Investment in Vietnam Prosperity Joint Stock Commercial Bank

Sumitomo Mitsui Financial Group, Inc. (President and Group CEO: Jun Ohta; hereinafter referred to as “SMFG” and the Group collectively referred to as “SMBC Group”), and Sumitomo Mitsui Banking Corporation (President and CEO: Makoto Takashima; hereinafter referred to as “SMBC”) today announced that SMBC has reached an agreement with Vietnam Prosperity Joint Stock Commercial Bank (Chairman: Ngo Chi Dung; hereinafter referred to as “VPBank”), a commercial bank in the Socialist Republic of Viet Nam (“Vietnam”), to acquire a 15% equity stake in VPBank (valued at VND 35.9 trillion, equivalent to JPY 183.1 billion) through a private placement, subject to regulatory approval (“Investment”). With this Investment, VPBank will become an equity method affiliate of SMFG and SMBC.

1. Purpose and Strategic Rationale of the Investment

SMBC Group has been pursuing its Multi-Franchise Strategy to capture the growth of key emerging markets in Asia and views Vietnam as one of its important markets. This is manifested in the investment in VPBank SMBC Finance Company Limited (“FE Credit”) by SMBC Consumer Finance Co., Ltd (President and Representative Director, CEO: Ryohei Kaneko) in October 2021, as well as SMBC entering a business partnership with VPBank in May 2022, which has yielded successful results in various fields.

VPBank is a major Vietnamese bank with a strong presence in the retail and SME sectors. In recent years, VPBank has been focusing on digitalizing its products and services. It now demonstrates top class growth and profitability among local private banks. After signing a business partnership agreement last year, SMBC and VPBank have been working on business collaborations in multiple fields and various synergies have already materialized, especially in referring our Japanese customers to VPBank and providing VPBank’s products and services to them. By entering a capital partnership with VPBank through this Investment, we will further strengthen business collaborations which will enable SMBC to provide higher quality products and services to our customers growing their businesses in Vietnam.

Through the Investment, SMBC will leverage VPBank's nationwide branch network and expand business collaborations in various fields, including retail and SME financial services, which will enable SMBC Group to further strengthen our growth strategy in Vietnam and ultimately contribute to the further development of Vietnam's financial industry.

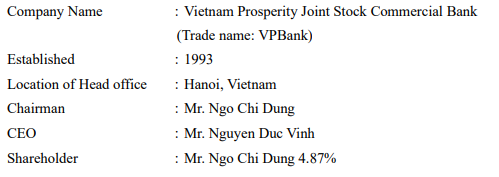

2. Overview of VPBank

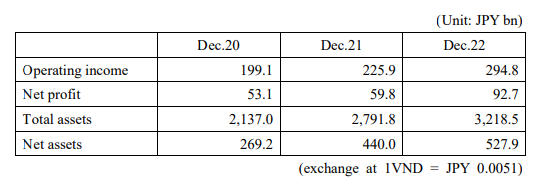

Financial results of VPBank for the past three fiscal years

First, please LoginComment After ~