New Zealand Dollar Takes the Lead on Chinese Data Resurgence & RBNZ Expectations

The New Zealand Dollar rose sharply at the start of March as China's economy jumped back to life and expectations for further Reserve Bank of New Zealand interest rate hikes made it a favourite amongst investors seeking exposure to the commodity currency complex.

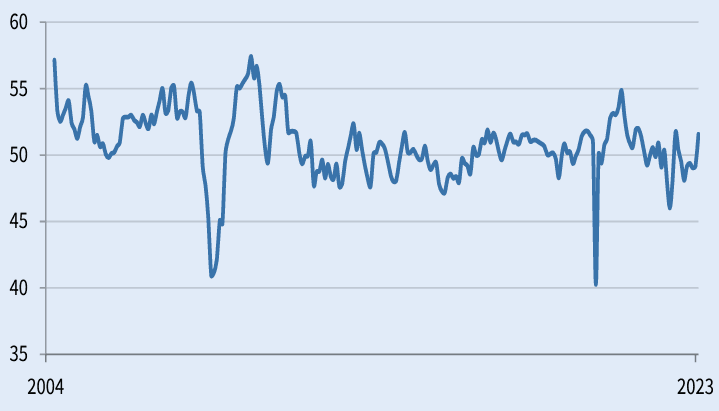

The NZ Dollar outperformed the Dollar, Euro, Pound and all the other G10 majors after the latest PMI data from China showed a resurgence in the manufacturing sector which returned to growth in February amid the recent rollback of pandemic restrictions.

China's Caixin PMI read at 51.6, surpassing expectations for 50.2 while a separate official version of the PMI read at 52.6, surpassing expectations for a reading of 50.5.

"A level above 50 indicates expansion and this is the best result since May 2021 before the onerous effects of the rolling lockdowns took effect, and the first jump in activity since July, with new orders, increased staff levels and higher output all showing up," says Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

These data show the world's second-largest economy is recovering quickly, which would help boost global growth and support China-linked economies such as New Zealand.

China is New Zealand's main export market for dairy products, lamb, mutton, beef and timber, therefore rising activity will boost the country's foreign exchange earnings.

Chinese firms reported renewed and solid upturns in both production and new orders as operations and customer demand revived, according to Caixin's survey.

Fresh increases in employment and purchasing activity were also seen, while pressure on supply chains eased and lead times improved to the greatest extent in eight years.

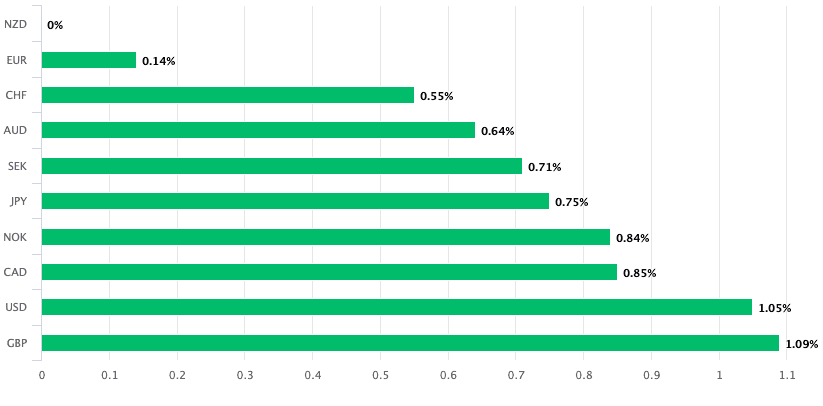

Above: NZD was the best-performing major on March 01.

The official PMI survey from the Bureau of Statistics meanwhile revealed the non-manufacturing PMI jumped to 56.3 in February, up from 54.4 in January. Growth in the services sector was the fastest since March 2021 as Chinese citizens were able to take advantage of their restored freedoms.

The New Zealand Dollar rose 0.95% against the Pound, taking GBP/NZD to 1.9255 at the time of writing. The currency meanwhile advanced 1.05% against the U.S. Dollar, taking NZD/USD to 0.9250.

"Among the commodity-linked currencies, the New Zealand dollar is leading the gains by a wide margin. The optimism around the recovery in Chinese demand is likely driving the risk-sensitive aussie, kiwi and loonie higher. But with the Bank of Canada pausing its rate increases and question marks about how much further the Reserve Bank of Australia will tighten, only the kiwi is able to stage a solid rally today," says Raffi Boyadjian, Lead Investment Analyst at. XM.com.

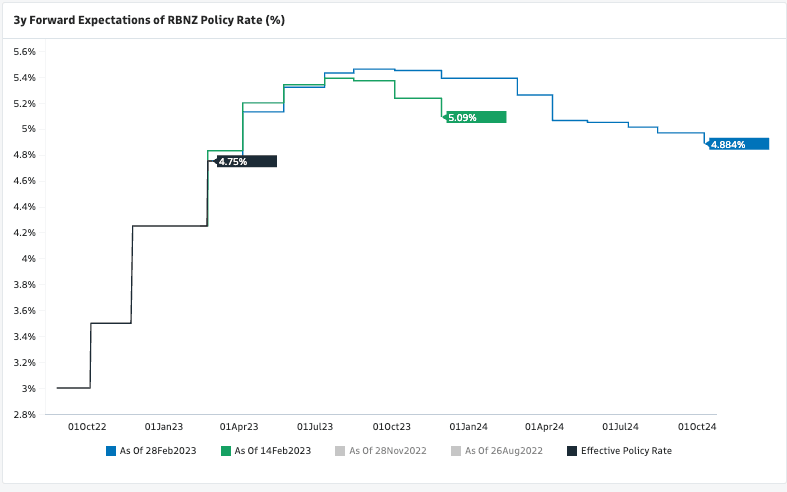

Money markets show investors are now priced for a peak in the Reserve Bank of New Zealand's Overnight Cash Rate of 5.45% by mid-year, which is higher than that expected in most peer economies.

Westpac expects the RBNZ's cash rate to reach a peak of 5.5% in the next few months, from 4.75% currently. This would put it on par with the expected peak in the Federal Reserve's interest rate, but higher than those in the Eurozone, UK, Japan and Australia.

Such a rate 'advantage' could underscore the currency and Westpac says it anticipates a steady appreciation in the New Zealand Dollar during 2023.

Above: Investors have raised expectations for the peak in the RBNZ's OCR through February. Image courtesy of Goldman Sachs.

First, please LoginComment After ~