Financial Market Trends in February 2023

Download → FMT(2302).pdf

Key Takeaways

♦The Treasury bond yield has risen significantly due to concerns about stronger monetary tightening by the US Federal Reserve and foreign investors' net selling of Treasury bond futures.

♦The KOSPI fluctuated within a narrow range due to a coexistence of factors driving it down, such as concerns related to the possibility of stronger monetary tightening in major countries, and factors pushing it up, including expectations of China's economic recovery and foreign investors' net buying.

♦Bank lending to the household sector declined by a smaller margin in February (-4.7 trillion won in Jan. 2023 → -2.7 trillion won in Feb.), while bank lending to the corporate sector exhibited slower growth (+7.9 trillion won → +5.2 trillion won).

♦Deposit-taking by banks grew considerably (-48.4 trillion won in Jan. 2023 → +22.3 trillion won in Feb.), while funds under management at asset management companies showed only a slight increase (+50.4 trillion won → +0.8 trillion won).

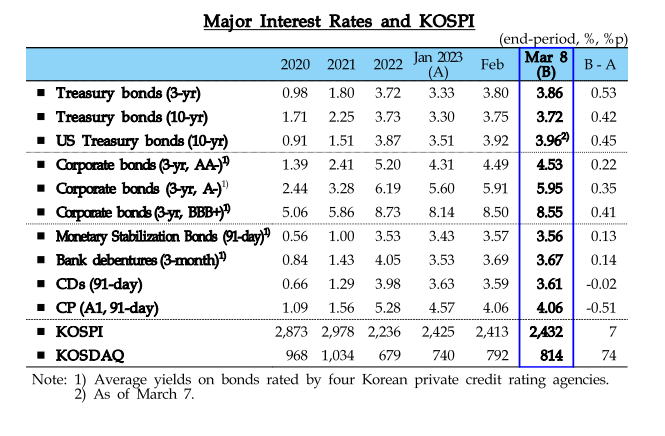

Interest Rates and Stock Prices

The Treasury bond yield has risen significantly due to concerns about stronger monetary tightening by the US Federal Reserve and foreign investors’ net selling of Treasury bond futures.

Major short-term interest rates increased overall, affected chiefly by a rise in Treasury bond yields and a fall in MMF deposit-taking since mid-February.*

* MMF deposits outstanding (trillion won) : 190.6 on Jan. 31 → 208.2 on Feb. 6 → 193.7 on March 7

o CP (91-day) rates continued to decline, however, owing mainly to the continued easing of credit risk aversio

The KOSPI fluctuated within a narrow range due to a coexistence of factors driving it down, such as concerns related to the possibility of stronger monetary tightening in major countries, and factors pushing it up, including expectations of China’s economic recovery and foreign investors’ net buying.

First, please LoginComment After ~