Quarterly Economic Review - Q4 2022

Download → Quarterly Economic Review-2022Q4

Chapter 1 International Economic Developments and UAE External Sector

I.1. Growth Outlook for Major UAE Economic Partners

I.2. Inflation and Monetary Policy Responses

I.3. Global Markets’ Developments

Chapter 2: Domestic Economic Developments

II.1. Growth in the UAE

II.2. Sectoral Analysis

II.3. Inflation

Chapter 3: Monetary and Financial Markets Developments

III.1. Money Supply and Interest Rates

III.2. Banking Developments

III.3. Financial Developments

III.4. Insurance Developments

I.1. Growth Outlook of Major UAE Economic Partners

Global

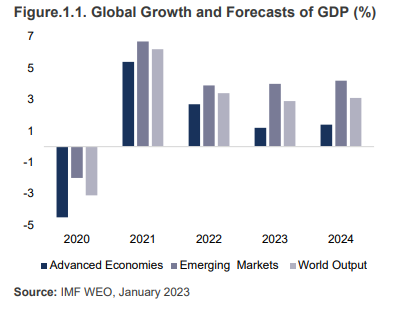

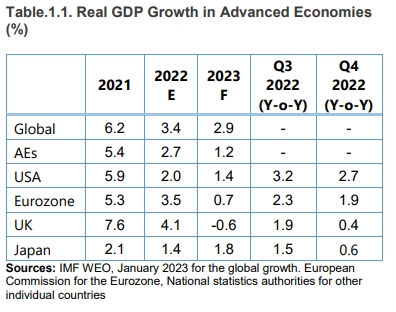

In its January 2023 WEO update, the IMF estimates global growth at 3.4% in 2022 and projects it to decelerate to 2.9% in 2023. The surge in policy rates to combat inflation, the conflict in Ukraine, and the resultant tighter financial conditions continue to restrain economic activity.

Advanced Economies

Growth in advanced economies is expected to drop from 2.7% in 2022 to 1.2% in 2023, reflecting a broad-based slowdown affecting almost 90% of the countries. Following a 3.2% Y-o-Y increase in Q3 2022, the US economy grew by 2.7% in Q4 2022 Y-o-Y. The rise in consumer and government expenditure as well as private inventory investments drove the expansion in Q4, which was partially offset by a decline in exports and housing investments.

Growth in the Eurozone declined to 1.9% in Q4 2022 Y-o-Y from 2.3% in Q3 Y-o-Y, posting the lowest growth since the beginning of the post-pandemic recovery. The slower growth highlights the ongoing strain that rising food and energy prices place on household real income, especially in Germany, France, and Italy. However, despite the worsening in the terms of trade associated with the conflict in Ukraine, Eurozone’s economic growth was estimated to reach 3.5% in 2022.

The UK economy decelerated significantly in Q4 2022 to 0.4% Y-o-Y from 2.4% Y-o-Y in Q3. The economy is projected to contract in 2023, as households continue to struggle with high inflation, which has severely impacted their living standards. The service sector growth, in particular, remained flat on the back of declines in education, transport, and storage.

In Japan, rising living costs put pressure on household budgets and constrained private spending, resulting in a decline in growth from 1.5% in Q3 Y-o-Y to 0.6% in Q4 2022 Y-o-Y. Japan's slow recovery from the pandemic is also affected by concerns over the global economy and inflation.

First, please LoginComment After ~