The Supportive Role of Bond Market for Indirect Financing

Discrimination between Direct Financing versus Indirect Financing

The main difference between direct financing and indirect financing is whether two sets of debt contracts are needed to complete financing.

It is generally acknowledged that direct financing means that the unit with surplus funds provides monetary funds to the unit in need of funds through direct negotiation or by purchasing the securities issued by the latter in the financial market, such as commercial credit, issuance of corporate stocks and bonds, and direct lending between enterprises or between individuals1. Indirect financing means that the unit with surplus funds deposits funds with financial institutions or buys various securities issued by financial institutions, which in turn provides pooled funds to the units in need of funds for paid use2.

In essence, direct financing creates a creditor-debtor relationship directly between the creditor and the ultimate debtor. This process also involves financial institutions as service providers, which are in a principal-agent relationship, rather than a creditor-debtor relationship, with creditors and ultimate debtors not obligated to repay the principal or pay the interest. The financing process can be completed with only one set of master contracts on financing. In indirect financing, by contrast, there is no direct creditor-debtor relationship between the supply and demand sides of funds. Rather, financial institutions intervene as creditors and debtors, act as credit intermediaries in balancing surpluses and shortages of funds and take credit risks. It involves two rounds of borrowing under two sets of debt contracts. First, the financial institution obtains funds through deposit taking or bond issuance and becomes a debtor of the fund supplier. Second, the financial institution becomes a creditor of the ultimate debtor by issuing loans or buying bonds.

How the Bond Market Supports Indirect Financing

i. Supporting indirect financing

1. From the perspective of liabilities: supporting banks to replenish funds and issue loans

The funds raised by financial institutions from issued policy bank bonds and ordinary financial bonds can be provided to the community in the form of loans. This is a form of indirect financing, that is, financial institutions pool the funds from suppliers (bond investors) and provide them to users (borrowers). For example, the money raised from policy bank bonds, special bonds for small and micro enterprise loan and special bonds for “agriculture, rural areas and farmers” are directly channeled into key sectors of the real economy in the form of loans.

2. From the perspective of capital: supporting banks to replenish their capital base and enhance their lending capacity.

Tier 2 capital bonds and perpetual bonds are similar to preferred stocks, and are usually considered a type of equity, rather than debt. They are important capital replenishment instruments for policy banks and commercial banks to increase their capital adequacy ratio and enhance their lending capacity, thus supporting indirect financing.

3. From the perspective of assets: providing funds to bond sellers

Bonds are notably more liquid than loans, regarded as high-liquidity loans in a broad sense. Policy banks and commercial banks, by buying government bonds, provide funds to bond sellers and become creditors of ultimate debtors.

ii. Enhancing the ability to support indirect financing services

1. Providing high-quality collateral

Policy banks and commercial banks can pledge their holdings in treasury bonds and local government bonds as collateral to gain easier access to financing that funds their lending activity.

2. Providing related information and valuation services

The bond market provides transparent information and fair pricing, with related information serving as an important point of reference for loan pricing. This is mainly because the bond market has the following important characteristics: First, the bond market requires adequate information disclosure, making such information as financing size, interest rates and issuers available to the public. Second, the liquidity mechanism for bonds is well established and bonds are fairly priced. Third, the internal valuation of financial institutions and third-party valuation are formed based on market prices; in particular, the yield curves and market implied ratings shed light on real-time market developments. Such information has become a benchmark for loan pricing and a reference for risk pricing at policy banks and commercial banks.

The Bond Market’s Specific Contribution to Indirect Financing

i. Support for indirect financing

There are both direct financing and indirect financing in the bond market. The issuance and purchase of bonds by policy banks or commercial banks represent the bond market’s support for indirect financing. However, the bonds issued by the government or non-financial corporations and directly purchased by non-bank investors (such as non-financial corporations, individuals, securities funds and insurers) are considered support for direct financing.

1. Calculation method

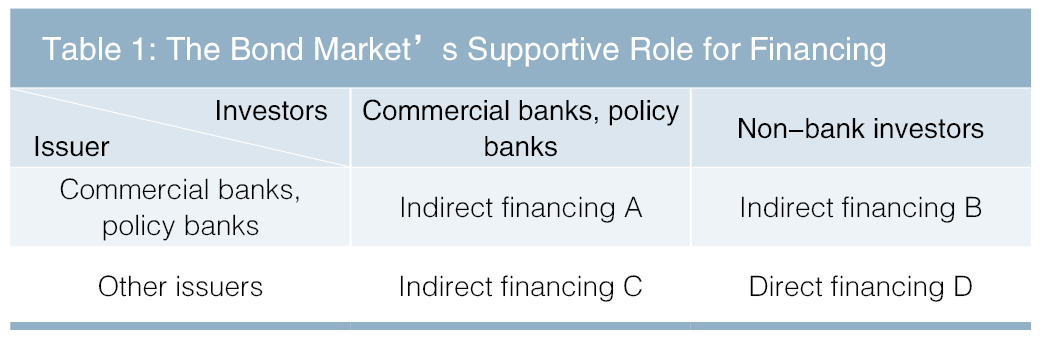

According to Table 1, the total support of the bond market for indirect financing =(A+B+C)/(A+B+C+D).

To avoid double counting, the backward induction approach is adopted, i.e. 1- support for direct financing/total support =1-D/(A+B+C+D).

More specifically, from the perspective of general liabilities3, the bond market’s support for indirect financing = the proportion of financial bonds, Tier 2 capital instruments and perpetual bonds in the bond market =(A+B)/(A+B+C+D).

From the perspective of assets, the bond market’s support for indirect financing = the proportion of bonds held by banks in the bond market =(A+C)/(A+B+C+D).

When calculating, the data of year-end custody size and annual issuance size are used respectively.

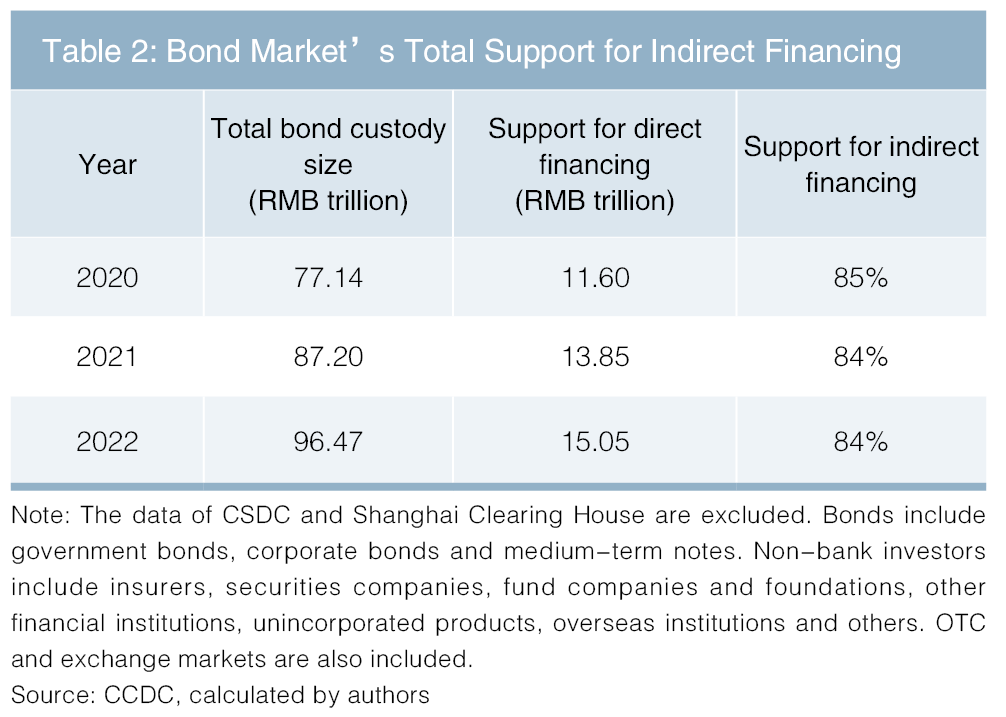

2. Calculation results based on year-end custody data

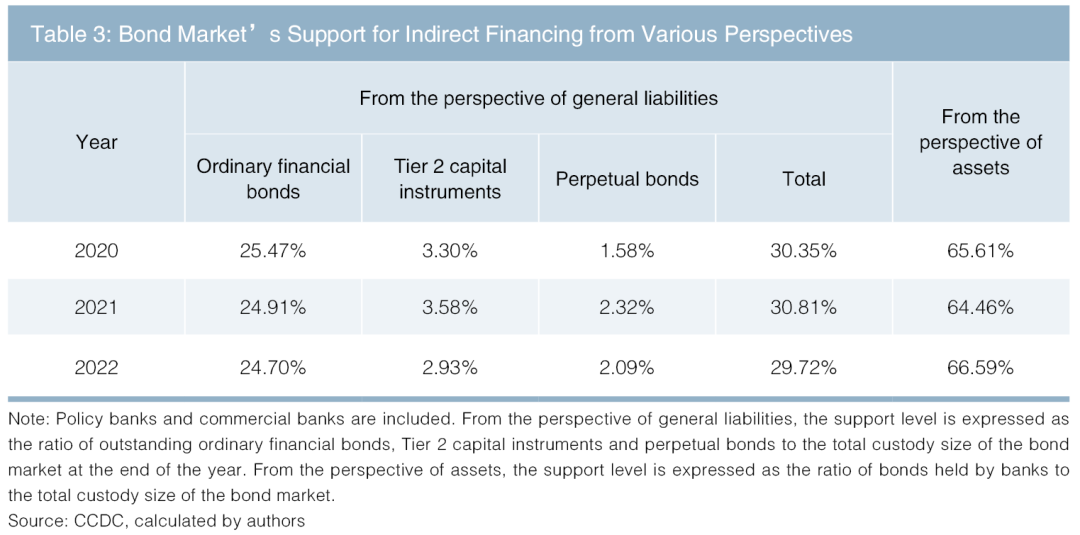

The calculation results show that the bond market’s total support for indirect financing is about 85% (see Table 2). More specifically, the bond market’s support for indirect financing is about 30% from the perspective of general liabilities, or 65% from the perspective of assets (see Table 3).

3. Calculation results based on annual issuance data

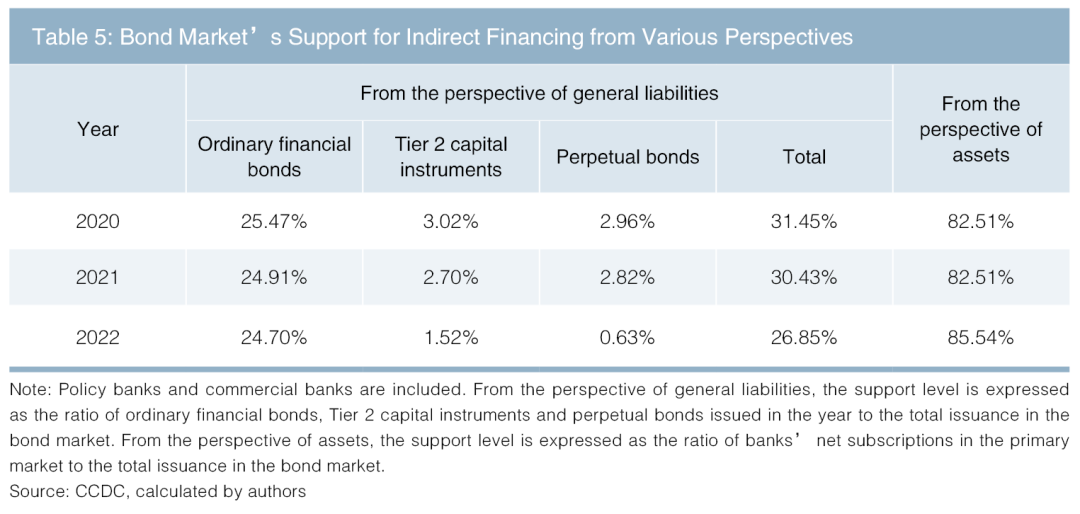

The calculation results show that the bond market’s total support for indirect financing is about 94% (see Table 4). More specifically, the bond market’s support for indirect financing is about 31% from the perspective of general liabilities, or 83% from the perspective of assets (see Table 5).

ii. Enhancing the ability to support indirect financing services

As collateral, policy bank bonds are next only to local government bonds. In 2022, the policy bank bonds and commercial bank bonds accounted for 25.33% and 1.73% of collateral bonds, respectively. Also, commercial banks are the primary participants in bond pledge business. State-owned large banks, joint-stock banks, city commercial banks, rural commercial banks and policy banks accounted for 88.64% of the bond pledge business4.

In terms of valuation services, by the end of 2022, ChinaBond Pricing Center had published more than 3,500 yield curves and over 100,000 bond valuations and related risk indicators a day, including all onshore negotiable bonds in various currencies, as well as overseas bonds such as Chinese-issued USD bonds, Chinese-issued EUR bonds and offshore RMB bonds. Daily publications also include over 1,500 ChinaBond Indices, more than 54,000 ChinaBond Market Implied Ratings and nearly 100,000 ChinaBond Market Implied Default Rates5. These indicators provide an important reference for credit risk analysis and monitoring, valuation and pricing by major market participants such as policy banks and commercial banks6.(This article was first published on Bond Monthly (Mar.2023).Please indicate the source clearly when citing this article. The English version is for reference only, and the original Chinese version shall prevail in case of any inconsistency.)

Note:

1. PBOC: http://www.pbc.gov.cn/rmyh/109339/751898/index.html

2. PBOC: http://www.pbc.gov.cn/rmyh/109339/764610/index.html

3. In accounting treatment, ordinary financial bonds and Tier 2 capital instruments are included in liabilities, while perpetual bonds are included in owners’ equity. To avoid ambiguity, since they are all bonds, this paper defines them as general liabilities.

4. Source: CCDC Collateral Management Service Center’s 2022 Annual Report on Collateral Management Services and ChinaBond Collateral Management Data Report.

5. Source: ChinaBond Pricing Center

6. Zhang Xin, Gong Lei and Liu Zhaoyang from CCDC also contributed to this article.

◇ Author: Vice President of CCDC

◇ Editors: Tu Xiaofeng, Lu Ningning

First, please LoginComment After ~