Breaking into asset management

Asset management is one of the real growth areas in the global financial industry. Decades of economic growth and globalisation have created enormous amounts of wealth, leading to more money being invested in funds – from actively managed products that seek market alpha to passive funds, like exchange traded funds.

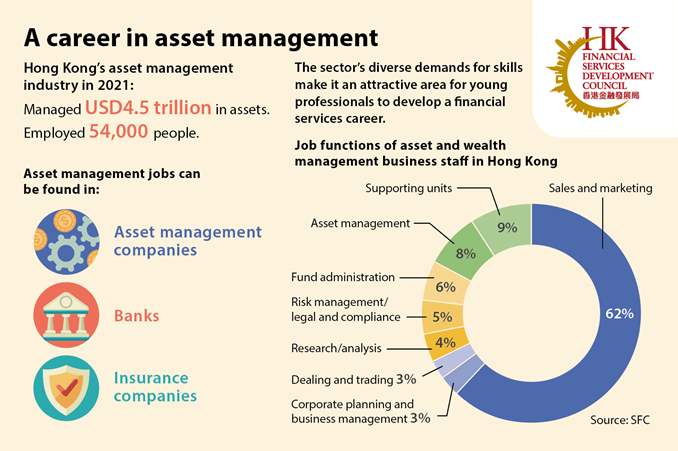

In Hong Kong, asset management is a significant part of the local financial ecosystem, managing assets worth HK$35.5 trillion (USD 4.5 trillion) at the end of 20211. It is also a major employer, with 54,000 people working in the sector across a wide range of functions.

How young professionals can approach a career in asset management was the subject of the latest session in the FSDC Practitioner Speaker Series (PSS) – a webinar that assembled two veterans of finance to share practical career advice so that students can fully realise their potential in the financial services industry.

Choosing a career path

Working in asset management does not necessarily entail working at an asset management company, as a variety of companies run funds for their clients – many banks and insurers, for example, have developed their own asset management capabilities.

At the same time, not all jobs in asset management are directly related to buying and selling securities. In addition to investment professionals managing funds, there are roles in research, corporate planning, and fund administration.

What this means for university students is that they can apply to a wide range of companies that have diverse skill requirements.

“Asset management is a very broad area, and it requires a wide skill set,” said Marko Tutavac, Managing Director, VMS Group. “Some people coming out of university will find that they have skills that they wouldn’t have originally thought as being valuable, but are actually useful in asset management.”

When students consider applying for asset management jobs, they often focus on client-facing positions in the front office. There are, however, plenty of roles in other departments that are essential for the smooth operation of the firm – including everything from accounting to IT.

“Middle and back-office functions are there to ensure that there is zero operational risk with client money,” said Mr. Tutavac. “And it can be a very good place to start out in the industry, as it is where you can understand the engine that drives the overall business, as well as what is important to clients.”

Aspiring asset managers should also be aware that asset management, like the rest of the financial industry, is being transformed by technology. There is a growing need for technology skills in both traditional asset management firms, as well as in new FinTechs that provide tech-driven investment services – most notably, rob advisors, which are digital platforms that offer automated financial planning.

Entering the industry

Applicants to the asset management industry should prepare themselves with a combination of hard and soft skills, as employers are not only looking for people with professional qualifications and knowledge of finance, but also the right personality to succeed in an intellectually demanding industry.

“The first thing an interviewer is going to ask is how well the candidate knows the industry,” said Vivien Khoo, Chairwoman and Co-founder, Asia Crypto Alliance. “The second thing they want to know is how passionate you are. And the third is whether you have the right level of integrity for the industry.”

Candidates therefore need to demonstrate that they know what an asset management company does, and how what they have learnt at university can contribute. At the same time, they need to convey that they have more intangible qualities – such as common sense, astrong work ethic, as well as good decision-making skills.

A successful interview will result in a job, but this is just the start of the career journey, as asset management is an industry that requires continuous learning to keep up with the ever changing needs of the market. This might be a formal qualification a few years down the line, with MBAs a popular choice for people interested in a management position, while getting a CFA qualification is often required for financial analysts and other investment professionals.

“Your first job in the industry is a learning ground where you can establish a good foundation for the future,” said Ms. Khoo. “It is also an opportunity to make friends and create a broad network of people you can reach out to as your career develops.”

With hard work and a willingness to learn, asset management is an industry where young and ambitious professionals can realise their potential in financial services. Students who are interested in joining the sector should look out for internships in the summer holidays, while final-year students can start applying for entry-level positions.

1 SFC

First, please LoginComment After ~