GBA – Survey Shows Strong Q1 Sentiment Rebound

- ♦Our GBA indices staged record q/q jumps in Q1, confirming a swift and broad post-COVID recovery

- ♦Expectation indices point to further acceleration in Q2; credit indices show improving cash flows

- ♦Respondents see plenty of headroom for normalisation; 53% raise their 2023 business targets

Please click to read the full report.

No major red flags for recovery sustainability either

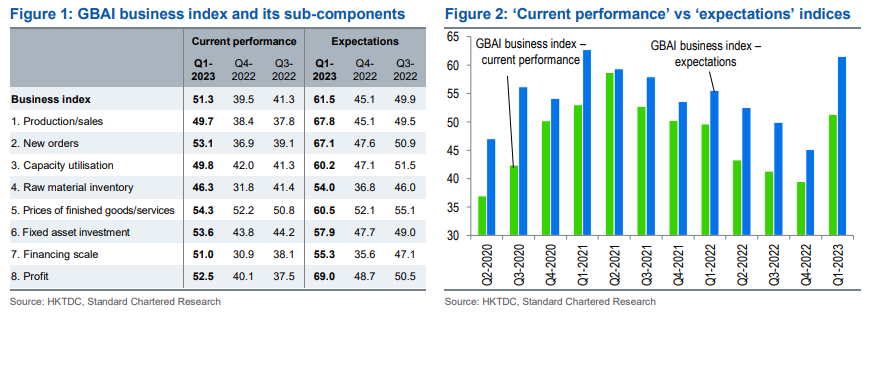

Our GBA Business Confidence Index (GBAI), based on quarterly surveys of over 1,000 companies operating in the Guangdong‑Hong Kong‑Macau Greater Bay Area (GBA) and conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that the current performance of ‘business confidence’ rose for the first time in seven quarters, to 51.3 in Q1‑2023 from 39.5 in Q4‑2022. This matches the recent string of positive macro data, confirming that China’s economy has turned the corner post‑COVID. With market focus recently turning towards the sustainability of this recovery, the sharper rise in the GBAI expectations index to 61.5 from 45.1 in the previous survey is encouraging, in our view. All eight of our GBAI components rose, and the credit sub‑indices showed improving cash flow positions and better access to bank lending. A further breakdown showed that by industry, ‘manufacturing and trading’ did not underperform despite looming external recessionary headwinds; by city, Guangzhou more than made up for its weak current performance index showing with outperformance in the expectations sub‑index.

Going forward, the performance of these sentiment sub‑indices may become more differentiated after a quarter of uniform increases, especially if the novelty of reopening wears off. On a positive note, China’s overall economic activity has some ways to go until it returns to the pre‑COVID trend, implying there is room to improve. Almost 60% of respondents expect to operate at over 90% of pre‑COVID levels by Q4, versus less than 40% saying they currently operate at 90% (at least). In addition to gauging how far post‑COVID normalisation has come (and could go), our thematic questions looked for changes to business targets, perceived risks and key policy expectations following recent domestic political events and external financial‑market shocks.

First, please LoginComment After ~