Customs Normalisaton Boosts Hong Kong-Guangdong Trade

Following China’s full relaxation of travel restrictions at the beginning of this year, trade and logistics operators have resumed their cross‑border activities in contemplation of rapidly restoring the capacity of logistics and transportation services between Hong Kong and mainland China, especially between Hong Kong and Guangdong, to bring trade back to normal. Many businesses are also responding to geopolitical developments and other external challenges by restructuring their production and supply chains and at the same time coordinating the production capacity of the mainland and Southeast Asia. While the link between Guangdong and Hong Kong is vital, transport operators also hope to take advantage of the convenience afforded by the Hong Kong‑Zhuhai‑Macao Bridge to further enhance the logistics and transportation links between the western part of the Pearl River Delta and Hong Kong and boost the recovery of Guangdong‑Hong Kong trade.

Dispelling pandemic's dark clouds

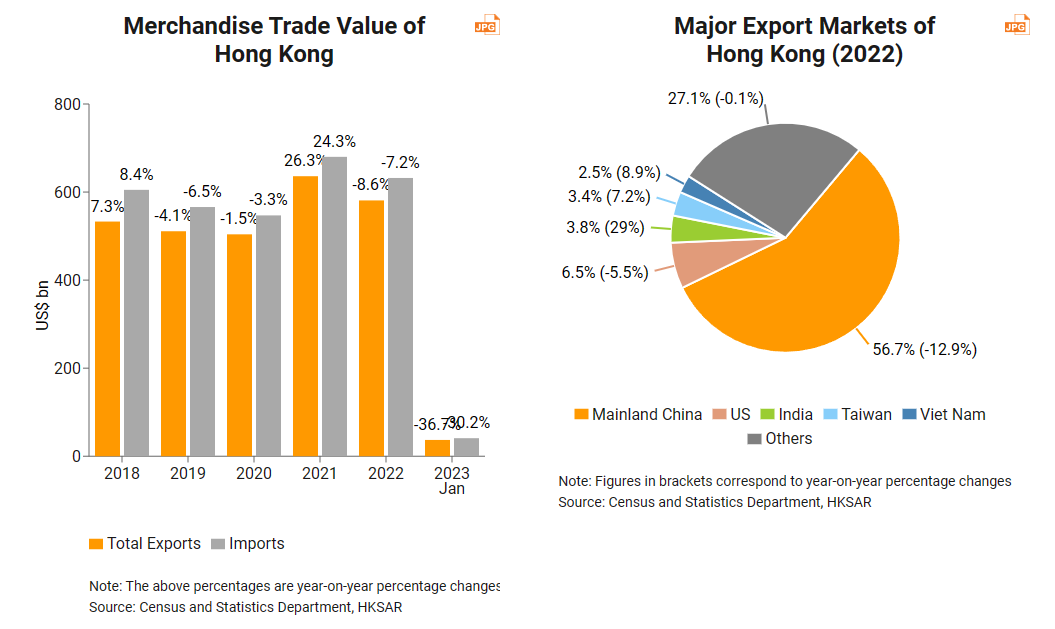

Hong Kong’s external trade has been sluggish since the beginning of 2022 after seeing a robust growth of more than 20% in 2021. Total exports fell 8.6% year‑on‑year to US$581 billion in 2022 and slumped 36.7% in January 2023 compared to the previous January. This is mainly due to the contraction of Hong Kong‑mainland trade. Mainland China as Hong Kong’s biggest export market accounted for 57% of Hong Kong’s total exports in 2022, but the value of the city’s exports to the mainland fell 12.9% last year.

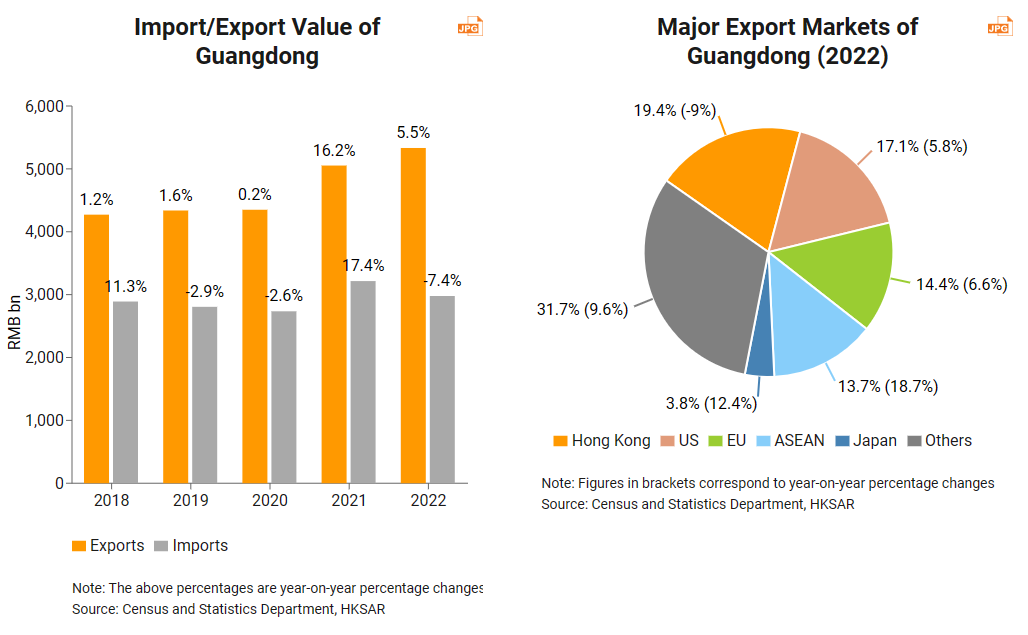

At the same time, the growth in China’s foreign trade slowed in 2022 [1]. Guangdong’s total exports amounted to RMB5.3 trillion (US$799.96 billion), representing a 5.5% increase from the previous year, but imports fell by 7.4%. Affected by Covid control measures, Guangdong’s exports to Hong Kong dropped by 9% year‑on‑year while imports from Hong Kong plunged by 36.9%. [2]

The strict Covid control measures taken by the Chinese government in 2022 had a significant effect on cross‑border cargo transport. However, the National Health Commission announced at the end of December 2022 that Covid-19 management measures would be downgraded to Class B from Class A starting from 8 January 2023. With the resumption of normal travel, companies are striving to re‑establish their cross‑border operations to restore their pre‑Covid level of business.[3]

HKTDC Research visited Zhuhai, Shenzhen, Dongguan and Huizhou in mid‑February 2023 to find out about Guangdong’s foreign trade situation and the latest developments of logistics and transportation between Hong Kong and Guangdong. Some manufacturing enterprises pointed out that they had imported raw materials and exported products to overseas markets through Hong Kong in the past but re‑directed some of their imports and exports to the ports of Shenzhen, Ningbo and Shanghai due to customs clearance problems between Guangdong and Hong Kong during the pandemic. Some goods were in fact imported and exported via the Chengdu Airport. Although such transportation through other mainland cities increased total logistics time, it did help solve problems of Hong Kong‑Guangdong customs clearance and severe delays in 2022. To save transportation time, some companies also changed their export shipment arrangement from FOB (Hong Kong) to FOB (Shenzhen) and directly shipped their goods from Shenzhen ports to overseas markets.

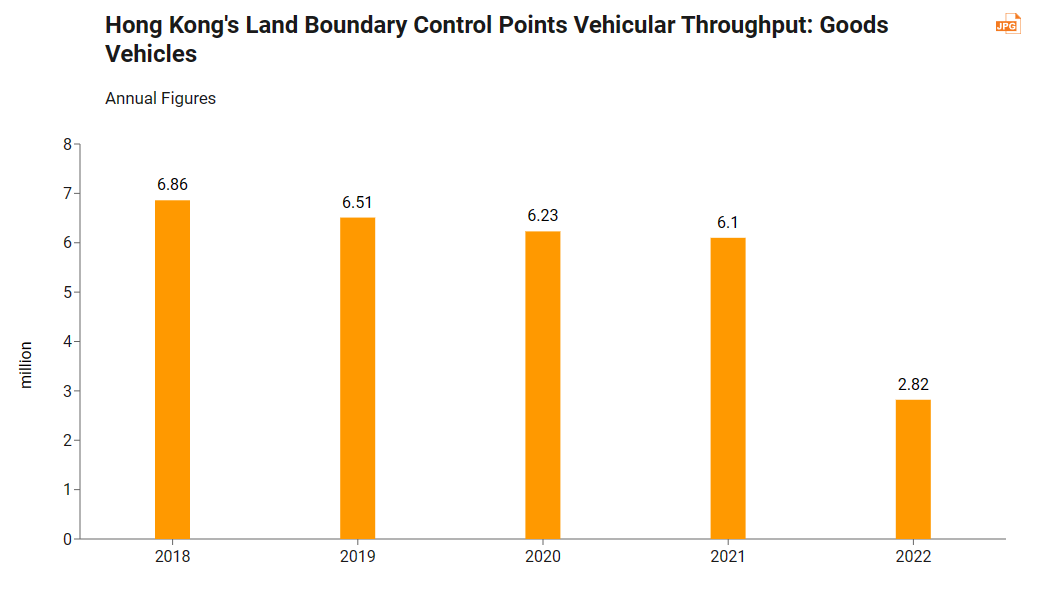

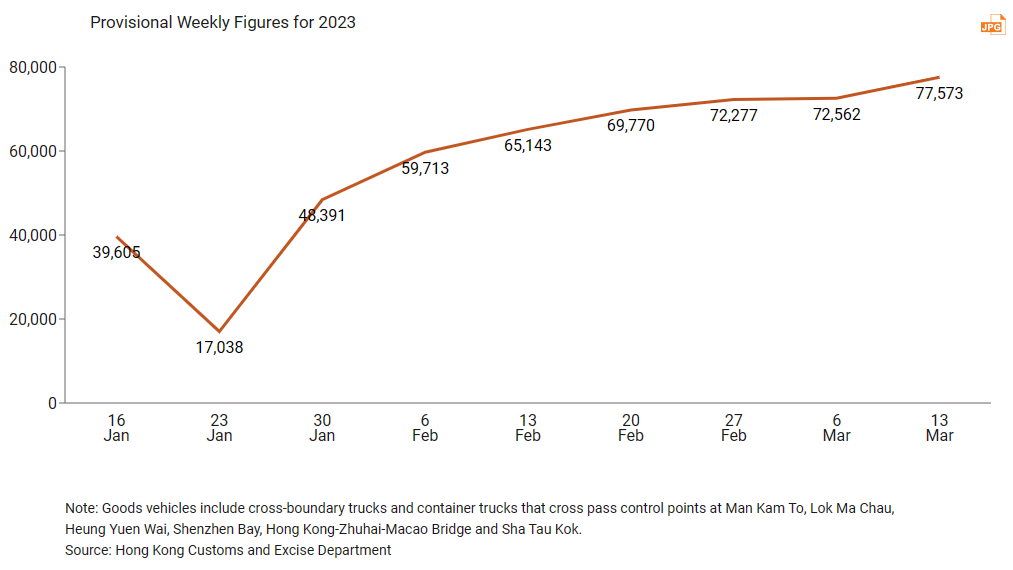

Due to side effects of the pandemic over the past three years, freight traffic over land between Hong Kong and mainland China dropped 54% from over 6 million trucks a year to less than 3 million in 2022, averaging about 54,000 trucks a week only. After the easing of travel restrictions in early January 2023, the flow of freight traffic gradually picked up and returned to 60,000‑plus trucks per week by the end of February. Freight transportation and logistics capacity between Hong Kong and the mainland, especially Guangdong, is expected to see a gradual recovery. HKTDC Research has learned that relevant authorities in Guangdong will join hands with Hong Kong government departments concerned in studying the situation with a view to further smoothening the channels of cross‑border transportation and trade between Guangdong and Hong Kong and working together for a steady increase in cross‑border trucking.

The companies interviewed also pointed out that as they have now adapted to the practice of arranging direct shipments from mainland cities to overseas destinations it is not easy to return to the pre‑Covid situation where goods were re‑exported through Hong Kong. However, since Hong Kong boasts excellent international transportation networks with frequent cargo transport routes, including air and sea transport, they expect to use Hong Kong as a trans‑shipment port again when external trade orders and cross‑boundary logistics resume and the fees fall back to normal levels. This will contribute to a return to normalcy in Hong Kong’s external trade in the medium term.

The Hong Kong-Zhuhai-Macao Bridge connection

The Hong Kong‑Zhuhai‑Macao Bridge resumed normal customs clearance service after the easing of travel restrictions in January 2023. This bridge directly connects the western part of the Pearl River Delta with the port of Hong Kong. Mainland enterprises hope to use the bridge for fast shipment of cargo from the western part of the Pearl River Delta to Hong Kong for air transport to other countries and regions after the pandemic. The Hong Kong International Airport has the advantages of frequent flights and extensive route coverage. At the same time, Zhuhai at the other end of the bridge is stepping up its development of the Guangdong-Hong Kong-Macao Logistics Park project to promote the development of logistics and transportation between Hong Kong and Zhuhai as normal trade resumes.

A further reduction in logistics and transport costs and charges for using the Hong Kong‑Zhuhai‑Macao Bridge is planned. Guangdong, Hong Kong and Macao will also discuss more measures to facilitate transportation across the Bridge. With Hong Kong’s advantages of logistics and transport services, more companies and logistics operators are expected to use the bridge to access Hong Kong’s air and sea ports. This will boost trade between Hong Kong and the western part of the Pearl River Delta and foster the development of related logistics and transportation services.

Restructuring regional production and supply chains

Companies interviewed noted that in the wake of China‑US trade conflicts, the Russia‑Ukraine war, and supply chain disruptions caused by the pandemic in the past few years, some overseas clients have requested mainland manufacturers to relocate part of their production to overseas destinations for reasons such as supply chain security and tariffs. This has prompted some manufacturers to actively consider “going out” and relocating part of their production to neighbouring Southeast Asian countries to increase their chances of winning orders. This is particularly true for manufacturers of electronic products.

However, some companies said they have been transforming and upgrading their business to increase production capacity in Guangdong as well as outsourcing. These companies are hoping to respond to challenges posed by constant changes in the external situation by linking mainland production capacity with overseas production lines and supply chains and optimising their overall business operation from the perspective of regional operation.

Uncertain export prospects

While Hong Kong‑mainland trade was throttled by gradually tightening epidemic control measures from the first quarter of 2022, cross‑border trade failed to pick up immediately after the full relaxation of relevant measures in early January 2023. Freight logistics has yet to return to the pre‑Covid level, because it takes time for cross‑border logistics and transportation to return to normal. Nonetheless, Guangdong‑Hong Kong trade is in fact affected more by weak external demand.

HKTDC Research learned from recent visits to Guangdong cities that some export enterprises have not yet returned to pre‑Covid business levels. The fact that demand for production raw materials and spare parts imported from (and re‑exported through) Hong Kong has not picked up also affects mainland China’s exports via Hong Kong. Many companies said that developments in the Russia‑Ukraine situation are affecting their exports to Europe. Rising global interest rates, soaring energy and oil prices, inflation and other problems have weakened overseas consumer markets. Moreover, some European and American companies still have not used up their inventory built up during 2022, and are only willing to confirm orders for the next quarter or shorten order confirmation and lead times. Prospects for exports in the longer term are yet to be seen. Nevertheless, many enterprises suggested that China and the world returning to normalcy will gradually stimulate economic recovery. They are confident that business will gradually improve in the second half of 2023 and overall business performance should pick up again.

[1] Mainland China’s total export value increased by 10.5% year‑on‑year to RMB24 trillion in 2022 (as opposed to an increase of 21.2% in 2021). Total imports increased by 4.3% year‑on‑year to RMB18 trillion (as opposed to an increase of 21.5% in 2021).

[2] Growth rates calculated in RMB.

[3] Covid-19 is classified as a Class B infectious disease in China but was earlier managed under stricter Class A protocols. Under this measure, patients who tested positive and suspected cases not yet excluded needed to undergo treatment in isolation while close contacts were subject to epidemiological investigation and medical observation in self‑isolation. After the management downgrade, there are no more isolation orders for infected patients and no more classification of close contacts or high‑ and low‑risk areas. Asymptomatic and mild cases are advised to stay home.

First, please LoginComment After ~