PBOC:Banker Survey Report (Q1 2023)

Download → Banker Survey Report (Q1 2023)

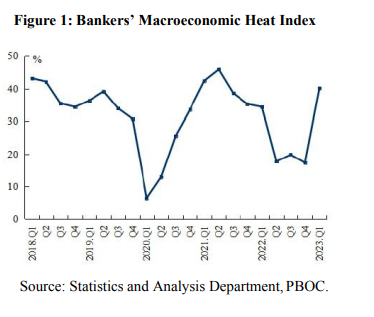

I. Bankers' Macroeconomic Heat Index (BMHI)

Bankers' Macroeconomic Heat Index was 40.2 percent, up 22.8 percentage points from the previous quarter. Among the surveyed, 62.8 percent bankers considered the current macroeconomic climate "normal", up 29.6 percentage points from the previous quarter; 28.4 percent considered it "relatively cool", down 37.6 percentage points from the previous quarter. For the next quarter, bankers' macroeconomic heat expectation index is projected at 50.9 percent, 10.7 percentage points higher than that of the current quarter.

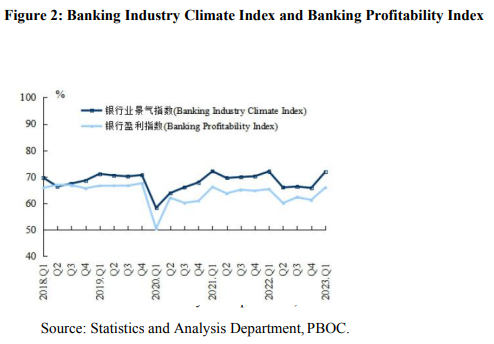

II. Banking Industry Climate Index and Banking Profitability Index

The Banking Industry Climate Index registered 71.9 percent, up 6.1 percentage points quarter on quarter, and down 0.1 percentage points year on year. The banking profitability index was 66.0 percent, up 4.7 percentage points from the previous quarter, and up 0.6 percentage points from the same period last year.

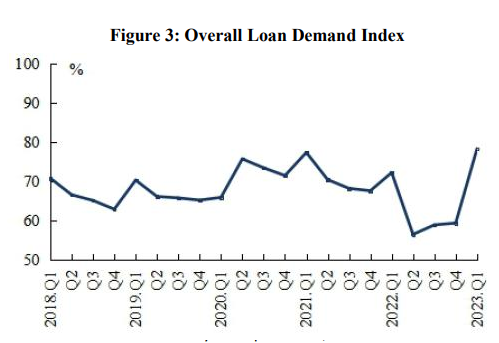

III. Overall Loan Demand Index

The Overall Loan Demand Index was 78.4 percent, up 19.0 percentage points from the previous quarter, and up 6.1 percentage points from the same period last year. By sectors, the loan demand index of the manufacturing sector stood at 73.9 percent, up 11.6 percentage points from the previous quarter; the loan demand index of infrastructure was 71.0 percent, up 10.4 percentage points from the previous quarter; the loan demand index of wholesale and retail industry posted 68.0 percent, up 10.9 percentage points from the previous quarter; the loan demand index of real estate enterprises was 55.3 percent, up 11.6 percentage points from the previous quarter. By scale, the loan demand index of large-sized enterprises, medium-sized enterprises, and micro and small businesses posted 64.9 percent, 68.2 percent, and 76.5 percent, up 10.3 percentage points, 11.8 percentage points, and 14.0 percentage points from the previous quarter, respectively.

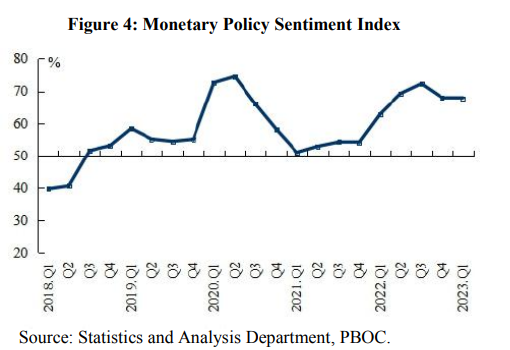

IV. Monetary Policy Sentiment Index (MPSI)

The Monetary Policy Sentiment Index posted 67.7 percent, down 0.3 percentage points quarter on quarter, and up 4.8 percentage points year on year. Among the surveyed, 37.2 percent bankers considered the monetary policy stance "eased", down 0.8 percentage points from the previous quarter; 61.0 percent considered the monetary policy stance "moderate", up 1.0 percentage point from the previous quarter. For the next quarter, the monetary policy sentiment expectation index is projected at 67.0 percent, 0.7 percentage points lower than that of the current quarter.

First, please LoginComment After ~