China Bulletin:The end of zero-Covid

Download → China Bulletin

Contents

1

Market backdrop The latest views on Chinese equities

2

Covid policy The beginning of the end

3

Investment perspectives This quarter’s key economic theme

4

Funds JP Morgan Funds - China Fund and JP Morgan Funds - China A-Share Opportunities Fund

5

Investment focus Semiconductors

Market backdrop

There was a marked change in direction for Chinese equities in the fourth quarter of 2022, as the alleviation of risks within the real estate sector, followed by the Chinese government removing all Covid containment policies much faster than expected, sparked a rebound in Chinese stocks.

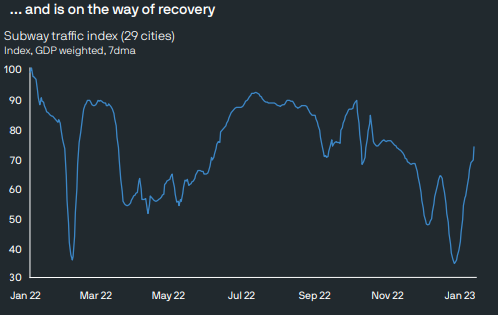

The initial wave of infection after the reopening was also faster than expected, and by the end of December many large cities had passed the peak of infection (but not the peak of hospitalisations). Similar to other countries, China experienced a shortage in healthcare capacity, and huge disruption to traffic and productivity.

No surprise that due to the quick spread of Covid, fundamental economic data prints touched lower. December’s manufacturing PMI (Purchasing Managers' Index) print fell 1 point to 47, which is the lowest reading since February 2020. The service sector was hit harder, with service PMI down 5.7 points to 41.6. Against this backdrop, cities such as Beijing, Guangzhou and Wuhan that were the first to be hit by the Covid surge, have started to see a recovery in consumption, traffic and business activities.

Covid policy – The beginning of the end

China has been forced to give up its zero-Covid policy because of heightened economic costs and challenges to local enforcement. The rapid and large exit wave of infections should be followed by a fast recovery in economic activity for a relatively extended period of time.

First, please LoginComment After ~