UK's New Investment Zones Policy

On 15 March 2023, the UK government announced a UK‑wide policy to create 12 new Investment Zones. The aim is to “drive business investment and level up” the country. An Investment Zones Policy Offer sets out the policy model for the Investment Zones and provides a framework for selected areas to build a local coalition of partners.

In his Autumn Statement, the UK Chancellor Jeremy Hunt unveiled the preparations for an Investment Zones programme, which is designed to catalyse a small number of high‑potential geographical clusters in need of stimulus to boost productivity and growth. In line with that, in this policy document, Investment Zones will be set up in places which have the right combination of characteristics to harness local sector strengths in order to drive productivity, and leverage the energy of local talent, knowledge and networks to deliver sustainable growth that will benefit the local community.

Setting up the Zones will require a holistic approach and will need to be rooted in a partnership between central government, local government, research institutions and the private sector. This should enable them to realise the potential of the UK’s cities and regions.

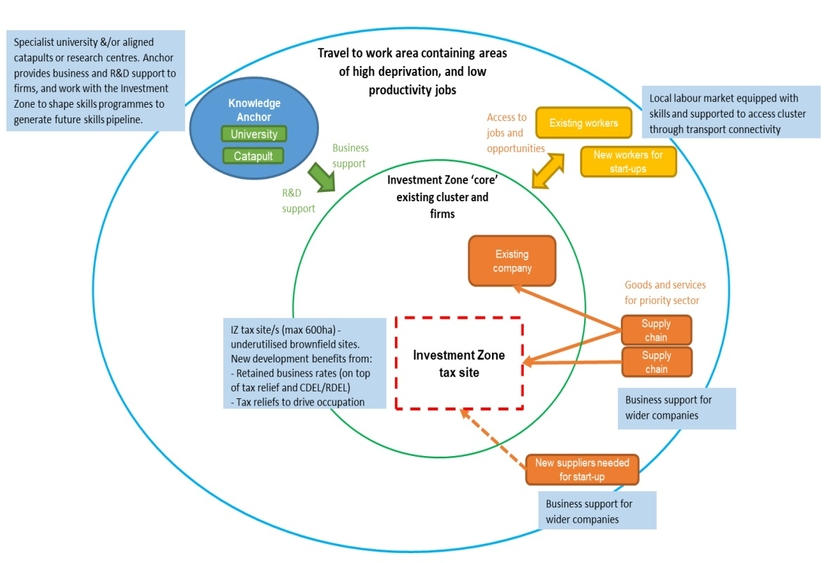

An illustrative diagram of an Investment Zone. Source: HM Treasury, Department for Levelling Up, Housing and Communities

Priority Sectors

The aim of the Investment Zones is to nurture the expansion of high‑potential strengths in key sectors and technologies, in order to deliver significant economic and employment gains. To achieve this, all Investment Zones will need to focus on growing clusters aligned with one or more of the following five priority sectors:

- Digital and Tech: the UK’s digital and tech sector is worth £143bn and has created more unicorns than France and Germany combined. Eight UK cities are now home to two or more unicorns.

- Life Sciences: the UK’s life sciences sector directly employs 268,000 people. All the top 25 global biopharmaceutical companies and the top 30 global medtech organisations have operations based in the country.

- Creative Industries: The UK’s creative industries (measured by gross value added) have been growing faster than the UK economy since 2011. Between 2010 and 2019, the sector grew by 43.6% – more than double the rate of growth of the overall economy.

- Green Industries: It’s estimated that the global transition to net zero will create opportunities worth £1tn for UK businesses and innovators.

- Advanced Manufacturing: The UK’s advanced manufacturing sectors are worth £93bn. Manufacturing R&D accounted for over 40% of total UK business R&D expenditure in 2021.

Locations Identified

Eight functional economic areas in England have already been identified for the beginning of discussions and the co‑development of proposals. Hong Kong investors interested in this policy model should therefore take particular note of the areas covered by the following local and regional authorities:

- The proposed East Midlands Mayoral Combined County Authority

- Greater Manchester Mayoral Combined Authority

- Liverpool City Region Mayoral Combined Authority

- The proposed North East Mayoral Combined Authority

- South Yorkshire Mayoral Combined Authority

- Tees Valley Mayoral Combined Authority

- West Midlands Mayoral Combined Authority

- West Yorkshire Mayoral Combined Authority

Eight of the UK’s 12 Investment Zones are set to be established in the English regions.

The shortlisted areas and authorities are expected to start soon to engage a coalition of partners through their existing networks of research institutions, businesses and other local stakeholders, including MPs, in alignment with their existing local strategies. These groups will develop Investment Zone proposals around the priority sectors,

In addition to the eight in England, the UK government is also engaging with the devolved governments in Scotland, Wales and Northern Ireland to discuss how and where at least one new Investment Zone could be delivered in each of them.

Fiscal Incentives

Subject to these proposals meeting specified requirements, the UK government has earmarked an overall fiscal envelope of £80m spread over five years. This can either be: (a) used flexibly with a 40/60 split between resource and capital funding across interventions such as R&D, skills, local infrastructure, local enterprise and business support and planning and development, in order to attract investment and unlock barriers holding back the growth of each sector, or: (b) taken as a single five‑year tax offer, or a mix of both, scalable based on the number of sites involved.

The £80m can be spent across the following five areas:

- Research and Innovation – e.g. grants for projects.

- Skills – e.g. skills boot camps, stimulating demand apprenticeships.

- Local infrastructure – e.g. land remediation for labs or schemes to improve connectivity to improve access to the local labour market.

- Local Enterprise and Business Support – e.g. sector-specific tailored support for start-ups and SMEs that leverages local research strengths and facilities.

- Planning and Development – e.g. funding to recruit a dedicated planning team, implement a local development order, or support a Development Corporation to deliver complex or large-scale developments.

Specific Investment Zone sites will be able to benefit from a 100% retention of business rates growth over an agreed baseline for 25 years. When drawing up proposals for Investment Zones, authorities will need to demonstrate how business rates retention will provide for local economic growth within their region, support the priority sector within the Investment Zone, and represent value for money for the government.

The UK government will offer the following tax reliefs in designated tax sites within each Investment Zone:

- Stamp Duty Land Tax (SDLT) – full SDLT relief for land and buildings bought for commercial use or development for commercial purposes.

- Business Rates – 100% relief from business rates on newly occupied business premises and certain existing businesses where they expand in Investment Zone tax sites. Business rates are calculated on a property’s ‘rateable value’.

- Enhanced Capital Allowance – 100% first year allowance for companies’ qualifying expenditure on plant and machinery assets for use in tax sites.

- Enhanced structures and Buildings Allowance – accelerated relief to allow businesses to reduce their taxable profits by 10% of the cost of qualifying non-residential investment per year, relieving 100% of their cost of structures and buildings over 10 years.

- Employer National Insurance Contributions (NICs) Relief – Zero-rated employer NICs on salaries of any new employee working in the tax site for at least 60% of their time, on earnings up to £25,000 per year, with employer NICs being charged at the usual rate above this level. This relief can be applied for 36 months per employee.

Implications for Hong Kong

To double down on the potential for zonal public policy to catalyse private sector investment into high‑potential locations across the whole of the UK, Investment Zones will look to ride on the early success of the UK Freeports programme.

The UK Government will look to promote Investment Zones and Freeports to prospective investors in a coherent, unified manner, given the degree to which they complement each other. However, unlike Freeports – which focus on brownfield (i.e. possibly contaminated land) regeneration within port areas and their hinterlands to attract trade‑orientated investment – Investment Zones will aim to nurture established or emerging clusters across the five priority sectors and concentrate on research institutions with the aim of boosting R&D and innovation.

Hong Kong is the UK’s second‑largest Asian FDI investor, accounting for an inward FDI investment position of £16.3bn in 2021. Businesses based in the SAR should therefore carefully examine the Investment Zones policy document to see how they might be able to benefit from the policy and its wide range of levers and incentives. They should look to enter into discussions and partnerships with the areas identified as prospective Zones and their local stakeholders, in order to help co‑develop development proposals.

The UK government intends to have the first proposals from the identified areas agreed by the summer, so the planning and preparation for delivery of the Zones can be expedited. It hopes that all Investment Zone proposals can be agreed by the end of the FY 23/24, and expects funding to begin in FY 24/25, subject to approval and change.

First, please LoginComment After ~