Understand the "raising, investment, management, and withdrawal" of equity investment in one article

The essence of equity investment is to support those who discover new continents.

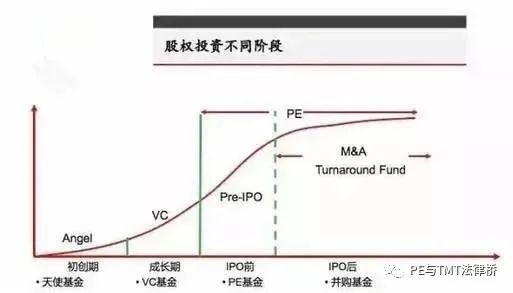

Equity investment is divided into several stages, the first is the start-up stage, the second is the growth stage, and the third is the IPO stage.

Generally speaking, it is divided into the start-up stage of angels, the growth stage generally refers to VC, before the IPO, it generally refers to Pre-IPO, and then in the later stage is the stage of mergers and acquisitions.

The rate of return for each stage is also different. An angel investor named Peter Thiel invested in FaceBook in 2004. He invested $500,000 at that time, and now has a return of 20,000 times. And in 2011, Russia's DST fund invested, only a few times the return.

But the benefit is directly proportional to the risk, and the probability of success at each stage will be different.

The success rate for seed-stage institutions is around 5-10%. The success rate of individual investors is just a few per thousand, institutional investors at the angel stage have a success rate of 10-20%, the success rate of VC is about 20-30%, and PE can achieve 50-70% .

Four stages of equity investment

一、Fundraising

The fundraising usually adopts the structure of limited partnership. Why use a limited partnership, because a limited partnership is taxed only once, that is, individual investors only pay personal income tax when they exit. If you use a limited liability company, it will involve a two-tier tax system. A limited company has to pay corporate income tax, and also collects personal income tax when dividends are distributed, so basically the limited partnership model is used. The limited partnership model also requires a fund manager. The fund manager will generally invest some funds into the fund, and the fund manager will then manage the fund.

At present, the mainstream fundraising objects are: the first is individual investors, and individual investors are generally executives of listed companies and the second generation of rich people. There are also institutional investors. Some large institutions and large groups and consortiums, such as Vanke, Country Garden, and Haier, all invest in some equity funds. There are also professional parent funds.

Regarding the security of funds, under the requirements of fund filing compliance, all investors' funds must be placed in third-party escrow accounts.

Every fund has a management company. Generally speaking, the management company now requires an annual management fee of 2%. At the same time, this management fee is not fixed. Some charge 3%, some charge 1%, and some even charge no There are also.

The distribution of investment income, the current mainstream is that investors get 80% of the income, and the management company gets 20%.

Fund Investment

The investment of the fund is the "one in a hundred" I just mentioned. Get 100 projects, filter 80% at the project approval stage, and only 20% can be approved.

After the project is established, 20% will filter 50% of it, and the remaining 50% can enter the due diligence of the project, and after the investigation enters the negotiation, 50% will be filtered. Generally, 100 projects can be invested in 1 project. Basically, many funds This is how the projects are screened, but the ratio of each fund will be different.

【Dimensions of Project Judgment】:The first thing to find out about a project is its value. Whether this project has investment value is the most important thing. If the first value of the project is not found, then there is no need to read below. The second is to look at the opportunity. This project is valuable, and it depends on whether there is an opportunity. The third is to look for risks. Many people read this project and say how good this project is, but they don't talk about risks. There are also problems, what problems does this company have, whether these problems can be solved, and whether they can invest after they are solved. Basically, these problems should be solved clearly.

【key points of the project】:The first is direction. Everything we do is like a story of "the opposite goes the other way". Don't go in the wrong direction. If the direction is wrong, a good team will fail. A good direction requires a good team, because many failures are due to the team rather than the direction. Many of them are like this. With a good team, there must be a good product. Regardless of whether you are a business model project or a product project, in the end, it must be fundamental that it falls on products and services. There is also the model. If you have a good product, you must have a good model to sell it.

A、Judgment of Direction:

1.How to judge the direction?

We used to always talk about "sharpening a knife and chopping firewood by mistake". What is this "work" is the "work" of research. If you don't know how to find a direction for an industry, you must do industry research well. Industry research is a basic skill. For any investment, no matter if you make stock investment, equity investment, or real estate fund, you must study this project and do some industry research.

2.What are good orientation criteria?

a. There must be market capacity. If you are an industry, if the industry market capacity is only 500 million or 1 billion in the whole country, no matter how you do it, you can achieve 50% of the national market and only have a ceiling of 500 million, so a market capacity is very important.

b. Is there any demand in the industrial chain? This is the pain point we are talking about. This industry must have pain points.

c. Competitive landscape. If you have a good project direction, you also need to see clearly the competition landscape. Therefore, in the big competitive landscape, we must not only see our own direct competitors, but we must also see where our own potential competitors are.

d. External factors. Because some policy factors will affect the entire industry, it may make an industry suddenly improve, or it may suddenly cool down an industry.

B. The judgment of the team:

At the heart of a great team is a great founder. The founder's ability requires first to have industrial ambitions. If the founder is just to make a little money, this kind of project must be particularly careful. The second is that the ability to lead the team is also very important, because in many projects he only has strong technical or market capabilities, but if he can't lead the team, this kind of project is also easy to fail, "people disperse money and disperse". The third is to have a high emotional intelligence, because the difficulties and pains of running any company will eventually be concentrated in the hands of your founder, and ultimately you will have to bear it. There are also learning ability, innovation ability, comprehensively judge the founder.

We talk about avoiding the following groups of people in particular when investing.

a. The equity of the founders is average. There are many situations where "the three monks have no water to drink". This is very important when a company invests, and it is also very important when it is founded. Equity is very critical

b. Too fussy. If you are very fussy when negotiating, you have to be very careful about the projects that you have negotiated very hard on every term, as it may be very difficult to deal with later. This kind of person may also be very fussy when dealing with the outside world, such as with his business partners, with his customers, and so on.

c. Show up in public. The more lively the place, the more careful you should be, and the founders of this kind of Tiantian should also be careful when they show their faces outside. Showing up every day, unless someone in his company helps him make decisions, he is a big PR, otherwise, this person must be very careful, because if he shows up every day, he basically has no time to do business and make decisions.

d. Excessive asking prices. If you are financing a project, don’t ask for a high price, because once you ask for a high price, many investors will turn around and leave immediately. Originally, you were a good project, but people would ignore you if you drove too high.

C、Product Judgment:

The main point is that there must be rigid demand for products.

D、Model and Price:

A good project needs a good price. If the best project is too expensive, sometimes you have to think about it.

Investing is growth.

E、Project Judgment Method:

Mainly through due diligence, including legal, human resources, finance, industry analysis, product technology, etc. to comprehensively judge.

Post-investment Management

After any project is invested, it must be managed. If it is not managed, there will be problems. Management is divided into two parts, the first is value-added services for investment. Value-added services are divided into: 1. Resource integration. First of all, you can integrate the resources of the brother companies you have invested in. 2. Talent introduction. Some good ones are acceptable. 3. Combing the business model. 4. There are also financing listings.

Because the subsequent financing also needs everyone's support.

The second is the control and management of financing. Management is very important. Some projects have learned a lot, so the requirements for investment projects after 2015 will be stricter. One is financial information and three tables, and the other is bank statement. The third is the material of human resources.

Why go to the bank statement?

Because the bank statement reflects a very real situation of the company. If some people only look at the financial statements, it is obvious that he has transferred all the money out, but the financial statements show that the bank deposits are still there, in the form of cash. Therefore, we must avoid this risk and prevent the fund from being transferred away. There are many cases of this money being transferred away.

Why look at the situation of human resources?

The situation where the first person enters and exits. The situation of people entering and leaving is also very important. When you find that too many people have entered a project in the last quarter, you have to talk to the founder why the number of people is so high. Because many initial entrepreneurs see the money desperately expanding, and then they can’t stop the car. Too many people come in and your system and process can’t keep up. People who come in are also in vain. Such cases abound, so investors must remind him.

The second leaver. When a project has a problem, the first thing is that the personnel start to change. It may be that the director level and the vice president level start to leave, so we need to check the personnel changes.

The third is operating data. We look at some of his operations every month. It is not necessarily a contract. There are also some Internet operations. Some Internet is easy to fake. If you look at his operations every month, it is not easy to make frauds. It must be supervision. You must take precautions to avoid many risks.

Exit after Investment

IPO and mergers and acquisitions are the main exit methods in the future. Compared with going public, mergers and acquisitions are easier and less difficult, and the speed of mergers and acquisitions will be faster. In mature markets such as the United States, only 20% can be listed. Therefore, the probability of hundreds of times, thousands of times, and tens of thousands of times of return may become smaller and smaller in the era of mergers and acquisitions.

PE and TMT legal bridge

Presiding lawyer: Yang Chunbao, first-class lawyer

Phone/WeChat: 1390 182 6830

Business contact and submission email:

chambers.yang@dentons.cn

Address: Floor 9/24/25, Shanghai World Financial Center, 100 Century Avenue, Shanghai

First, please LoginComment After ~