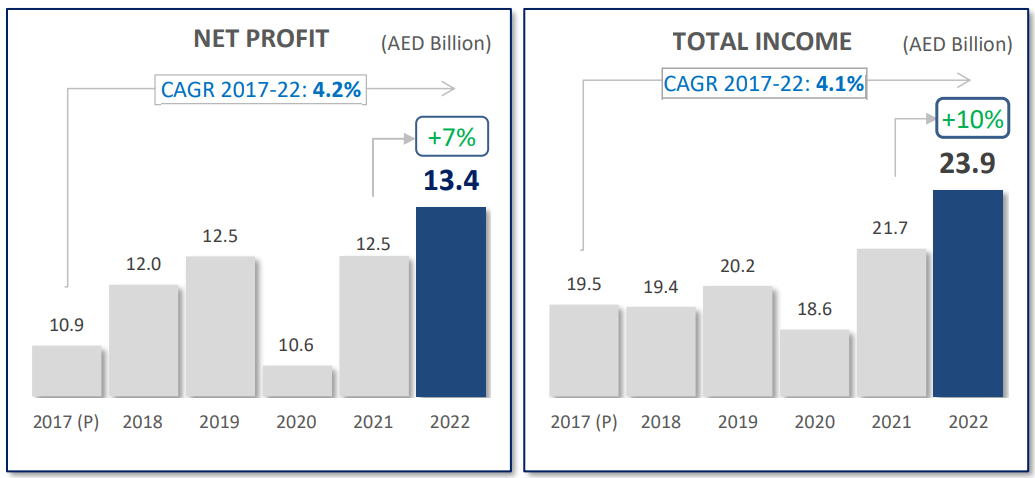

FAB reports full year 2022 Group Net Profit of AED 13.4 Billion

Download → File

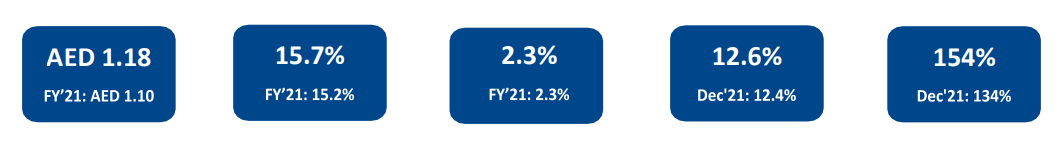

FY'22 Key Performance Indicators

Earnings Per Share Return on Tangible Equity Return on RWA CET1 ratio (post-dividends) Liquidity Coverage Ratio

Record profitability driven by strong underlying business performance in a rising rate environment; prudent risk management and cost discipline maintained amid continued investments

FY’22 highlights:

• Group Net Profit at AED 13.4 Billion, up 7% yoy; Earnings per Share at AED 1.18

• Q4’22 net profit was AED 2.5 Billion, compared to AED 2.9 Billion in Q3’22, reflecting prudent provisioning and conservative asset valuations

• Total Income at AED 23.9 Billion, up 10% yoy, driven by 23% growth in net interest income and gain on sale of majority stake in Magnati; enhanced revenue diversification geographically with greater contribution from MENA

• Operating costs at AED 6.7 Billion, up 15% yoy driven by integration of operations in Egypt (FABMisr), write-off of legacy systems in Q4’22 as part of our ongoing technology transformation strategy, as well as continued investments into the business

• Impairment charges (net) at AED 2.8 Billion, up 7% yoy, reflecting prudent provisioning with AED 1.1 Billion charge taken in Q4’22; FY’22 cost of risk at 62 bps compared to 65bps in the prior year

Double-digit balance sheet growth reflects strong business momentum; Group foundation remains robust across all key metrics

• Loans, advances and Islamic financing up 12% to AED 460 Billion, outperforming industry average of 5.5%2

• Customer deposits up 14% to AED 701 Billion; despite rising interest rates, CASA balances grew 3% yoy

• Liquidity Coverage Ratio (LCR) at 154% underlines strong liquidity and funding profile

• NPL ratio of 3.9% with provision coverage of 98% • Common Equity Tier 1 (CET1) at 12.6% post-proposed dividends, improved 19bps yoy on the back of earnings generation and RWA optimisation

• FAB’s Board of Directors recommend cash dividends per share of 52 fils amounting to AED 5.7 Billion for FY’22, compared to 49 fils cash dividends distributed in the prior year

Delivered record net profits and total income since merger

Market-leading growth across assets and liabilities

First, please LoginComment After ~