collecting overdue payments.

- Using marketing and other professional services

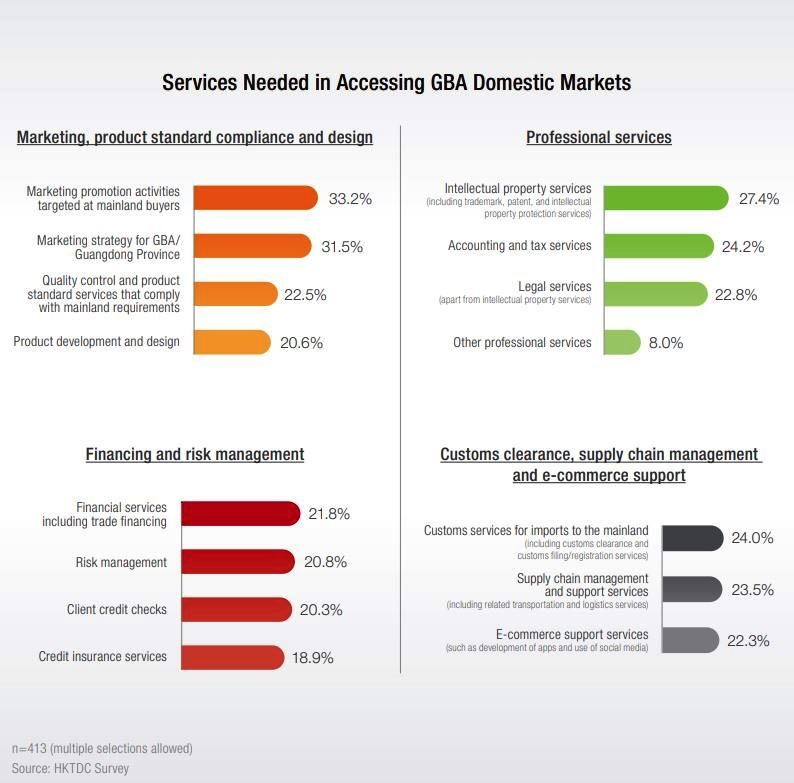

To deal with the various challenges, respondents that are developing domestic markets in GBA may seek professional services. Many use marketing promotion activities targeted at mainland buyers (33.2%), marketing strategy for the GBA/Guangdong Province (31.5%) and intellectual property services (27.4%). Other popular services include accounting and tax services (24.2%), customs services for imports into the mainland (24.0%) and supply chain management and support services (23.5%).

In the areas of financing and risk management, 21.8% of the respondents said they need financial services including trade financing, 20.8% need services in risk management, 20.3% need client credit checks and 18.9% need credit insurance services.

Questionnaire Survey Methodology

To assess the impacts of the external trade environment on Hong Kong’s businesses and the opportunities brought to Hong Kong by GBA and other domestic markets, HKTDC Research conducted a questionnaire survey on Hong Kong companies in the third quarter of 2022. The focus is on understanding the external business environment and how these companies are exploring GBA market opportunities. The survey covers the market strategies Hong Kong companies adopt when venturing into the GBA markets, the advantages they possess, the difficulties they encounter in making domestic sales and their needs as regards professional services, risk management, etc. Such information is for the reference of relevant service providers and organisations so that they know how to help Hong Kong companies seize the mainland domestic market opportunities, particularly those in the GBA in the post‑pandemic era.

This questionnaire survey was carried out in Hong Kong. Information about Hong Kong companies that are engaging in trade and manufacturing activities was extracted randomly from HKTDC’s database. Through an online questionnaire and direct telephone contacts, 413 Hong Kong companies were successfully interviewed. All these companies are developing domestic sales in the mainland GBA cities/Guangdong or are planning to do so in the future.

This article forms part of a joint study conducted by Hong Kong Export Credit Insurance Corporation and HKTDC: “Hong Kong - the Business Platform to Capitalise on Greater Bay Area Opportunities in Post-pandemic Era”

First, please LoginComment After ~