The Road to Net Zero: ESG Ratings

Delivering ESG can be challenging, especially for resource‑poor small and medium‑sized enterprises (SMEs). Limited access to consistent and comparable metrics and databases of company‑level information makes it difficult for such businesses to assess and develop appropriate ESG and climate risk management practices, with increasing regulatory and market pressure only adding to their burden.

At the recent HKTDC Research webinar, The Road to Net Zero: ESG Ratings, experts analysed the latest development trends and explored how ESG rating services can help SMEs identify and understand the associated risks, enabling them to make strategic decisions in a more effective manner.

Boosting Green Finance Growth

Nicholas Fu, Economist (Global Research) at HKTDC Research, noted that in recent years many institutions and governments have launched sustainable development programmes to catch the attention of businesses and consumers and many companies have set their own carbon reduction targets, spurring the growth of green finance. Quoting UNCTAD’s World Investment Report 2022, he pointed out that the value of sustainability‑themed investment products in global financial markets amounted to over US$5 trillion in 2021, up 63% year‑on‑year. The issuance of social and mixed‑sustainability bonds more than quadrupled between 2017 and 2021. These figures reflect that the increasing number of companies showing concern for sustainable development has fuelled the boom of sustainability‑linked financial products.

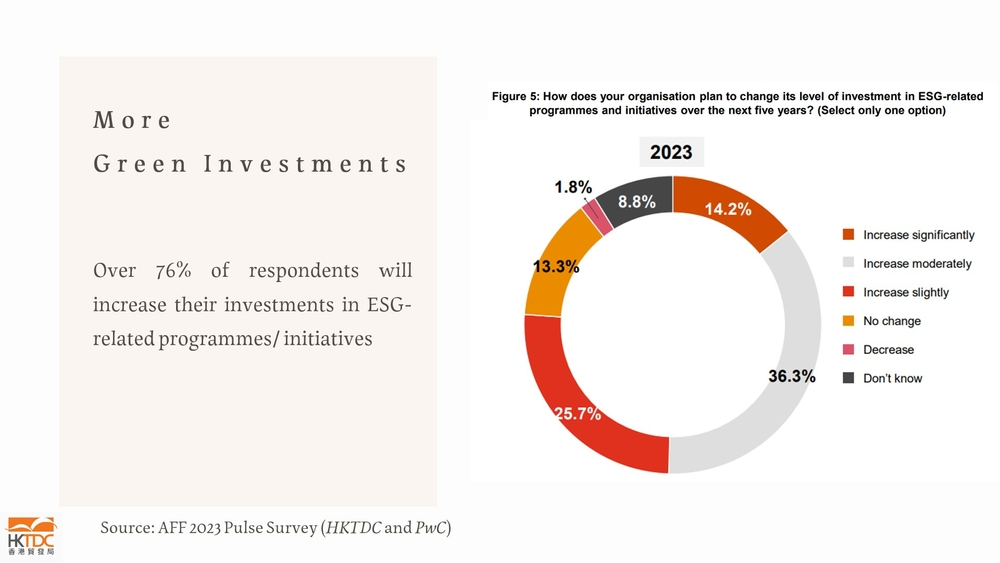

The survey findings jointly presented by HKTDC Research and Pricewaterhouse Coopers (PwC) at the Asian Financial Forum (AFF) 2023 shows that over 76% of respondents will increase their investments in ESG‑related programmes/initiatives over the next five years. Fu said that the majority of companies focus on environmental protection in their ESG work because it is easier to measure and calculate the benefits. Common carbon reduction measures include transitions to renewable energy and eco‑friendly materials or supply chain changes such as adopting green transportation solutions. Nespresso, for instance, recycles coffee capsules into a range of products including bicycles. CLP Power launched the “Renewable Energy Certificate” programme in 2019, encouraging business and residential customers to buy these certificates to support local renewable energy development, including solar power, wind power and landfill gas projects, and reduce carbon emissions in business activities or everyday life.

The survey also pointed out that strengthened competitive advantage in the longer term, improved reputation, lower cost of capital and reduced supply chain risks are major incentives for businesses to embark on the path of sustainable development, even though they may face many challenges when delivering ESG, such as lack of expertise, few government policy incentives and insufficient funding.

Over 76% of respondents will increase investments in ESG‑related programmes over the next five years: HKTDC PwC joint pulse survey.

Avoiding Greenwashing

Fu said that “greenwashing” has become a prevalent problem as the market demand for ESG increases. In recent years, a leading European auto maker was fined for installing software in their cars to skirt air‑pollution controls, and a US retail giant was fined for mislabelling rayon products as bamboo. Governments and international organisations have now tightened controls and issued regulations and guidelines, such as the EU Unfair Commercial Practices Directive and the US Green Guides, to provide companies with useful references and to protect consumer interests.

Due to “greenwashing”, financial institutions are exercising greater prudence and making testing certification and rating mandatory when approving green loans. Though relatively resource‑poor, SMEs can still meet environmental criteria by introducing efficient and affordable environmental measures to supply chains. This will allow them to gain third‑party ESG certification and ratings and to secure green financing for sustainability‑themed business expansion. Fu added that a company may start with the procurement stage to assist third‑party certification institutions in tracing supply chain sources and their ESG performance. Nestlé, for one, made the commitment to have 100% of coffee responsibly sourced by 2025. Hong Kong jeweller Chow Tai Fook has adopted the Best Practice Principles for Suppliers to ensure compliance with labour and environmental regulations in the procurement of diamonds and precious metals. Major long‑term suppliers are asked to fully abide by these practices.

Looking to the future, Fu anticipated a growing demand for the services of third‑party certification institutions. Accordingly, companies must regularly examine carbon emissions from production processes and make environmental and risk assessments of their supply chains so as to provide relevant information to other supply chain stakeholders, including banks. “SMEs must pay due attention to sustainability, build a green corporate image and follow the ESG path while seeking profits,” Fu added.

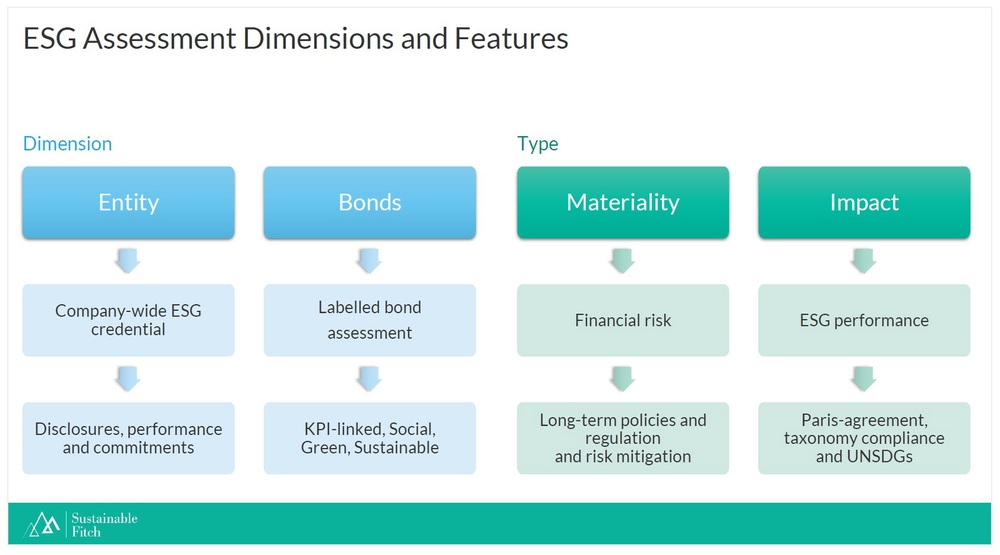

Sustainable Fitch’s ESG analysis service gives ratings to ESG entities and ESG financing instruments.

Growing Demand for ESG Rating

“Why are ESG considerations taken into account in a company’s credit rating? It is because they stand for ‘non‑financial risks’,” said Aaron Wei, Director, ESG and Sustainable Finance, Business and Relationship Management, Fitch Ratings, adding that good or bad corporate management would affect credit rating results to some extent. If a company is fined for mismanagement or environmental damage by employees, its financial performance and credit rating will be affected.

In view of growing market demand for ESG analysis, Wei pointed out that Fitch added ESG targets to its credit rating and integrated the analysis of all ESG factors in credit rating in 2018. Sustainable Fitch was launched in 2021 to provide ESG analysis service.

Fitch rates a company by its overall ESG performance and ESG financing instruments. In ESG entity rating, the audit scope covers a company’s positive or negative impact on the outside world, its internal ESG management, whether diagnosis of ESG risks has been made, data statistics of previous years, and presence of negative news reports.

On the rating of ESG financing instruments, the audit scope covers a company’s ESG financing commitments, such as how much the production lines have been improved and how much carbon emissions have been reduced, whether these changes are in line with international standards and how the company compares with its peers. Wei added that more investors are interested in investing in ESG financial products that can promote social progress, such as new energy bonds. Companies that can provide evidence of their improving ESG performance stand a better chance of obtaining green loans.

After the performance of all ESG factors has been assessed, a company will receive a detailed report of ESG qualitative analysis and an overall rating. “The rating is provided on a scale of 1 to 5, with 1 being the best, 5 being the worst, and 3 being average. Most Asian companies get a rating of 3. Sizeable companies that have been working on ESG for many years may get a rating of 2.”

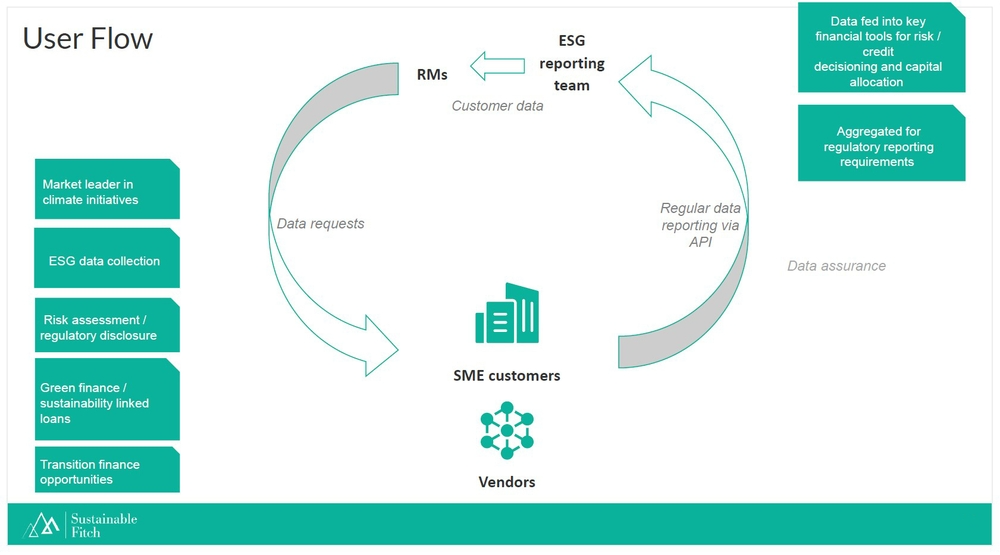

Managing ESG Data

On the rating process, Wei pointed out that Fitch typically assigns two analysts to rate the performance of each customer. The analysts begin by browsing the customer’s website or open‑source information to check for relevant disclosures. If information is insufficient, they will point out areas where the customer should provide more written information. Senior executives or chief executive officers may directly contact the analysts and state their views. The analysts submit a draft report to the customer after completing the analysis. If the two sides have disagreements, amendments may be made after discussion. “The most common disagreement in Asia is the discrepancy between international standards and local requirements. Generally, things will work out smoothly after discussion.”

Companies may use Fitch’s online platform to manage their ESG data. They may choose a report format that suits their needs, give explanations to employees and divide the work, such as who is responsible for which KPI. Staff members need to collect and record data to keep informed of progress. Lastly, the platform consolidates the data into a report. Companies with green financing needs may compile reports on an annual or monthly basis and submit these directly to their bank for loan approval.

In Wei’s opinion, SMEs should try to learn more about ESG and grasp the latest market trends through online ESG courses and information. They may also collaborate with relevant ESG rating institutions to provide customised training courses for employees.

Analysts compile ESG rating reports based on customers’ website or open‑source information as well as written or spoken communication.

First, please LoginComment After ~