Christopher Kent: Long and variable monetary policy lags

Download → PDF full text

It's great to be back at the KangaNews Summit. Last year I discussed the Reserve Bank's move to quantitative tightening (QT). Today I'll provide a brief update on the unwinding of our unconventional policies before turning to more conventional monetary policy issues, which will be the focus of my presentation.

The unwinding of unconventional monetary policies

We are currently pursuing passive QT, whereby we allow our holdings of government bonds to roll off as they mature. The next maturity of substance is $13 billion of the April 2023 Australian Government bond. Some central banks have slowed QT by reinvesting some of their maturing bonds; others have done the opposite, pushing QT along by selling bonds well ahead of maturity.

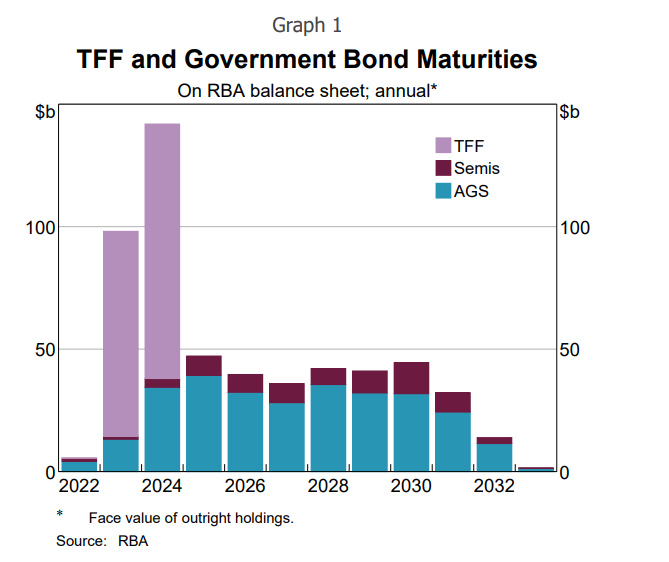

While QT will contribute to a moderate decline in our balance sheet over the next few years, the roll-off of the Bank's Term Funding Facility (TFF) will lead to a sizeable reduction in our balance sheet this year and next (Graph 1).

Banks are preparing for that in advance. When the time comes, they will use some of the balances held in their Exchange Settlement (ES) accounts at the Reserve Bank to repay loans they have obtained under the TFF. In return, they will receive back the collateral secured against those loans. If that collateral was in the form of securities issued by the Australian Government or the states and territories, there will be no net effect on a bank’s liquid asset ratio. But much of the collateral pledged for the TFF was in the form of self-securitised assets, which do not count towards a bank’s liquidity for regulatory purposes. Accordingly, as they run down their ES balances to repay funds borrowed under the TFF, banks will need to obtain high-quality liquid assets (HQLA). They could also source more of their funding in products like term deposits to reduce the amount of liquid assets they need to hold.

Meanwhile, banks have been issuing more long-term bonds in what had been relatively favourable conditions in global bond markets. Our liaison with the banks suggests they are planning for further issuance of bonds as they prepare for the roll-off of the first tranche of $76 billion of the TFF between April and September this year.

However, conditions in global bond markets have been strained recently following the failure of Silicon Valley Bank in the United States. Volatility in Australian financial markets has picked up but markets are still functioning and, most importantly, Australian banks are unquestionably strong – the banks’ capital and liquidity positions are well above APRA’s regulatory requirements. Banks are already well advanced on their bond issuance plans for the year and could defer their bond issuance for a while. Even if markets remain strained for a time, Australian banks’ issuance will continue to benefit from the strength of their balance sheets.

As loans from the TFF mature and are replaced with funding at higher cost, this will tend to push up banks’ funding costs. The TFF accounted for around 5 per cent of banks’ overall funding at its peak. However, much of the funding was hedged, either by issuing term-matched fixed-rate mortgages or by using derivatives to convert the fixed rate TFF payments back to floating rates. Hence, the rise in the cash rate and interest rates more broadly has already had some effect on the cost of banks’ funding from the TFF

First, please LoginComment After ~