EBA publishes annual assessment of banks' internal approaches for the calculation of capital requirements

The European Banking Authority (EBA) published today its Reports on the annual market and credit risk benchmarking exercises conducted in 2022. These exercises aim at monitoring the consistency of risk weighted assets (RWAs) across all EU institutions authorised to use internal approaches for the calculation of capital requirements. Regarding market risk, for the majority of participating banks, the results confirm a relatively low dispersion in the initial market valuation (IMVs) of most of the instruments, and a decrease in the dispersion in the value at risk (VaR) submissions compared to the previous exercise. For credit risk, the variability of RWAs remained rather stable, despite the pandemic and the different banks’ pace in complying with the policies set out in the EBA internal rating-based (IRB) roadmap. A particular focus has been put on analysing the impact of the pandemic and the compensating public measures on the IRB models.

Market Risk exercise

The Report presents the results of the 2022 supervisory benchmarking and summarises the conclusions drawn from a hypothetical portfolio exercise (HPE) conducted in 2021/22.

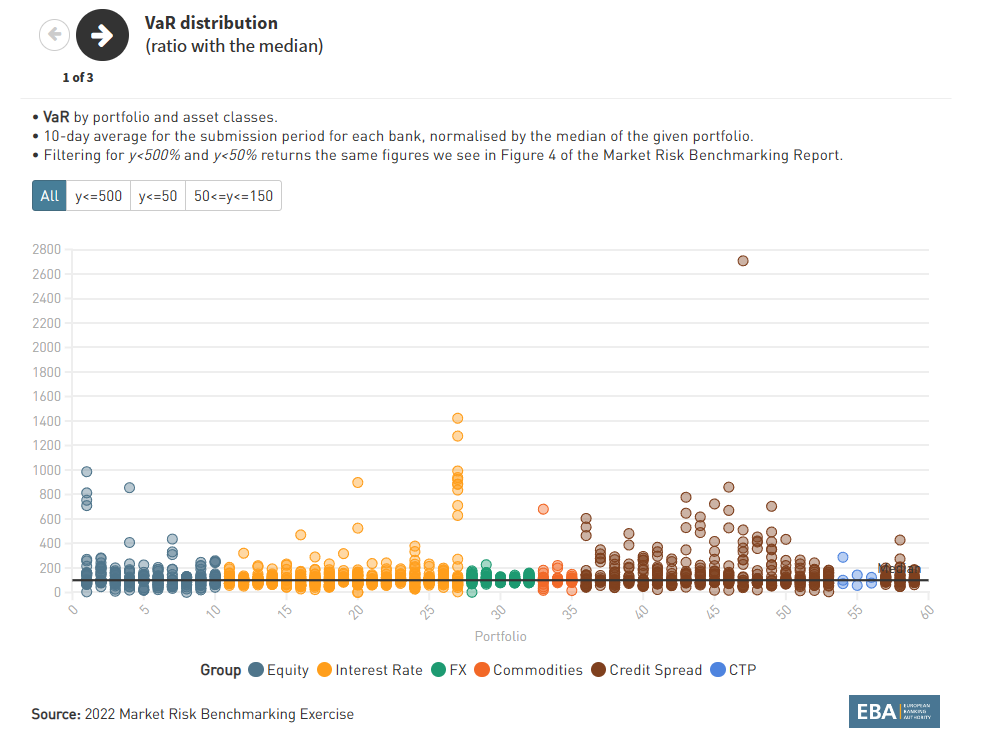

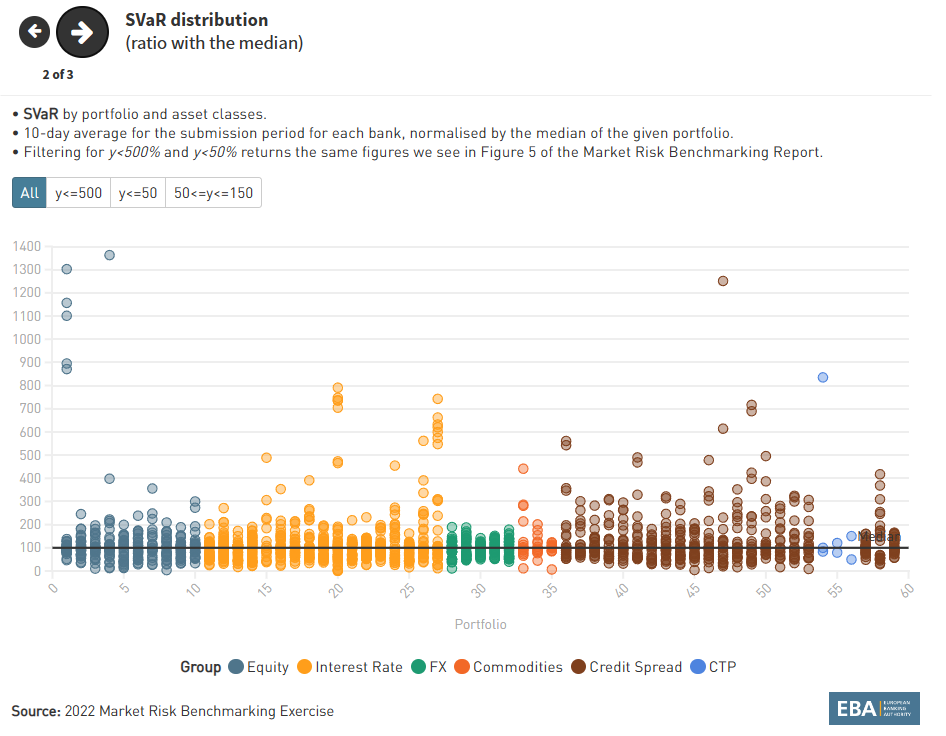

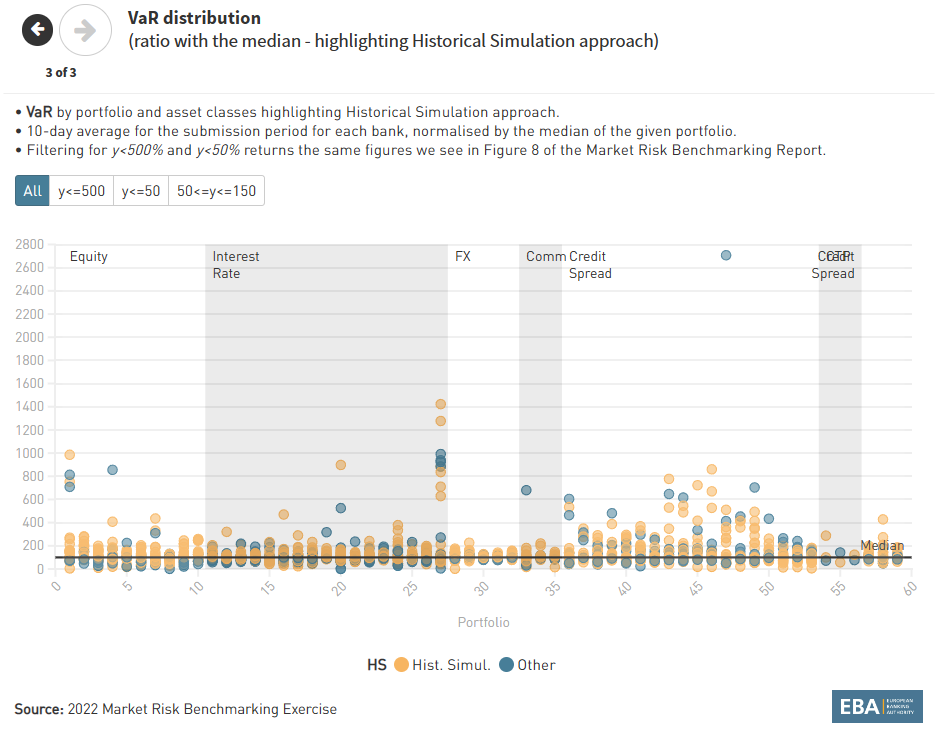

From a risk factor perspective, FX and commodity portfolios exhibit a lower level of dispersion than the interest rate, equity and credit spread asset classes. Except for a minority of instruments, the variability is lower than in the previous exercise. This is likely to be due to a decrease in market volatility, which impacted the level of the risk measures, thus decreasing the dispersion.

Regarding the single risk measures, across all asset classes except for credit spread the overall variability for the VaR is lower than the observed variability for stressed VaR (sVaR): 21% and 28% respectively, compared with 27% and 31% in 2021 and with 18% and 29% in 2020.[1] More complex measures such as the incremental risk charge (IRC) show a higher level of dispersion (45%, compared with 43% in 2021, and 49% in 2020).

Competent authorities also complemented a questionnaire on banks participating in the exercise to supplement the quantitative analysis. Although the majority of the causes were identified and actions put in place to reduce the unwanted variability of the hypothetical RWAs, the effectiveness of these actions can be evaluated only with ongoing analysis.

Credit Risk exercise

This year’s Report continues to provide in-depth analysis of the observed and potential impact of the COVID-19 pandemic on the IRB parameters used to calculate own funds requirements.

The analyses imply that the support measures continue to significantly influence the observed default rates and the average PD estimates. It should be noted that while for large corporate exposures the average PDs seem to revert to pre-crisis levels, the average PDs for some HDP portfolios are significantly below the 2019 levels.

In addition, the horizontal analyses reveal a notable decrease in defaulted exposures and a notable increase in non-defaulted exposures. The implications of this observation on IRB parameter estimates, and the short-term and structural changes of the macro-economic environment observed in the recent years, are a core aspect of this analysis and should remain on the regulators and supervisor’s radar.

The assessment conducted by competent authorities and based on the benchmarks provided by EBA revealed a significant impact for single institutions in the review of their IRB models to achieve compliance with the IRB roadmap policies. However, for the majority of institutions the supervisory review process to reach compliance with the IRB roadmap was still ongoing during the CA assessment. Therefore a potential impact from the harmonisation of terminology and concepts set out in the products of the IRB roadmap is yet to be observed in the data.

The Report also provides an analysis of the share of energy firms in the IRB portfolio of the institutions in the benchmarking sample. It is evaluated whether there were already any expectations or signs of the economic uncertainties related to the energy crisis in the credit risk parameters. The analyses have shown a rather limited incidence of exposures to the energy firms in the sample. Furthermore, the risk parameters of the energy firms were rather stable between end 2020 and end 2021 and there were no significant statistical differences between the energy firms and the other companies.

First, please LoginComment After ~