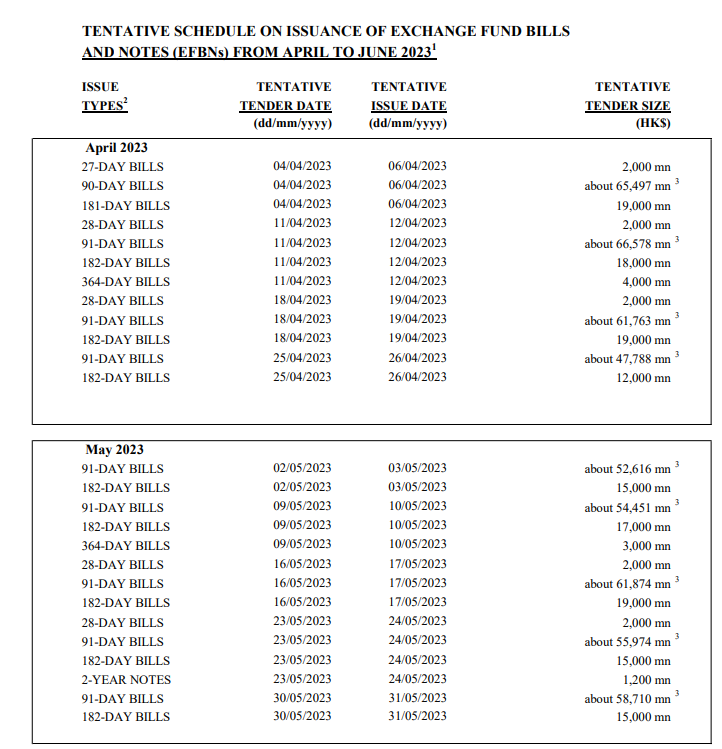

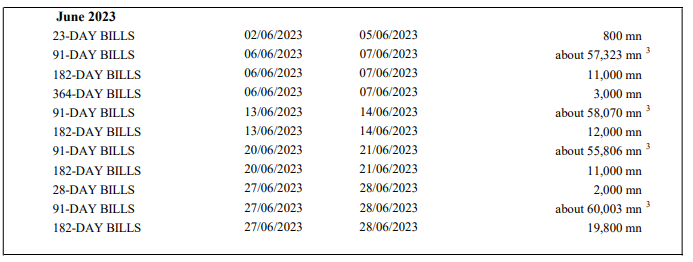

Tentative issuance schedule for Exchange Fund Bills and Notes:HKMA

The Hong Kong Monetary Authority (HKMA) issued today (15 February) a tentative issuance schedule for Exchange Fund Bills and Notes (EFBNs) for the coming quarter of April to June 2023. The schedule contains information on the tentative tender dates, issue sizes and issue dates of individual issues, representing rollover of maturing issues and taking into account planned adjustments to the maturity spectrum of the EFBN portfolio.

The quarterly schedule is issued in the second month of each quarter (i.e. February, May, August and November), covering the EFBN tenders in the following quarter.

It should be noted that the tender dates, issue sizes and issue dates projected in the advance issuance schedule are tentative. The details of new issues of Exchange Fund Bills are to be confirmed and announced at least 4 business days prior to the respective tender dates. The details of new issues of Exchange Fund Notes are to be confirmed and announced 7 business days prior to their respective tender dates. The HKMA may make changes in the light of prevailing market conditions.

Annex

All tender dates, tender sizes and issue dates given are tentative. Details of new issues of Bills will be confirmed and

announced at least 4 business days prior to the respective tender dates. Details of new issues of Notes will be confirmed

and announced 7 business days prior to the respective tender dates. The HKMA may adjust the schedule in the light of

prevailing market conditions.

All tender dates, tender sizes and issue dates given are tentative. Details of new issues of Bills will be confirmed and

announced at least 4 business days prior to the respective tender dates. Details of new issues of Notes will be confirmed

and announced 7 business days prior to the respective tender dates. The HKMA may adjust the schedule in the light of

prevailing market conditions.

Notes

(1) The next schedule will be released by the middle of May 2023 covering the period from July to September 2023.

(2) Actual tenors may differ slightly due to market holidays.

(3) As each issue of 91-day Bills includes an amount to cover recent interest payments on the outstanding total of EFBNs, the size of each issue of 91-day Bills cannot be projected with precision and is to be announced at least 4 business days prior to the tender date. The figures provided above represent rollover amounts taking into account planned adjustments to the maturity spectrum of the EFBNs portfolio

First, please LoginComment After ~